Electric Vehicles (EV) and Complicated: Grid, Lithium, use Mass Transport Campaign amid recession (and not only talk about Tesla)

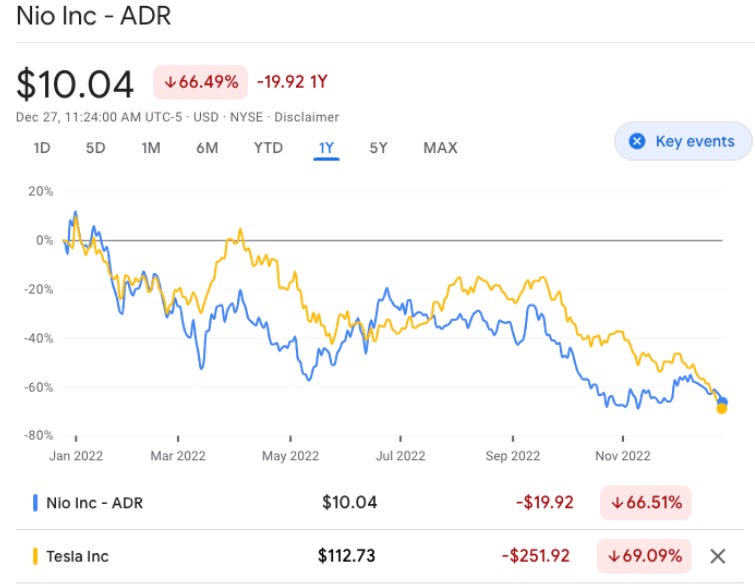

Since November 8th, when Elon Reeve Musk acquired Twitter, Tesla has faced backlash. Price of Tesla shares dropped very deep. But to be fair, it’s not only Tesla.

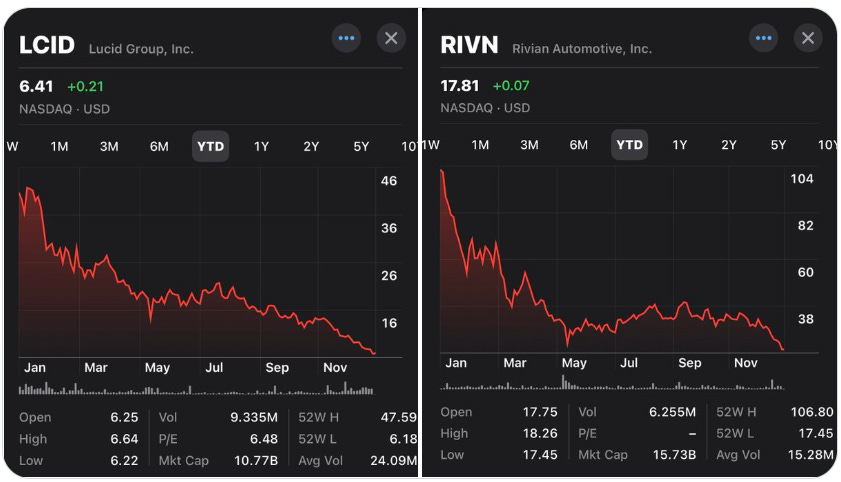

It seems most of the EV industry is having a bad time. LUCID and RIVIAN, the Tesla rival, also faced drops in the Nasdaq.

Tesla is down about as much this year as Chinese electric vehicle maker NIO. Twitter conundrum since November may well be weighing Tesla price as well, but China-related disruptions seem relevant too. Both stocks seem down today on weak EV deliveries in China.

Elon Musk told employees that they should not be "bothered by stock market craziness" & that long term Tesla will be the most valuable company on earth. He also urged employees to make a push to deliver vehicles at the end of Q4. The P/E remains about three times other auto stocks and every company now has an EV model. Looks like a pump and dump and not coming back.

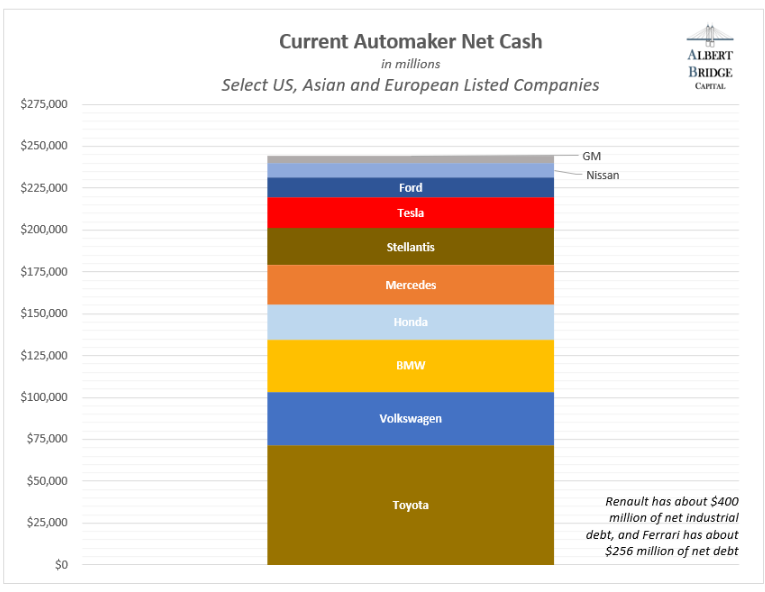

Many traditional, incumbent automakers (what $TSLA fans like to call "legacy") are awash with cash as they make the transition to EV. Much of the Tesla community is confused by the financing arm of these businesses, and believes they are laden with debt. They're not.

To think a Tesla is just a car is to not understand the power of a strong brand and how quickly that loyalty is wiped out with consistently contrary behavior. Nevertheless, Tesla is still the fourth most expensive stock in the NYSE FANG+ index, trading at 33 times projected earnings for 2022. The company is worth nearly $440 billion, far more than any other major global automaker. Tesla cars are now $7.5k cheaper in the US relative to others due to the IRA (Inflation Reductio Act) EV tax credit. Everyone else is unchanged due to legacy tax credit still being applicable.

Elon Musk’s supporters on Twitter (*based Dec 27th 2022, Elon Musk's followers are 123,4 million) and elsewhere have two things in common: They don’t drive Teslas, and they never will. They’re hardwired for gas-powered vehicles, and many don’t even believe in climate change. While Elon Musk panders to this group, he is losing an increasing number of customers who helped build the Tesla empire that allowed him to make this wrong-headed acquisition. The part of the tesla business plan where pissing off key customer demos increases sales sadly the days of “free” advertising is over. The recent bottoming of the stock price has caused Musk to be pressured by shareholders to resign from Twitter and devote himself back to (focus on) Tesla (again).

December 28th, 2019, days before covid emerged in Wuhan (Dec 31st, 2019), Tesla had an $80 billion market cap. Even after losing over one trillion dollars in market cap from its bubble-high in the past year, it still has a diluted market cap of $390 billion, nearly 5x higher than where it was in December 2019. Point out how fundamental expectations had increased, even for a given year. Sure, there was growth between 2019 and 2023 (or between 2023 and 2026) but it was a stretch to find any estimates in 2019 beyond 2023.

During this period, fundamentals improved, and 2023 EPS expectations rocketed nearly 190% (from $1.90 to $5.40), so the stock - all else equal - should have been up 190%; but even after this initial drop, it's still up over 300%, despite all the insider sales at higher prices and this analysis assumes that 2023 earnings expectations stay where they are; but when we see these last minute, EoQ discounts in both China and the US, one must wonder if we are about to see downward revisions to both sales and EPS. Cited: improved in covid pandemic.

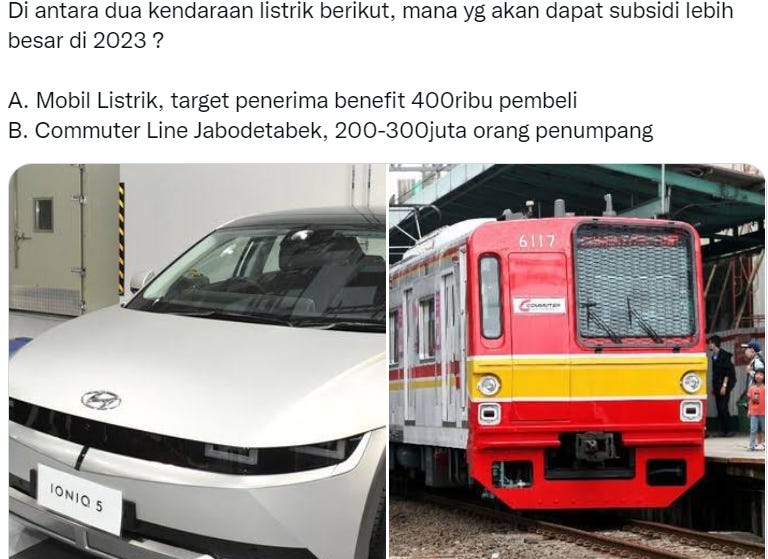

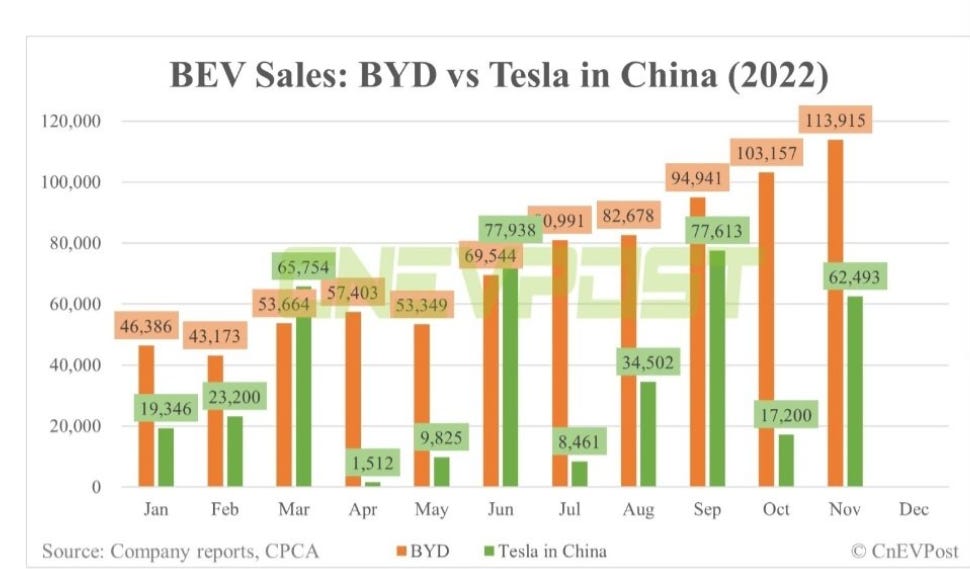

Even in China, a lot of people still buy EV, despite brutal lockdowns, whatever brand (not only Tesla). Alienation of core West Coast customers as it is about mean reversion from a preposterously silly price level (bigger than US$400) and competition increasing, especially in China. Of course Tesla sells a lot outside China and BYD does not. But over 50% of global EV sales are in China.

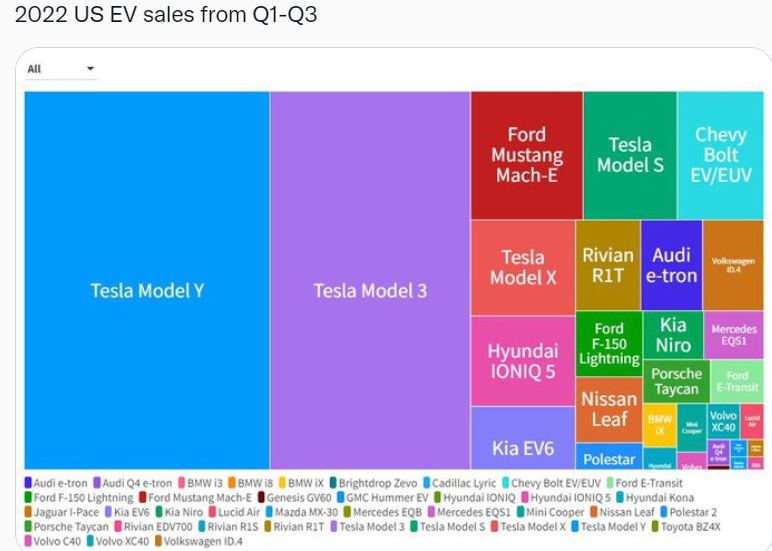

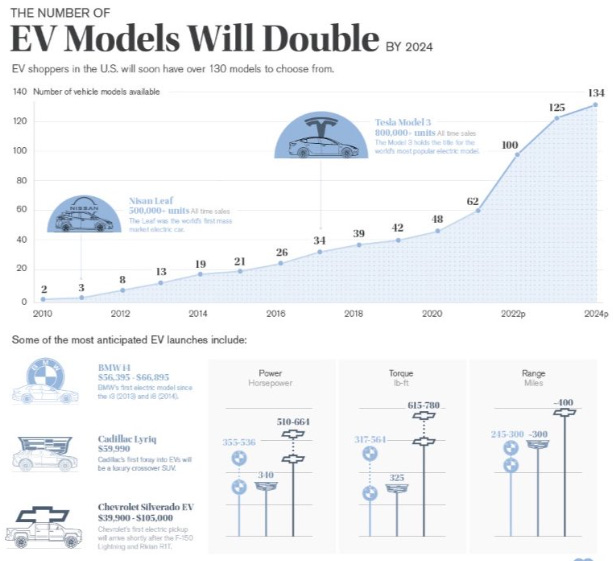

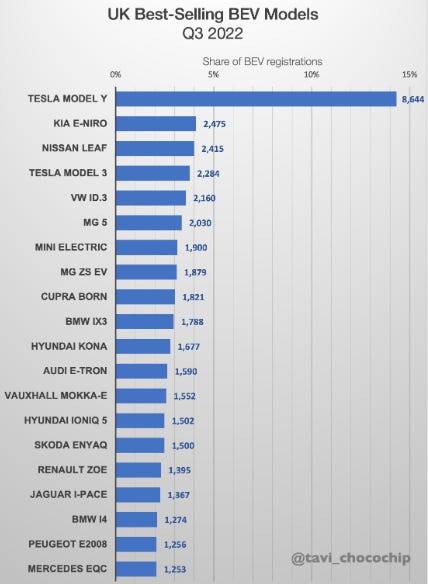

Admittedly, Tesla was the only real game in every country (in the past to present). But those days are over. EV models will double. Buyers will have more options. As many as 134 models are forecasted to be on sale in the U.S. by 2024 .more than double today's offerings . All these models require raw material inputs.

Maybe the one factor why EV is interesting stuff to buy despite covid: rocketing oil and gas price, at least between March-September, regardless (now) price of gasoline in the U.S. is cheaper than before the Russia - Ukraine war started (February 24th, 2022). Tesla still has no competition. No one can make 100k EVs a year. The only competitive rivals are BYD and Polestar, and maybe TATA India. 75 million cars sold a year globally. Tesla sells 2% of them currently. Only one direction for Tesla. We’ve been waiting for years for anyone to scale.

People forget this is an entirely new business vertical for Tesla. And the battery manufacturing business is Not easy. There is a lot of very technical expertise required to build EV-grade lithium ion batteries at scale. Big 5 manufacturers by volume control 77% of the total industry’s output. And these players have been building batteries for years. Decades.

This is a highly consolidated business environment that requires a completely new supply chain. Think about what Tesla has done in 2 years. The only thing that matters is their performance against their competitors and the market. And here, they’re very early. EVs are still very early. But they need to keep production growing exponentially as they have been, and we will be observing.

Lithium ion batteries are getting better, lower cost, and abundant. For example, in Australia, production is forecast to grow from 335,000 tonnes of lithium carbonate equivalent (LCE) in 2021–22 to 399,000 tonnes in 2022–23 and 470,000 tonnes of LCE in 2023–24. That is the recipe for complete technological distribution that we are in the midst of. The next ten years will see this trend play out in lithium conversion & batteries. Let’s see if lithium prices can roll over, or if this will look like May 2022 and resume an upward trajectory. Mining is where the bottleneck is and where the margins are, and that’s not changing anytime soon lithium refining capacity is the short term bottleneck which Tesla are attempting to address. But lithium mining is a longer term bottleneck that needs addressing.

Over the past 20 years, China has risen from obscurity to become a global leader in the car parts industry. Its growth was fuelled by European and American carmakers that farmed out the production of an increasing number of their components to China to save costs and establish links with the world’s largest car market. But international groups have now launched a quiet yet concerted effort to cut their reliance on China’s sprawling network of components makers, according to industry executives and supply chain experts. “There is a large-scale rethinking of logistics operations [across the industry],” said Ted Cannis, a senior executive at Ford. “The supply chain is going to be the focus of this decade.” The move has been prompted by two developments. As per Rene Le Blanc CTO at Lithium Americas it will take at least 3 years to build the plant at Thacker Pass. In the UK, Tesla drivers are facing multiple hour wait times at Supercharging locations around the country, showing that the need for more chargers is alive and well.

The first is uncertainty caused by China’s zero Covid-19 policy that forces plants to close at short notice. “The longer the pandemic stretches, the more uncertainty there is,” Volvo Car boss Jim Rowan said earlier this year, when announcing the Geely-backed carmaker was increasing its use of non-Chinese components. But the second is a longer-term concern about a larger political decoupling in the event of a breakdown in China’s relations with the international community, similar to Russia, that could threaten trade. Although most international groups are unlikely to abandon the Chinese market entirely because of its size, they expect the flow of components from the country to plants across the world to fall over time. Consequently, foreign manufacturers aim to make parts and cars inside China exclusively for use within the country. This cuts their reliance on Chinese factories for goods sold overseas, while retaining a secure local supply chain for their own plants inside the country.

Future cash flow estimates will be more complicated by Elon Musk and also Tesla (and now Twitter, because several teams in Tesla now work-to-resolve Twitter). 2023-2025 is murky due to macro effects on demand and vehicle mix, but these can resolve. This is why after buying Twitter, Elon set a “hardcore” work, both in Tesla and Twitter. Stocks are forward looking. EV’s will not commoditize for easily a decade and Chinese automakers are the only ones besides Tesla building serious capacity. No one knows the future, we’ll see who’s right. Will be interesting to see ICE trying to compete with limited EV capacity.

A quarter of China’s exported car parts end up in US plants at present, said a report from Sheffield Hallam University in December, which highlighted the country’s rise as a global supplier over the past two decades. In private, car bosses draw parallels with their experience in Russia after president Vladimir Putin’s invasion of Ukraine. Then, groups from Renault to Mercedes-Benz were forced to wind down or sell plants in Russia, while important components, such as palladium, had to be sourced elsewhere. “I think that the [auto] world got surprised by Russia and Ukraine,” said Cannis. “The US-China relationship is more difficult than it has been previously. it’s a new world.”

However, the supply chain shake-up will take time as carmakers rarely switch the sourcing of components until the end of a vehicle’s life, which is about seven years. It could also prove expensive for an industry that already operates on lean margins. “I don’t think sourcing is difficult. It’s the price that winds up changing,” said Tom Narayan, an automotive analyst at RBC. “If everyone tries to shift to the same European or US providers, you’re limiting the supply, and the price will go up.” Ted Mabley, supply chain consultant at PolarixPartner, said moving away from China “will be looking at a price lift for both labour and material”.

This means carmakers must make savings elsewhere, particularly with costs rising in the switch to electric, or risk becoming uncompetitive. “If we don’t fix the affordability issue, the middle classes won’t buy EVs [electric vehicles],” said Stellantis chief executive Carlos Tavares. “If 85 percent of the total cost of a vehicle is parts, if you don’t act on that 85 percent, you will have no impact,” he said, and that “requires us to use low cost countries”. China is “not the only one and not even the best”, he added, with “plenty of options” across India, Mexico, and parts of north Africa and Asia. But, statistics show China is too big to forget. BYD Han/Seal sales are key as it pertains to Tesla. Closest competitors to Model 3. Cheaper PHEVs/EVs not as relevant. BYD China demand is strong. Tesla needs a $30K EV for the China market.

However, carmakers are also aiming to be more rigorous over their choice of suppliers as they focus on the resilience of the supply chain, as well as costs, to make sure it does not break down. “It is no longer an era where cost is the major driving factor,” said Masahiro Moro, senior managing executive officer at Mazda. “Right now, the robustness of our supply chain also needs to be considered to ensure the stable procurement of parts.” Mazda said it was shifting production of some components made in China to its home market in Japan.

This is a sign that even Japanese carmakers, which tend to be less dependent on the country than their rivals in Europe or the US, have started to reduce their reliance on China-based supply chains. The company has already asked more than 200 of its suppliers that use components made in China to stock up on inventories in case there are disruptions ahead. Yet despite growing wariness behind boardroom doors, the industry remains reliant on sales to consumers in the Chinese market, making it hard for executives to talk openly about some of the changes.

Executives said Mazda’s reallocation was driven mainly by concerns over the reliability of supplies as a result of the Covid lockdowns. Japan-based Honda admitted it was considering ways to cut supply chain risks, although it denied media reports that it was exploring the possibility of building cars and motorcycles with as few China-made parts as possible. “With a series of production supply impacts due to multiple factors, including the Shanghai lockdown, we are considering various ways to hedge supply chain risks. Japan will begin extracting rare earth metal from seabed in 2024, Nikkei cited. This is a long-term Japan strategy to wean Japan off its reliance on Chinese imports.

However, we are not specifically considering a scenario of decoupling in China,” the company said. Both Ford and General Motors have been proactively shifting parts out of the country for their US factories for more than a year, according to several people. GM said: “Most of the parts we use in North America are already sourced in North America, and supply chain challenges over the past few years have reinforced the value of the resilience of our sourcing.” The company added that “most of our sourcing in China is for production in China”, and “we plan to continue this approach”. Supply chain risks are greater for the German carmakers Mercedes, BMW and particularly Volkswagen.

The three are so deeply embedded in China that, alongside German chemicals group BASF, they accounted for a third of all European direct investment between 2018 and 2021. “The Germans are so tethered to China, not only for sourcing but on the customer side too,” said RBC’s Narayan. “That is actually right now the biggest risk that investors are looking at.” However, Jörg Burzer, head of supply chains at Mercedes-Benz, stressed any changes to the company’s sourcing of parts were not driven by political concerns. “Obviously, we look at the sources which are nearby, which could also be from European suppliers or US suppliers or Mexican suppliers,” he added, stressing it was not about the nationality of a supplier. 9 Days before the G20 Summit in Bali Indonesia, Chancellor Olaf Scholz met Xi Jinping in Beijing, the 3rd leader visiting China after Putin (Winter Olympic 2022) and Jokowi (July 25-27).

(total Trabant/Trabi, sovyet car era, in Germany > Tesla)

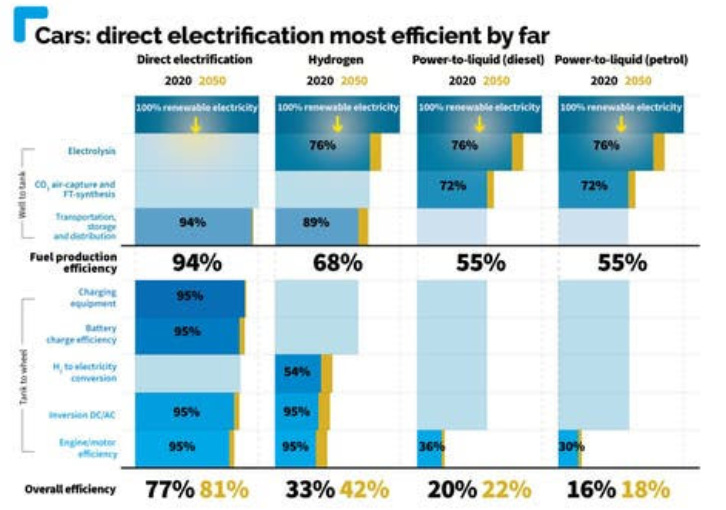

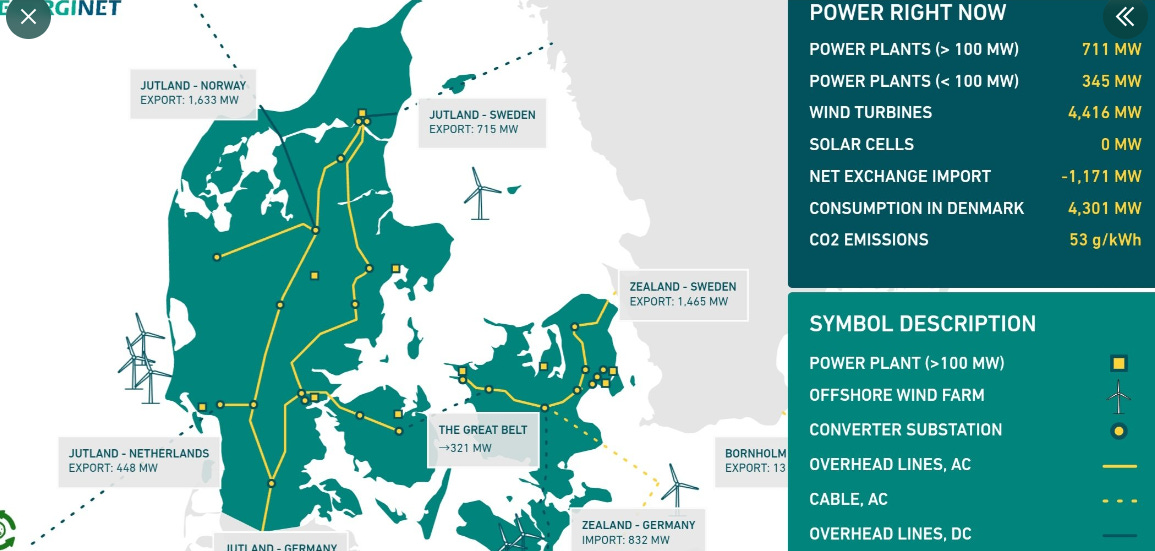

Global investment in EV charging infrastructure surged from $5bn in 2017 to $62bn in 2022 and is forecast to hit an incredible $100bn next year. EV looks very gold, promising. Then, the primary problem emerged, awkwardly, in the U.S. itself: electricity.

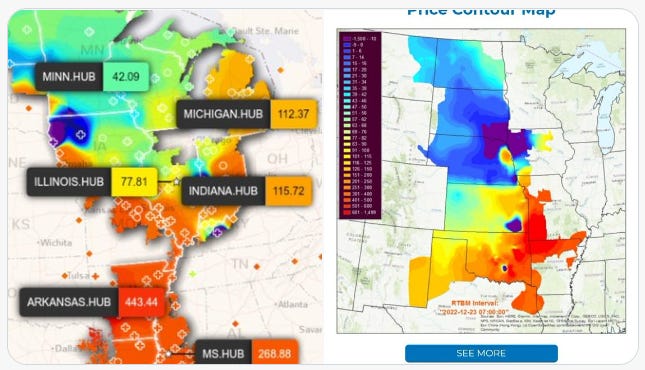

Northern America (*actually also Canada, Japan, these are countries with a lot of EV consumers alongside China) facing reels from the storm/blizzard of the century (Elliott Storm). Prompt closer look at climate change and severe storms. Over 1.5 million customers had their power knocked out by winter storms last weekend. 13 Were dead in Northern Japan. NBC News reports at least 62 people have died in weather-related incidents. The historic snowstorm has left more than 4,000 people in Buffalo NY without power. At the peak of the storm, about 20,000 people lost electricity. Not counting another state. The condescension is through the roof. Many people can't afford the electricity to heat food let alone buy presents to wrap them. People are dying of cold and hunger.

The grim costs of a colossal winter storm that brought Christmas chaos to millions. Frigid cold and blowing winds on Christmas holiday knocked out power and cut energy production across the United States, driving up heating and electricity prices as people prepared for holiday celebrations. Power grid company PJM Interconnection asks consumers to reduce use of electricity amid Winter Storm Elliot.

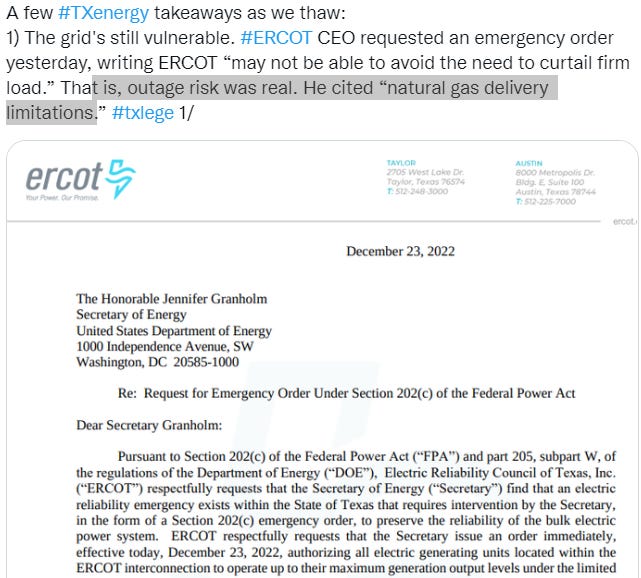

The Texas electric grid barely survived Winter Storm Elliott, but The Legislature wants to raise rates. Elliott shattered winter electricity demand records in Texas and across much of the Northern, Midwest, and Southeast. PJM and MISO hit stage 2 EEAs while TVA and Duke Energy Carolinas resorted to rolling blackouts during the morning of Christmas Eve. The Electric Reliability Council of Texas (ERCOT) manages power for most of Texas, and the council is confident the grid will keep running, despite the forecasted winter weather. Yes, Tesla (and SpaceX) headquarter in Texas (Gigafactory Tesla in Harold Green, and another Tesla site in Bastrop Austin; SpaceX in Brownsville). Gigafactory Texas is expected to increase production from 40K this year to 375K next year.

When electricity became a staple in households across the U.S., electric companies started monopolizing. But Texas wanted to avoid any federal laws that would determine how energy was bought, sold, or distributed. And because the state has two time zones, people from the state thought it would never be overloaded.

However, that hasn't always been the case, especially during power outages. And as previously mentioned, because of its independent grid, Texas cannot use electricity from other states in the event of a blackout. While there could be economic advantages, it can result in serious damage. This (ERCOT monopoly) is arguably awkward for (specific) Tesla if in the future, Texas hits a gargantuan storm like 2021. For this year, the most victim is Northern America (and also Japan, Canada).

Grateful to all the folks who worked in extreme conditions through the holiday to keep power flowing. Thinking of all the snow plow drivers that have been out all night working to keep the roads as safe as possible for those forced to travel, as well as the lineworkers who are ensuring that electricity is functional across the U.S. (also Japan, Canada). Lower weekend and holiday demand likely averted deeper and more widespread blackouts.

Recent market reforms help plan for this risk with renewables but not for conventionals. This distorts market outcomes. Amperon successfully defended its extreme weather load forecasting title. There were generally large demand shape and volume misses across multiple ISOs in the extreme cold. Net zero is an illusion the electricity would have to come from somewhere whether it's nuclear or coal fired generators. Even solar power and wind power is not technically net zero as you would need maintenance and to build the original generators.

So, although the EV industry will “eat” the conventional carmaker, the problem, in detail, is more complicated than anyone thought.