From Walkman (say no to iPod) and Plug-In Hybrid (not EV): What can we learn from Japan's anomaly?

Tesla said it would spend more than $3.6 billion to expand its plant near Reno, Nevada, where the electric-vehicle maker assembles batteries and produces EV car components. In the Biden administration, “these are things that don’t happen on their own.” Transportation Secretary Pete Buttigieg defended federal investment in electric-vehicle charging networks and tax credits for EV purchases after Tesla CEO Elon Musk earlier criticized the Biden administration’s plans. America has come a long way from an Early Electric car casualty.

A member of the team behind GM’s ill-fated EV1 reflects on the momentum of the last year. The Biden administration will allow more cross-over SUVs to qualify for the newly-revamped electric vehicle tax credit following lobbying by automakers. Yes, Gigafactory in Austin Texas, but more than 240,000 Texans were still without power after an ice storm swept through the state this week, downing power lines and snapping heavy tree branches. Texas will face a fourth day grappling through an ice storm that has caused power outages, grounded flights and triggered deadly accidents on slippery roads.

The US Treasury Department has announced it's changing things so that the Treasury Department’s definition of an SUV will now comply with the “consumer-facing” standard the EPA uses on fuel-economy labels and on its website. With new rules now in effect for electric vehicle tax credits, that answer could mean thousands of dollars to some car buyers and lots of money to automaker profits. Under the new regulations, car buyers can’t claim tax credits for cars costing more than $55,000. But, for SUVs, the sticker price can be as high as $80,000. Until now, the Treasury Department considered the Mustang Mach-E a car, not an SUV, for purposes of tax credits. Same with the Tesla Model Y, unless it was equipped with a third row of seats.

If you search the Environmental Protection Agency’s FuelEconomy.gov website for electric SUVs, though, you will both those models appear in your search regardless of how many seats they have. The tax rules seemed to defy both common sense and what the EPA was saying. So the US Treasury Department announced on Friday that it was changing things so that the Treasury Department’s definition of an SUV will now comply with the “consumer-facing” standard the EPA uses on fuel-economy labels and on its web site.

Before, the Treasury Department had been relying on vehicle definitions used by the National Highway Traffic Administration to administer Corporate Average Fuel Economy regulations. The so-called CAFE definitions of vehicles are often different from what the average American might think based on a vehicle’s shape. Also, under the CAFE definitions, the same vehicle might be defined as an SUV when equipped with certain options but as a car without those features.

The Volkswagen ID.4, would be considered an SUV under CAFE when equipped with all-wheel-drive, but a car if not. Under the standards used by the EPA for its website, those vehicles are SUVs no matter how they’re equipped.

“This change will allow crossover vehicles that share similar features to be treated consistently,” the Treasury Department said in an announcement.

Not every vehicle that an automaker markets as an SUV will necessarily qualify, though. The Chevrolet Bolt EUV, for example, retains the $55,000 cap, even though GM has called it a crossover SUV version of the Bolt hatchback. The lines dividing cars from SUVs are, in many cases, quite vague, said Chris Harto, a senior policy analyst for Consumer Reports.

“In many cases, they’re really just hatchbacks and station wagons with, you know, slightly better marketing,” he said.

People who had purchased a vehicle since January 1. 2023 and who didn’t qualify for a tax credit under the old rules may now qualify, Treasury said in its announcement. No vehicles are losing eligibility based on this rule change, Treasury said. Tesla’s Autopilot was once groundbreaking technology. But in a recent ranking by Consumer Reports, which tested advanced driver assistance systems from 12 different carmakers, Tesla’s ranked seventh and Ford’s BlueCruise was in the top spot.

Rivian is developing an electric bike, the company's chief executive officer told staff, potentially expanding the EV maker’s product lineup. BMW, number 7th in the world automaker, will invest $872 million in its San Luis Potosí, Mexico, plant to manufacture electric vehicles, as part of a broader effort to ramp up its global production network. In France, trucks powered by hydrogen fuel cells are more appealing than battery plug-in vehicles because they offer greater autonomy. The European Union's push to scale up renewables in its bid to reach carbon neutrality has become bogged down by a debate over hydrogen's role in the transition.

But the 2nd biggest automaker (behind Volkswagen Germany) says no about EV. Toyota's sober strategy on full electric cars is correct. Plugin hybrids use less minerals & can reduce more emissions than full electric vehicles. Toyota can produce eight 40-mile plug-in hybrids for every one 320-mile EV & save up to 8X the emissions.

Toyota chief executive always said he wasn’t a skeptic about electric vehicles—he was a realist. Long time “anomaly” in Japan, actually. Until today, in 2023, Walkman SONY still exists when iPod already “rest in peace.”

Longtime CEO Akio Toyoda called himself a spokesman for “a silent majority” of people in the auto industry who questioned a single-minded focus on EVs. He argued that hybrid gas-electric vehicles like Toyota’s Prius could be just as environmentally friendly, and said other companies were pushing consumers to make a leap into EVs that they might not be ready for, without a charging infrastructure fully in place.

Then, last week he handed the reins of Toyota to a successor.

“When it comes to digitalization, electrification and connectivity, I personally feel that I belong to the older generation,” said Mr. Toyoda, 66 years old, in announcing that 53-year-old engineer Koji Sato would take over as president and CEO in April, while Mr. Toyoda would become chairman. “For me to take a step back is important.”

The transition is a landmark moment not only in the car industry but in the complicated shift to green energy throughout the business world. Some companies, investors and governments are pushing for big leaps into renewable energy and green technology, arguing that the consumer and the infrastructure will catch up to the changes. In the auto world, Mr. Toyoda is among those who have advocated for moving more slowly and deliberately.

Meanwhile, government agencies and investors are incentivizing companies to move into EVs with subsidies and tax breaks. New EV tax credits in the U.S. law dubbed the Inflation Reduction Act don’t apply to hybrids that don’t plug in.The European Union has mandated zero-emission new car sales by 2035. The state of California will also only allow new sales of EVs, plug-in hybrids and hydrogen-cell vehicles beginning in 2035.

EVs are taking growing chunks of the European and U.S. markets, and one fifth of the world’s largest car market, China, already consists of EVs.

Even before Toyota’s first change at the top in 13 years, it was weighing some changes to its EV strategy behind the scenes. The company has been studying rivals including Tesla Inc., according to people at Toyota, and considering bigger upfront investment in its EV technology and manufacturing capabilities.

Toyota’s current EV platform—the underlying architecture on which various car models can be built—is partly repurposed from an existing platform for gasoline-powered vehicles. Earlier this month, Mr. Toyoda told The Wall Street Journal that the company was considering rolling out a new platform for its EVs, in what would be a shift in its longtime strategy of piggybacking on its existing technology. Last August, the company said it would spend up to $5.6 billion to expand its EV battery factories in the U.S. and Japan.

Last month, Mr. Toyoda wondered aloud how much longer he could keep up his arguments for a more incremental and multifaceted approach. Thanks to his efforts, “the silent majority has been put more at ease,” he said, speaking at a racetrack in a rural area of eastern Thailand as race cars whizzed by. “But who is going to continue to do this?” he asked. “Until more comrades emerge, am I going to do this until I collapse?”

At the racetrack, Mr. Toyoda pulled aside Mr. Sato with a request. “Can you do me a favor? Can you be the president?” he said. Mr. Sato said yes.

Two generations ago, Toyota was remaking the car industry with innovations like just-in-time manufacturing and an obsession with continuous improvement. Its rise in the 1960s through 1980s was all about trying to match and exceed Detroit’s Big Three with what ultimately became a global network of factories including more than a dozen manufacturing plants in North America.

By the time Mr. Toyoda took the top job in 2009, there were signs that the company had been moving too fast. Its quest for global dominance was cutting into profit margins and causing some to question whether quality was being sacrificed. The grandson of Toyota Motor founder Kiichiro Toyoda, Akio Toyoda was 53 at the time—the same age Mr. Sato is today.

Mr. Toyoda was weeks into the job when a car driven by a California patrolman crashed over an embankment and burst into flames, killing the driver and his wife, daughter and brother-in-law. Reports blamed a floor mat that became lodged against the accelerator pedal.

In the months after the crash, Toyota recalled more than eight million vehicles for fixes. The company temporarily halted production and sale of several vehicles in the U.S., and Mr. Toyoda testified before Congress in 2010 to explain.

The day of his congressional testimony, Feb. 24, became an annual remembrance at Toyota dedicated to making sure such problems never happened again, complete with a commemorative tree near a Toyota museum.

In 2010

Mr. Toyoda said he had to clean up problems caused by a rush to expand too quickly, exacerbated by a global financial crisis that pushed Toyota into the red. He has often spoken of his loneliness at the top during that period, saying he felt bullied by career executives who, in his telling, didn’t believe a family scion had the grit to lead a global auto maker. He was determined to prove them wrong.

After Japan’s recovery from a devastating earthquake in 2011, Toyota’s vehicle sales, revenue and profit marched steadily forward. Its lineup of hybrids, which began with the pioneering Prius in the late 1990s, grew into a full range of RAV4s, Corollas and other hybrid-equipped models selling more than two million units a year.

Mr. Toyoda cut costs and pared the executive ranks. By 2020, Toyota was the world’s largest auto maker by unit sales, surpassing Volkswagen AG.

In recent years, as electric vehicles captured the imagination of some investors, Mr. Toyoda said he wanted to make up his own mind about the role of EVs, not get swept up by excitement about what he saw as a not-yet-mature technology.

One of his hires was an American chief scientist, Gill Pratt, whose previous jobs included teaching electrical engineering and computer science at the Massachusetts Institute of Technology. Mr. Pratt had researchers run the numbers. He said they showed that factoring in the emissions from manufacturing and generating electricity to charge cars, a diverse lineup of electric and hybrid vehicles has similar lifetime carbon emissions to an EV-only fleet. That was the case even on a power grid getting a significant chunk of its electricity from renewable sources, he said.

Another calculation hinged on the short supplies of lithium for batteries and the fact that hybrid cars, with their smaller batteries, need only a fraction of the lithium used in full EVs. “Let’s not let perfect be the enemy of good,” Mr. Pratt said at a roundtable in Tokyo on Friday.

Mr. Toyoda gave talks making the case for a diverse lineup of vehicles that would include EVs but not only them. He said that it was hardly environmentally friendly to have coal-fired electricity plants powering cars on the road, and in developing nations of Asia it was unlikely renewables could be built out quickly.

“Ford and GM did a great job convincing Washington that EVs were the only solution,” said Steve Gates, chairman of Toyota’s dealer council. “It’s not popular to talk about things that hybrids and plug-in hybrids have done for the environment.”

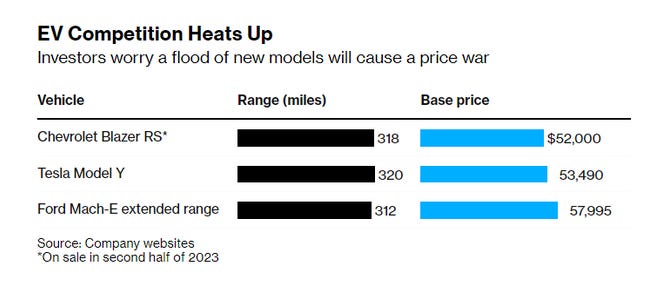

But as Tesla surpassed Toyota to become the world’s most valuable auto maker by market capitalization, competition grew. General Motors Co. in 2021 set a goal of phasing out gasoline- and diesel-powered vehicles by 2035. It has several EVs in showrooms now and more coming this year. The Detroit auto maker opened its first battery plant last year and has plans for more. Others including Volkswagen AG, Hyundai Motor Co. and Ford Motor Co. are making similar moves.

Toyota, meanwhile, has remained the leader in selling hybrids and plug-in hybrids, two model types that accounted for nearly 30% of its global shipments in 2022 through November. But sales of pure EVs—models that run on electricity only—are still tiny.

In the U.S., where Tesla dominates the EV market, Toyota didn’t rank in the top 10 of EV sellers last year, according to data-research firm Motor Intelligence, although it did introduce an all-electric sport-utility vehicle called the bZ4X.

Toyota’s all-electric sport-utility vehicle, the bZ4X, on display at the company's showroom in Toyota City, Aichi Prefecture, Japan, last June.

PHOTO: AKIO KON/BLOOMBERG NEWS

Industrywide, more than one in 10 vehicles sold in Europe in 2022 and nearly one in five in China were fully electric vehicles, according to LMC Automotive. In the U.S., EVs accounted for 5.8% of vehicle sales last year.

The first sign of a major shift in Toyota’s EV strategy came in December 2021. Mr. Toyoda said Toyota would aim to sell 3.5 million EVs annually by 2030, a big step up from the previous target.

The company posted a video on its website showing Mr. Toyoda driving a Lexus EV with Mr. Sato beside him in the front passenger seat, egging on the boss to enjoy himself.

Mr. Toyoda hit the accelerator and the two men whooped out “Woo-hoo!” Mr. Toyoda, who loves to drive race cars, said the experience persuaded him that an EV could be fun to drive.

As these trends built momentum, Mr. Toyoda assigned a longtime lieutenant to take another look at the auto maker’s EV strategy, according to people at the company.

The study included a careful examination of the strategies of Tesla, which has been an all-EV company from the start, these people said. Tesla has shaken up industry practices with innovations such as direct-to-consumer sales methods and over-the-air software updates.

One lesson from Tesla is that big spending upfront on common parts and efficient manufacturing processes can pay dividends later when volumes get big and economies of scale kick in. That is the idea behind the EV-dedicated platform Mr. Toyoda said he was considering: It takes a lot of money to design this architecture, but once it’s ready, large volumes and multiple models can be built off similar blueprints, saving costs over the long term.

A competitive EV business remains, for Toyota, one part of a bigger strategy to promote and invest in a diverse lineup that also includes hybrids and hydrogen-powered cars. “We have to take a 360-degree approach,” said Mr. Sato, the next CEO.

Earlier this month, Mr. Toyoda said he was worried that government policies mandating EV sales had sparked a race between auto makers to put EVs on roads as soon as possible and kill off other promising technologies.

“That’s not Toyota’s approach,” he said. “Energy policies are unique in different countries and people have different uses for cars, so why make just one solution?”

That stance isn’t likely to change, but Toyota observers say Mr. Toyoda’s move to the chairman’s role makes it easier for a new CEO to steer in new directions on EVs. Mr. Toyoda said it was the job of younger people to “come up with the answer of what future mobility should be” and added, “We need to be attentive to not being late.”