Breaking: (Dominoes Falling of) Evergrande is good alarm for Saudi on ultra-ambitious property business mixed with sport business

Hong Kong 2.53pm / DC 2.53am / Riyadh 9.53am

Worrisome 2007-2010 subprime mortgage repeated again, and also worrisome about false strategy to diversification business on EV (electric vehicle), and (also) too ambitious on football or soccer business. Evergrande case is a good alarmed for Saudi, actually, currently Saudi has a gigantic ambitious on property and sport business (especially football or soccer).

Evergrande Auto, a division of vehicle business under Evergrande, tumbled as much as 16% in Hong Kong Hang Seng Indexes Company on Friday after Evergrande filed for Chapter 15 bankruptcy protection in New York. Evergrande Group - Evergrande Real Estate Group Limited, a behemoth property developer, filed for bankruptcy protection on Thursday more than two years after it defaulted on its debt, files for bankruptcy protection in U.S. court.

Chapter 15 of the US bankruptcy code shields non-U.S. companies that are undergoing restructurings from creditors that hope to sue them or tie up assets in the U.S.

Evergrande’s woes become apparent in September 2021 (nearly 2 years ago) when it admitted it could not meet the most pressing of its mammoth US$300bn debts or even complete the 1.6m homes it had already taken payment for.

Sprawling empire. It started in 1996 when Chinese real estate, commercial real estate, was in its infancy. And over the last decade, Evergrande has gone into all kinds of businesses. So, it has what was a health division but now is supposed to make electric vehicle or electric cars. And it's released six models, although it hasn't actually sold any of them. It has financial products. It has all kinds of investment products that target both its employees and its customers as well as outside investors. It owns a football or soccer club (Guangzhou Football Club, formerly known as Guangzhou Evergrande Taobao Football Club).

Evergrande Group has been the most passionate supporter of this campaign.

The company entered the football world in 2009 by taking over a club in the southern city of Guangzhou previously owned by a pharmaceutical company. Evergrande invested enormous financial resources in recruiting top domestic and international players and coaches, developing youth academies and upgrading its club facilities.

The club peaked in 2013 when it clinched titles in the Chinese Super League and the Asian Champions League under the leadership of legendary Italian coach Marcello Lippi.

Evergrande FC, by far the most successful club in China. As such, the company and Chinese football have become intertwined – both financially and politically – and will rise and fall together.

This has flow-on effects for the government and its reliance on football to boost national pride to deflect criticism and achieve its broader goals. The Evergrande crisis suggests trouble is on the horizon. And Evergrande now files bankruptcy.

China has long used sport as a way to instill a sense of social cohesion, encourage patriotic citizenship and forge a shared national identity.

The “Evergrande effect” boosted public interest in the league and laid the foundation for the central government to include football development as a key project of President Xi Jinping’s comprehensive economic, social and political reforms towards national rejuvenation.

Since then, the government has invested significant financial and reputational capital in the sport. Same similar today by Saudi long-term plan on football or soccer.

Guangzhou Evergrande’s success led other tycoons to invest in teams to boost their profile with both the Chinese public and the government. This triggered an intensified “arms race” to challenge Guangzhou Evergrande, with teams spending record transfer sums and outrageous wages to lure foreign talent to China.

Jiangsu Suning FC, owned by a major electronics retailer, for instance, hired ex-England coach Fabio Capello and signed Brazilian players Alex Teixeira and Ramires for nearly US$100 million (A$138 million) combined.

Altogether, the Chinese Super League spent 529 million euros (A$772 million) on players in the transfer market in the 2016-17 season – the most of any league in the world – while bringing in income of just 147 million euros (A$215 million).

Despite the increased competition, Guangzhou Evergrande maintained its position at the top of the league for the past decade. It has won the Chinese championship every year since 2011, bar two seasons in which it finished runner-up.

This caused a degree of hubris. In a postgame speech, the former CEO of the club, Liu Yongzhuo, asserted that “no other team can take the championship unless Evergrande gives it to you”.

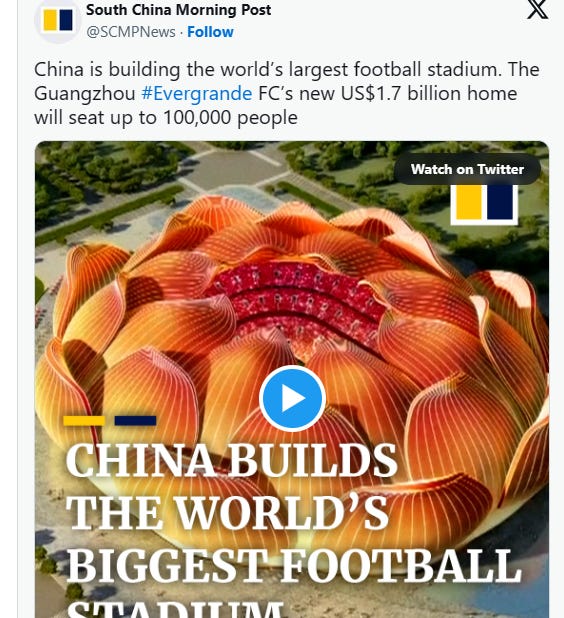

In recent years, the club also started building a $US1.8 billion ($A2 billion) lotus-shaped stadium that would seat 100,000 fans – touted as the largest in the world. Construction on the half-built stadium appears to have stalled.

With clubs running huge deficits, the Chinese Football Association stepped in with a 100% tax on foreign signings and then a salary cap this year. But it wasn’t enough to prevent the bubble from bursting.

This unsustainable spending made the Chinese clubs more vulnerable to the economic slowdown brought by COVID-19 than any other global football league.

Jiangsu FC, the reigning Super League champion, has been the biggest victim thus far, shutting down operations in March 2021, just months after winning the title. It hadn’t paid its players for months.

Evergrande’s crisis marks the end of a golden era in Chinese professional football history. It also vividly shows the abnormal political and commercial environment that has defined the Chinese league for the last decade.

In 2019 alone, Evergrande paid 870 million renminbi (A$182 million) in transfer fees, salaries and resettlement costs for five naturalised players, contributed heavily to the club’s 1.94 billion renminbi (A$400 million) loss in 2019.

No other clubs were willing to shoulder such a burden for the national cause.

China’s football reform has, until now, resembled a sort of “Great Leap Forward”, with crony capitalist characteristics. Evergrande’s crisis likely signals the end of this experiment, which could have implications beyond sporting fandom.

The central government has made a point of prioritising and promoting Chinese football as a significant component of its efforts to strengthen social and national bonds. The failure of its most successful champion in this enterprise will inevitably damage this larger goal, compounding the political fallout of the Evergrande crisis.

So, it's an enormous company, and it's very difficult to understand exactly what it owns and perhaps more importantly, what it owes.

Chinese real estate industry has gone through a boom period and the growth rate tends to be gentle gradually in recent years. The survival and development of real estate enterprises have attracted extensive attention from multiple sectors of society. A stable source of funds and lower capital cost are crucial to the development of real estate enterprises, choosing financing mode correctly is a necessary condition accordingly. Several problems existing in Evergrande financing mode are summarized: excessive asset-liability ratio, certain blindness in financing, excessive financing cost, certain dependence on bank loans, and excessive current liabilities.

SIMILAR SAUDI(?)

The UK government is facilitating collaboration between British businesses and the planned Saudi megacity Neom, despite allegations of serious human rights abuses taking place to make way for the project.

The Saudi government has been accused of forcibly displacing members of the Howeitat tribe, who have lived for centuries in the Tabuk province in northwest Saudi Arabia, to make way for the US$500bn city. Nearly 2x times of Evergrande debt.

At least 47 members of the tribe have been either arrested or detained for resisting eviction, including five who have been sentenced to death, according to a report by the UK-based Alqst rights group.

UN experts expressed alarm at the imminent execution of three members of the tribe who reportedly "resist[ed] forced evictions in the name of the Neom project".

Recent job and event advertisements show the UK Department for Business and Trade encouraging British companies to learn about opportunities at Neom and invest in the project.

the trade department invited British companies to an event showcasing Neom's "ambition to work with the UK as a key western partner".

The event was said to be geared towards space, robotics, artificial intelligence and emerging technologies sectors, aimed at "identifying supply chain opportunities" in Neom.

The UK government has separately announced that at least two British companies are working with Neom in the solar energy sector: Solar Water Plc and Space Solar Ltd.

Solar Water is providing fresh water to the megacity as part of a carbon-neutral hydro-infrastructure that involves chanelling sea water into glass and steel domes.

In March 2020, authorities sent in special forces, sometimes 40 vehicles at a time, to raid the homes of those resisting eviction and intimidate them.

The report found that 15 members of the tribe had been sentenced to between 15 and 50 years in prison, while five were sentenced to death. A further 19 were detained with no further information on their fate, while eight were released.

"Despite being charged with terrorism, they were reportedly arrested for resisting forced evictions in the name of the NEOM project and the construction of a 170km linear city called The Line," the UN experts said on Wednesday, in relation to three members of the tribe facing execution.

"Under international law, States that have not yet abolished the death penalty may only impose it for the 'most serious crimes', involving intentional killing," they said. "We do not believe the actions in question meet this threshold."

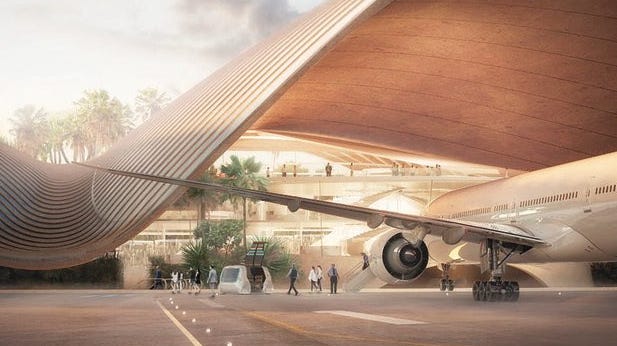

The $500bn megacity, which organisers claim will be 33 times the size of New York City, is planned to include a 170km straight-line city, an eight-sided city that floats on water, and a ski resort with a folded vertical village.

Not only THE LINE on NEOM. Another gigantic ambitious by Saudi: The Cube.

The Mukaab (Arabic: المكعّب, romanized: mukaʻʻab, lit. 'cube', [mukaʕʕab]) is a proposed architectural project to build a 400-meter-tall mammoth cube-shaped skyscraper in the al-Qirawan district of Riyadh, Saudi Arabia, one of the five neighborhoods of the planned real estate development of New Murabba. Launched in February 2023, its cuboidal layout and design are inspired by the Murabba Palace.

The massive undertaking was announced by the Kingdom's de facto ruler Crown Prince Mohammed bin Salman on February 16, 2023. The design has been the subject of some criticism for its similarity to the Kaaba at the Masjid al-Haram Mosque in Mecca, Islam's holiest shrine.

The interior as currently planned will feature enormous holographic projections aimed at making viewers feel as if they are in different realities, times, and places. The interior will also feature a swirling tower for observation decks and restaurants, from which the projections will emanate.

The Mukaab is planned to be the centerpiece of a giant new downtown built within the Saudi capital city of Riyadh called New Murabba. It will be the world's largest single-built structure with around 2 million square meters of interior floor space.

The project will be undertaken by the New Murabba Development Company of which Crown Prince Mohammed bin Salman is the President.

The cube is intended to be 400 meters (1302 ft.) tall and 400 meters (1302 ft.) wide on each of its four sides. Plans for the Cube are part of the Saudi Vision 2030 project.

The building's design is inspired by the modern Najdi architectural style. The Mukaab will also feature a rooftop garden.

The latest news has it that Neymar is on the verge of officially participating in football or soccer's hottest, lamest trend: leaving Europe to play in Saudi Arabia. The numbers, as we've come to expect, are obscene. A reported €90 million transfer fee is headed toward Paris Saint-Germain to procure Neymar's services, while he is set to earn something like €150 million annually over the course of a two-year contract with Al Hilal, the team that tried but mercifully failed to take Lionel Messi into the desert. With this, we reach the ostensible end of one of the more remarkable, disappointing, misunderstood careers in the game's history.

Let's just start here, since any conversation about the Brazilian inevitably winds up here anyway, about whether or not his career has been a failure. While there have definitely been major disappointments along the path, I'd argue that, in contrast to the going notion about him, on the whole his career has in no way been a failure.

Al Hilal, the most successful club in Saudi Arabia and Asia, was arch-enemies for Evergrande Guangzhou before collapsed, have won 66 trophies and hold the record for the highest number of league and Asian Champions League titles, with 18 and four respectively.

Strengthening the squad is a priority for the Riyadh-based club after the Saudi Public Investment Fund announced in June an investment and privatisation project for sports clubs involving league champions Al-Ittihad, Al-Ahli, Al-Nassr and Al Hilal. Al-Hilal also confirmed the signing of Moroccan World Cup hero Goalkeeper Yassine Bounou.

With Neymar and Yassine Bounou, currently 2 players in ROSHN Saudi Premier League receive minimum US$10 million per year, this scale is 4x times than China Super League at peak (2014-2017).

For comparison, FC Bayern Munich, the top 3 European Club nowadays alongside Manchester City and Real Madrid, and top 3 most successful ever football club alongside Real Madrid (14x UCL winner) and AC Milan (7x times), just have 6 players with salary minimum US$10 million. The craziest salary in ROSHN Saudi Premier/Pro League is Cristiano Ronaldo, assume US$200 million per year.

Sebastian Vettel. Lionel Messi. Cristiano Ronaldo. At least 3 legend - champion in 2 sports, F1 and Football / Soccer, already linkage, directly or indirectly, was received gigantic money from Saudi. Even Messi received not only from Saudi but also Qatar: Messi was playing to PSG, owned by Qatari. Messi is ambassador of Visit Saudi until today, and hours ago play for 2nd time to Inter Miami CF, a MLS Club

Saudi has spent at least $6.3bn (£4.9bn) in sports deals since early 2021, more than quadruple the previous amount spent over a six-year period, in what critics have labelled an effort to distract from its human rights record.

Saudi Arabia has deployed billions from its Public Investment Fund over the last two-and-a-half years, spending on sports at a scale that has completely changed professional golf and transformed the international transfer market for football.

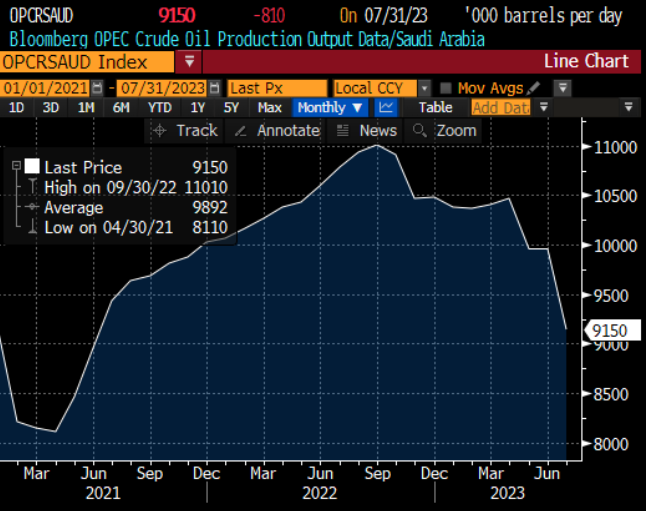

Saudi Aramco had revenue of $589 Billion in 2022. For context: There were ONLY 24 countries with better GDPs than that in the same year. That's how LONG oil money is.

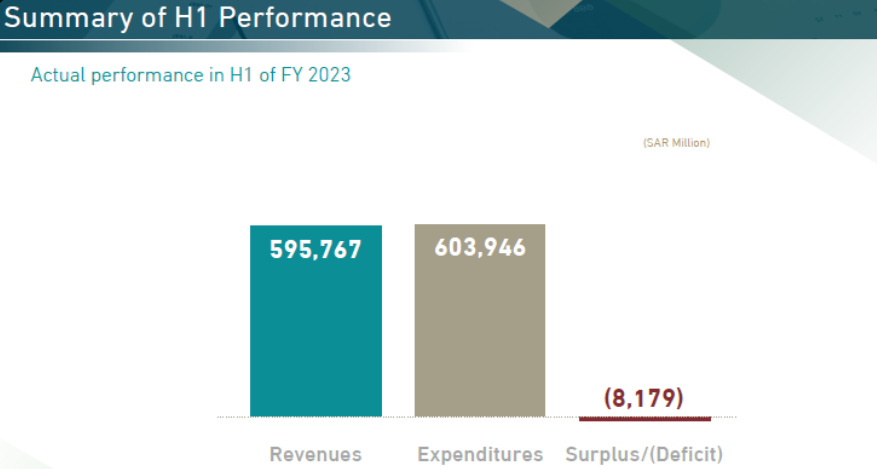

A dividend boost from Aramco will tip the govt 2023 budget from deficit to surplus The Saudi government reported a shortfall of 8.2b riyal ($2b) in the 1st half. This would double to $4b over the full year. Assuming unchanged oil revenue, non-oil income & spending.

But Saudi oil revenue was set to fall in the 2nd half of 2023, widening the full-year deficit by $5b to $9b

Why?

• Production cuts would lower crude output

• Higher expected oil prices would only partially offset that

Aug 7th, 2023, 11 days ago, Aramco increased payout to shareholders by $10b Enough to close the deficit for the government, which owns a 90% stake directly. More payments in the 4th quarter will take the budget balance into a surplus. The company remains bullish about demand in China —- with correlation de-dollarizing commitment between Saudi and China, even as the Asian nation saw its imports of oil slump in July.

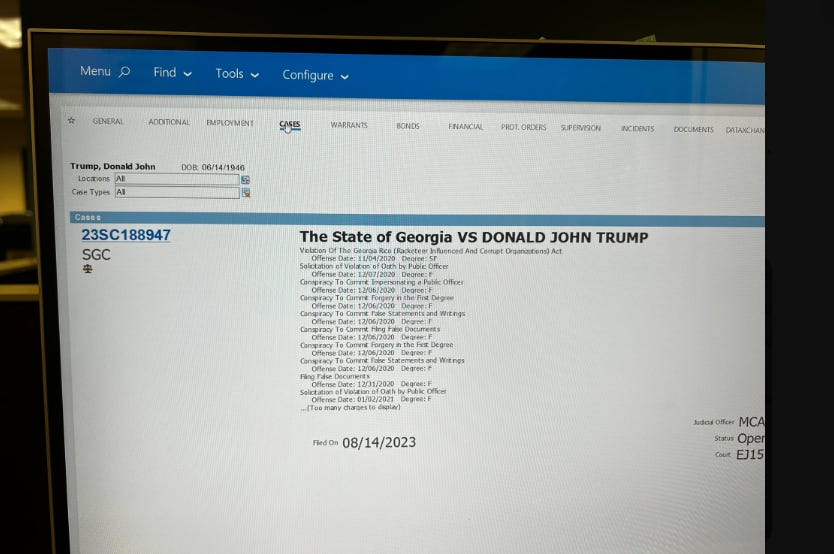

And hours ago, Evergrande bankruptcy. This bankruptcy literally good alarm for Saudi, if anyone in Kingdom of Saud noticed. Saudi Arabia’s sovereign wealth fund “Public Investment Fund” (PIF) reported a $15.6 billion comprehensive loss in 2022 after the value of its investments in SoftBank Vision Fund plunged and other tech ventures were hit by a market downturn.

In addition to US$11 billions of losses on investments — announced by the fund last month — the amount includes figures for operations, taxes and other expenses. Othr expenses by Public Investment Fund, of course, a lot of investment on sport business, from Golf until Football or Soccer.

US Senator Richard Blumenthal - who has been leading calls for an investigation into the deal made between Saudi-backed LIV Golf and the PGA Tour - has sent a letter challenging a Saudi official's refusal to offer voluntary testimony during a Senate hearing.

=========END————

Thank you, as always, for reading. If you have anything like a spark file, or master thought list (spark file sounds so much cooler), let me know how you use it in the comments below.

If you enjoyed this post, please share it.

______________

If a friend sent this to you, you could subscribe here 👇. All content is free, and paid subscriptions are voluntary.

——————————————————————————————————

-prada- Adi Mulia Pradana is a Helper. Former adviser (President Indonesia) Jokowi for mapping 2-times election. I used to get paid to catch all these blunders—now I do it for free. Trying to work out what's going on, what happens next. Arch enemies of the tobacco industry, (still) survive after getting doxed.

Now figure out, or, prevent catastrophic situations in the Indonesian administration from outside the government. After his mom was nearly killed by a syndicate, now I do it (catch all these blunders, especially blunders by an asshole syndicates) for free. Writer actually facing 12 years attack-simultaneously (physically terror, cyberattack terror) by his (ex) friend in IR UGM / HI UGM (all of them actually indebted to me, at least get a very cheap book). 2 times, my mom nearly got assassinated by my friend with “komplotan” / weird syndicate. Once assassin, forever is assassin, that I was facing in years. I push myself to be (keep) dovish, pacifist, and you can read my pacifist tone in every note I write. A framing that myself propagated for years.

(Very rare compliment and initiative pledge, and hopefully more readers more pledges to me. Thank you. Yes, even a lot of people associated me PRAVDA, not part of MIUCCIA PRADA. I’m literally asshole on debate, since in college). My note-live blog about Russia - Ukraine already click-read 4 millions.

=======

Thanks for reading Prada’s Newsletter. I was lured, inspired by someone writer, his post in LinkedIn months ago, “Currently after a routine daily writing newsletter in the last 10 years, my subscriber reaches 100,000. Maybe one of my subscribers is your boss.” After I get followed / subscribed by (literally) prominent AI and prominent Chief Product and Technology of mammoth global media (both: Sir, thank you so much), I try crafting more / better writing.

To get the ones who really appreciate your writing, and now prominent people appreciate my writing, priceless feeling. Prada ungated/no paywall every notes-but thank you for anyone open initiative pledge to me.

(Promoting to more engage in Substack) Seamless to listen to your favorite podcasts on Substack. You can buy a better headset to listen to a podcast here (GST DE352306207).

Listeners on Apple Podcasts, Spotify, Overcast, or Pocket Casts simultaneously. podcasting can transform more of a conversation. Invite listeners to weigh in on episodes directly with you and with each other through discussion threads. At Substack, the process is to build with writers. Podcasts are an amazing feature of the Substack. I wish it had a feature to read the words we have written down without us having to do the speaking. Thanks for reading Prada’s Newsletter.

Wants comfy jogging pants / jogginghose amid scorching summer or (one day) harsh winter like black jogginghose or khaki/beige jogginghose like this? click

Headset and Mic can buy in here, but not including this cat, laptop, and couch / sofa.