Silicon Valley Bank chaos: Not Like Lehman, but Bank collapsed combine with Prolonged Crisis in Big Tech

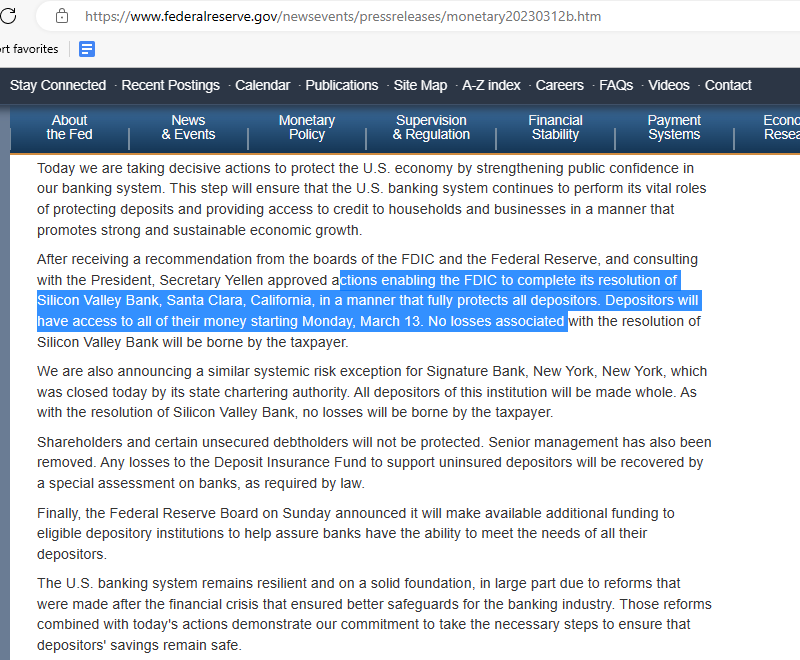

(update: Federal Reserve Board (Joint statement Treasury, Fed, and FDIC), 6.15 pm EDT/Eastern Daylight Time, announced actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, the 16th largest US bank, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated. [but] Also announced Signature Bank, $SBNY, roughly the 40th largest US bank with $118b in assets, has been closed by State authorities. On Monday, Biden will be addressed U.S. public about this issue)

According to the latest news tonight (London time) by Bloomberg, there is no risk of contagion to UK banks from SVB collapse, Rishi Sunak says. U.S. Treasury Secretary Janet Yellen rules out a bailout for Silicon Valley Bank (SVB). The fiasco SVB and complicated relation with VC (Venture Capital) are likely similar (although different crises) about how run out of money a lot of startups in Indonesia have been since March 2022, but added situational issues like the Bank Century scandal in Indonesia (2007-2009).

I was in turbulence because (I was) “steno-notulen legal intern, analyst” for a plenary session, months, about the Bank Century saga in Indonesia Parliament, so I saw (Sri Mulyani (2004-2008, Finance Minister at the moment before replacing by Pak Agus Marto), saw IDIC (Indonesia Deposit Insurance Corporation/LPS Lembaga Penjamin Simpanan), and MPS also other stakeholders. Now, I really try to be monitoring very close about SVB - FDIC (US Federal Deposit Insurance Corporation).

2020 - 2022 (sadly because coronavirus) were the most ridiculous investment years since the dot com era. These were record years not just for startups raising money but also for VCs.

Yellen said "We're not going to do that again (Washington Mutual 2008, or not a similar type of bank but Investment Bank like the cases of Lehman Brother 2009) ," she said. But, policymakers worry that the collapse of Silicon Valley Bank will trigger a domino effect in the financial system and force thousands of companies out of business. SVB went bust because it bought treasury bills, not because Venture Capitals. Startups raise money roughly every 18 months to 2 years but VCs don’t hold large balances of cash. VCs do not handle start-ups’ money for them.

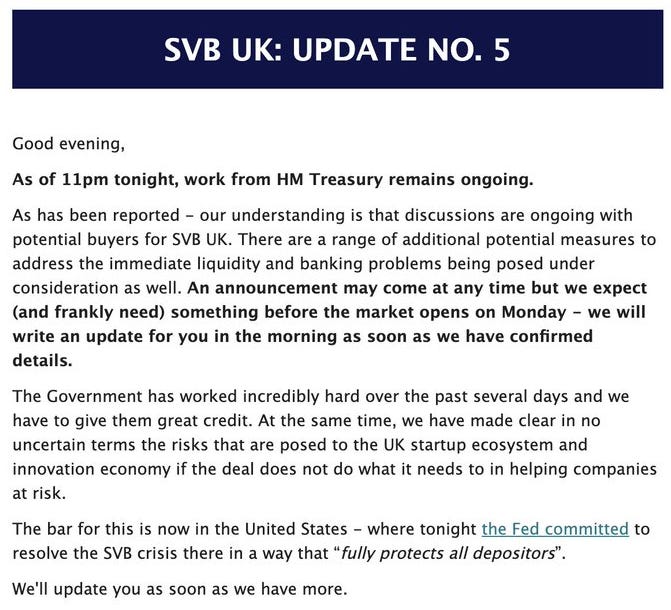

The UK Business Angels Association (UKBAA) is asking tech entrepreneurs affected by the situation at SVB to complete a short survey to provide further data to the Treasury. Again, UK, across Atlantic from America. Distance HQ of SVB to (literal) Silicon Valley only (around) 17 km. UK Secretary of Treasury Jeremy Hunt is preparing to offer a cash lifeline to tech firms with cash locked up in stricken bank SVB UK as soon as Monday. Talks today with Sunak and BoE governor Andrew Bailey to finalise the exit plan.

SVB had 40,000 small business customers who were impacted. If this was “Farmers’ Bank,” you would understand the risk of contagion. It will be obvious soon enough. …deregulation is actually terrible decision making and not just bad for consumers but also bad for the businesses and the banks.

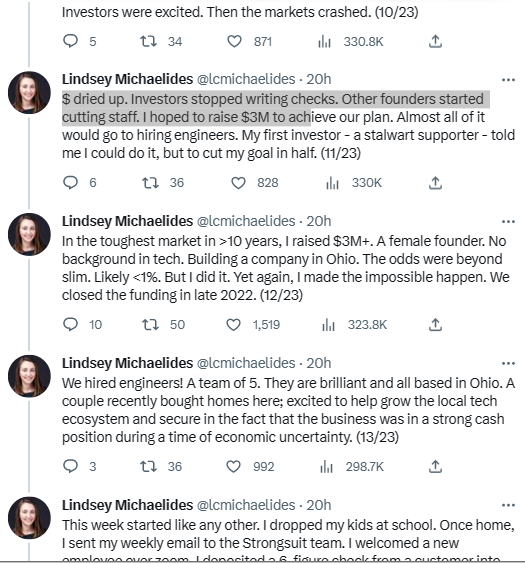

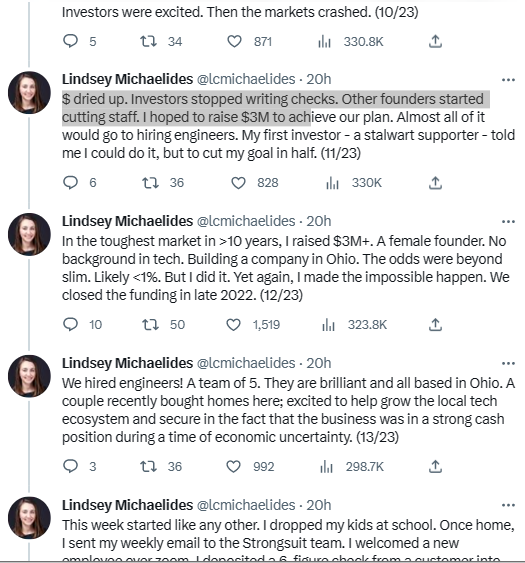

One of entrepreneurs named Lindsey Michaelides, CEO Strongsuit, shares her epilogue, sad story about SVB. Ohioan (born in Ohio, 4,000+ km from HQ of SVB in Santa Clara California), doesn't have a background on IT, mother of 4, only used Honda Odyssey.

She tweeted that the collapse of SVB might look like a 1% problem that only impacts the coastal-tech-elite. Not true. These impacts small businesses made up of hard-working people making modest mortgage payments in the midwest. This impacts parents putting dinner on the table. She started raising fund-investment in spring ‘22. Investors were excited. Then the markets crashed.

She begged for anyone to refuse to accept the convenient narrative that bailing out SVB or allowing it to be purchased by a larger bank is a handout to the tech-elite. This narrative is gaining traction. It’s convenient and easy to believe. Demand more facts. She admits that she ran the business in a strong cash position during a time of economic uncertainty. She also admits her story and the stories of thousands (40k small businesses) like her that have been impacted by SVB’s collapse do not match the current narrative (SVP collapsed because of greed by some person in internal SVB).

Silicon Valley Bank used former US Speaker of the House McCarthy staffers to weaken regulations, lobbying FDIC, according to WSJ. SVB depositors withdrew $42bn on Thursday (March 9th, 2023). Blockchain solves bank runs because it would take years to handle $42bn of transfers. U.S. Banking regulators (not only FDIC) should ensure the integrity of the system. Either deposits in the US are safe or they’re not. If not, look out below.

The spike in interest rates took out SVB first, but it could have been any bank. Soon the contagion will spread, and it will become obvious that animosity towards tech is blinding people to the real issue. if SVB depositors aren’t made whole somehow, and people speculating about ‘only’ 20-30% haircuts are right (?) then on >$100bn uninsured deposits (after the $40bn withdrawals last week) - that would be, what, 25-50% of annual US venture? SVB’s customers are being treated like they engaged in some incredibly risky behavior for which they’re being unfairly bailed out. But all they did was open a bank account. That’s not an investment, it’s a deposit.

US Taxpayers amid prolonged war Ukraine - Russia don't have to do the research to know whether food is safe, or whether that person calling themself a doctor is qualified, or whether this apartment building will fall down. These are specialist fields, and delegates. That's why regulation exists. Expecting the founder of a 5- or 10-person company to do a stress test on the bank’s balance sheet is not just weird but delusional. That’s the regulator’s job.

Panic began to spread in the morning, and there was a run on SVB, the 16th largest bank in the U.S. Many people and companies' assets are now stuck. And it unfolded in less than 24 hours. Roughly 25% of SVB deposits attempted to be withdrawn in that time period, meaning that 75% of the funds were not in "panic mode." It was the first time we've seen a bank run in the age of instant messaging, public forums, electronic money transfer, and most of the world being always online.

So the entire focus of the federal government, federal reserve, FDIC, state governments, banks, and companies should be: "how do we make sure there isn't a run on any other bank?" Because if there's a run on another bank on Monday, it will be catastrophic for the U.S. financial system.

There is one action that those in charge across DC and Wall Street can take to lower the probability of a run on any other bank. It's the single most important thing that needs to happen by Monday morning (March 13). A clear and loud message that SVB depositors will ultimately recover their funds beyond the FDIC-insured limit. Not that SVB is bailed out as a company, not that SVB shareholders get anything, but that *depositors,* who in good faith had their money in cash so that they could run their businesses, will get their money. This should not cost the taxpayer much, perhaps even zero, given where SVB's assets were last week, before the run: ~$200B in assets against ~$180B of deposits. But what it does is send a message to everyone with funds at other banks above the FDIC-insured limit: that their money is safe. That there's no need to move it to a bigger bank. A further step of increasing the FDIC-insured limit would further help prevent more bank runs.

Here are some of the companies affected by the fall of Silicon Valley Bank, which was known for serving start-ups, tech companies and venture capitalists:

Roku

The company that has built a brand on low-priced streaming devices said in a filing that it had about $487 million of its $1.9 billion at Silicon Valley Bank, about 26 percent of the firm's cash as of Friday.

"The company's deposits with SVB are largely uninsured," said the filing, which was signed by Roku Chief Financial Officer Steve Louden. "At this time, the company does not know to what extent the company will be able to recover its cash on deposit at SVB."

The San Jose-based company, which went public in September 2017, said it has enough money and cash flows to "meet its working capital" for at least the next 12 months.

By the close of US. markets Friday, Roku's stock was valued at $59.99, 0.53 cents less than the prior day.

Circle

Payments-technology firm Circle tweeted Friday that $3.3 billion of the $40 billion of its USD Coin (USDC) cryptocurrency reserves remained at Silicon Valley Bank.

"Like other customers and depositors who relied on SVB for banking services, Circle joins calls for continuity of this important bank in the US economy and will follow guidance provided by state and federal regulators," the Boston-based company said in a tweet on Friday.

The bank, Circle said in another tweet, is one of six it uses for managing the 25 percent of USDC reserves held in cash. The company had about $44.5 billion worth of tokens in circulation in January, according to a reserve report issued by accountants at Deloitte.

"While we await clarity on how the FDIC receivership of SVB will impact its depositors, Circle & USDC continue to operate normally," the company said. The company traded under $1 on Friday.

Roblox

Roblox, the California-based online gaming platform with metaverse ambitions, said in a Friday filing with the SEC that about 5 percent of its $3 billion of cash as of Feb. 28 was kept at Silicon Valley Bank.

Chief Financial Officer Michael Guthrie said in the filing that no matter the outcome of the bank's collapse and the timing, "this situation will have no impact on the day-to-day operations of the company."

At Friday's close, Roblox stock was valued at $40.05, 0.28 percent more than the prior day.

BlockFi

The defunct crypto lender BlockFi has $227 million at Silicon Valley Bank, according to a new bankruptcy filing.

Its trustee warned this week that BlockFi's funds are not insured because they are in a money market mutual fund, a type of fund that invests in cash and low-risk short-term debt securities.

The New Jersey-based cryptocurrency bank filed for bankruptcy in November after the arrest of Sam Bankman-Fried, the FTX chief executive. Bankman-Fried had pledged to save the crypto lender, which was in financial trouble for months.

Despite his announcement to lend BlockFi up to $400 million, the privately owned company filed in U.S. Bankruptcy Court for the District of New Jersey. The firm also has an international subsidiary in Bermuda that filed for bankruptcy there.

Compass Coffee

An email from CEO Michael Haft obtained by Fox Business said the District of Columbia-based coffee business's payroll was "severely impacted" by the collapse of Silicon Valley Bank.

Haft said in the email that the privately held coffee company had learned its payroll "was not processed by the bank as planned." Employees were expected to receive their payments by Monday at the latest, depending on their bank, the email said.

His company was "working tirelessly" on the issue and "taking every possible step" to avoid a similar situation in the future, Haft said in the email. The company changed providers for next week.

Camp

The New York-based privately owned toy store took to social media for help just hours after regulators shut down Silicon Valley Bank on Friday.

"Our bank got shut down by regulators, so we're asking that you RUN, don't walk to our BANKRUN sale," the company posted on its social media accounts with a picture of a girl looking solemn and text reading, "When your bank collapses." The retail company asked customers to purchase items from its 40 percent online sale.

In an email to customers sent Friday, CNN reported, co-founder Ben Kaufman said: "Unfortunately, we had most of our company's cash assets at a bank which just collapsed. I'm sure you've heard the news."

Camp did not immediately respond to a message from The Washington Post on Saturday with questions about the company's assets and whether they remained at the bank at the time of its collapse.

Axsome Therapeutics

Pharmaceutical company Axsome Therapeutics said Friday that it had "material" cash deposits at Silicon Valley Bank and at another bank but that it believed the second bank's account and an existing loan would be enough for it to keep funding operations. The company is both publicly and privately owned.

At Friday's close, Axsome Therapeutics stock was valued at $58.39, which is 5.78 percent less than the day before.

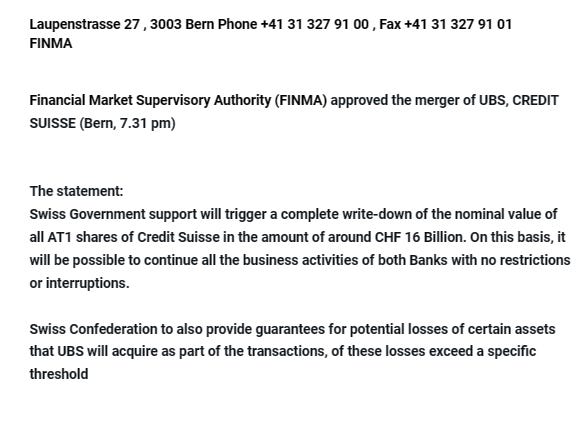

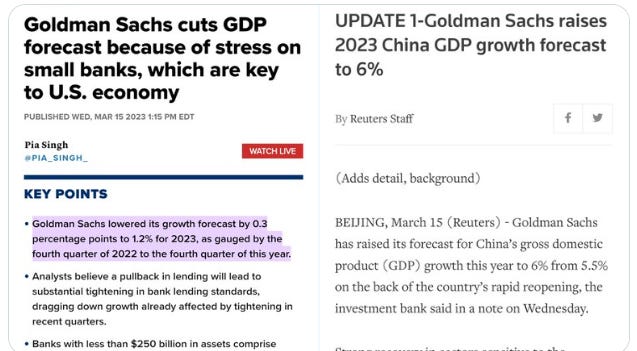

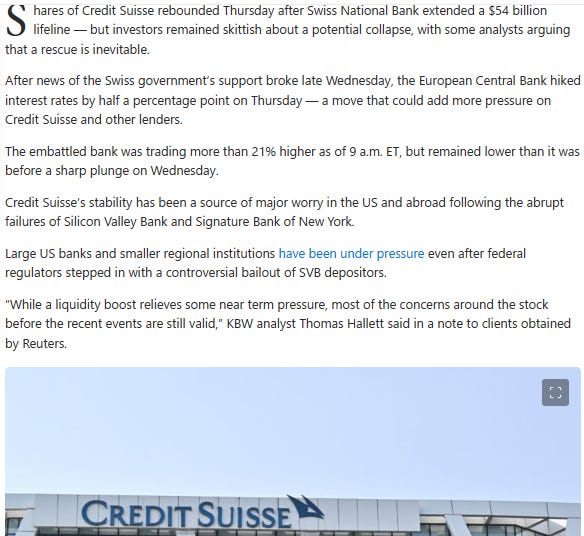

The problem is that the contagion has spread. Public conversation, that many wires are queued up on Monday morning (March 13) to transfer assets from smaller banks to the top few U.S. banks.

This is such an awful weekend for the founders, CEOs, and leaders at every company and organization affected by SVB's collapse. For those that think it's rich VCs and elites that are affected, you're wrong. It's hard-working small business owners - 40,000 of them. It's non-profits - universities, foundations, museums, hospitals (all of whom are the backbone of limited partners to venture capital firms). What I see around me is an incredible amount of effort being poured into planning for the scenarios that lie ahead. Answering questions such as: "if we only have $250K in funds on Monday, how do we make payroll and other obligations?" "What's the easiest way to loan money to companies to make sure they meet these obligations and don't have to shut down?" All of this is critical work. The stress is brutal. No one is sleeping well. Everyone is exhausted. Please keep these folks in your thoughts. Please speak up about the need for a strong message from the government, regulators, and banks by Monday morning.

Another businessman/woman like Lindsey. Max Cho found himself in the middle of a bank run while sitting on a shuttle bus in Montana.

The co-founder of insurance startup Coverage Cat, Mr. Cho had landed at the Bozeman airport Thursday and boarded the bus for the hourlong drive to a startup founders’ retreat in Big Sky.

Mr. Cho took his seat and scanned the group. Fellow passengers were frantically tapping on their phones, rushing to move their money. “The bank run,” he realized, “was actually happening.”

Silicon Valley had turned on Silicon Valley Bank.

By the time the lender closed for business Thursday, depositors had attempted to withdraw $42 billion. The Federal Deposit Insurance Corp. seized the bank before it could open Friday morning. It was the second biggest bank failure in U.S. history. Only the 2008 collapse of Washington Mutual Inc. COOP -4.11%decrease; red down pointing triangle was bigger.

It took four decades to build Silicon Valley Bank and its parent company, SVB Financial Group SIVB -60.41%decrease; red down pointing triangle, into the startup world’s pre-eminent financier. It took 36 hours to dismantle it.

The culprit wasn’t the kind of exotic derivatives and risk-taking that doomed banks in the 2008 financial crisis. Rather, it was a mismatch between deposits and assets—the building blocks of the vanilla business of commercial banking.

The fallout threatens to engulf Silicon Valley. Customers that didn’t get their money out in time have no idea when they will. (Depositors will get “receivership certificates” for their uninsured balances.) Startups and their investors scrambled over the weekend to find lifelines that would tide them over. Founders put expenses on their personal credit cards and venture-capital firms stood ready to fund payroll for their portfolio companies this week. Some appealed directly to customers, asking them to make purchases that would deliver funds to new bank accounts.

“Let us be clear: this poses a major existential threat to many small businesses,” the founders of Omsom, a maker of prepared Asian foods, said in an email to customers.

The rest of the banking system is on edge. The episode has exposed a new set of vulnerabilities for the financial system. Bankers that grew up in the easy-money era following the 2008 crisis failed to ready themselves for rates to rise again. And when rates went up, they forgot the playbook.

SVB’s intense focus on the insular world of Silicon Valley made it uniquely vulnerable to a run, but that hasn’t stopped people from worrying about who might be next. Investors dumped the stocks of banks big and small Friday, and a broad industry index had its worst performance last week since the early days of the pandemic.

Investors are especially wary of banks that grew rapidly collecting hefty deposits from businesses and rich people. Shares of First Republic Bank, once an industry darling, have fallen around 30% since Wednesday. “First Republic’s deposit base is strong,” the bank said Friday.

SVB built a banking franchise around startups—companies, founders, venture-capital firms. It grew when they did. Deposits rose 86% in 2021.

The cash was flowing faster than the bank could lend, so SVB plowed much of it into super-safe Treasurys and 30-year mortgages.

But when tech started to tumble after the Federal Reserve started raising rates, VCs closed their wallets and startups burned through cash. Deposits fell, as did the value of the bonds SVB had bought when money was cheap.

On Wednesday, the bank announced it had sold a chunk of its holdings at a loss and would sell a slug of stock to raise cash. The timing couldn’t have been worse: Crypto-focused bank Silvergate Capital Corp. was collapsing. Slack and WhatsApp groups lit up across the startup scene.

SVB’s stock, which closed at $267.83 Wednesday, crashed when the market opened. The panic grew as the West Coast woke up. VCs pulled their money and urged their portfolio companies to do the same. Some debated if they should wait to warn startups to buy themselves more time to move their own, much bigger, balances.

Social media, which hadn’t been a factor during the last banking crisis, pinged both fact and fiction around the world at lightning speed. Spooked customers whipped out their phones and opened their banking apps. With a few taps and swipes, their money was on its way.

Startups that didn’t have business accounts at other banks sent their funds anywhere they could. “They were wiring to their law firms’ bank accounts and, get this, into the CEO’s bank account,” said Kathleen Utecht, partner emeritus at venture firm Core Innovation Capital.

Mr. Cho signed into SVB as his bus drove toward Big Sky. He attempted to wire most of his company’s seven-figure balance to an account at another bank. The transaction is pending.

“The best place to be in a bank run is first out the door,” Mr. Cho said.

Silicon Valley Bank opened in 1983 to serve the community’s fledgling tech companies. It encouraged its bankers to be entrepreneurial and develop niche businesses, such as lending to wineries.

Tech was always the bank’s bread and butter. As the industry boomed, SVB grew into one of the nation’s 20 largest banks. It opened overseas offices.

SVB counted nearly half of the country’s VC-backed technology and life-sciences companies as clients. It owned warrants in 3,234 companies, which gave the bank the right to buy shares in them. The bank also offered invitation-only mortgages to company founders and venture-capital executives.

“For startups, all roads lead to Silicon Valley Bank,” said Varun Badhwar, chief executive of Endor Labs. Endor is the third company Mr. Badhwar has helped found, and in each case the company either started off with SVB as its bank or ended up moving its business there later.

The Covid-era deposit boom left SVB, like other U.S. banks, awash in cash. Deposits tripled in a two-year span to $189 billion, helping make 2021 SVB’s most profitable year ever.

The strategy, while lucrative, left the bank with a deposit base heavily skewed toward tech firms and their huge accounts. The vast majority of the bank’s deposits—$157 billion at the end of 2022—were held in just 37,000 accounts that were over the FDIC’s $250,000 deposit-insurance cap.

Chief Executive Greg Becker dismissed concerns that his company’s reliance on tech could become a problem. “I have no doubt we are in the best market,”

It was around that time that Mr. Badhwar decided it would be prudent to secure a credit line—an insurance policy that could help keep his company afloat for another year if needed. SVB was willing to lend to Endor, so long as the company moved all of its money to the bank, he said.

Mr. Badhwar shifted his deposits to SVB from First Republic Bank. Mr. Badhwar said he felt well taken care of at SVB, and he had access to the firm’s senior bankers.

“Things were hunky dory,” he said. “Until the 8-K.”

SVB’s March 8 regulatory filing announcing the stock sale and bond losses set off all sorts of alarm bells. But Mr. Badhwar had paid little attention to the bank’s situation until Thursday morning when, at around 10:30 a.m. California time, an employee noted on Endor’s Slack channel that SVB’s shares were in free fall.

“My first inclination,” Mr. Badhwar said, “was that this sounds like an overreaction.”

Within hours, the tech industry’s support for SVB seemed to melt away. Prominent VCs began to urge their portfolio companies to pull their money.

At 2:30 p.m., Mr. Badhwar emailed his former banker at First Republic: Was his account there still active? “We can work on activating it,” the banker told him.

Mr. Badhwar felt torn. He knew pulling all of his money from SVB would affect the status of his credit line. Moving about a quarter of his deposits, though, would assure Endor had enough cash to meet its payroll obligations for six to eight months. At 2:47 p.m.—13 minutes before SVB cuts off wire transfers for the day—he pulled the trigger.

Within minutes, Mr. Badhwar heard from his banker at SVB, who told him rivals had been spreading misinformation about the bank’s condition. Yes, he said, the bank would help him process the transfer. At 4:50 p.m., First Republic confirmed the funds had arrived.

Ben Lewis was perched on a hotel bed in Anaheim, Calif., when he decided to pull the $30 million his baby-food company, Little Spoon, kept at SVB.

Mr. Lewis had at first planned to stay put, but a mentor advised him not to take any chances.

He anxiously refreshed his Wells Fargo & Co. account, waiting for the money to arrive. By 9 a.m. local time Thursday, the funds appeared.

“I feel super grateful for having made the swift decision I made. But I feel horrible for these companies,” said Mr. Lewis. “Startups rely on these deposits for their operations if they’re not profitable. Time is of the essence.”

For Ashar Rizqi’s AI startup, an investment of “a few million” had been in its SVB account for only a few days when the run began.

On Thursday morning, founders and CEOs were posting tweets about SVB’s financial woes in private Slack channels. Mr. Rizqi decided to move a portion of his money, but the online banking portal wasn’t working. He spent a few hours furiously refreshing his browser. By afternoon, Slack was buzzing with messages from people moving all their money out of SVB.

He decided to follow suit, nearly draining his account. The transfer still says “in progress.”

“I have no idea how they’re determining whether money in flight will be honored or not,” Mr. Rizqi said.

Some companies didn’t realize that they had anything to do with the bank until it failed.

When employees of Los Angeles management consulting firm Linea Solutions checked their bank accounts Friday morning, they found that their paychecks hadn’t been deposited, said Brian Colker, the firm’s finance chief.

The 100-employee company used payroll provider Rippling, which banked with SVB. Rippling moved money from the company’s bank account into employee accounts, a routine back-end function of the banking system upended by the failure.

“It never would have occurred to us that the bank that holds our payroll deposits for less than 48 hours might go insolvent in that period and not be able to pay out the money,” Mr. Colker said.

Rippling’s CEO tweeted that the company had switched to JPMorgan and will use its own money to cover missed paychecks by Monday.

Founders across Silicon Valley are scrambling to figure out how they’ll pay employees this week. Jonathan Bensamoun’s smart dog collar company, Fi, had been banking with SVB since its founding five years ago. That relationship deepened when Fi took on a $10 million credit line. In return, Fi had to keep all of its operating accounts at SVB.

When Mr. Bensamoun first heard rumblings of a bank run, he faced a multimillion-dollar decision: Transferring money out of SVB would mean repaying the $4 million the company owed on its credit line.

Mr. Bensamoun conferred with his investors on Thursday. His contact at SVB assured him the bank wasn’t seeing huge outflows. Moving funds, Mr. Bensamoun decided, would be an extreme reaction to the situation.

On Friday, he changed his mind and tried to wire $5 million out of SVB. The transfer failed. Within an hour, he heard that the bank had been taken over by regulators.

Since then, he’s been calling investors asking for upward of $500,000 to fund payroll on March 15.

“Some of them were at SVB as well so they don’t have access to their funds,” he said. “The rest of them have calls from 20 companies just like us.”

President Biden spoke with California Gov. Gavin Newsom about Silicon Valley Bank and the federal response on Saturday, and the FDIC spoke with members of the California congressional delegation late Saturday night.

Yellen said that in the wake of Silicon Valley Bank's failure, Treasury officials have been hearing from depositors, many of which are small businesses, and she has been working with bank regulators to "design appropriate policies" to address the situation, though she declined to provide further details. The FDIC, she said, is likely considering a "range of available options" to stabilize the situation, which could include an acquisition by a foreign bank.

"The American banking system is really safe and well-capitalized. It's resilient," she said. "In the aftermath of the 2008 financial crisis, new controls were put in place, better capital and liquidity supervision, and it was tested during the early days of the pandemic and proved its resilience. So Americans can have confidence in the safety and soundness of our banking system."

Still, Silicon Valley Bank's shutdown has prompted nervousness about whether it could trigger a run on other small and regional banks. Yellen, though, said financial regulators are working to prevent the fallout from spreading to other institutions.

"We want to make sure that the troubles that exist at one bank don't create contagion to others that are sound," she said. "The goal always of supervision and regulation is to make sure that contagion can't occur."

Following the closure of Silicon Valley Bank, the FDIC said it created the Deposit Insurance National Bank of Santa Clara, to which insured deposits from Silicon Valley Bank were immediately transferred. All insured depositors will have access to their insured deposits by Monday morning, while uninsured depositors will receive an advance dividend within the next week, the FDIC said. Future dividend payments may be made to uninsured depositors as the FDIC sells Silicon Valley Bank's assets.

As of the end of 2022, Silicon Valley Bank had roughly $209 billion in total assets and about $174.5 billion in total deposits, according to the agency.

But more than 85% of Silicon Valley Bank's deposits were uninsured, according to estimates in a recent regulatory filing.

"We're very aware of the problems that depositors will have," Yellen said. "Many of them are small businesses that employ people across the country, and of course this is a significant concern and [we're] working with regulators to try to address these concerns."

Lawmakers are scrambling to get information from banking regulators and industry leaders on whether the demise of SVB — which had counted some of the world’s top investment firms among its customers — could pose a risk to other banks. SVB is the largest lender to fail since Washington Mutual went down during the 2008 global financial crisis, and its collapse is sowing concern that thousands of businesses may be unable to make payroll on Monday.

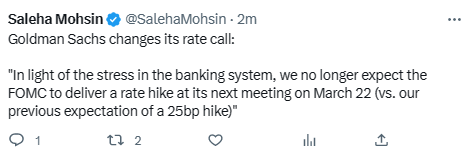

Battle lines are already being drawn over what caused SVB’s stunning demise. Progressives and some investors are blaming the Federal Reserve for its rapid interest rate hikes, which have burdened many lenders. Democrats say Republican-led deregulation of banks removed critical safeguards. Others say regulators failed to spot red flags in the bank’s investment portfolio and customer base. Many blame SVB itself.

“Imagine if politicians’ campaign funds were in SVB. Does anyone think we wouldn’t have had more action & communication?” Democrat Rep. Ro Khanna, whose Northern California district is home to the bank, tweeted on Saturday afternoon.

So far, the Federal Deposit Insurance Corp. has offered little clarity on what might happen to SVB’s more than $150 billion in uninsured deposits that support thousands of high-tech startups and health-care companies across the globe. After briefing House Financial Services Committee members on Friday, the agency on Saturday postponed a meeting with California lawmakers whose districts are among those most affected by the crisis, frustrating the Congress members.

As agency officials race to make sense of SVB’s massive loan portfolio and accounts, speculation is swirling over whether the bank will be acquired or sold off in pieces — or if a government-funded bailout might be in the works. Treasury Secretary Janet Yellen has convened regulators to monitor the fallout.

The crisis is also reigniting a fierce debate over the regulations that should be applied to large regional lenders — which are much smaller than megabanks like JPMorgan Chase and Bank of America but considerably bigger than most of the country’s nearly 5,000 banks. Congress voted in 2018 to loosen regulations on those institutions with bipartisan support.

Sen. Elizabeth Warren (D-Mass.) is renewing calls for strengthening oversight and bolstering measures that reduce bank reliance on debt — something that Fed officials have identified as a top priority. Banks have launched a lobbying onslaught to resist those efforts.

“Silicon Valley Bank’s collapse underscores the need for strong rules to protect the financial system,” Warren tweeted. “Regulators must not buckle to pressure.”

——

-prada- (Adi Mulia Pradana) is a Helper. Former adviser (President Indonesia) Jokowi for mapping 2-times election. I used to get paid to catch all these blunders—now I do it for free. Trying to work out what's going on, what happens next. Arch enemies of the tobacco industry, (still) survive after getting doxed.

(Very rare compliment and initiative pledge. Thank you. Yes, even a lot of people associated me PRAVDA, not part of MIUCCIA PRADA. I’m literally asshole on debate, since in college). Especially tonight heated between Putin and Prigozhin.

========

Thanks for reading Prada’s Newsletter. I was lured, inspired by someone writer, his post in LinkedIn months ago, “Currently after a routine daily writing newsletter in the last 10 years, my subscriber reaches 100,000. Maybe one of my subscribers is your boss.” After I get followed / subscribed by (literally) prominent AI and prominent Chief Product and Technology of mammoth global media (both: Sir, thank you so much), I try crafting more / better writing.

To get the ones who really appreciate your writing, and now prominent people appreciate my writing, priceless feeling. Prada ungated/no paywall every notes-but thank you for anyone open initiative pledge to me.

(Promoting to more engage in Substack) Seamless to listen to your favorite podcasts on Substack. You can buy a better headset to listen to a podcast here (GST DE352306207). Listeners on Apple Podcasts, Spotify, Overcast, or Pocket Casts simultaneously. podcasting can transform more of a conversation. Invite listeners to weigh in on episodes directly with you and with each other through discussion threads. At Substack, the process is to build with writers. Podcasts are an amazing feature of the Substack. I wish it had a feature to read the words we have written down without us having to do the speaking. Thanks for reading Prada’s Newsletter.