Crunched the numbers energy price cap (Subsidi BBM cuma bayarin supaya rakyat & oposisi ga rusuh)

This is bi-lingual about energy. English and Bahasa Indonesia

Day-184 war between Russia - Ukraine. Putin is betting that sky-rocketing energy prices and possible shortages this winter will persuade Europe to strong arm Ukraine into a truce -- on Russia's terms. Zelensky and Putin aren’t amenable to conflict-ending talks right now. Both leaders hold maximalist goals and believe the other will eventually break. Russian oil production falls less than 3% as sanctions have ‘limited’ effect. Just like the Russian economy, Russian diplomacy is trying to replace its ties with the west by switching to the domestic market and looking for audiences in other parts of the world.

The world has changed on energy bills so policy will have to too. We can wake up to that reality now or later, but either way we’ll be in a very different phase of this crisis policy wise by Winter (for Northern & Southern Hemisphere), or after G20 in Bali (for Indonesia). We've crunched the numbers on what the new energy price cap.

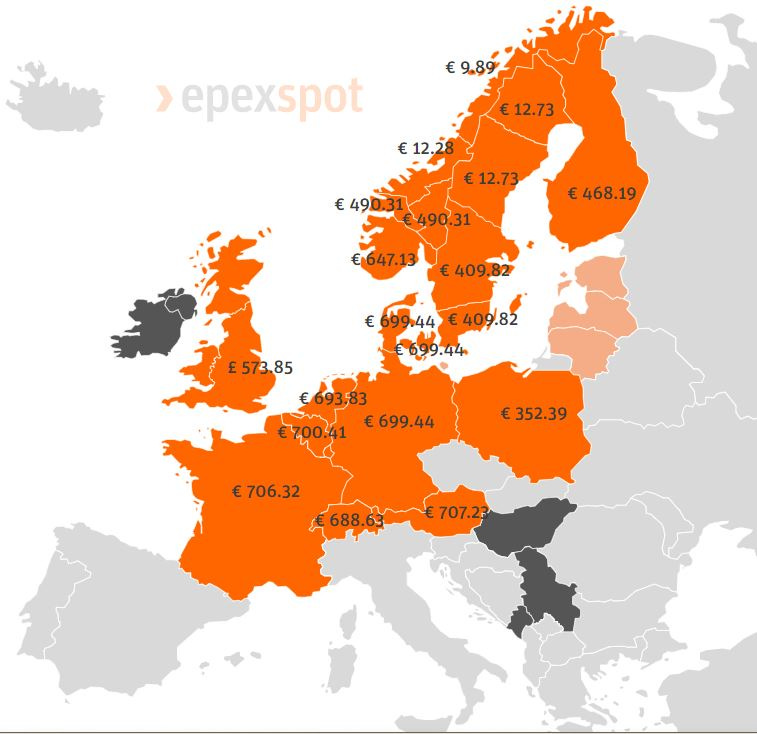

Thought bills we're heading to EUR 800 - EUR 1400 for Eurozone, or US$ 750-1000 for U.S., Canada$ 900- 1600, or mid-£3,000s for UK, or Pertalite in Indonesia maybe will reach IDR 21k and Pertamax will reach IDR 27k/litre, the textbook economic answer of let prices rise (so everyone has incentives to cut use) + support lower income households was also the right answer. But it’s time to recognise that is not the world we’re living in.

In UK, October price cap will rise to £4,000. You can add another £1,500 to that in January 2023. Rising prices will combine with falling temperatures (half of domestic gas use is between Jan & March). We’re on course for a winter catastrophe.

Radically rethought policy answers are needed otherwise we’re heading for thousands having their energy shut off & millions running up arrears. Govt has already announced lots of support (IDR 502 trillion in Indonesia; US$ 360 billion with Inflation Reduction Act by Biden; another EUR 90 billion by Scholz just in Germany after "all-in-ticket" for transport EUR 9; and £40bn+ in UK---- regardless still confused for next PM between Sunak / Truss). But, for the UK, winter bills are now set to be 47% (£881) higher than we thought back in May. U.S. still busy for midterm election in November 2022.

(Price in Germany. Aug 27th, 1.03 am CET)

A massive cliff edge that sees those who aren't on benefits get nothing (including the poorest). As the problem/those payments get bigger the less tenable this is. Every research/study about subsidies in Indonesia, 70-85% subsidies goes to the upper class, the rich. Those payments are flat rate so take no account of very different energy bills (and therefore energy bill rises).

Time to recognise that the idea poorer households need to face the full marginal cost of energy for "incentives" reasons is dangerous at this point. To be blunt we are going to be capping energy costs, the question is 1) for whom 2) how we do and pay for it. The challenge? Implementation is hard (but not impossible). Those on benefits could be automatically enrolled, while others would apply to their energy company with govt checks via tax data in Northern Hemisphere, or in Indonesia since last July, forced everyone to use MyPertamina apps so govt controlled how much people consume Solar (get subsidies 8-9k per litre) and Pertalite (get subsidies 6-7k per litre).

In Indonesia, the administratively easier (but politically more difficult) route to achieve broadly the same outcome is to cut everyone's bills and then claw back the gains from higher income households. Reduce subsidies get direct "No" by opposition like Gerindra.

Reduces the incentive of higher income households to cut consumption, will be some that lose out overall. One reason we need to urgently get on with thinking these things through is that there are big trade-offs/decisions to be made that are currently being ignored. In Indonesia, the big picture fiscal side of this needs more attention - we're talking about the third big ratcheting up of debt in last 20 years (especially after December 2004 Tsunami), but this is the first happening while the costs of that debt are also being increased. Rising energy prices and the likelihood that governments are about to put in place big fiscal support are partly why markets are expecting bigger interest rate rises.

The fiscal issue isnt that we can't afford to cover everyone's bills - it's that we don't know how long this will go on for (so far August 26th is Day-184 of the Russia-Ukraine war). So ideally we'd put in place an approach that isn't so expensive (either via targeting or recouping it via tax) that we can't sustain it. France (via EDF), Indonesia (via Pertamina), Saudi (Aramco), Norway (Equinor ASA) basically started at the "state picks up the rising energy costs for everyone" end of the market and is now heading the other way (allowing bills to rise) because of exactly this problem. There's not much free about a market Putin is controlling. Russia contribution is (at least) 9% oil for the world and 12-13% gas for the world.

Once prices are up 250% do we really think an increase to 300% massively changes incentives much? Like in Indonesia. 502 Trillion with price cap / ICP US$ 105 per barrel. What if in December oil price rocketing to 160? Social Incentives (in Indonesia: BLT/Bantuan Langsung Tunai) set up 400 Trillion or what? Please remind Indonesia is host G20 in November, and in gross, budget for G20 (infrastructure, hospitality) arguably absorb IDR 20-30 Trillion. This gets suggested quite a lot. Challenge is that while higher income households use slightly more energy than lower income ones, there is much more variation amongst lower income households - so this is very bad for large families.

There is no way the reluctance to tackle the windfalls being accrued by renewable energy generators can hold. The choice is just if we windfall tax those profits or regulate them down. The choice regulate already happened in France (EDF), Indonesia (Pertamina), Saudi (Aramco), or in Norway (Equinor ASA, 67% shares owned by Norway government --- so far energy prices in Norway less than EUR 150, only EUR 9-EUR 12).

In other side, always naive to expect the Saudis would boost oil production. Why? Because Aramco is raking in tens of billions of dollars a quarter on the back of high prices. It’s serving Riyadh quite well. Aramco's revenue surged by nearly 23% (to $48.4 billion) between Q1 and Q2. Commanders tasked with winning a war always believe they can salvage the situation if they have more resources. Policymakers, though, have a responsibility to see the bigger picture: recession across the globe because insufficient energy amid war.

Saudi may be pushing for $100 oil as Energy Minister Prince Abdulaziz bin Salman signals he doesn't like yo-yo pricing and says ‘cutting production at any time’ is an option. Armed with oil wealth, Gulf funds control more than $6 trillion in assets. Saudi Arabia’s oil exports rose to $31 billion in June — the highest in at least six years — driven by rising prices and increasing production. oil averaging more than $100 a barrel means Saudi Arabia’s economy is the fastest growing in the G-20. Saudi Arabia’s economy is expected to grow 7.6%, according to the IMF’s latest projections published on Wednesday, consistent with a previous estimate in April." For comparison: Indonesia on 5.44%.

Germany, the biggest economy in the Europe, the 4th biggest in the world, German climate/energy/econ minister Habeck wants to decouple wholesale power prices from gas prices to reduce energy cost. The ministry does not seem to plan an ad hoc measure but a more comprehensive reform that will take time to prepare. "European institutions and partners should be involved". UK households will pay almost triple the price to heat their homes this winter compared with a year ago, as Ofgem hikes the energy price cap to a record £3,549, thanks to Boris Johnson and his predecessor (Sunak or Truss, whatsoever). Power prices are more than $1,000 per barrel of oil equivalent across the Europe. Gas price is 13 times its seasonal norm, compared with last year. Heat waves are boosting electricity demand.

Because Ukraine - Russia war, Iraq's oil export revenues are now 4x that of Iran's. Iraq made more than $330m a day from oil exports in Jun 2022. Total for the month > $10b Average prices per barrel in Jun: Brent = $117 vs Iraqi crude = $101.

Indonesia Finance Minister Sri Mulyani Indrawati, in her 60th birthday today (August 26th) is ready to increase budget spending to protect consumers – and Indonesia's economic recovery – amid surging inflation.

She conceded that energy subsidies were perhaps “not the best option” because the poor may not enjoy the benefits as much as the middle to upper class, but said political considerations needed to be taken into account as well. Several research, both government and private sectors, since 2004 shows that 70-85% subsidies absorbed by upper class. This year, minimum, Indonesia subsidies reach 502 Trillion. March 28th 2022, Jokowi said that the budget to building the basic infrastructure of the capital /IKN NUSANTARA in the first phase, would cost an estimated (ONLY) Rp 466 trillion (US$31 billion ---- assumed US$ 1 = IDR 14,900).

502 Trillion (& still counting, because with ICP US$ 105 ---- oil price currently on US$ 117-124) vs 466 Trillion.

With satire - skepticism, Minister Mulyani in her birthday slandering "the rich", shout "Mobil Bagus (Orang Kaya) menikmati subsidi IDR 4800 / litre ----- the rich with fancy-luxury car even we subsidized IDR 4800 / litre."

========|||||========

Subsidi BBM itu bukan membayarin bensin. Tapi bayarin supaya rakyat ga rusuh dan oposisi gak nanggok. 502 Triliun (& bisa lebih besar lagi, tergantung harga minyak naiknya makin drastis gaknya) bisa tuk bikin kota baru. 28 Maret 2022, Jokowi sendiri yang bilang, biaya tahap awal hal-hal primer untuk bikin IKN NUSANTARA (CUMA/HANYA) 466 Triliun. Lebih sedikit dibanding 502 Triliun.

Merujuk warga Semarang yang ultah hari ini (*baca: Bu Sri Mulyani, pidato hari ini), dari zaman (jadi anggota aktif) BEM UGM sampai sekarang ga pernah setuju dengan subsidi BBM. nyokap pakai motor berapa sih sebulan literannya.

Bandingkan (Bu SMI tadi pidato, dengan nyinyir, ucap) "MOBIL BAGUS" disubsidi 4800-5200 seliter (& bisa makin besar lagi kalau harga BBM makin mahal, istilah Bu SMI “proyeksi dan kesepakatan harga meleset dari realita”), dimana "MOBIL BAGUS" bisa sebulan 500 liter. Sedih banget ultah2 kekgini dia sampai harus jelasin culasnya warga/orang2 Kaya NKRI.

Gue kalau jadi RI-1 bersumpah (*istilah sarkas tapi ada benarnya) menghapus "nyogok ke rakyat dan oposisi dengan istilah subsidi BBM". 500-900 triliun hilang dimana 70-80 persen yang pakai itu orang2 kaya doang.