Tax Day: US$2 trillion & 700 million Tax Evasion by Ultra Rich

The deadline to file your taxes is today, which is just around the corner. Navigating the tax system can be complicated — especially if this is your first time.

The deadline to file your taxes is today (April 18th), which is just around the corner. Navigating the tax system can be complicated — especially if this is your first time.

The American version of “let them eat cake” had long been real estate mogul Leona Helmsley declaring that "We don't pay taxes. Only the little people pay taxes." But at least she went to jail. On this year’s IRS day, data suggest the modern tax ethos is more akin to the quip on the latest episode of Succession, when Roman Roy says that his father being lauded as a “business genius” is mediaspeak for Logan having “never paid a penny in U.S. taxes.”

America’s wealthy have stashed nearly $2 trillion in foreign tax havens, and most of that is controlled by a handful of oligarchs. The data comes just after a little noticed Supreme Court ruling limited federal regulators’ power to use fines and penalties to prevent rich people with offshore accounts from ignoring tax disclosure laws.

Credit Suisse concealed more than $700 million in accounts from the IRS, flouting a 2014 plea deal the bank made with the Justice Department for wide-ranging criminal tax evasion, the Senate Finance Committee said in a report released Wednesday (March 29th).

The troubled Swiss bank, which is being acquired by rival UBS, broke the terms of the deal when it failed to tell the Justice Department about transferring nearly $100 million belonging to a U.S.-Latin American family from large undisclosed accounts to other banks for almost a decade, the report said.

The Senate investigation determined that Credit Suisse’s former head of private banking for Latin America played a significant role in handling the family’s assets.

Based on information requests from the committee, the bank identified 23 undeclared accounts belonging to ultra-wealthy U.S. citizens with more than $20 million at the bank. The Senate report noted that more concealed accounts could be uncovered as the bank’s review continues.

“At the center of this investigation are greedy Swiss bankers and catnapping government regulators, and the result appears to be a massive, ongoing conspiracy to help ultra-wealthy U.S. citizens to evade taxes and rip off their fellow Americans,” committee Chair Ron Wyden (D-Ore.) said.

The bank had paid $2.6 billion under the 2014 plea agreement with Justice.

“Credit Suisse got a discount on the penalty it faced in 2014 for enabling tax evasion because bank executives swore up and down they’d get out of the business of defrauding the United States,” he added. “This investigation shows Credit Suisse did not make good on that promise, and the bank’s pending acquisition does not wipe the slate clean.”

The revelations pose potentially significant problems for Credit Suisse, which reached an agreement on March 19 to be bought and have its legal liabilities assumed by domestic Swiss rival UBS.

The massive merger of the financial institutions was hastened by Swiss authorities and regulators, who feared that collapse of Credit Suisse, which sustained billions of dollars of losses in 2021 and faced several scandals, could send shockwaves through the global financial system.

At a moment when the talk of Washington is all about the debt ceiling, strengthening tax collection might seem like a simple fix that could garner bipartisan support among politicians eager to fly the “law and order” banner. After all, nearly $400 billion of owed taxes goes uncollected every year.

But while the IRS is getting a much-needed boost in resources, that’s not where the budget conversation is.

Instead, Republicans are protecting the donor class by making sure the debt-ceiling discourse is not about Swiss bank accounts, but about cutting food stamps and hobbling tax enforcement. Meanwhile, the Biden administration has paid lip service to forcing billionaires to pay their fair share, but has refused to close an egregious $50 billion tax loophole that its tax officials could end with the stroke of a pen.

Leona Helmsley and Logan Roy may be dead, but they’d be pretty satisfied with these political conditions on tax day 2023.

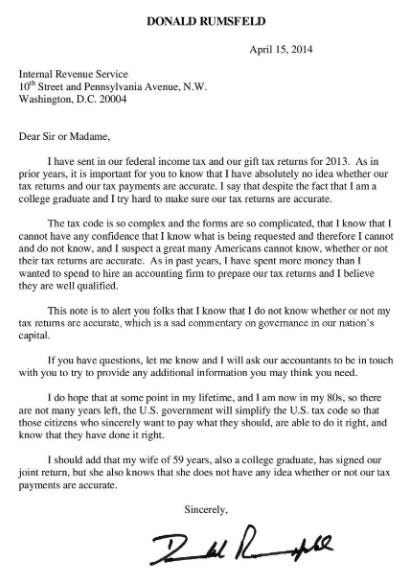

For another comparison about mandatory to files your taxes.

President Joe Biden and first lady Jill Biden paid $137,658 in federal income taxes on $579,514 in earnings, according to their 2022 tax return provided Tuesday by the White House.

The Bidens’ effective tax rate was 23.8 percent. They reported donating $20,180 to 20 different charities — the largest gift was $5,000 to the Beau Biden Foundation, an organization that protects children from abuse and named for their late son. They gave the same amount to the charity last year.

The couple owed $4,632 to the IRS.

The numbers closely mirrored those from last year, when the Bidens reported paying $150,439 in federal income taxes on $610,702 for an effective tax rate of 24.6 percent.

White House officials again released copies of the first family’s tax returns on Tax Day as a demonstration of transparency. Former President Donald Trump had refused to do so while in office and during the 2016 presidential campaign, claiming repeatedly that he was under government audit. With the release of their 2022 taxes, Biden has shared 25 years worth of tax returns that include his years as vice president and an earlier presidential run, according to the White House.

Much of the couple’s income was via the president’s $400,000 salary. Jill Biden was paid $82,335 for her teaching position at Northern Virginia Community College.

The Bidens, who filed their returns jointly, also reported paying $29,023 in state income tax in Delaware, where they have two homes. The first lady reported paying $3,139 in Virginia income tax.

The Bidens hit the $10,000 cap on state and local tax deductions, called SALT, a product of Trump’s tax law and derided by Democrats in high-cost states. They also paid more than $2,000 in additional federal taxes imposed by the Affordable Care Act.

Other charitable donations include $4,000 to Tragedy Assistance Program for Survivors; $2,000 to the Fraternal Order of Police Foundation; $1,680 to St. Joseph on the Brandywine (the Bidens’ home parish); $1,125 to Westminster Presbyterian Church; $1,000 each to Cranston Heights Fire Company and Ministry of Caring.

Vice President Kamala Harris and her husband, second gentleman Doug Emhoff, paid $93,570 in federal income taxes last year, with an effective tax rate of 20.5 percent.

Their combined federal earnings were $456,918, including Harris’ vice-presidential salary and a reported $169,665 from Georgetown University, where Emhoff, an intellectual property and business lawyer, joined the Law Center’s teaching ranks in January 2021.

The couple paid $17,612 in California income taxes, and Emhoff paid $9,697 in District of Columbia income tax.

The couple contributed $23,000 to charity during the year. They owed $611 to the IRS.

The income figures for Harris and Emhoff were far below what they reported in prior years when Emhoff was still practicing law. When Harris campaigned for president in 2019, they released 15 years of tax returns, including earning about $2 million in 2018.