Gargantuan (Revenue) Super Bowl Which Never Beaten by FIFA Football: $14 Billion, $7 million per 30 seconds

In 2003 (exactly 20 years ago), total revenue from ads and broadcast rights was about (ONE) 1x GP of Formula One, only around 40-50 million Euro. OK, at least (regularly / every year) 18-21 circuits on F1 races, so total revenue is (around) 2-2,2 billion euro.

If Lennox Lewis, or Roy Jones Jr, or Floyd Mayweather play, in only 1 match, ads and broadcast rights raked 130 million dollars, with, for example, Floyd receiving 50 million alone. Highlight: sometimes a boxer only plays 1 game for 1 year or even 1 game in 2 years, with entire months just to train.

One match in (European / UEFA Champions League in 2003 maybe only (worth) 10-15 million euro, but if (in scale / in the moment 2003) a club who plays like Bayern Munich, Real Madrid, Barcelona, AC Milan, or Manchester United, 1 game will be worth 60-65 million euro. If Semi Finals or Final UCL, rocketing to 125-140 million euro. This is why idea of Super League still alive although get hammered by UEFA and FIFA: because organizer of Super League promise every match will worth (from ads and broadcast rights) at least 110 - 120 million euro. Feb 9, 2023, the organizers behind the European Super League have announced a revamped format, a new (ESL) proposal for the controversial tournament, which would see 60 to 80 teams competing in a “multi-divisional competition”. The new-look Super League would be based on “sporting performance” only with no permanent members.

In (format) 2021 Proposal (not new / 2023 proposal), each participating club in the European Super League will receive 3.5 billion euros to start with, with American bank JP Morgan heading up the financial backing of the project. The club that wins the European Super League could be due close to 400 million euros, compared to the 120 million euros that is given out to the UEFA Champions League winners each year. Barcelona, who reached the semi-finals in 2019, received 117 million euros in prize money. In 2002, Bayer Leverkusen received 103 million euro, thanks to Germany which is (of course) the biggest population for TV viewers because (biggest) population in the EU, and the winner of UCL 2002, Real Madrid, received 120 million euro.

As for the rest of the 1.95 billion euros in the European Super League, 488 million (25 percent) will be handed out in initial payments and another 585 million based on results.

Another 30 percent of payments will go based on a club's coefficient achieved over the past 10 years. That leaves 292 million euros (15 percent) dished out in add-ons. These figures haven't been confirmed by the European Super League, but they almost triple those currently earned by clubs in the Champions League. The European Super League will decide how to distribute the TV rights of their competition. The make-up of the project makes it a lucrative prospect for a lot of TV companies.It's thought that the TV money generated could be worth as much as 10 billion euros, compared to the four million euros that UEFA made in 2020 from its competitions, which it shared with its member federations.

The FIFA World Cup final is a sporting event like no other in terms of its ability to draw in a major international audience from across the globe. Football's popularity around the planet means the final showdown is always a huge occasion with supporters tuning in to watch the game on every continent. The reach of the major domestic European UEFA Champions leagues, primarily the English Premier League, has only deepened the role watching football plays in everyday viewing.

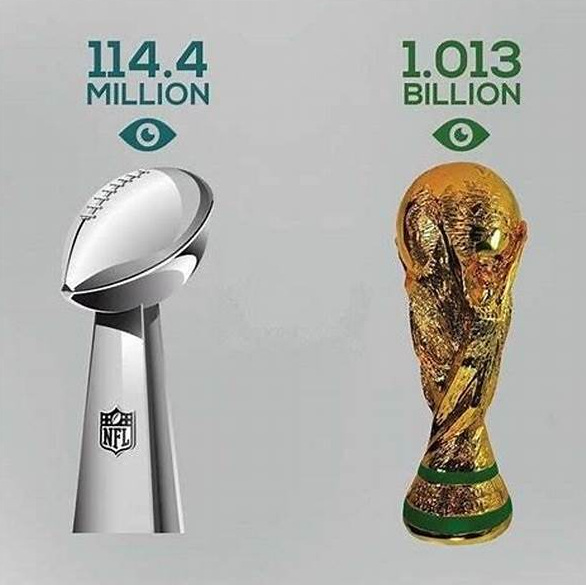

But, whatever FIFA World Cup (63 games and especially Final FIFA World Cup), F1, European UEFA Champion League, (plan of) European Super League, even NBA, cannot and never ever beat NFL. Especially the Super Bowl, although there were very few viewers (on TV, especially compared with UCL and World Cup Football. Still overwhelmed why with “few viewers” on TV, revenue from NFL and especially Super Bowl is gargantuan. Yes a lot of meme(s) say that Super Bowl only gets around 100-112 million viewers, rather than World Cup Final (because every 4 years, the viewers reach 1,3 billion - 1,4 billion, not counting another 63 games in World Cup). FIFA's figure of over 1.4 billion viewers watching the 2018 World Cup final in Moscow Russia outstrips the NFL Super Bowl almost nine-fold. But again, revenue from the Super Bowl outstrips the FIFA world Cup almost three-fold.

In U.S. only (not counting other countries), FIFA World Cup final on Fox (16.783M) trailed CBS's late NFL window (mostly Bengals/Buccaneers, 21.45M) and Fox's early window (18.658M) but bested CBS's regional window (14.8M) and Sunday Night Football (15.4M) even without including Telemundo.

Hefty as the fees were for advertising time on this year's Super Bowl this year — up to $7 million per 30 seconds — there weren't that many commercials whose concepts and execution seemed worthy of the price tag. Total revenue in the Super Bowl this year may be US$14 billion. 20 Years ago, every 1 game of NFL showered at least US$90 million (*read again in the first paragraph, 2003, peak Schumacher era, only 40-50 million Euro).

This year in UEFA Champions League, only FC Bayern wins 6 all-games in group stage, coincidentally, of course, a German club, a 83-million population, biggest in Europe. Bayern have so far earned €68.82m from the UCL after the group stage, more than any other club. Advancing to the quarterfinals would mean another €10.6m. The club would earn up to €121.52m by winning the title, in addition to the spectator revenues and TV market pool. But this number can’t reach gignatic “$7 million per 30 seconds” ads in Super Bowl. This is why idea of European Super League keep alive: capitalizing football.

From Jlo-Ben Afleck about Dunkin Donut (Grab me a glazed), Rihanna announce she’s pregnant, UFO ads by U2 amid at least 5 “UFO” (1 China balloon & 4 benign ballon by Hobbyist in U.S.) in america’s skies, (again) Affleck in 3 ads during halftime Super Bowl, and christening of Mahomes to be the next legend of NFL, the dollars around NFL is gargantuan. The Super Bowl is an economic indicator.

Data from Nielsen Media Research indicates 91.6 million US-based viewers watched the 2021 Super Bowl between the Tampa Bay Buccaneers and the Kansas City Chiefs, with an estimated worldwide figure of 140m. In comparison to the UEFA Champions League final, which is widely viewed as the biggest game in club football, the World Cup wins by another huge margin. Thanks to the landed number of covid, this year Fox’s broadcast of the Super Bowl averaged 113.1 million viewers across all platforms. That’s a slight, 1 percent improvement over Super Bowl LVI 2022 and a six-year high for the game. Final Nielsen ratings put the on-air telecast at 112.17 million viewers, with Fox Deportes contributing 882,000 more.

Data from Statista shows the global audiences for the five Champions League finals from 2016 to 2021, which involved superpowers from Spain, Italy, England, Germany and France, averaged at 76.1m, with a high in 2017/18 of 105.8m.

NBC sports reported 112.3 million viewers across all platforms last year, but using different metrics for streaming than in the past. The network broadcast averaged 99.18 million viewers, and 1.9 million people watched Telemundo’s Spanish telecast. NBC Sports said 11.2 million people watched via streaming or digital platforms, while prior years had measured the number of devices in use during the game. NBC counted 6 million devices streaming; Fox is citing an improvement on that figure to 7 million on Sunday. Given the high likelihood that more that one person was watching at least some of those 7 million streams, the true audience for Super Bowl LVII is somewhere above 113 million.

A more detailed breakdown of Sunday’s on-air audience, Spanish-language viewing on Fox Deportes and streaming figures will be available early Tuesday.

Viewing peaked with Rihanna’s halftime performance, which averaged 118.7 million viewers and was the second-most-watched halftime show on record (behind the Katy Perry/Left Shark spectacle of 2015), Fox says.

As usual, Super Bowl LVII is only competing with past Super Bowls in terms of ratings comparisons. The space between it and the second-most-watched primetime show of the 2022-23 season — CBS’ telecast of the NFL’s AFC Championship game on Jan. 29 — is almost 60 million viewers.

The home markets for both teams were both hugely invested in the Super Bowl (unsurprisingly). Household ratings showed Kansas City recording a 52.0 rating/87 share and Philadelphia at 46.3/77, meaning more than three quarters of all homes watching TV in both cities during the Super Bowl were tuned to the game. Nationally, the game scored a 40.0 rating/77 share.

After the game, the second-season premiere of Next Level Chef — which started at 10:37 p.m. ET/7:37 p.m. PT — averaged 15.66 million viewers, the best mark of the 2022-23 season for non-sports programming in primetime but a low for a show airing immediately after the Super Bowl. The previous low came way back in 1975, when NBC’s nightly newscast had 15.92 million viewers. For entertainment programming, the previous low was 17.36 million viewers for an episode of Alias on ABC in 2003.

NBC drew 21.28 million viewers a year ago for Winter Olympics coverage as its post-game programming. The last time Fox had the Super Bowl, in 2020, The Masked Singer brought in 23.73 million same-day viewers.

How the big game’s ads explain the crypto bubble, the price yo-yo, and the revenge of the touch-grass economy.

What’s the best way to understand the economy? I guess you could ask around about it. Hey, you might say to a stranger, do you have a job? All right, and your weekly income? Thanks, and how much did you last pay for eggs? You could also read government reports on employment and prices, but they’re long and complicated, and they have broad error margins.

So maybe just watch the Super Bowl.

Advertising might be the art of fibbing responsibly, but marketing budgets can’t help but be honest: You either spend $7 million on a 30-second spot or you don’t. That’s why the biggest day in American sports, which is also the biggest day in American ads, is a useful measure of which firms and sectors believe themselves to be the future of the economy—and why it’s an excellent barometer for bubbles.

In 2000, 14 young “dot-com” companies bought ad time in the Super Bowl, including Pets.com, OnMoney.com, E-Stamps.com, Epidemic.com, HotJobs.com, and e1040.com. The next year, the dot-com bubble had popped, and the software industry slashed its advertising budget below the threshold of Super Bowl spots. Two decades later, almost all of the above start-ups are dead.

Last year, a cluster of crypto companies—including FTX, Coinbase, Crypto.com, and eToro—ran ads during the big game. The surge of blockchain-related spots inspired some people to call it the Crypto Bowl. But since then, crypto-asset values have crashed. Several crypto firms have gone bankrupt. And FTX, the brainchild of the disgraced crypto maven Sam Bankman-Fried, is a dumpster fire. And what do you know, the industry has “zero representation” at this year’s Super Bowl.

In general, the ad roster seems to be snapping back to the pre-COVID status quo. Anheuser-Busch leads all firms with three minutes of airtime. Other alcohol brands such as Heineken and Diageo are in. So are M&M’s and Doritos and movie studios and automakers. This year’s Super Bowl is going to feel a lot like 2019 or 2020—except with a shiny fleet of new electric vehicles.

This sharp pendulum swing to crypto and back to junk food is clearly reminiscent of the dot-com boom and bust. But it’s also reflective of what I’ve called the yo-yo nature of the pandemic economy.

The clampdown on the physical world in 2020 funneled economic activity online. Restaurants closed, and streaming accounts opened. Investors poured into speculative tech such as crypto, believing that we were accelerating into a berserk digitized future. When the pandemic receded and the economy recovered, inflation spiked, rates increased, and risky start-ups and growth stocks that thrived in a low-rate environment crashed. It’s the revenge of the touch-grass economy.

The crypto yo-yo is just one of many vertiginous ups and downs that the U.S. economy has gone through in the past few years. Gas prices went up and down; shipping costs went up and down; the price growth of durable goods (think: furniture, jewelry) went up and down; savings rates, housing investment, and tech employment went up and down.

I’m anxious about saying something as simplistic as “the U.S. economy is just a long line of price bubbles,” but that’s true enough. The crypto bubble reflected in last year’s Super Bowl really is a microcosm of the U.S. economy.

And yet. Some bubbles enjoy life after death. The dot-com companies that perished in the early 2000s fertilized the software boom that changed the world in the 2010s. Although the 2023 Super Bowl clearly represents a return to the old normal, we might look back two decades from now and see that, just as the death of Pets.com augured the rise of online shopping, the bursting of the crypto bubbles presaged the rise of a new weird kind of digital economy. I guess we have no choice but to keep watching.

viewers were stuck watching commercials that stranded some big name celebrities in thoughtless concepts (Jon Hamm and Brie Larson inside a giant refrigerator for Hellmann's mayonnaise?) or spots which made the products they were advertising look bad (Jennifer Coolidge getting her face stuck to a glass door by e.l.f. Cosmetics).

And, after cryptocurrency exchange Coinbase made waves with a QR code embedded in a Super Bowl ad in 2022, it felt like every other advertiser this year found a way to stick them inside their commercials.

Ironically, this year saw almost no crypto ads — perhaps the only good outcome from the spectacular collapse of FTX (seems their Super Bowl ad last year with Larry David expressing a comical level of skepticism about the company was right after all). We also saw lots of nostalgia and more partnerships, including Netflix passing up ads of its own to partner with GM and Anheuser-Busch's Michelob Ultra.

Another trend also stuck out: a rise in ads for products normally considered adult vices, including liquor (via the Foo Fighters' Dave Grohl for Crown Royal), sports betting and a wider variety of beers (since Anheuser-Busch gave up its exclusivity, allowing Molson-Coors to come play).

Super Bowl LVII arrives to cap off an eventful NFL season that saw record TV ratings, but also high-profile injuries that again called into question the sport’s safety and reputation. Super Bowl LVII was full of celebrity appearances, tech brands and humor that sought to court Gen Z. We’re speaking of the ads, of course — not the game.

While 60% of Super Bowl viewers tuned in to watch the game, and 20% were watching for Rihanna’s halftime show, 14% were mainly there for the ads. Similar figures for the 2022 game.

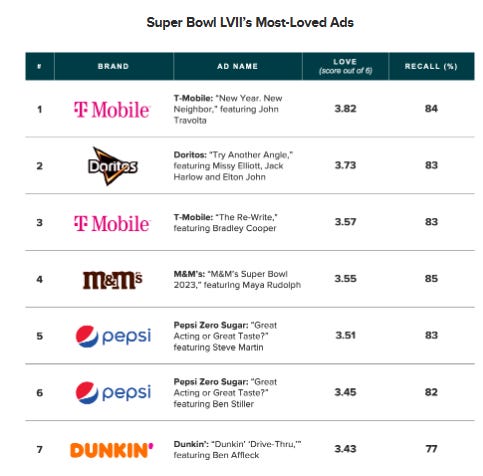

Many of this year’s advertisers used celebrities in their effort to engage audiences, with nearly 2 in 3 ads featuring a well-known personality.

Overall, that celebrity cameo did make a Super Bowl 2023 commercial slightly more effective: At an aggregate level, the average celebrity ad outperformed ads without celebrities on both love and recall metrics. But hidden beneath the average is a wide range of performance: For all of the love shown for T-Mobile and Pepsi’s commercials, some ads — such as Squarespace’s “The Singularity” and Workday’s “Rockstars” — failed to connect. It’s not just the presence of a famous face that makes an ad work: It’s what you do with it.

Part of the problem with celebrity ads is that the personality can eclipse the advertised brand. Most advertising works in the longer term by being recalled when a consumer needs to make a brand decision.

Simply put, the impressions that an ad lands will only be recalled if they are made in association with the brand. Dunkin’s spot, one of the most strongly branded ads —53% said “I’d definitely remember it is for this brand,” 17 percentage points higher than the average for a 2023 Super Bowl ad (36%) — works because Ben Affleck was working in a Dunkin’ store, in a Dunkin’ uniform and is a well-known, long-term Dunkin’ fan. Conversely, only 26% said they linked Workday’s celebs to the brand.

Because most Super Bowl commercials come from more established brands, the intended benefit of advertising would be to support salience. For brands looking to grow from their presence in an arena like the Super Bowl, the most likely route is to nudge consideration. And consideration is exactly the same, regardless of whether a personality is featured.

Chip, beer and soda brands dominated the airwaves this Super Bowl, but tech brands also had a heavy presence. In the year that Apple became the sponsor of the halftime show, plenty of other tech brands bought airtime, demonstrating that even the most market-disrupting brands need advertising.

As a group, the tech ads were less effective than their more traditional counterparts: After T-Mobile, the next most-loved ad in the sector was for Google Pixel, coming in at No. 18 in “Ad Likeability Score.” The company’s light-hearted demonstration of its handset’s photo capabilities placed it ahead of Amazon’s emotional pet-based tale at No. 22.

The tech group’s overall performance was pulled down by Super Bowl newcomers CrowdStrike and Limit Break, whose ads were missed by half of the game’s watchers and given low likeability scores by those who did recall them.

Although previous research shows Gen Z is less sports-focused than other generations, many advertisers still saw the Super Bowl as an opportunity to target this hard-to-reach audience. The use of new and emerging celebrities by some brands was seen as an attempt to appeal to a marketing-savvy — and often marketing-cynical — demographic.

Gen Zers showed that they are just as capable as other generations of showing love: Their favorite commercial, Doritos, had a similar ranking to that of T-Mobile’s “New Year. New Neighbor” among all watchers. This analysis was conducted among Gen Z adults regardless of whether they said they watched the Big Game.

The choice of celebrity clearly is important though: The Braff/Faison/Travolta combination, loved by the general population, doesn’t make Gen Z’s top 10 (it came in at no. 16). Rather, they favored ads featuring the likes of Missy Elliott and Jack Harlow, who starred in the Doritos spot, and Meghan Trainor, who was in the Pringles ad. The top 10 for this group also included brands that might be expected to skew younger anyway, such as Amazon, DoorDash and Paramount+.