EY identified “a potential risk of bias or fraud through THG management manipulation by manual adjustments”: audit matters in the THG saga

Back in 2010, THG had to call off a planned IPO after its new auditors PwC realized it had been provided with a falsified document during its audit. PwC warned Tesco’s audit committee that commercial income, the statement line where the problems were hidden, was an “area of focus…” PwC missed the fraud anyway. Now, 2023, highly interesting disclosure from THG's present auditor EY. Critical audit matters identify auditor areas of focus, in THG case because they did find a mistake. Case of CYA.

THG's founder Matt Moulding told investors back in May 2021 (and sadly, the peak covid in Europe, May-August 2021) the deal could go through within six months. Very hard to see why SoftBank would choose to exercise it now unless things change drastically. THG market cap now less than £2.5bn after BlackRock dumps half of its stake. So the whole company of THG is now worth £2bn less than the value SoftBank's option implies for its much-hyped Ingenuity subsidiary.

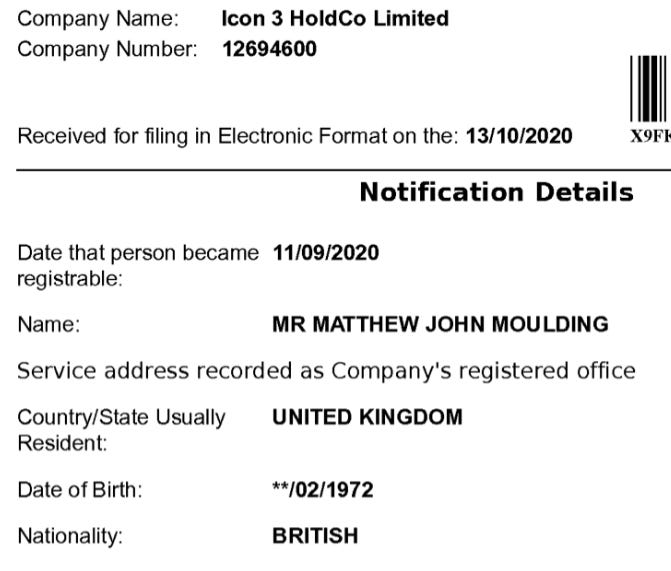

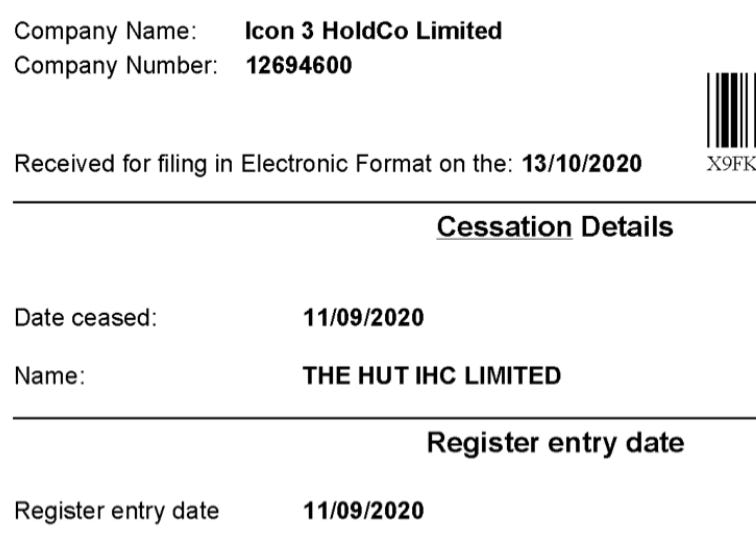

Warrington gave a £200mn loan facility to entrepreneur Matt Moulding soon after he floated his THG ecommerce biz. But when councillors had approved the massive credit line, the deal was described as a loan to THG itself. Warrington's Labour-run cabinet met on 12 Oct 2020 and in a confidential session approved the £200mn loan facility. This is the confidential council report the cabinet reviewed. It took over a year + action by the ICO to get just this redacted version. Matt was the counterparty on the loan through entities he controls. There is even a significant error about THG's creditworthiness. The council report says the company had "a credit rating of BBB", which is an investment grade rating. But in October 2020 the three major credit rating agencies rated THG far lower, in junk bond territory.

Warrington didn't address the credit rating error, but said portions of the report withheld for commercial confidentiality reasons spell out "extensively" that the loan was actually to entities controlled by Moulding. But why have references to THG being the borrower? Lawyers for THG and Moulding say Warrington knew all along that the counterparty was entities Moulding controlled personally. They also made no representations about THG's credit rating, the lawyers added.

The day immediately after the cabinet approved the facility, the Moulding-controlled SPV that would be the primary borrower filed change-of-control documents at Companies House showing it had moved from THG to his ownership. Moulding/THG's lawyers say the statutory filings simply recorded what Warrington knew already.

Always a fan of browsing the key matters sections of auditors’ reports, page 163 of last month’s THG annual accounts caught our eye (emphasis ours): In regards to the revenue from THG Ingenuity, the risk we have identified is split across both product revenues and other revenues (services, hosting) reported by THG.

As a result, identified a potential risk of bias or fraud through management manipulation by manual adjustments, especially in the last quarter of the financial year. Also identified a potential risk of bias or fraud through management inappropriately classifying revenue to THG Ingenuity. We have also identified a risk of inappropriate recognition of THG Ingenuity contract revenue by manipulating the performance obligations against which revenue is recognised.

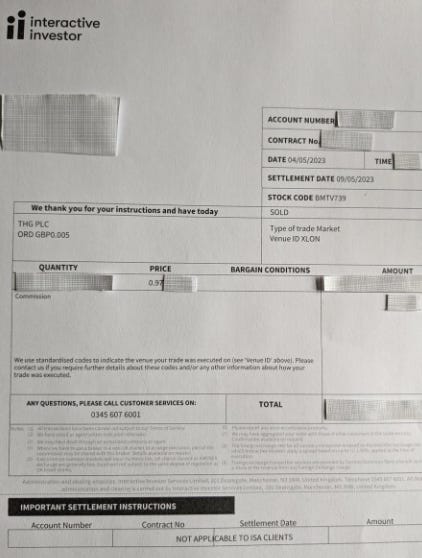

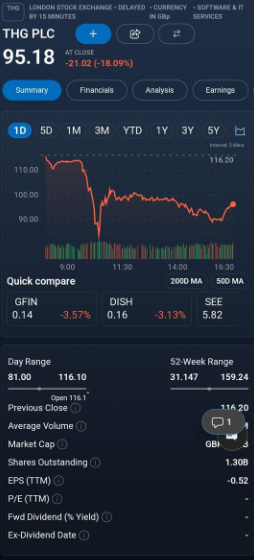

Once known as The Hut Group, THG is a controversial British tech-ish conglomerate that has not met the expectations of its much celebrated floatation at a £5.4bn valuation in 2020. THG’s market capitalisation at pixel was sub-£800m, following the recent announcement that it won’t sell itself to private equity group Apollo.

Apollo Global Management has allegedly drafted in ex-Coty and Holland & Barrett retail veterans to help draw up its offer to acquire THG. The US buyout firm has brought in former CEO of beauty giant Coty, Camillo Pane, to advise on its interest in the health and beauty retailer. THG Founder Matt Moulding has posted a long explanation of why the Apollo bid was rejected, complete with the hashtag #NoThanks and the phrase "the Numis led short attacks"

(Promoting to more engage in Substack) Seamless to listen to your favorite podcasts on Substack. You can buy a better headset to listen to a podcast here (GST DE352306207). Listeners on Apple Podcasts, Spotify, Overcast, or Pocket Casts simultaneously. podcasting can transform more of a conversation. Invite listeners to weigh in on episodes directly with you and with each other through discussion threads. At Substack, the process is to build with writers. Podcasts are an amazing feature of the Substack. I wish it had a feature to read the words we have written down without us having to do the speaking.

Indicated Appolo’s offer could have been made at start without the pump to let people out. 2 opportunities for Management of THG to arrange sale of the company. Twice share price spikes, twice it falls. Matt probably be crying on the floor in his office again blaming these pesky shorters for the share price drop, while pocketing millions in rent from THG and probably sweeteners from his city friends. If Matt and the other 65% dispose the market so much they can take it private, they only need 75% of votes cast if it was put to a vote. If that 35% not owned by the cohort, would need 363m votes against from the 507m in free float.

Most people simply wouldn’t vote or sell out, so unlikely to block it anyway, but even worse on announcement Share price would potentially drop to £100m market capital say, like IBPO did, and be 5-10p / share, Matt and co gobble them up to ensure it passes, then list divisions if need cash. Multiple other examples from the past did the same, as much as I want THG to be worth more and actually post some net profits, debt paid down, i can't help but think how much more cash is there to be made by current ownership at expense of retail, they have been accumulating for years.

As well as Tony Buffin, who held the position of CEO at health food chain Holland & Barrett from 2019 to 2021.

The company first announced its interest in acquiring the entire share capital of THG last month, which caused stocks in the online retail giant to soar 44%.

It is unclear whether Pane and Buffin would have ongoing roles within the business if Apollo succeeds in its buyout.

Brands currently within Apollo’s portfolio include MyProtein and Cult Beauty.

THG’s CEO Matthew Moulding also took to LinkedIn in late-April to hit back at the media’s “negative” coverage of the company in the wake of a potential takeover.

He claimed the British press, hedge funds and bank analysts had regularly built “negative coverage” against UK listed companies so the three groups could bet on which share prices will fall.

In a recent trading update, THG reported an operating loss of £495.6m for the year ended 31 December 2022.

Total revenues increased 2.7% to £2.2bn, with the group's beauty sales up 4.5%.

Over the past 12 months, THG has received numerous buyout offers before Apollo’s, but all had stalled.

Excitement about the potential bid may be why the auditor’s report went largely unread and unremarked. The key matters section of such reports has been essential reading ever since PWC highlighted “commercial income” as a risk at Tesco in 2014, warning readers that the amount of revenue recognised from promotions, discounts and rebates from suppliers was “material” and “judgemental”.

PWC said then: We focused on this area because of the judgement required in accounting for the commercial income deals and the risk of manipulation of these balances. We mention Tesco and its subsequent accounting scandal purely as reason why investors pay attention to such things as a general matter, to be clear.

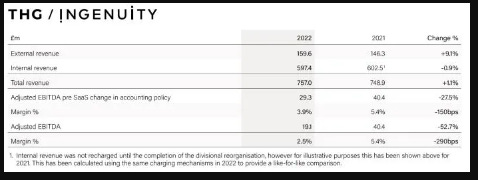

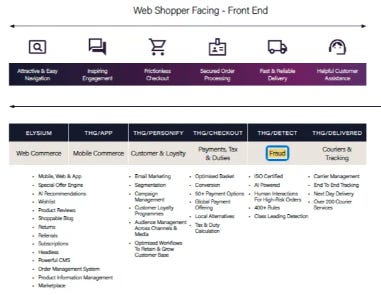

The key matter at THG highlights the group’s restructuring of reporting lines last year. THG Ingenuity is one of THG’s three divisions, the “operational infrastructure and digital hub” which supports the other two — Beauty and Nutrition — as well as being a “third party e-commerce solution” targeting what the annual report describes as a £277bn addressable market. Following the restructuring, the annual report explains that “revenue is now recharged for the services that THG Ingenuity provides to the wider group.”

As it happens, one of the services is “fraud management and detection”. An operation that is both an e-commerce supplier to other retailers and a significant cost centre no doubt requires excellent management and internal controls to keep everything straight.

Helpfully, THG provides investors with a split of Ingenuity’s £160m revenue, and its much larger £597m of “internal revenue” that is eliminated on consolidation.

Investors can also rest easy in the knowledge that EY, having identified the risk of bias or fraud, took the following procedures: We performed a walkthrough of each significant class of revenue transactions within THG Ingenuity or ‘Other revenue’ and assessed the design effectiveness of key controls. For a sample of new contracts, we reviewed the terms of business and management’s assessment of how IFRS 15 is applied to the contract terms, including the identification of performance obligations and allocation of consideration to each performance obligation identified. Assessed the status of the project and whether the relevant site had ‘gone live.’ Where these projects were yet to go live, we understood the reasons and considered whether revenue had been recognised in line with IFRS 15. Assessment included, but was not limited to:

(1) Variable consideration;

(2) Services which have been rendered at nil charge;

(3) Principal vs agent considerations,

(4) Consideration of whether any contracts contain embedded leases (IFRS 16).

For a sample of existing contracts, we enquired of the customer managers as to whether there had been changes in the contract terms, including changes in performance obligations and allocation of consideration to each performance obligation identified.

Sample of other revenue transactions, agreeing the amounts to invoice, proof of service or cash receipt. For the items selected we tested that the correct amount of deferred revenue has been recognised at year-end. For these items we also tested the classification of the revenue by segment.

Questioned and challenged management on the classification of revenue as ‘Infrastructure’ and ‘Commerce’ revenue and ensured that different elements of THG Ingenuity are clearly articulated given external interest in this business. Also tested manual revenue journals at in-scope locations, understanding the reasons for the transactions and corroborating to appropriate evidence. Tested these journals throughout the year, with increased focus on those booked in the last quarter of the year where we consider there to be a heightened risk of manipulation.

Also selected a sample of transactions at random to build in an element of unpredictability to our testing.” In its key observations communicated to the audit committee, EY identified “a reclassification for discounts amounting to £17m” that was corrected by management, said it did not identify any other material misstatements in the revenue, and was “satisfied that the disclosures appropriately describe the classification of revenue and are also in compliance with IFRS 15.”