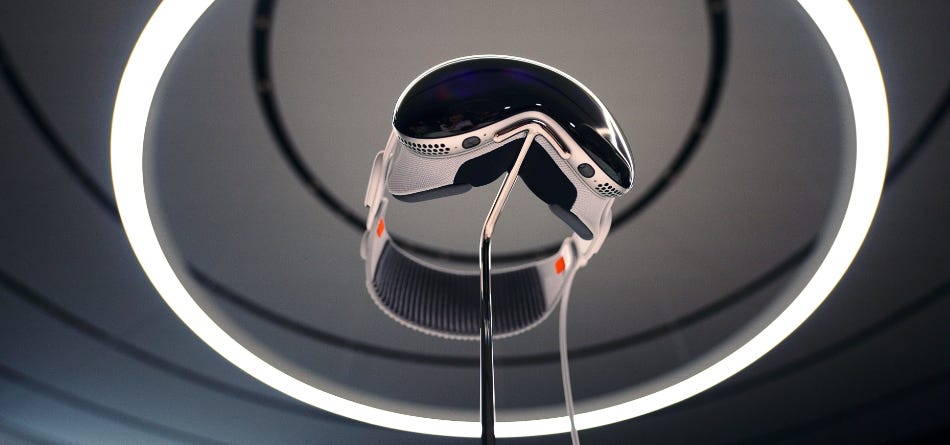

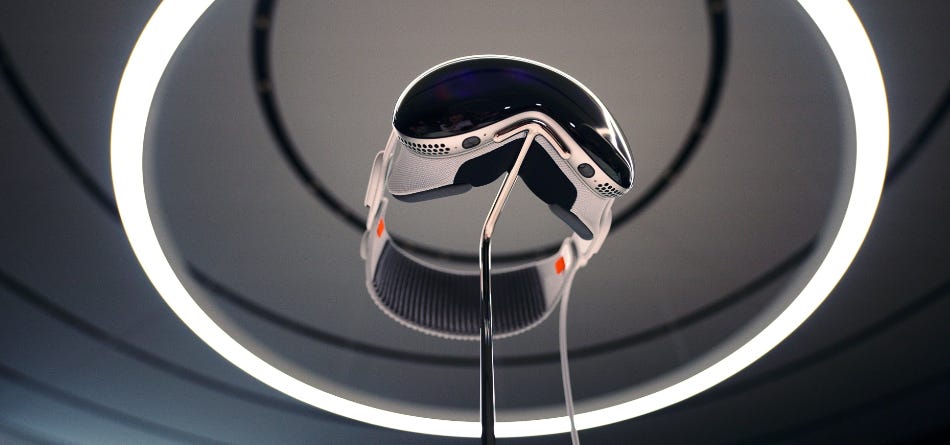

ONE MORE THING, Tim Cook, the markets did not like $3499 price tag of (surreal, dystopia) "Ready Player One" APPLE VR

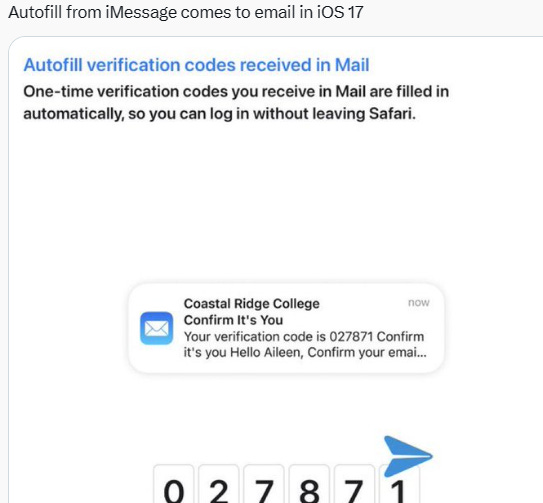

Recap WWDC 2023

The main benefit of wearing a headset to do stuff is that you can rage quit by taking it off which is in my opinion much cooler than closing a laptop lid. (New APPLE VR) looks like a kidney because you'll have to sell one. No controllers. Everything is controlled with hand movements. Really interesting.

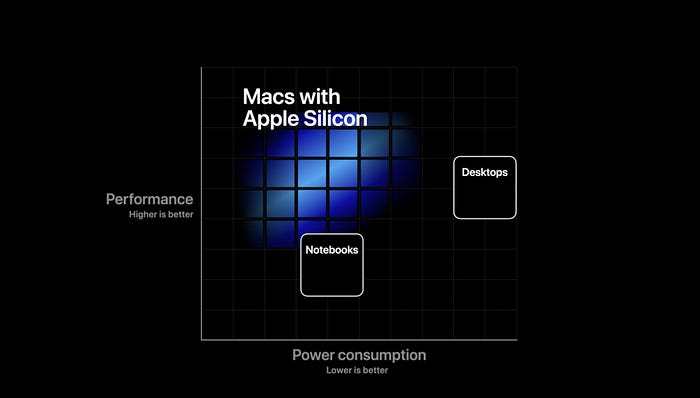

Apple’s announcement of “Apple Silicon” is important for many reasons. Delivering on such an undertaking is the result of remarkable product engineering. An annotated.

Also today, 'the two companies’ plans to launch competing subscription-video services made it difficult for Mr. Iger to remain on the Apple board, according to a person familiar with Mr. Iger’s thinking.' Iger resign from the Apple board, same hour WWDC started.

Amidst all the details, installing pre-release, and commentary (including my own) I want to take a moment to reflect on #WWDC putting it in context of the past two decades. Quite simply: APPLE show the muscle after “bad step” on AI (thanks Microsoft, you already win 6-7 years ahead on AI), with APPLE VR.

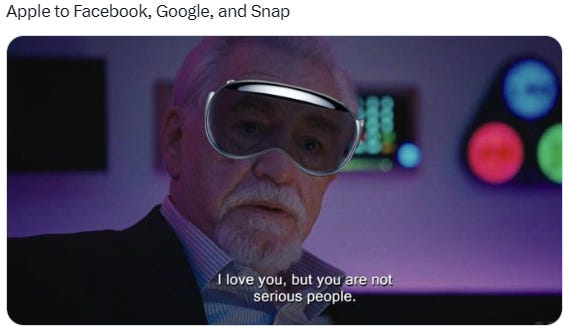

Tim Cook apple is just going down the list of things Zuck loves and taking them from him. ad targeting. VR/AR. next he's gonna announce he's a black belt at brazilian jiu jitsu. or has solved AI—-but Satya Nadella Microsoft already years ahead on AI. Just when the metaverse had mostly faded from the headlines, a heavily rumored new product launch appears poised to bring it roaring back.

Today let’s talk about what’s happened in the world of virtual and mixed reality since last we left it, and whether Apple can find mainstream uses for headsets that go beyond the games that have defined it so far. The most interesting explanation for why Apple would want to build a VR platform, Google payments to Apple to be the default search engine on iOS have exceeded $120B, with $20B expected this year. Becoming a platform landlord is so crazy lucrative. Meta’s Reality Labs losses are stunning, but such investments aren’t rare - and they're increasingly essential to building (or disrupting) a billion user platform.

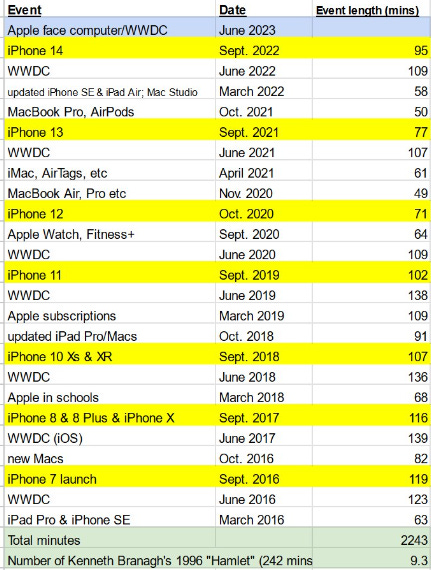

The combined time of Apple's staged product events since 2016 is the equivalent of 9+ viewings of Kenneth Branagh's 1996 "Hamlet."

In contrast to Meta’s Reality Labs and Amazon’s Alexa investments, there is clear evidence of Google Cloud’s improving prospects. Annual losses have halved from their peak of $5.6B on $13B in revenue in 2020 (−43%) to $2.9B in 2022 (−11%), and in Q1 2023, the division booked its first profit, $191MM on 7.5B, or 2.6% margins. Most analysts expect the division to remain in the black going forward. Still, forecasts suggest Google Cloud won’t reach cumulative breakeven until the 2030s (it won’t be IRR positive until years later,). That’s a literal quarter century and not guaranteed, either.

Though we typically think of a platform as being “digital,” there is no such requirement. A platform is any infrastructure or product that third parties can build upon. This includes iOS, Alexa, and AWS as well as the U.S. Interstate Highway System, Mattel’s Barbie, and Lego.

There are many ways to monetize a platform, few of which are mutually exclusive. For example, the owners can charge upfront fees to end users (e.g., buying Windows 98) or to third parties that want to sell their own products using that platform (Dell shipping a PC running Windows). A platform is also optimally positioned to offer adjacent services to its customers or users (such as ad products, productivity software, analytics). However, the most common form of platform monetization is the collection of “rents” from the third parties that build on top of it. This model also tends to be the best one, too, as it allows the platform to directly benefit from the value they create as well as leverage the investments of all its developer partners, thereby gaining access to their many total addressable markets, or TAMs.

The rent model is also why digital platforms are particularly valuable. Every person and company uses the Internet and computing devices (making it a far larger market than just a road system or toy), and there’s no constraint to how many customers can be served at once (Barbie doesn’t appeal to all toy buyers, nor can everyone use a highway at once without making the highway worse), while the marginal costs from incremental revenue are essentially zero (meaning every sale goes straight to the bottom line).

To this end, it’s notable that almost all of the most valuable companies in the world operate digital platforms that support billions of daily users and tens of billions of dollars in economic value daily. iOS is owned by the world’s most valuable company, Apple, while Android is owned by the number-three entrant, Google. Google also operates Google Search and Chrome, the top two platforms of the World Wide Web. The second-most-valuable company, Microsoft, owns Windows, the third-most-used operating system, as well as Azure, the second-most-used cloud infrastructure provider. The world’s fourth-largest company, Amazon, has a distant fourth-place OS, Fire, which runs on its tablets, TVs, and digital assistants (500MM+ total sold), but also the leading cloud service platform (AWS). Though not a strictly digital platform, it’s worth highlighting that three-quarters of Amazon’s e-commerce sales are through its third-party marketplace—an infrastructure platform where independent sellers/businesses sell through amazon and its fulfillment/payment service but set their own prices and hold their own inventory costs, rather than wholesale to Amazon. Facebook, the world’s ninth-largest company, operates the largest identity platform globally, with thousands of websites and applications using its “Log-in With Facebook” feature in lieu of, or alongside, their proprietary customer ID system.

Though a platform does not technically require developers or users to be a platform, this is a practical threshold. Epic Games founder/CEO Tim Sweeney has said that he “[adheres] to the 1990's definition that something is a platform when the majority of content people spend time with is created by others.” Bill Gates reportedly defines a platform as “when the economic value of everybody that uses it, exceeds the value of the company that creates it”, while highlighting that Facebook would not meet this definition as barely any users or developers generated meaningful income from using it (Barbie would also fall short here). Horace Deidu uses the term “ecosystem” to differentiate between aspirant and actual platforms, saying that an ecosystem “implies the acceptance of a platform by a large base of developers.”

Regardless of the technical definition, it is the ecosystem that makes a platform so powerful. Not only does the ecosystem generate “rents” and provide extra value to users, it produces powerful barriers to market entry. In the early 2010s, Amazon and Microsoft both tried to launch smartphones to rival iOS or Android. But no matter their corporate investment, they could not alone build an ecosystem. And without the ecosystem, why would users adopt these platforms? And without users, why would developers make apps for them? After all, the Fire Phone was an Android fork, rather than a wholly unique operating system, thereby making it fairly easy for developers to port their app over. Few bothered anyway.

Over the past decade, the strength of the major mobile platforms has intensified as their ecosystems have grown in scale, complexity, and global importance. They have also explicitly strengthened their controls, too. This in turn makes these platforms more financially valuable and more difficult to replicate. Again, this is not unique to digital platforms, but it’s far more valuable given the flexibility of what can run on these platforms (versus, say, Barbie or a given toll road) and the low-or-even-zero marginal cost from operations. Here, Apple is a key case study.

For the company’s first few decades, Apple’s strength was typically attributed to the rich integration of hardware and operating system. In recent years, Apple’s tight integration has expanded into first-party software and services, the distribution of third-party software and services, digital and real-world payments, web browser engines, identity, messaging, and standards. This growing bundle doesn’t just give Apple more profit streams and make its ecosystem more attractive to users and developers alike; it also provides Apple with considerable hard, soft, and even accidental power.

For example, Apple essentially bans some business models from existing on mobile devices. Xbox, Nvidia, PlayStation, Google, and Facebook have all tried to build cloud gaming services on iOS, but such applications are effectively prohibited by Apple. As a result, these services are relegated to the browser, which makes Bluetooth/Wi-Fi controller connections flimsy and friction-filled, most forms of notification impossible (such as a friend sending you an invite to play), among other impediments (there’s a reason we watch Netflix in app versus in browser—and that’s just a video player). In other cases, certain types of businesses are outright banned from having apps. One example is pornography. Three of the eleven most visited sites in the world (excluding China) are pornographic, yet none have an iPhone or iPad app—it’s not permitted.

Although a lot “amazing” stuff in WWDC today - this year, we can agree that APPLE VR is the winner. AND more amazing stuff to the world will be ended on trash bin.

Reality Pro will offer VR FaceTime calls, immersive video, and an external display for connected Mac computers, among other features. As of January, though, Gurman reported that the company hadn’t yet discovered a “killer app” for the device — an experience compelling enough both to justify the high price tag and drive everyday use.

While reporting on VR often focuses on the middling sales numbers, the usage numbers should arguably be of greater concern. Last year, the Wall Street Journal reported that six months after purchase, more than half of Meta’s $400 Quest headsets were no longer in use — a testament to how quickly the novelty of the experience tends to fade. (Or, perhaps, how quickly the many inconveniences of using the device pile up.)

OF COURSE this is huge concern because…. APPLE VR price is US$3499, arguably too expensive. The markets did not like the $3499 price tag. David Hogg, anti-gun activist, tweet a plea: Instead of dropping $3499 on something that basically does everything your phone does but worse- you can donate $3499 to http://Marchforourlives.com/donate to support our work to end gun violence.