Creating Job, Overheated, and How After The SVB Crisis

Jon Stewart, April 4th: I can't figure out how $850 billion to a department means that the rank and file still have to be on obamacare free school, pr food stamps. To me, that's fucking corruption."

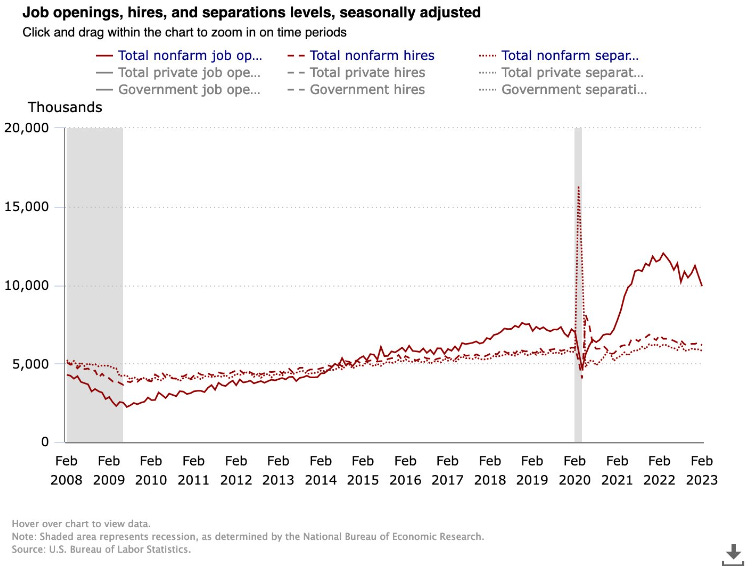

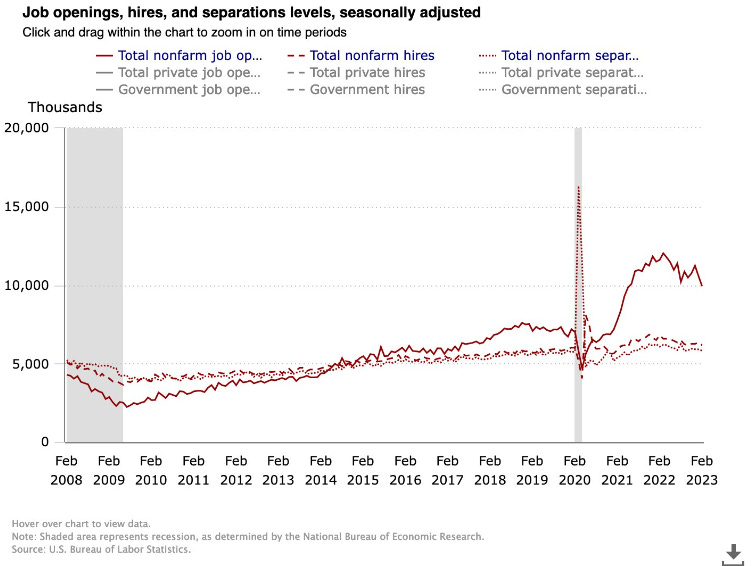

Official US government economic data increasingly lags private, alternative data sets. Indeed/Linkedin data leads JOLTS. Credit Card data leads retail sales.Truflation leads CPI/PCE.

Is overheated economy, supply of job 3-4x than demand, is really good for Biden in the wake of prolonged war (Russia - Ukraine)?

Before too far read, just reminder this note substack (and 29 million substack users) losing access in twitter, very difficult to appears in twitter in last 77 hours because friction between Elon Musk and substack. $ Months ago, actually, Elon Musk wants to buy Substacl after buying Twitter.

Back again about job data.

Latest report further confirms the labor market remains secularly tight with employment growth that remains elevated compared to low overall labor force growth.

There are some small signs of softness here and in other labor measures, but overall pretty strong – with (keep to) skepticism. Please noted that in the next report maybe has a significant change because the SVB crisis. Unemployment ticked back down to 3.5% in March. The US added 236k jobs in March, in line with the 230k expected. All time record-low black unemployment in March 2023, (would) be a good response from the Biden administration amid skepticism too much (currently around US$ 60 billion) aggregate taxpayers funds from U.S. citizens to Ukraine. Amid skepticism, 15 million people are losing access to Obamacare.

In March 2023, the prime-age employment-population ratio hit 80.7%, surpassing its pre-COVID peak and climbing to its highest level since May 2001. Average hourly wages increased by 0.3% in March. Notable how strong the HH survey has been over the last 4 months after lagging payrolls in the middle of last year (June 2022: Biden lowest rating, chaos phone call between Biden-Zelensky/frustrated, Uvalde mass shooting).

What happened to all those folks who so aggressively asserted that HH survey leads payrolls? Or were they maybe talking about their books positioned for a downturn? Turns out the divergence is just mean reverting as it's always been. That said there are some indications under the hood that suggest that the cycle is progressing (slowly).

Seeing continued weakening in the more cyclical sectors of the economy. None of these declines enough to topple employment, but clearly softening = IRA’s effect. gigantic US$ 300 billion IRA’s fund flow to market.

Temporary jobs which also give some indication of the leading edge of employment continue to be soft, even if not as weak at the end of last year. Weekly hours did soften a tad as well and have been a bit softer than earlier in the cycle.

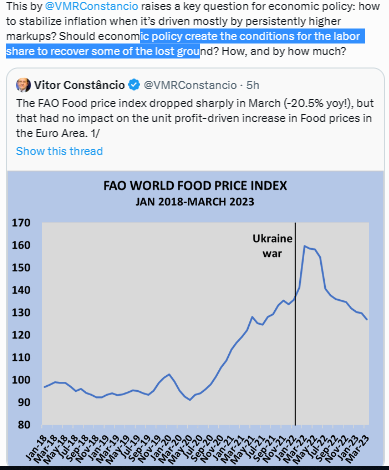

These conditions look nothing like what would align with a shift to significant rate cuts any time soon. Yet still the bond market is pricing in such moves. That path looks increasingly improbable as these incremental data come in. Taken together suggests 1) the labor market is secularly tight and 2) weakening a tad. While some softening is a good thing from the Fed's perspective, this is still far from what is necessary to durably bring inflation pressures down.

The persistence of elevated inflation and a red-hot job market have made hopes of a painless disinflation look more remote in recent weeks. But to the degree American workers bear the brunt of that adjustment, it will intensify bipartisan pressures on the central bank.

Every month that passes without inflation receding raises the odds that the Fed will keep tightening, and pushes the eventual pain closer to the presidential election cycle.

What they're saying: "When you're slowing the economy, you're trying to put people out of work. That's your job, is it not?" asked Sen. John Kennedy (R-La.) in Tuesday's Senate Banking Committee hearing.

"Not really," Powell replied. "We're trying to restore price stability."

Kennedy noted that historical patterns would imply that joblessness would need to jump well above the 4.6% Fed officials now expect in order to bring inflation down to 2%.

Powell acknowledged "that's what the record would say" but argued this time could be different.

Things were more heated with Senator Elizabeth Warren (D-Mass.). She emphasized that even a 4.6% jobless rate would imply another 2 million Americans were out of work. "Putting 2 million people out of work is just part of the cost, and they just have to bear it?" she asked, incredulously.

Powell, displaying a hint of exasperation, retorted, "Will working people be better off if we just walk away from our jobs and inflation remains 5, 6%?"

Warren added that history has no real examples of unemployment rising only slightly outside of a recession; when unemployment rises, it tends to overshoot anything the Fed now forecasts.

The Fed has held out hope that unique circumstances — including post-pandemic supply chain problems and one-time fiscal stimulus — mean that inflation might dissipate with minimal pain.

In theory, the labor market could come into balance, for example, through fewer job openings and slower hiring rather than outright job losses.

The problem is that, so far in 2023, it just isn't happening. And the longer it takes, the more likely the Fed is to see an old-fashioned recession, with all the economic pain that entails, as necessary

The bottom line: The heat is already being turned up at a time when the unemployment rate is at a five-decade low. Just wait until the job market actually hits the rocks.