Reflection on Christmas Night: Jerome Powell Was Right [Sadly]

Why Jerome Powell was right all along about interest rates, inflation and the economy© Chip Somodevilla/Getty Images

Once again, President Donald Trump has been proved wrong about inflation, interest rates and the Federal Reserve.

Once again, Fed Chair Jerome Powell has been proved right.

In case you missed it amid the frantic run-up to Christmas, the U.S. government just released its latest batch of economic data. These data showed that the economy remained much stronger in the third quarter than most people had feared. Gross domestic product grew at an annualized rate of 4.3%, well above expectations. Inflation jumped to 2.8%, from 2.1% in the spring.

Why does this matter? Because for most of this year, Trump and his proxies have been pounding the table furiously, demanding that the Federal Reserve slash short-term interest rates deeply in order to get the economy out of a stall.

The president has been attacking Powell personally in a war on the Fed that is unprecedented in half a century. The president even demanded that short-term rates be cut to 1% or even lower.

Can you even imagine? At the time, the fed funds rate was in a range of 4.25% to 4.5%. Yet even then, the economy was rolling along well.

As the latest data shows, if the president had gotten his way, inflation would surely be rocketing again, the economy would be overheating and the Fed would have to raise short-term rates again. Meanwhile, long-term interest rates and mortgage rates would be soaring and the economy would be faced with stagflation and a deepening housing-market slump. For retirees and others who live on fixed incomes, in particular, this 1970s nightmare scenario of rising inflation would be an unmitigated disaster.

It was surely due to Trump’s political pressure that the Fed cut short-term rates this month.

Let us therefore give thanks this Christmas that Trump and his allies were not able to secure complete control over the Fed in 2025.

And let us be worried about what 2026 holds, as Trump gains even more influence over the Fed. Powell’s term as Fed chair ends in May, and Trump is expected to nominate a loyalist as his successor. He is also engaged in a campaign to tighten his political control over the central bank in other ways, such as trying to fire governor Lisa Cook.

The record for 2025 is unambiguous. Trump has repeatedly called Powell a “loser” and labeled him with the moniker “Too Late” for supposedly failing to cut short-term interest rates early enough or deeply enough. Vice President J.D. Vance chimed in that it was “monetary malpractice” for the Fed to refuse to cut rates in the spring.

During this time, Trump and others insisted that the economy was slowing sharply and that it was all the fault of the Fed. As the latest data shows, they were completely wrong.

U.S. economy posted biggest growth spurt in two years, GDP shows. Don’t expect a repeat.

Inflation remained and remains above the 2% target that the Fed has been aiming for and on which the global bond market is relying. The consumer-price index has risen 2.7% in the past year. Only during the prolonged government shutdown this fall did the annualized inflation rate drop below the 2% rate. The analysts at the Cleveland Federal Reserve Bank estimate the current annualized rate is back above 3%.

In July, when Trump was insisting that inflation was effectively zero, the Treasury-bond market was betting it was on track to average as much as 2.5% a year over the next five years. Gold a key barometer of inflation fears, has risen 62% since Trump took office in January and just hit a new high. The price of silver has more than doubled.

All this with a Fed chair who was defending the institution’s independence.

Jerome Powell: Fed Independence Is ‘a Matter of Law’

Part of the problem is the continuing misreporting on and faulty analysis of the entire interest-rate market. People, including politicians and many in the media, continue to treat short-term interest rates and longer-term interest rates as much the same thing. They aren’t. The Federal Reserve’s fed funds rate, which is what people usually mean when they talk about the Fed and interest rates, is the short-term rate. It refers to the rate charged on overnight money, and it feeds through to things like the three-month yield on Treasury bills. It also affects savings rates at banks and the interest rate you’ll pay on shorter-term borrowing such as credit cards and car loans.

The rates on longer-term loans, meanwhile, are set by the independent bond market and are heavily — heavily — influenced by expectations of future inflation. If I’m going to lend somebody money for five, 10 or even 30 years, and I have to set the interest rate they’ll pay me in advance, then future inflation will play a critical factor in my math. I’m not going to lend you money for 10 years at 4% if I think inflation might average 4% or even higher. I might just as well set fire to my money. On the other hand, if I were confident inflation were going to average 2% a year or less, I might. The future inflation rate makes all the difference.

This is why your correspondent generally prefers inflation-protected Treasury bonds, known as TIPS, to the regular kind.

Corporations, the U.S. government and home buyers taking out mortgages are all dependent on long-term interest rates. The key number is generally the rate on 10-year U.S. Treasury notes Not only does that underpin most financial calculations in the corporate world, but it’s also the basis for the interest rate charged on new 30-year fixed-rate mortgages in the United States.

There is no point in the Fed cutting short-term rates if this causes the bond market to worry about an overheating economy and rising inflation. If that happens, then when the Fed cuts those short-term rates, long-term rates will rise. That’s what happened in 2024 when the Fed cut short-term rates, and it’s what’s been happening lately. The yield or interest rate on 10-year Treasury bonds just jumped to 4.19%. It is now higher than it was in early September, before the Fed began cutting short-term interest rates.

There is plenty of reason to be worried about 2026. But maybe we shouldn’t overdo it.

First, it seems that Trump’s political clout is not what it used to be. At Republican-friendly polling company Rasmussen, the president has now sunk to a minus-15% rating, meaning the percentage of voters who “strongly approve” of his job performance is a full 15 points below those who strongly disapprove.

As recently as September, they were nearly level.

Second, it seems that some Republicans in Congress have finally cracked open a copy of the Constitution and discovered the part about the separation of powers. Over the summer, the president fired the independent statistician in charge of compiling the federal government’s jobs and inflation data and tried to replace her with a controversial and partisan figure from the Heritage Foundation, a right-leaning think tank. He was forced to abandon the plan.

Finally, it is worth viewing Trump’s rhetorical war against the Fed in context. All this year he has had the freedom to demand that the Fed slash rates, because he knew it wouldn’t. This meant he could have it both ways. If the economy had tanked, he would have been able to blame Powell. But the economy has done just fine, and nobody (well, almost nobody) is demanding Trump account for his past comments on rates.

Next year, when the Fed is stocked with more MAGA loyalists, the situation will be different. They might actually listen to him. So the smart move for Trump might be to stop haranguing them and find another scapegoat he can blame if things go wrong.

===========================

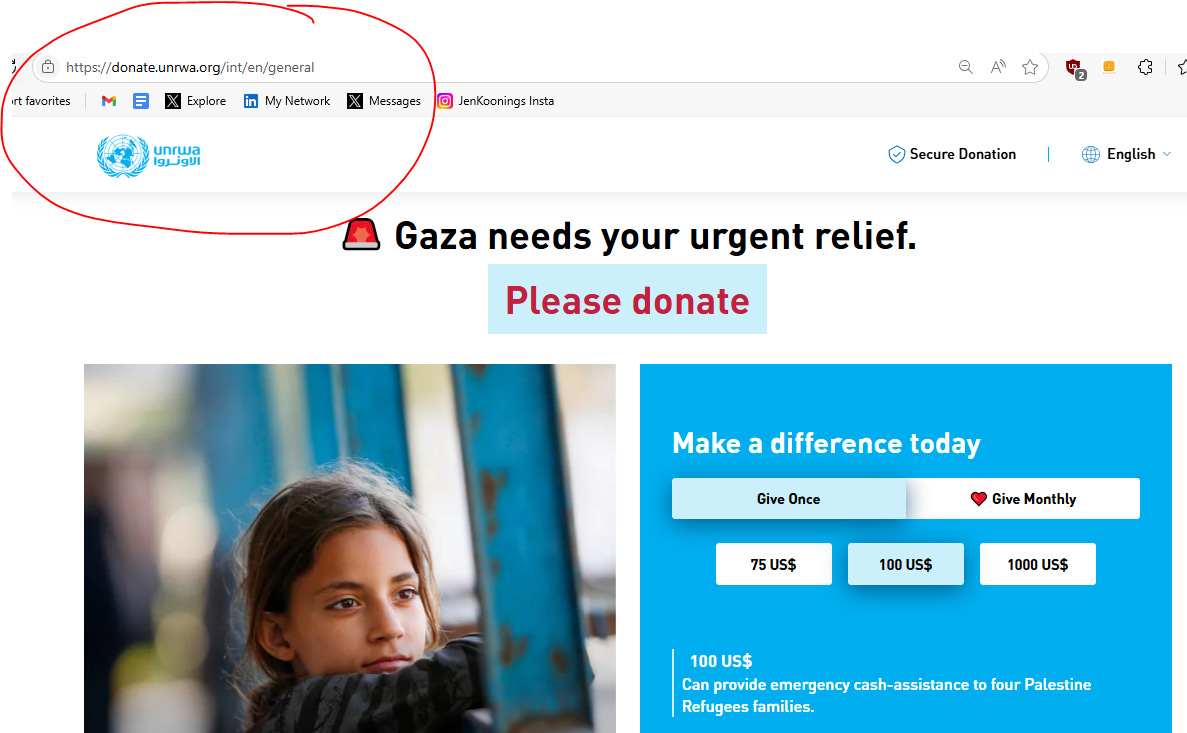

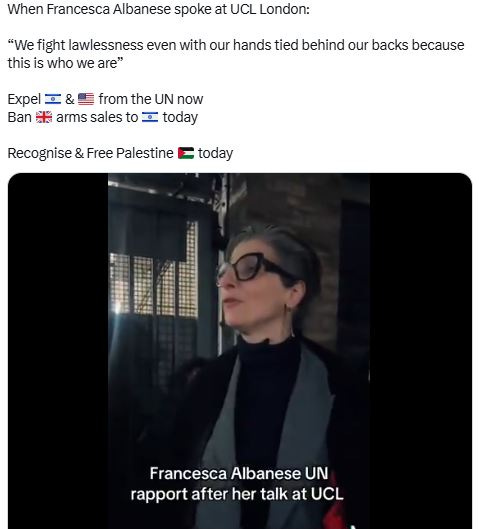

If you feel powerless to help Gaza, you still has a choice: donate. When so much of what exists is false, authenticity is a powerful weapon we can wield that the state never could. So if you feel lost, hopeless, depressed, angry and afraid, I implore you to return - again - again - and again - to the feeling of love that exists within you that brought you here in the first place. It is only through this that we can remake the world. To redress Gaza’s famine, displacement, and destruction, independent and impartial humanitarian organizations - UN agencies, international and national NGOs - must be allowed to deliver relief at scale. To salvage Gaza’s people from the devastation inflicted by Israel, it must be unified with the West Bank to form an independent and sovereign Palestinian State, not to be parceled and colonized by the former.

Meanwhile, children continue to be shredded by US bombs, and the starvation reaches new depths of hellish collective punishment. If both parties are going to continue to support an ongoing genocide, at least they can both be honest about doing so, rather than having one openly bloodthirsty party, and another—unconvincingly—playing the role of powerless, bumbling humanitarian.

Please keep donate Gaza especially if you, as reader, has [background] International Relation [whatever universities]. IR Graduate means [you must, at least] get some semester [about] studying Middle East [in macro, not specifically Gaza].

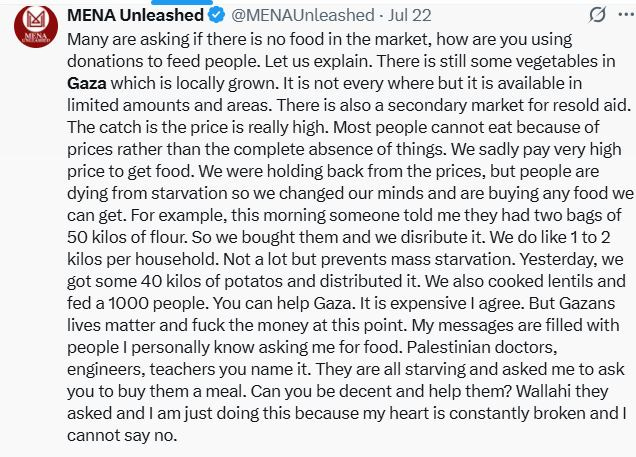

We need more people to share fundraisers instead of only talking about Gaza. Some people think that those in Gaza don’t need money but that’s wrong. Almost everyone lost their source of income while essentials, food & medicine get sold for astronomical prices. So I put my attempt in all social media as I can, in twitter / X, in substack [since October 2023 I put link donation], in bluesky or bsky, in threads, in instagram.

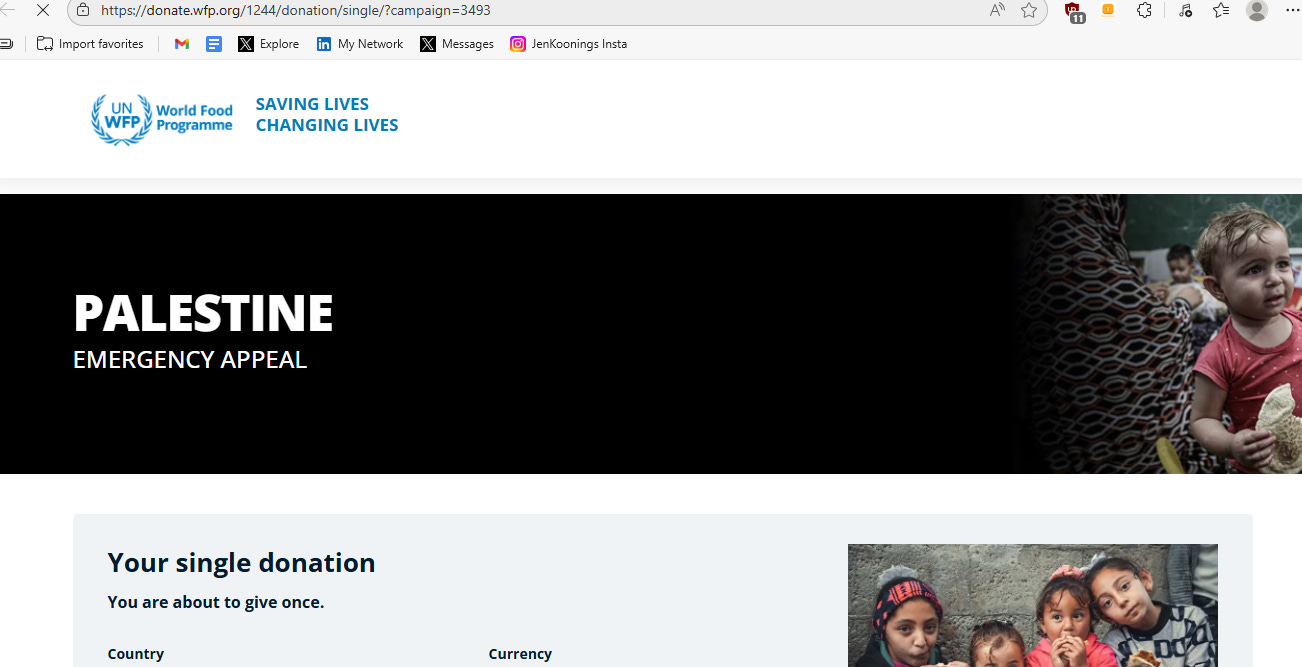

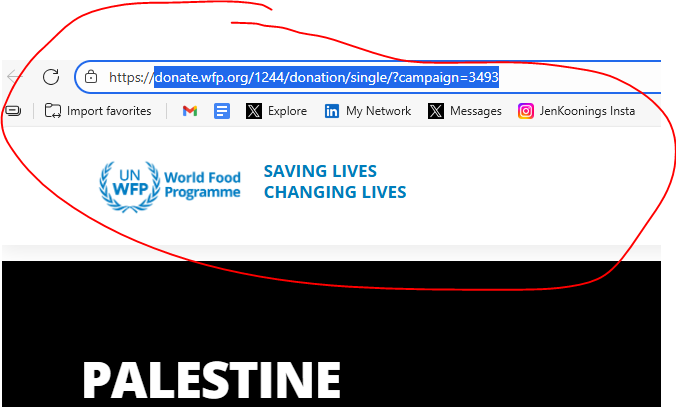

Link to donate World Food Programme - Palestine appeal: click here

[Daniel Brühl]

Most campaign shared or circulated in social media are for REAL people in Gaza. They’re legit. There are a lot of small campaigns for struggling families. This is their only lifeline. By donating & sharing, you are literally making history and alleviating part of their pain

Please do not rely on me alone for sharing your campaign. I’m only 1 person and sometimes I’m not online which is unreliable. I never ignore anybody on purpose but I have a very limited capacity & very little energy and time.

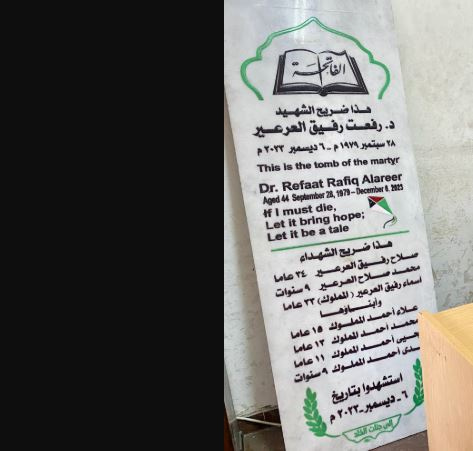

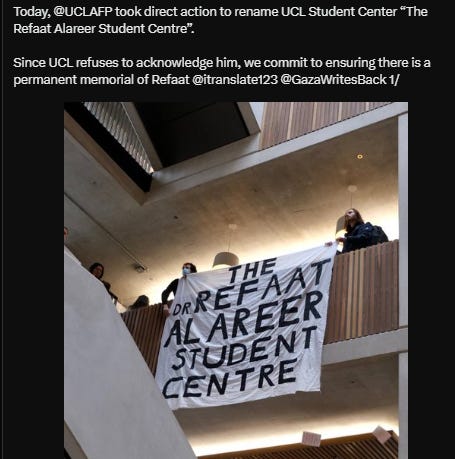

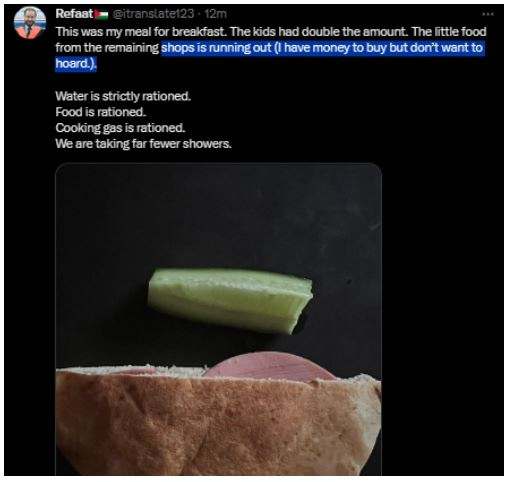

[Refaat Rafiq Alareer IF I MUST DIE] Refaat Rafiq Alareer was extremely hungry, November 2023, days before Refaat killed by Israel airstrike. If November 2023 already [one-by-one Gazan] extremely famine, extremely hungry, imagine November 2025 or more than 2 years Israel’s Genocide in Gaza.

[RENEW] 455 Languages IF I MUST DIE of Refaat Rafiq Alareer [by 6100+ Translators, Social Media Users]

Dec 9th, 2023, New York City, 4.10am —- with update total languages to be 310 as of July 1st, 2024, 3.52am New York City, and then, to be 350 languages as of July 28th, 2024, 1.37am ====== newest update as of July, 3rd, 2025 already 384 languages, and October 8th, 2025 reaches 455 languages across the globe.

Thanks for reading Prada’s Newsletter.

![[RENEW] 455 Languages IF I MUST DIE of Refaat Rafiq Alareer [by 6100+ Translators, Social Media Users]](https://substackcdn.com/image/fetch/$s_!jwSl!,w_1300,h_650,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fc25bd266-d4e2-4169-a5e4-e901227a8b0c_725x560.png)