Paris 10.20am

NATO, means US and Europe counterparts must invest urgently in ammunition production capacity to make Ukraine's war effort sustainable, western may have only a few years to get Europe's own defences in order against Russia, and why the US may not be coming to save us next time. Not passing a Ukraine aid package won't just embolden Russia in Ukraine. It will also further reinforce to Putin that the U.S. Republican Party is absolutely vital to his foreign policy objectives. Russia will have even more incentive to interfere with the 2024 election.

But ‘money talks’ never can be ignored.

When a group of Chechens with links to warlord Ramzan Akhmadovich Kadyrov [Рамзан Кадыров] showed up this summer to seize control of Danone Société anonyme (S.A.) operations in Russia, the company began receiving frightened calls from its staff in the country. The French dairy group had been close to finalising a Rothschild-brokered deal to leave Russia when the Kremlin declared its local operations, along with those of Danish brewery Carlsberg Aktieselskab (A/S), had been placed under “temporary external management”.

But while the designation sounded the death knell for Carlsberg’s role in its Russian business, two of whose top former executives now sit in prison, what has followed for Danone has been more of a bizarre stasis. Much of life at its Russian dairy operations continues as before, with the Chechens largely running the expropriated factories in name only and previous leadership still involved in much of the day-to-day management.

Danone’s new Chechen bosses are “running it basically as an MBA case, fairly professional and without raising too many flags — pulling the guns out and stuff like that,” according to one person close to Russia’s government subcommittee on western assets. “It is extremely amicable,” the person said. Danone “are not telling the world they have been mistreated. They don’t sound like they are offended”.

Behind the scenes the company is still scrambling to complete the formal sale of its Russian business, according to people familiar with the talks, believing it can still get some money if properly matched with the right Kremlin-approved buyer. Danone declined to comment. The announcement of the expropriations and the subsequent appointments of external managers came as a shock to Carlsberg and Danone and other Russian government officials who had been negotiating their exits.

Russian people to be one of the highest consume [average per year] yoghurt and beer per capita.

Russia accounted for about 5 per cent of the group’s €27.6bn in annual revenues in 2022, making the French company among the most exposed of European consumer groups to the war. The yoghurt maker, Russia’s biggest dairy business, first entered the market three decades ago after the fall of the Soviet Union.

As other western companies pulled out after Russia’s full-scale invasion of Ukraine last year, Danone initially said it would remain in Russia while halting investments, arguing that it had a responsibility to its 7,000 local employees and the dairy farmers who supplied its 13 factory sites. “It is very easy to get drawn into black-and-white thinking and demagogic positions, but in the end our reputation is about our behaviour,” chief executive Antoine de Saint-Affrique told.

“We have a responsibility to the people we feed, the farmers who provide us with milk and the tens of thousands of people who depend on us.” Eight months into the conflict the company changed tack, saying it would leave Russia, in a transaction that could lead to a writedown of up to €1bn.

Danone and Carlsberg’s differing approaches to the seizures provide a striking illustration of the divergent fates meeting some of Russia’s biggest foreign investors as they attempt to execute plans to leave the market. The announcement of the expropriations and the subsequent appointments of external managers came as a shock to the two companies and other Russian government officials who had been negotiating their exits.

The yoghurt maker Danone, Russia’s biggest dairy business, first entered the market three decades ago after the fall of the Soviet Union.

Russia last month arrested two former Carlsberg executives including the country’s former Russia CEO on accusations of fraud. Carlsberg has condemned the move, alleging that the Russian government has resorted to “targeting innocent employees” as part of its broader attempt to seize the company’s business. “The Russian state can be quite unpredictable,” said Alexandra Prokopenko, a non-resident fellow at Carnegie Russia Eurasia and German Council on Foreign Relation. “Neither Danone nor Carlsberg has any clear view about the further steps of the Russian government,” she added. “And even the Russian government doesn’t have any clue what step they will make next.”

Ahead of Danone’s own takeover, the French company had narrowed its list down to three potential buyers, hoping to retain a 25 per cent stake in the subsidiary with the option to buy back its majority stake in the future, according to two people with knowledge of the situation. But since the appointment of external managers, the French group has issued only measured statements about the takeover, saying it was “preparing to take all measures to protect its rights as shareholder”, but stopping short of accusing Russia of expropriation.

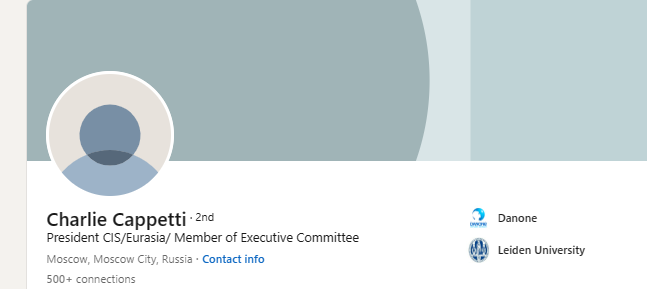

Although Kadyrov’s 33-year-old nephew Yakub Zakriev is listed on Russia’s corporate registry as general director of the renamed “Life & Nutrition”, Dutch Danone veteran Charlie Cappetti unofficially fulfils many of the role’s duties.

For now, Danone Russia’s pre-seizure executive committee remains in place, working to protect assets and staff, while localising all operations — including IT systems and brands — in preparation for a prospective sale, according to people familiar with the matter. The new external managers have yet to fire anyone from the previous management structure.

Cappetti and other executives at the group — both foreign and Russian — remained in regular contact with Danone’s head office in Paris, the people said, to ensure the business continues to run smoothly. “Below the surface, and below the psychological and political impact of these decisions and this announcement, things [are] actually continuing quite normally,” said one person close to Danone’s Russia business, noting that the new external managers of the company had no interest in “rocking the boat” and potentially depreciating the asset.

It’s not the first time Cappetti faced complicated ownership of Danone unit business. Cappetti worked in Indonesia as President Director Danone Waters Indonesia [April 2009 - January 2017], which means led water mineral product named AQUA, largest bottled mineral water producer in ASEAN [and 6th biggest in Asia] in terms of market share. 1998, Danone, through Danone Asia Holding Pte, acquired a majority stake PT Aqua Golden Mississippi. Tirto Utomo himself still holds shares in Aqua through PT Tirta Investama.

Along with the acquisition, Aqua’s packaging began to change and the Danone label began to be embedded in Aqua’s packaging.

PT Aqua Golden Mississippi was previously listed as a public company on the Indonesia Stock Exchange (IDX). But then the company decided to exit the stock (delisting) in 2011.

Back to Russia, Chechen, and Kadyrov.

People close to the company said Zakriev, who was placed under sanctions by the US in November, had made several appearances at the Danone Russia premises but was not there often initially. Instead, he installed subordinates to oversee the operations, yet those people did not have very deep business knowledge, according to people with knowledge of the business.

On its new board sit three other Kadyrov acolytes: Chechnya’s former deputy agriculture minister Ruslan Alisultanov and two young, Kazan-based businessmen — Yakov Khachanyan and Mintimer Mingazov, who have posed in photographs with the Chechen warlord or members of his regime.

The new team of external managers at first appeared afraid of messing up the underlying business, according to people with knowledge of the Danone Russia operation. Any slowdown of the company’s production could hurt Russian dairy farms and retailers. Nataliia Shapoval, chair of the KSE Institute at the Kyiv School of Economics, said the complexities of yoghurt-making gave Danone more leverage over their new bosses.

The production process requires the management of complicated supply chains for the colours, flavours, ferments and bioplastics required. “Withdrawing their unique ingredients from production would make the whole difference to this business,” she said. Since the arrival of the new managers, Danone has been approached by new parties looking to buy the company, according to people with knowledge of the talks.

The company is continuing to work with Rothschild, which also managed the earlier aborted sales process. However, it continues to encounter differing views within the Russian government about the future of its asset, according to people on both sides of the discussion. There have been signs in recent weeks that the new management is ready to exert more control, including on decisions regarding product and marketing, said one person with knowledge of Danone’s Russia operation. “It’s becoming a real takeover . . . They’re taking control little by little . . . [They’re] not just guys who came to ‘tour the property’,” the person said.

Nataliia Shapoval said Danone’s slowness to exit Russia had helped land it in its predicament with the Chechens. “Russia was saying directly that they would take control over the assets of the international businesses and they violated the rights of investors well before they came to expropriate the asset. But Danone didn’t go to investment arbitrage or make sufficient effort to exit,” she said. “It was clear from the very beginning that Russia would take them hostage and Russians would try to leverage foreign governments with these hostages, which is exactly why there has been such a push for exits,” she added.