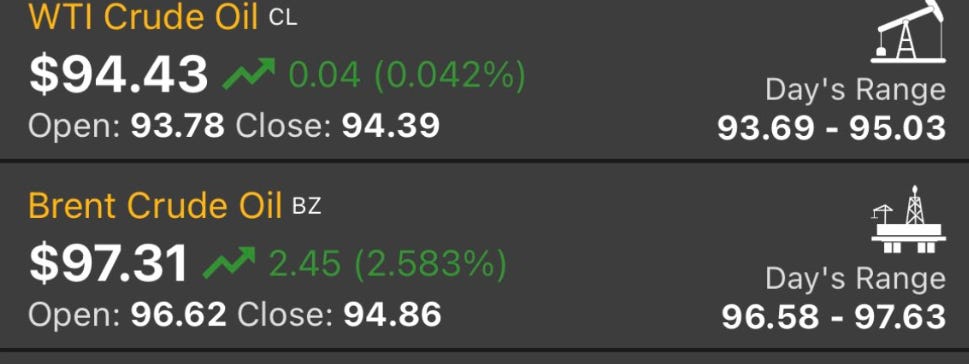

Oil already US$100. Growing consensus from top executives from the industry and oil analysts that US$100 won’t hurt demand

Jeddah 12.12pm

The price of Arab Light for Asia delivery has now surged above US$100 a barrel. Growing consensus from top executives from the industry and oil analysts that US$100 won’t hurt demand.

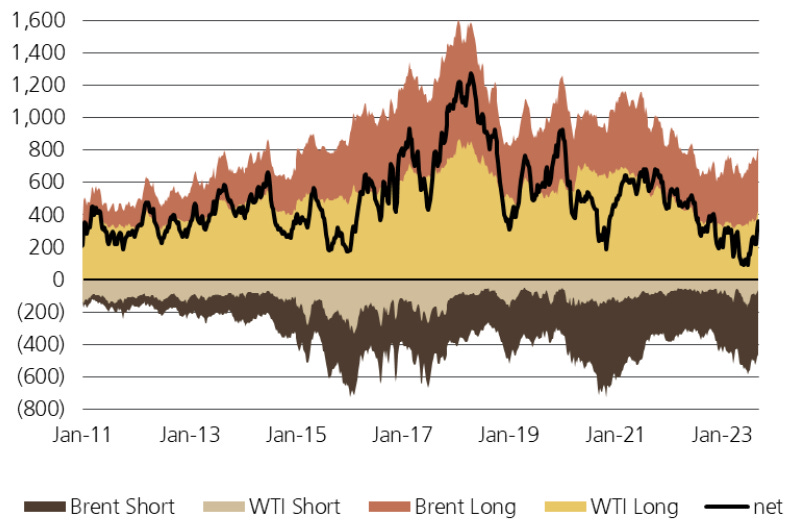

Charts on crude net-positioning of non-commercial accounts (=managed money and other reportables) in Brent and WTI futures and options combined latest value is September 27. Oslo 10.10pm [Sept 28, 2023], Brent settled at USD 95.38/barrel, WTI settled at USD 91.71/bbl.

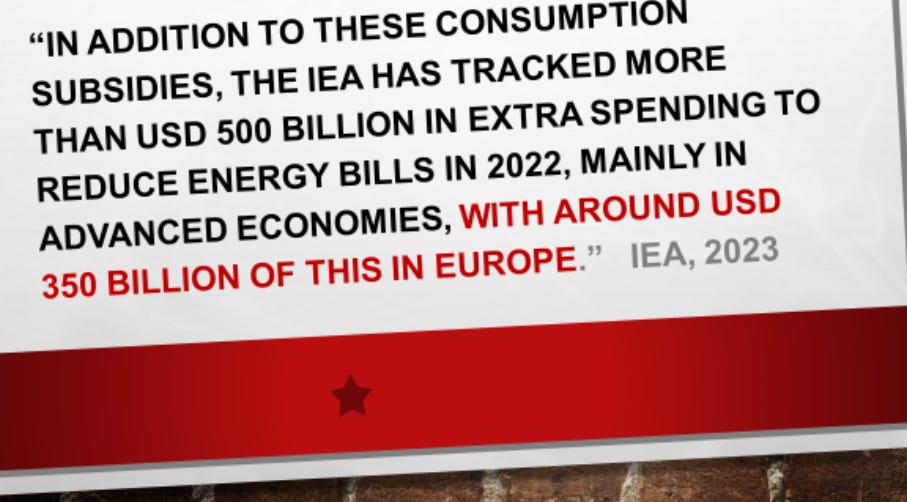

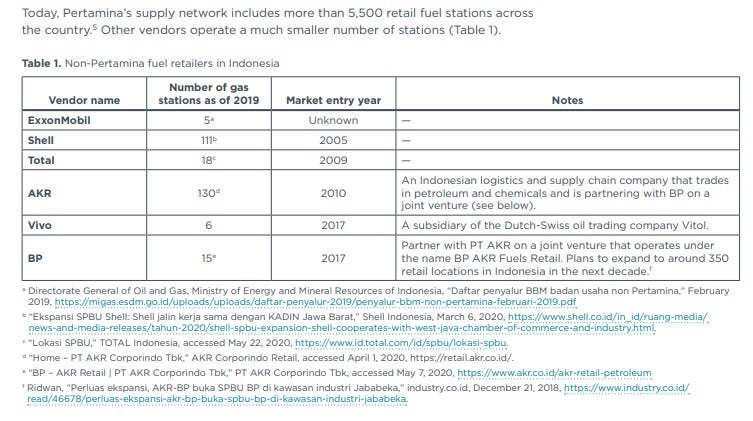

I bet that if oil goes to US$102-103 / barrel, Jokowi (& Pertamina CEO Nicke) may try to keep the price (in SPBU) as seen today. Especially because 2023-2024 is the election year: (government) normally makes sure “whatever cost” to the stability of price.

But if in October or November oil price rocketed to US$106-110 (or higher), Jokowi will give up and make sure that Parliament / DPR and Kemenkeu / Finance Ministry meet for revision of BUDGET (Revisi APBN). Similar decision may be followed by other country.

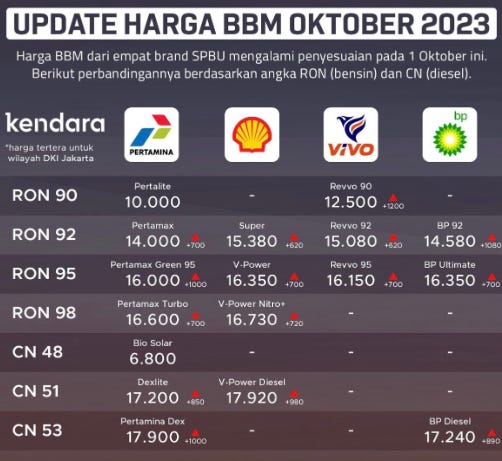

The Indonesia government recently increased fuel prices to prevent an excessive burden on the state budget from subsidies aimed at keeping domestic fuel prices low despite high oil prices. However, some may wonder why even supposedly unsubsidized gasoline in Indonesia is still priced far below global standards. And it has a lot to do with definitions. Earlier this month, today Oct 1st, 2023, the government decided in the face of ballooning energy subsidies to increase the price of fuels, including the unsubsidized Pertamax gasoline, so as to close the gap between retail prices and the economic prices and thereby alleviate the pressure on state coffers.

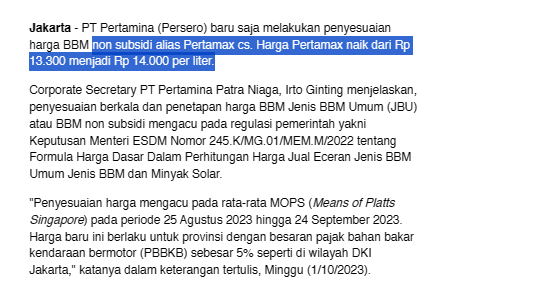

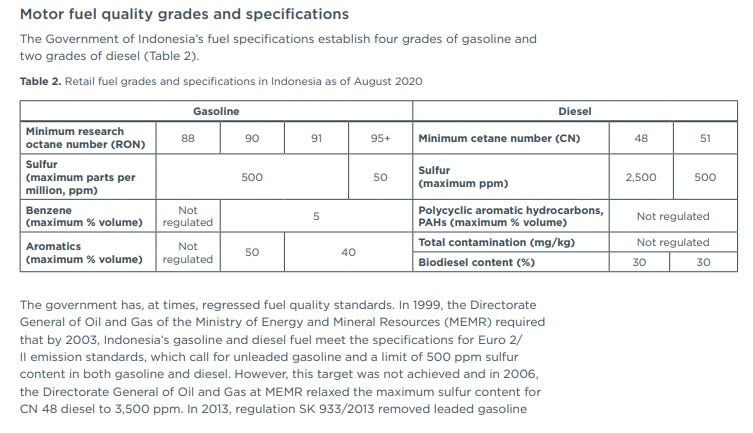

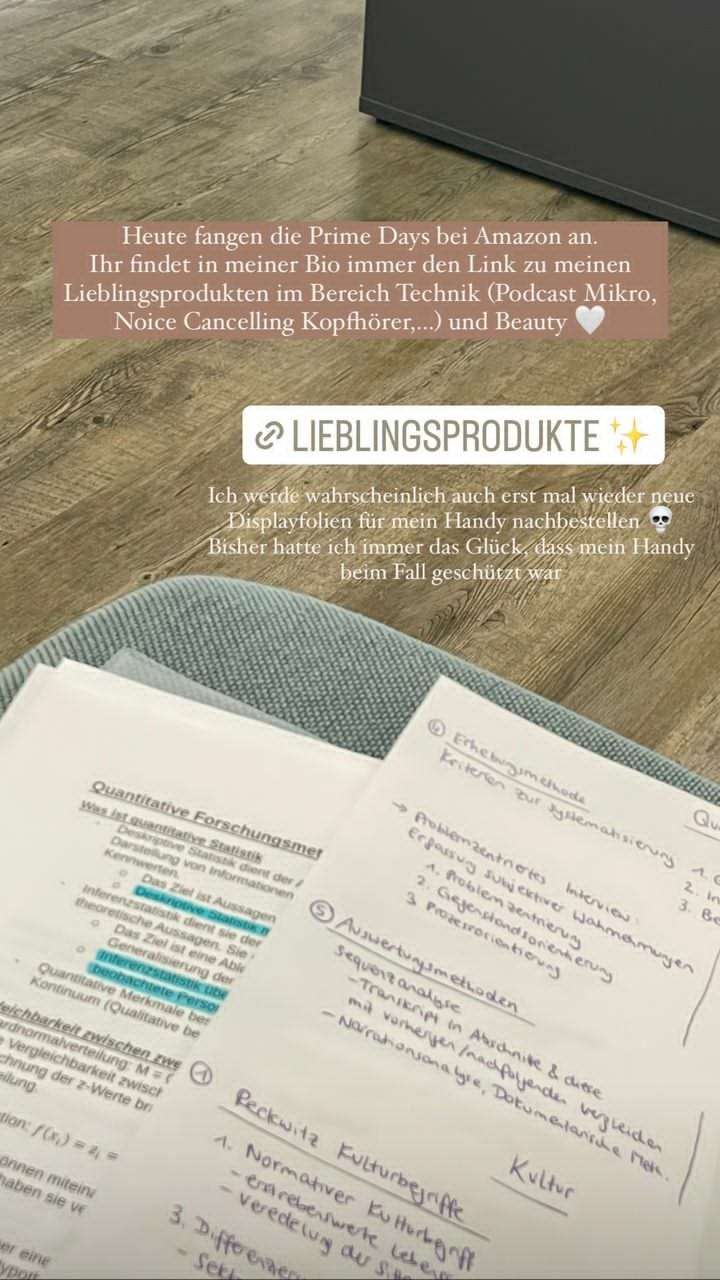

Jokowi administration and Pertamina adjusting to surging global crude prices, highest since Ukraine - Russia war, state-owned oil and gas company Pertamina raised by around 6 percent the price of its unsubsidized Pertamax brand of gasoline. Pertamina said on Sunday that prices of the high-grade RON 92 fuel would be raised to Rp14.000 [USD1] per liter, from the previous price Rp13.000 [USD 91 cent] per liter, depending on the region. The company noted that despite the increase, prices were still below the economic value of Rp 16,000 per liter given that crude prices were averaging US$100 a barrel. The value was based on Indonesia Energy and Mineral Resources Ministry estimates [pict below, on Indonesia language]. Adjusting of price because of MOPS [Means of Platts Singapore].

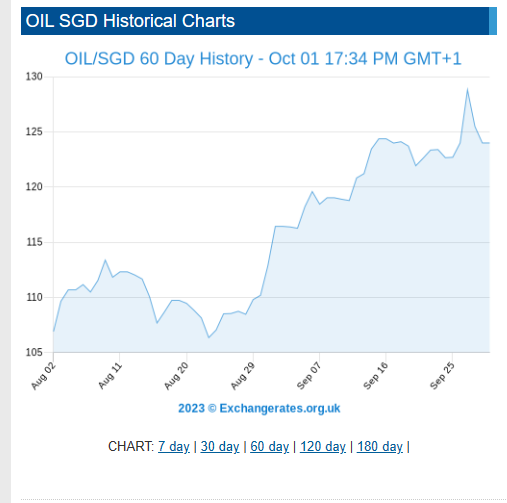

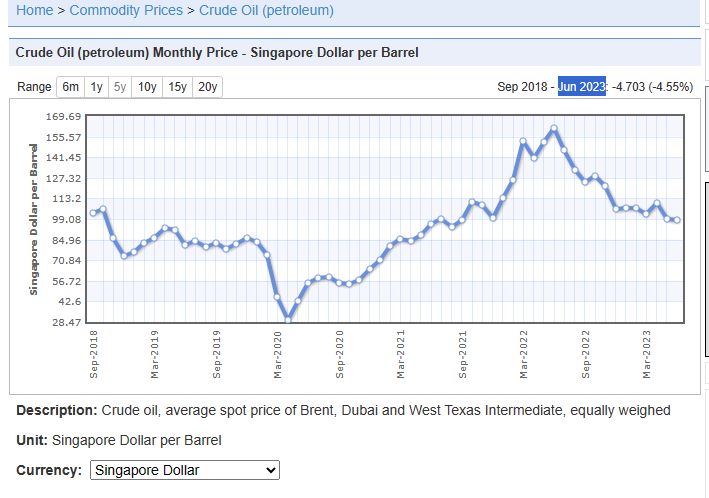

The problem, MOPS between AUG 25 - SEP 24, is around 109 Singapore dollar [79.79 US dollar] - 123 Singapore dollar [90 US dollar]. In reality, Oslo 10.10pm [Sept 28, 2023], Brent already settled at USD 95.38/barrel [5 US dollar higher than 90 US dollar], WTI settled at USD 91.71/bbl [1 US dollar higher], Arab Light already USD 100 [10 US dollar higher] since Sept 26, 2023. So, next month or November 1st, 2023, Indonesia consumers will be facing another adjustment, 99 percent will be higher than today.

[announcement new prices, circulated since 11am-1pm, Oct 1st, 2023, in Indonesia Language]

[MOPS between AUG 25 - SEP 24, is around 109 Singapore dollar [79.79 US dollar] - 123 Singapore dollar [90 US dollar].

Click link for graphic

click link for graphic

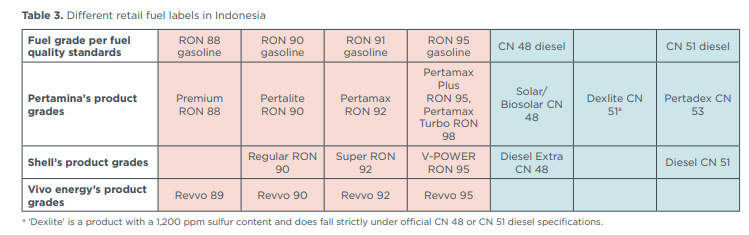

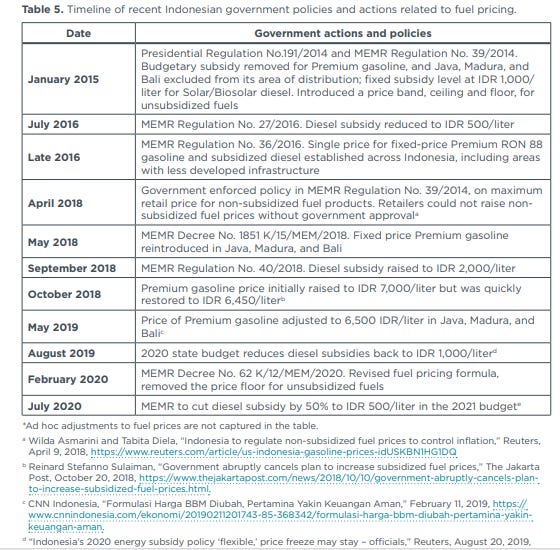

For unsubsidized fuels, the 2015 reforms established a new price-setting mechanism. MEMR sets fuel prices using a pricing formula that can be summarized as follows, and it was most recently updated in MEMR Decree 62 K / IO / MEM / 2020 in February 2020.

Fuel price = Base Price + Constant + Margin

The base price is an estimate of the international price in domestic currency terms, calculated as Mean of Platts Singapore (MOPS) × adjustment factor × exchange rate. MOPS is the benchmark price for many refined petroleum products in Southeast Asia. The adjustment factor for a fuel depends on whether it is gasoline or diesel and its octane/cetane value.

For example, the base price for RON 90 gasoline is MOPS92 × 99.21%. MOPS92 is the Mid-Oil Platts Singapore price for RON 92 gasoline and it is adjusted by 99.21% to account for the difference in octane content between domestic RON 90 gasoline and the benchmark RON 92 price Indonesia used in the international market. The exchange rate from U.S. dollars to IDR is the average Bank of Indonesia exchange rate from the 24th to the 25th days of the previous month. Note that there is no formula in the decree for RON 88 Premium gasoline, the fixed-price lowest grade of gasoline in the market.

Pressed between high prices and stagnant incomes, the French government is trying new, obscure, and potentially disruptive policy responses to higher fuel prices - like allowing retail stations to sell at a loss. French President Emmanuel Macron said the government would ask the fuel industry to sell at cost price and would grant 100 euros ($106.52) in aid to the poorest workers who drive to work, to stem the impact of inflation on households.

TotalEnergies shares have surged today to an all-time high, surpassing the peak set in 2007, one day after the French company updated its strategy with a firm focus on oil and gas. Yesterday, France's TotalEnergies expects the global LNG market to remain tight through at least 2026. TotalEnergies plans to invest US$16-$18 billion/year through 2028 to expand energy output, predominantly in LNG & electricity, announced by Helle Kristoffersen, head of strategy of TotalEnergies.

Most of any increase in net oil revenue attributable to increased oil prices has been siphoned off by inflation in capital expenditures and operating expenditures and increasingly expensive debt service due to increasing interest rates." from Dallas Fed Energy Survey.

SAUDI ARABIA and RUSSIA make net revenue gain as oil price increases more than offset lost volume. The changing dynamics in the global oil space also shows consumers like India are emerging as a voice for bringing market stability — after all if there are no buyers where will suppliers go?

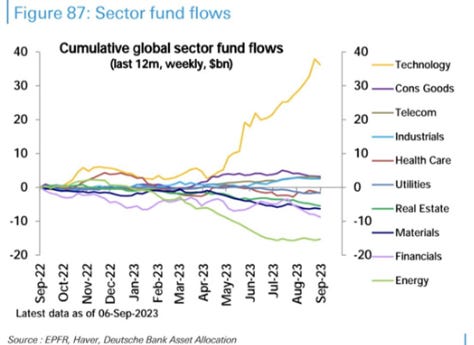

Oil markets / traders are remarkably entrepreneurial. We are very early in what will be a multi-year bull market for oil and energy stocks. Skepticism remains high and investors scarred from the worst bear market in history remain afraid of being hurt again, yet fundamentals to me have never looked better.

Russia has succeeded in avoiding G7 sanctions on most of its oil exports, a shift in trade flows that will boost the Kremlin’s revenues as crude rises towards $100 a barrel. Russian oil sold to India at 30% above Western price cap. Russia is selling oil to India at nearly $80 per barrel, some $20 above the Western price cap, as tight global oil markets help Moscow generate strong appetite for its exports. Russia's main export grade Urals has been trading above the $60 per barrel Western price cap since mid-July amid output cuts by OPEC+ producers, including Saudi and Russia.

Russian oil companies have become tight-lipped on their operations and plans following the sweeping Western sanctions imposed on the country after Moscow's invasion of Ukraine last year. Despite the deeper Saudi/ Russian cuts the entire Opec+ group are emerging as winners from the current market environment. Quality or quantity as they say

On the other hand, U.S. CRUDE OIL inventories around the NYMEX delivery point at Cushing in Oklahoma depleted by another -1 million barrels over the seven days ending on September 22. Stocks have depleted in 12 of the last 13 weeks by a total of -21 million barrels since June 23:

Demand is at a record high, inventories at a multi-year low and headed lower, and OPEC+ under the strong leadership of HRH ABS is determined to provide stability to the oil price. Given the strongest balance sheets in history, the highest free cashflow in history, and an ironclad commitment to return 60%-100% of that free cashflow back to investors once final debt targets are reached in the coming months, I can arrive at only one conclusion. We remain bullish.

So, has the price cap on Russian oil purchase been a success? The opinions vary. Yes, output cuts have happened but parallelly in sync with the global oil prices, there has been an upward swing in prices of Russian oil variants too. The price cap has had an impact but not to the intended extent, for two reasons: failure to revise the level of the cap down periodically, failure to enforce the cap effectively, he added.

Russia continues to rely on tankers owned or insured in Europe for three fourths of the tanker capacity that carries its exports. This shows that if the price cap coalition could overcome its habitual timidity and implement the policy to its full potential, this would have a massive impact on the revenue accruing to the Russian state and to the military.

There was a time when all fingers were being pointed at India for not following the G7 price cap on Russian crude oil and also flooding the market with Russian processed refined petroleum products. Has that changed now? Saudi cuts helped, obviously. India has become a hub for refining Russian crude oil, due to the “refining loophole” that the US, EU and others left in their bans on importing Russian oil, he said adding that there are increasing calls from Ukraine and within western countries to close this loophole, but as long as these governments continue to allow Russian oil refined in third countries into their markets, it’s hardly realistic for India or other countries involved in the refining trade to close the loophole for them.”

Are the recent decisions of the oil producing nations changing the dynamics of the global oil market? China’s restocking has made this easier but that support should have played out by now.

“Demand destruction due to high prices and triumph of EVs will make it hard to sustain the high prices though. If the price cap on Russian oil was successfully lowered and enforced, that would change the incentives for Russia from a high prices approach to a high volumes approach which would balance the market on a lower level.

Those offset surging Iranian flows. Meanwhile, oil demand is, as he predicted, booming everywhere.

The price cap did however contribute by limiting the tanker capacity available to move Russian oil and increasing the risk for tankers that load Russian oil, driving a wedge between prices paid for oil from Russia and other sources. This happened at a time when Russia’s need for tanker capacity increased, as oil began to be transported longer distances, e.g., to India instead of to Europe.

TotalEnergies launches Suriname offshore oil development studies; first oil seen in 2028. But today is still 2023. Still too far.

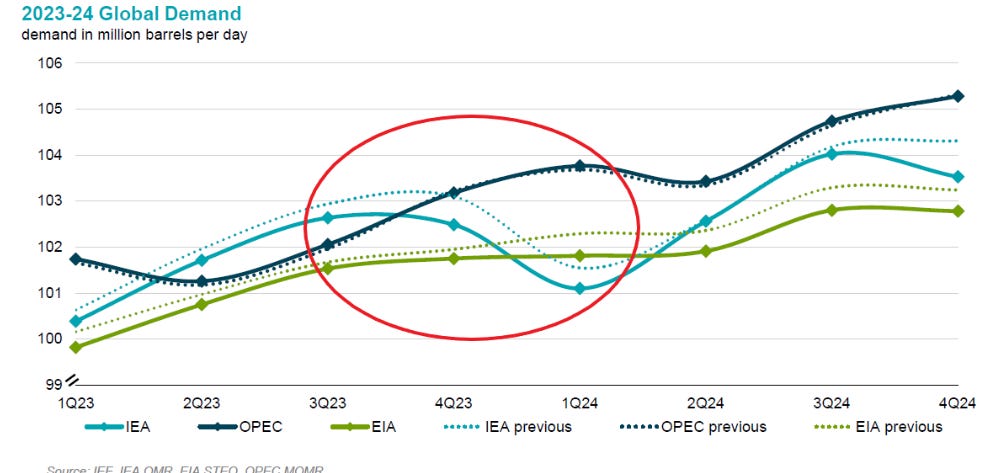

Differences in oil demand outlooks between the IEA and OPEC are a given (and natural) but the divergence in seasonal trajectories (both magnitude and direction) in the next 2 quarters is still pretty wild - almost mirror opposites, with a 3 MMb/d gap by 1Q. IEA and OPEC should be for the most part - but there's always some level of estimation involved given reporting gaps, hence divergence even in "actual" months.

Very different markets. On paper, the IEA outlook certainly lends itself a lot more to "pre-emptive" management than OPEC. OPEC is trying to manage the price up while the rest are trying to manage the price down. Truth probably in the middle.

====

=========END————

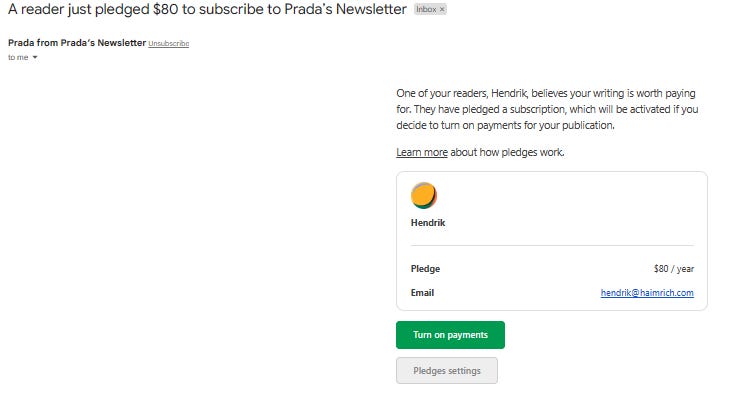

Thank you, as always, for reading. If you have anything like a spark file, or master thought list (spark file sounds so much cooler), let me know how you use it in the comments below. Thank you so much for letting me vent! If you enjoyed this article, you can give pledge to me (click PLEDGE button) or simply share this article with a friend. It helps me more than you realise.

If you enjoyed this post, please share it.

______________

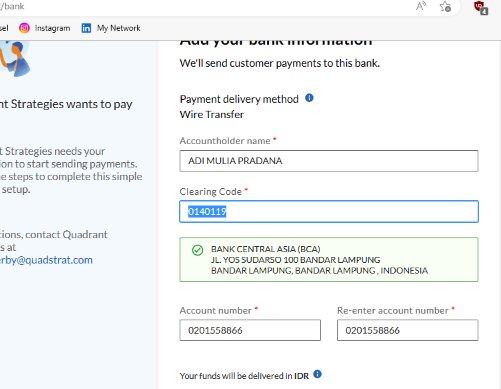

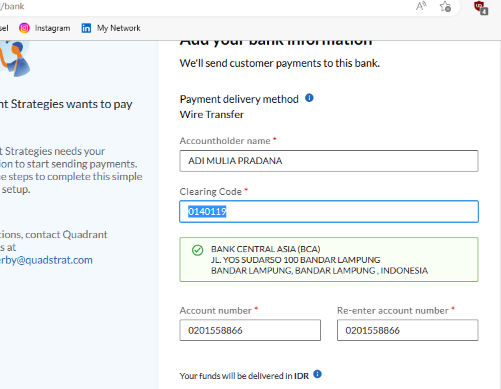

Professor Hendrik, Professor Eric, and another person, Prof David A. Andelman, former Bureau Chief NYTimes recommended my substack, also some Chief Technology of Financial Times (FT) recommended my substack, not only subscribe. I'd be happy to get more & more PLEDGE and recommendations for better crafted writing (via Bank Central Asia (with my full-name ADI MULIA PRADANA, clearing code 0140119, account number 0201558866 or via STRIPE. For me, prefer Bank Central Asia).

If a friend sent this to you, you could subscribe here 👇. All content is free, and paid subscriptions are voluntary.

——————————————————————————————————

-prada- Adi Mulia Pradana is a Helper. Former adviser (President Indonesia) Jokowi for mapping 2-times election. I used to get paid to catch all these blunders—now I do it for free. Trying to work out what's going on, what happens next. Now figure out and or prevent catastrophic of everything.

(Very rare compliment and initiative pledge, and hopefully more readers more pledges to me. Thank you. My note-live blog about Russia - Ukraine already click-read 6 millions, not counting another note especially Live Update Substack (mostly Live Update Election or massive incident)

=======

Thanks for reading Prada’s Newsletter. I was lured, inspired by someone writer, his post in LinkedIn months ago, “Currently after a routine daily writing newsletter in the last 10 years, my subscriber reaches 100,000. Maybe one of my subscribers is your boss.” After I get followed / subscribed by (literally) prominent AI and prominent Chief Product and Technology of mammoth global media (both: Sir, thank you so much), I try crafting more / better writing.

To get the ones who really appreciate your writing, and now prominent people appreciate my writing, priceless feeling. Prada ungated/no paywall every notes-but thank you for anyone open initiative pledge to me.

(Promoting to more engage in Substack) Seamless to listen to your favorite podcasts on Substack. You can buy a better headset to listen to a podcast here (GST DE352306207).

Listeners on Apple Podcasts, Spotify, Overcast, or Pocket Casts simultaneously. podcasting can transform more of a conversation. Invite listeners to weigh in on episodes directly with you and with each other through discussion threads. At Substack, the process is to build with writers. Podcasts are an amazing feature of the Substack. I wish it had a feature to read the words we have written down without us having to do the speaking. Thanks for reading Prada’s Newsletter.

Wants comfy jogging pants / jogginghose amid scorching summer or (one day) harsh winter like black jogginghose or khaki/beige jogginghose like this? click

Headset and Mic can buy in here, but not including this cat, laptop, and couch / sofa

![Today October 1st Gasoline IDR 14k [USD1] is too small a hike. The fact MOPS Singapore August [USD79] too low if compare new oil price [USD93-100]](https://substackcdn.com/image/fetch/w_1300,h_650,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fcfdd246b-ab8f-4be0-b41a-6c968185c5bd_657x534.png)