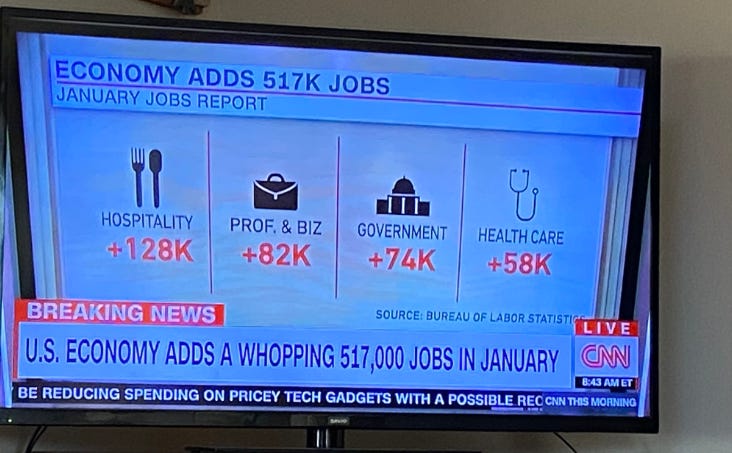

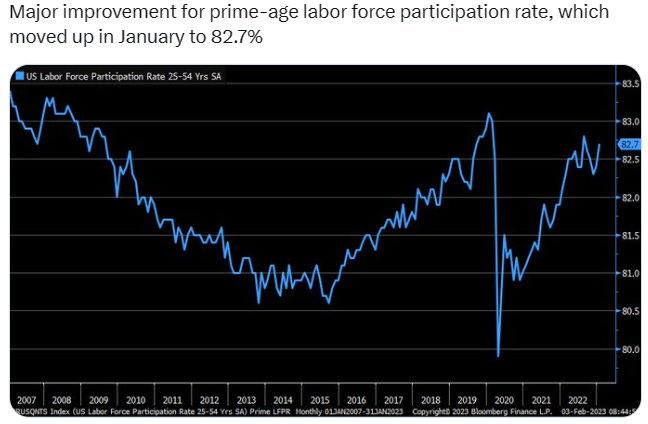

U.S. employers added 517,000 jobs in January 2023, far more than expected, and the jobless rate fell to its lowest level since 1969. Coincidentally, the Treasury yield curve was inverted for the ninth time since 1968. Lowest level (jobless) since the height of the Vietnam War when a half million young men were in Southeast Asia. In fact, growth and unemployment rates continue to defy expectations and inflation is down. Fed officials are adamant that the inflation fight isn’t done. Investors don’t believe them.

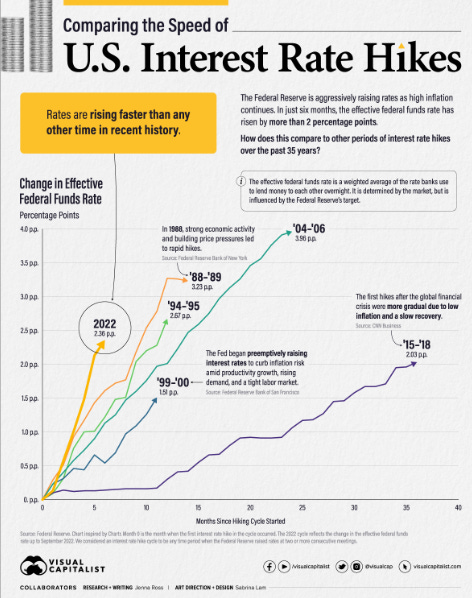

In 2022, the Fed lifted rates eight times by a total of 4.25 percentage points, which helped prompt inflation to drop to an annual pace of 6.5% in December from 9.1% at its peak in June. The Fed has cranked up interest rates eight times since March 2022, including four consecutive 0.75 percentage point increases, lifting borrowing costs in hopes of dampening demand. The Fed funds rate acts as a base rate for shorter-term interest rates, such as for car loans and credit cards.

The figures (additional jobs) showcase the resilience of the job market despite rising borrowing costs, a pullback in consumer demand and an overall uncertain economic outlook. Demand for workers continues to outpace supply As it goes up, short-term borrowing rates increase by about the same amount. UK Pound reacted to the US jobs report — it's still trading below $1.22

The Fed acknowledged recent indicators "point to modest growth in spending and production" as economic activity eases. The latest rate hike by the US central bank marks a step down from December's 2022 half-point hike and the series of bigger spikes last year. However, increases could continue further, as indicated by the FOMC statement.

According to Jerome Hayden “Jay” Powell, current or 16thn Chairman of The Fed, it will take a few more rate hikes to get to an "appropriately restrictive" policy level while inflation runs hot. Fed officials are "highly attentive to inflation risks" amid fallout from (prolonged) Russia's war against Ukraine (today or Feb 3rd 223 is Day - 345 war), which is contributing to greater global uncertainty.

Despite the Treasury yield curve being inverted for the ninth time since 1968, economist Campbell Russell Harvey (Professor of Finance at the Fuqua School of Business, Duke University and a Research Associate of the National Bureau of Economic Research) says it’s probably not a harbinger for a recession. January’s jobs report offers a chance to see whether the labor market is finally cooling off, like inflation (also looks like cooling off).

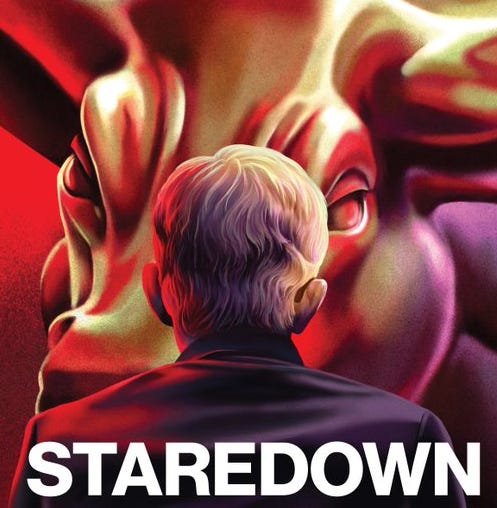

Traders were forced to capitulate months ago & have pushed back predictions for a rate cut to July at the earliest. And yet, much of that same inflation-is-about-to-melt-away good vibe has taken hold of markets once again. Investors breathlessly push up asset prices in anticipation of a pivot in Fed policy, only to get crushed when Powell reminds them that it’s too soon.