Fiasco Biden - McCarthy on Debt Ceiling, In Same Time Dollar Declining or De-Dollarizing: What Biden Must Repair?

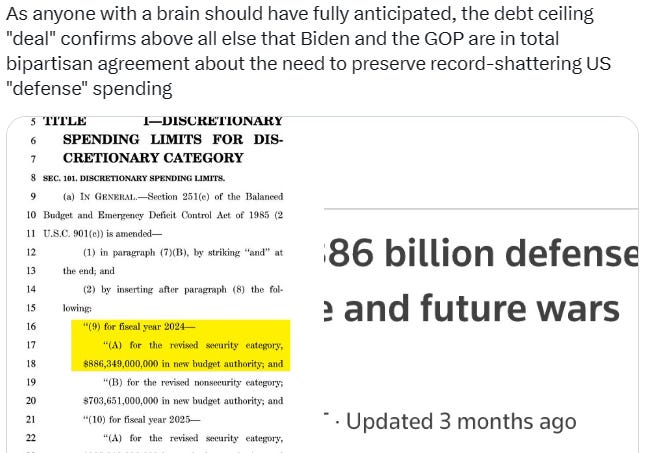

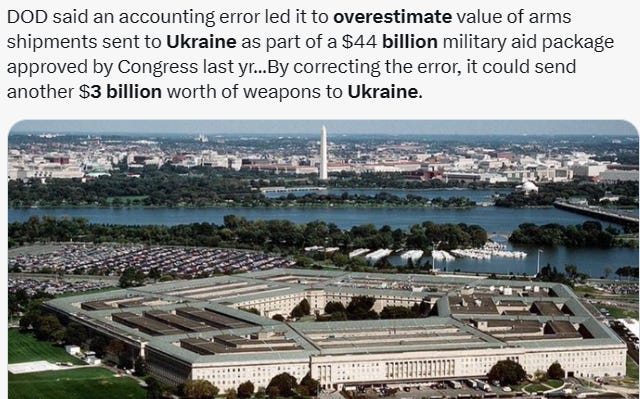

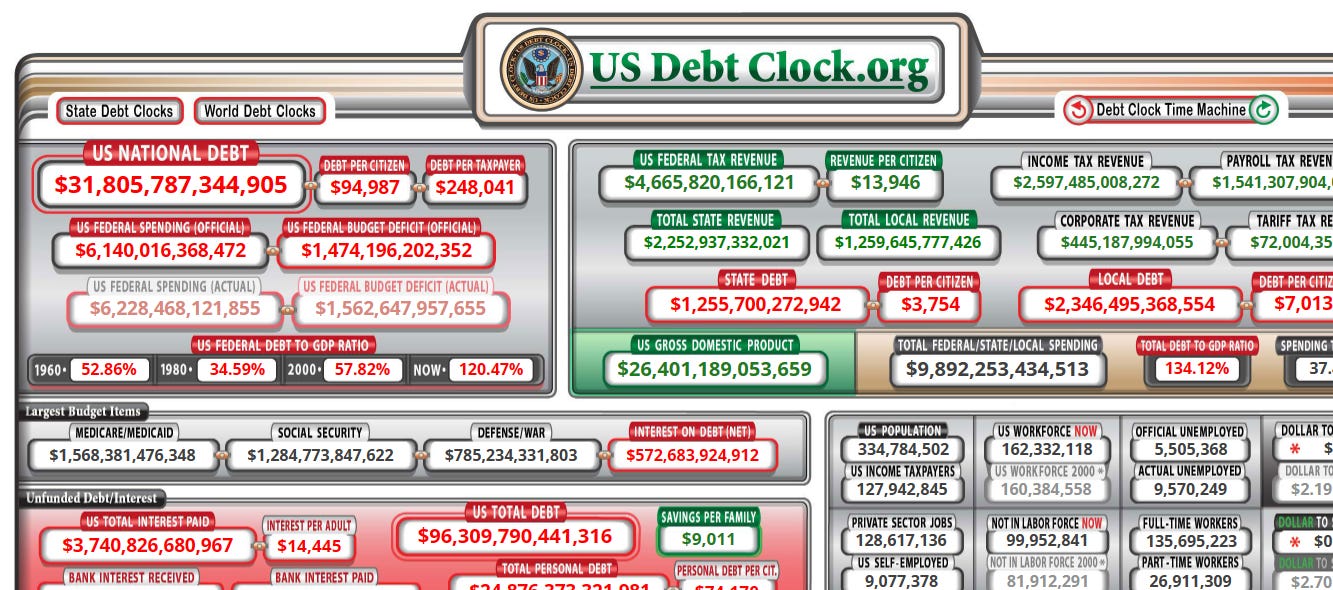

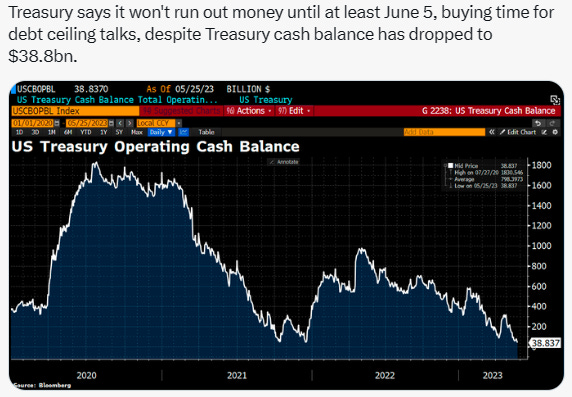

$1.5 trillion increase in the debt ceiling won't get them a full year. Annual US govt budget deficit is ~$2 trillion and growing. Without spending cuts, America is on a path to oblivion. With the world de-dollarizing, the Fed will be forced to print and buy it.

4.44pm, May 25th, DC time

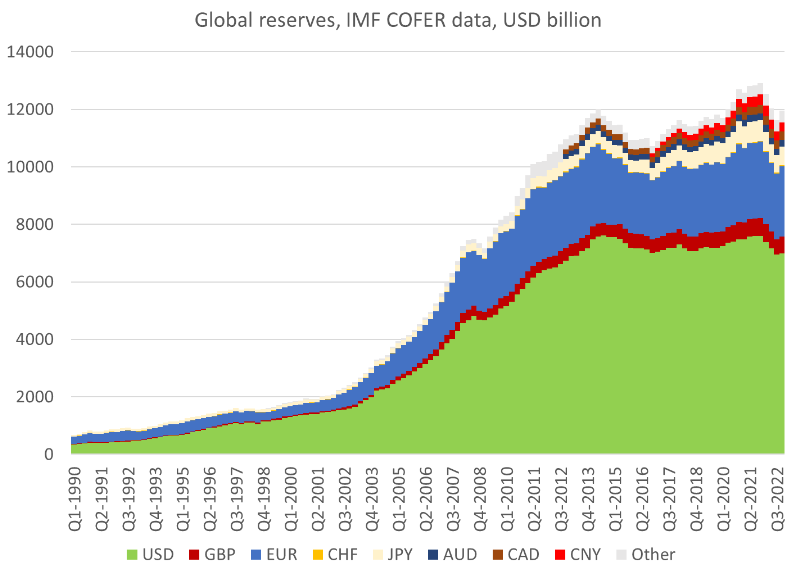

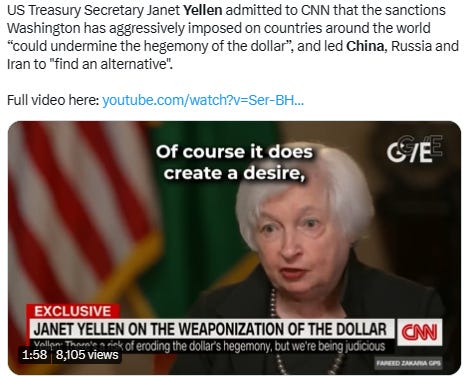

The global shift away from the dollar is happening at a "stunning" pace. 2022 represents about (only) 47% of total global official reserves, down from 73% in 2001, or at least 2021 still above 50% (55%).

Back then, it was the “indisputable hegemonic reserve”. A 15% decline year on year that's 10 times the average annual pace of erosion in USD's market share in the prior years.

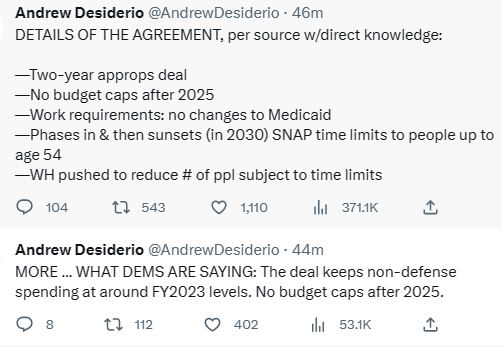

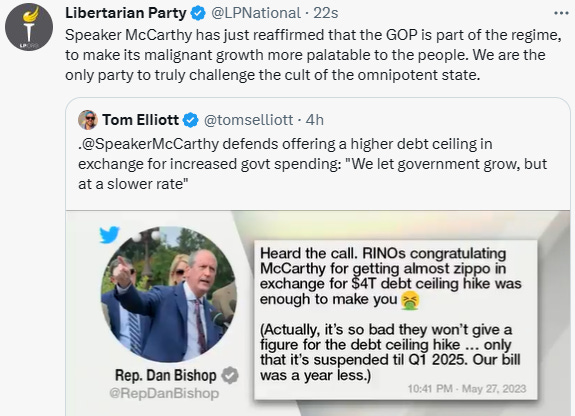

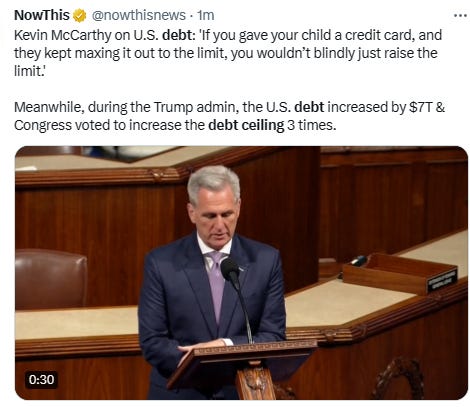

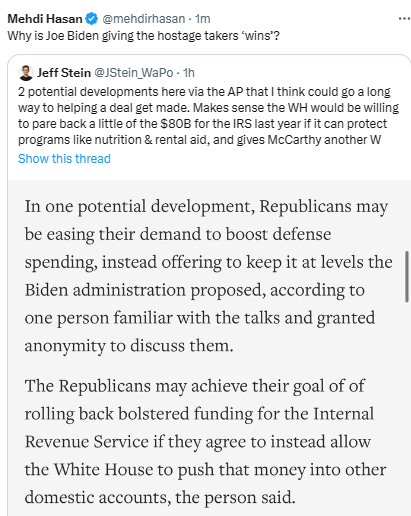

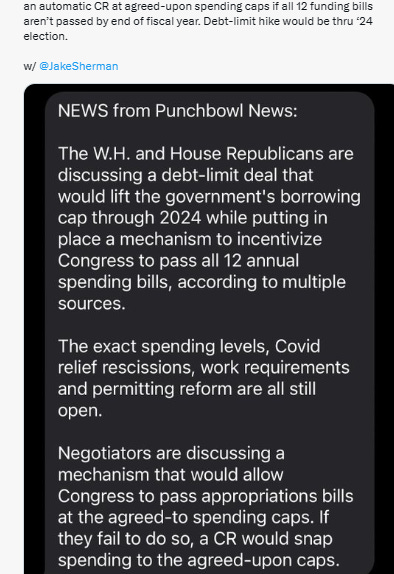

As Washington slow-walks toward a crisis over the national debt, President Joe Biden and House Speaker Kevin McCarthy are talking to two very different Americas.

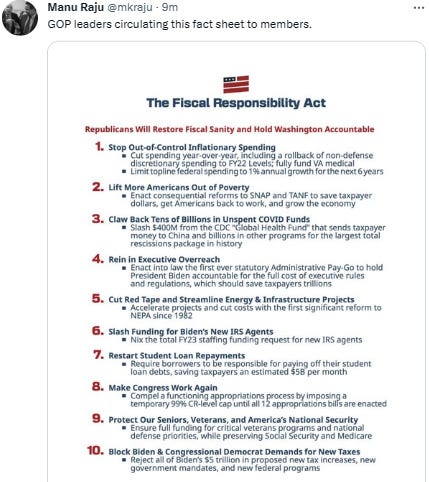

The GOP congressional leader kicked off the week by heading to Wall Street to outline his conditions for raising the country’s borrowing limit. The Democratic president planned to offer his rebuttal on Wednesday at a union hall in Maryland, where he was set to lambaste Republicans for “holding hostage” the country’s ability to pay its debts.

“While I’m here in this union hall with you, the Speaker of the House Kevin McCarthy went to Wall Street two days ago to describe the MAGA economic vision,” Biden planned to say, according to speech excerpts released in advance. “Folks, it’s the same old trickle-down dressed up in MAGA clothing. Only worse.”

The two men, who need to come together for the sake of the U.S. economy, are playing out diametrically opposite strategies to different audiences, each wagering he’ll win out in the end.

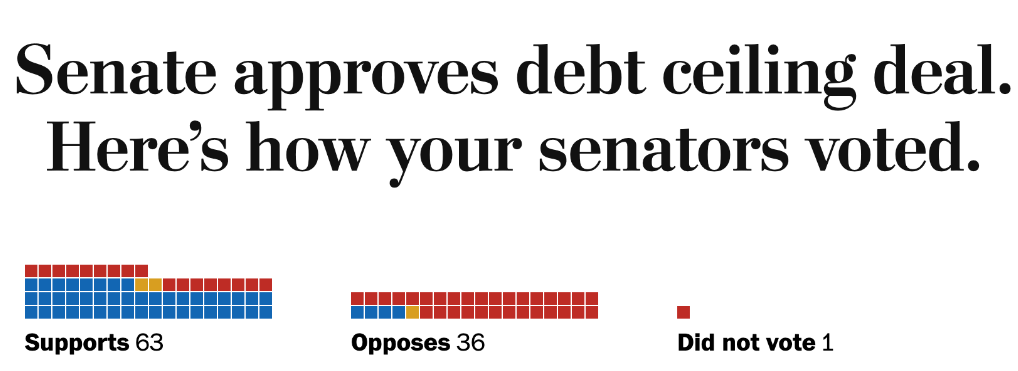

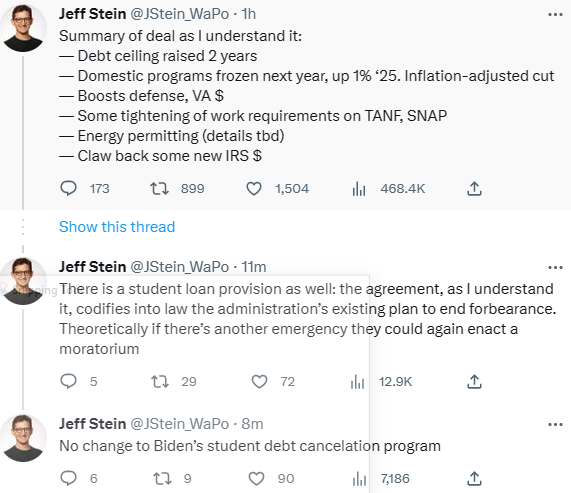

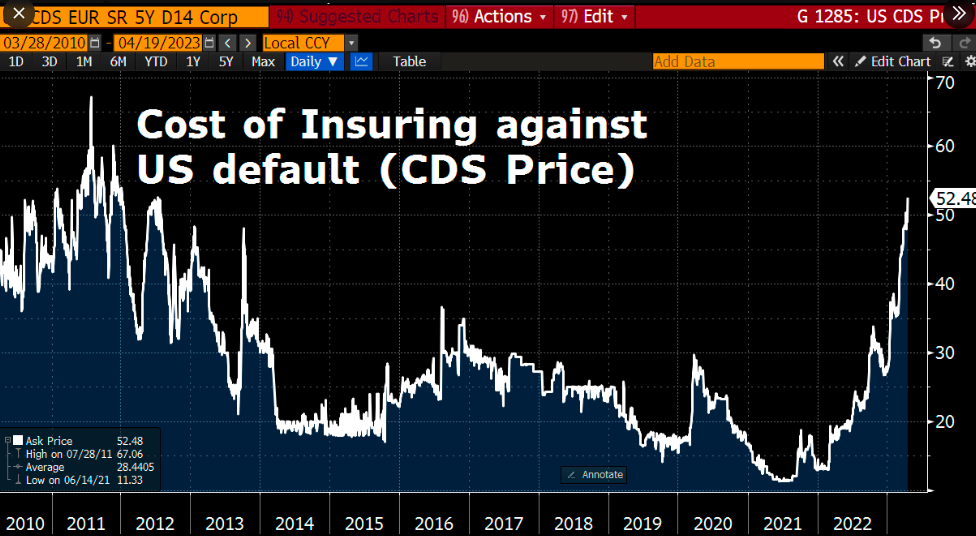

To the extent they have engaged each other — with no active negotiations between the two camps so far — it has been only to provide fodder for attacks. McCarthy says Biden is “bumbling” into a default by not meeting with him; Biden counters that McCarthy has already “threatened to become the first speaker to default on our national debt” unless he gets what he wants in the budget. Cost of insuring against US Default (CDS price) jumps to highest since 2012 as US debt-ceiling deadline may be nearing faster than expected. Weak tax collections so far in April suggest an increased probability that the debt limit deadline will be reached in the first half of June 2023, Goldman Sachs says.

The challenge with the 'dollar losing status as a reserve currency' conversation is that few quantify the potential impact, which is essential to understand as an investor. Nearly any plausible projection for reallocation would have a pretty minimal drag on the dollar and bonds. The global financial system is evolving in response to sanctions -- but there wasn't a big shift out of USD reserves in 2022. Period.

Given the dollar's rise v other currencies the dollar's share should have increased substantially since 2014, and making hay over the fact that the USD share was instead constant (or down v 2016 —- check graphic, especially 2016 and after 2016)

"USD is losing its market share as a reserve currency at a much faster rate than is commonly believed." The dollar's share of reserves didn't actually change at all in 2022. It is hard to know, frankly, where to start. To begin with, the immobilization of Russia's reserves actually froze far more euro than dollar reserves, and it showed that shifting your reserves to Europe wasn't sufficient to offer real protection from coordinated sanctions. Now it is possible to argue that the G-7 sanctions devalued all reserve holdings (the most Asian countries liked having reserves when the dollar was super strong) and that threatens the dollar more than the euro because of its starting point. And it is certainly the case that global reserve accumulation stopped in 2022 (as often happens when the USD is strong).

Gold sentiment is as extreme as dedollarization hysteria right now. Here are searches for "how to buy gold" on Google, back to 2004. Second tweet shows how peak searches coincided with peak gold price in 2011. This year, fears that the US dollar will collapse are nonsense, and doomsayers are often hawking gold, investment chief says.

In part because Singapore shifted reserves over to the GIC (Government of Singapore Investment Corporation) + Temasek and the GCC (Gulf Cooperation Council) preferred its national oil companies and SWFs. In March 2022, the money flowing in from Moscow has left some US Treasury officials concerned that CIPS—the Chinese cross-border yuan payment system seen as a potential rival to SWIFT—may be turning into a key vehicle for Russians to route their money to the UAE. 51% of China's oil comes from the Middle East; it has signed more than $200bn worth of big deals here. Trade and FDI are still oily, despite talk of diversification.

But there's a growing military and security component too, whether it's Gulf states buying Chinese drones and soliciting help on ballistic missiles or working with Chinese tech firms on electronic-surveillance kit, so Saudi-China intensifies its use of Riyal Saudi - Renminbi China. The other, somewhat more illusory relationship positions China as a foil for an America that the Gulf states often find frustrating. Which in a sense is nothing new: China filled that role (for Saudi Arabia) as far back as the 1980s, before they even had full diplomatic ties.America can't force a zero-sum view onto a region determined to diversify its relationships. Equally, though, the Gulf states should recognize that a too-eager embrace of China may hasten the very abandonment by America that they fear.

Head The Economist magazine in Middle East Bureau, Greg Carlstrom, on February 28th: "Ask quietly in government circles in Riyadh, Abu Dhabi, Kuwait City or Doha about the petroyuan, and the response — even in the weeks following Xi's visit to Riyadh — is unanimous: the petrodollar is here to stay."

But if the IMF's data on reserve holdings is adjusted for changes in US bond market valuation, I don't get any real US dollar sales.

No currency got large reserve inflows in 2022 in fact. Another preliminary opinion explaining a big part are hedged back into USD and thus the "true" USD share of global reserves is higher than the reported share. And looking at reserves without also looking at the foreign assets of state banks and SWFs is so 2012.

The cutting edge of flow tracking (imo) captures SWFs, forwards, state banks, etc. The dollar share of all official flows probably was down a bit -- but that's because the dollar share of SWFs is likely a bit lower than the dollar share of reserves and because countries tend to buy euros and yen to keep their currency shares constant with the USD rises. The US BoP data has a line item for official flows (reserves + SWFs). It ain't perfect. Yet it is the official number, and it showed a net inflow into the US (gotta include the Chinese flow into Agencies). And total purchases of Treasuries and Agencies (and for that matter all US bonds) over the course of 2022 were actually very strong. Another, at least 2 reasons:

One, most are portfolio balancers -- so they have to buy what is going down (the euro and the yen after 2013) to keep those currencies share of their portfolios constant. Two, intervention tends to happen when the dollar is weak (and other currencies are strong) as most central banks don't want their currencies to be too strong for a host of reasons. Combine those facts and there isn't anything that surprising about the constant rather than rising level of dollar reserves over the last almost ten years

You really have to adjust for bond market valuation changes here (and in the reserve numbers) to have a chance to be close to right. There is no doubt that total reported dollar reserves did fall in 2022. Some folks did intervene -- tho the MoF hardly moved away from the dollar when it sold fx to support the yen. Others moved to SWFs. But the biggest driver of the fall in reported dollar reserves was bond market valuation changes tied to rising US rates -- and the biggest reason why folks sold reserves and FX was the dollar's extreme strength.

I am not an apostle of "dollar dominance" -- I am most associated in fact with the argument that excessive accumulation of fx reserves actually causes problems for the US and the global financial system (including safe asset shortages and the like). If USD noitonals are unchanged and the price of USD goes up 15 percent. To assert that “real USD reserves” dropped 15 percent feels like meaningless mathematics.

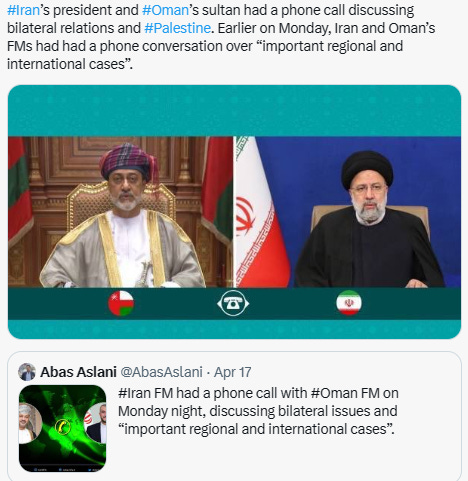

But maybe this year dollar only less 40% total global reserve: (because of) multiple peace in the Middle East. (I try based of first time moment until the latest) From Saudi with Iran, Saudi with Syria, Kuwait - Iran, Kuwait - Bahrain, Qatar - Bahrain, Syria - UEA, Qatar - Kuwait, Syria - Bahrain, Saudi - Oman, Saudi - Palestine, Syria - Kuwait, Qatar - UEA, and the latest (4 hours ago) Iran - Oman. All brokered-triggered because China’s diplomacy. No amaze if (abruptly) Middle East (significant) use Yuan.

Despite the recent slowdown, China’s economy is still growing at almost three times the rate of the US – around 5-7.5% over the last couple of years, compared to less than 2.5%.

The two nations are on an even keel when it comes to exports. However, the US has a trade deficit – it imports more than it exports – while China imports significantly less than it exports, resulting in a trade surplus.

Closing the gap

But there is still a lot of catching up to do: China lags in terms of foreign direct investment flowing into the country. Its high-tech exports amount to nearly four times less than those of the US.

Closing this gap may just be a matter of time though, not least because China is committed to education, with around 4% of total GDP now being invested in training its people. China’s education system is the largest in the world. It has more university students than the EU and the US combined, and there is growing demand for higher education among its young people.

China is well on its way to becoming the world’s leading economy, and is already there in PPP terms. However, in order to surpass the US’s highly diversified, tertiary economy, there’s more to do: China still needs to make the all-important transition from a resource-intensive manufacturing hub to a modern, consumer-driven economy.

——

-prada- (Adi Mulia Pradana) is a Helper. Former adviser (President Indonesia) Jokowi for mapping 2-times election. I used to get paid to catch all these blunders—now I do it for free. Trying to work out what's going on, what happens next. Arch enemies of the tobacco industry, (still) survive after getting doxed.

(Very rare compliment and initiative pledge. Thank you. Yes, even a lot of people associated me PRAVDA, not part of MIUCCIA PRADA. I’m literally asshole on debate, since in college). Especially tonight heated between Putin and Prigozhin.

========

Thanks for reading Prada’s Newsletter. I was lured, inspired by someone writer, his post in LinkedIn months ago, “Currently after a routine daily writing newsletter in the last 10 years, my subscriber reaches 100,000. Maybe one of my subscribers is your boss.” After I get followed / subscribed by (literally) prominent AI and prominent Chief Product and Technology of mammoth global media (both: Sir, thank you so much), I try crafting more / better writing.

To get the ones who really appreciate your writing, and now prominent people appreciate my writing, priceless feeling. Prada ungated/no paywall every notes-but thank you for anyone open initiative pledge to me.

(Promoting to more engage in Substack) Seamless to listen to your favorite podcasts on Substack. You can buy a better headset to listen to a podcast here (GST DE352306207). Listeners on Apple Podcasts, Spotify, Overcast, or Pocket Casts simultaneously. podcasting can transform more of a conversation. Invite listeners to weigh in on episodes directly with you and with each other through discussion threads. At Substack, the process is to build with writers. Podcasts are an amazing feature of the Substack. I wish it had a feature to read the words we have written down without us having to do the speaking. Thanks for reading Prada’s Newsletter.