Tech Rout

Running one startup is a lot harder than advising 100000000000 startups. Great startups happen when founders figure out how to get paid for being themselves. People forget that startup is about build something and not to be richest, not just raising valuation or money.

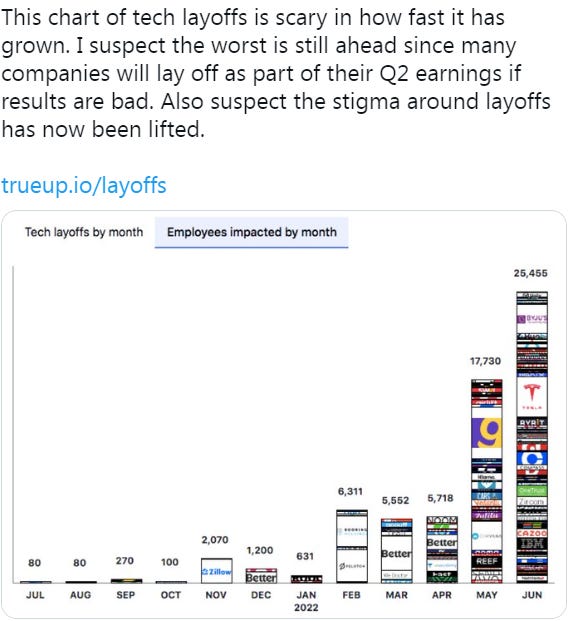

Empathy, unity & unwavering support for the weak in amidst tech crisis globally. Not only in Indonesia. Too much firing when just 1 month ago (is) May Day. Even empathy to her. As a person in past has too much painful etcetera etcetera etcetera, I really feel how big the crisis now, folks. No lie.

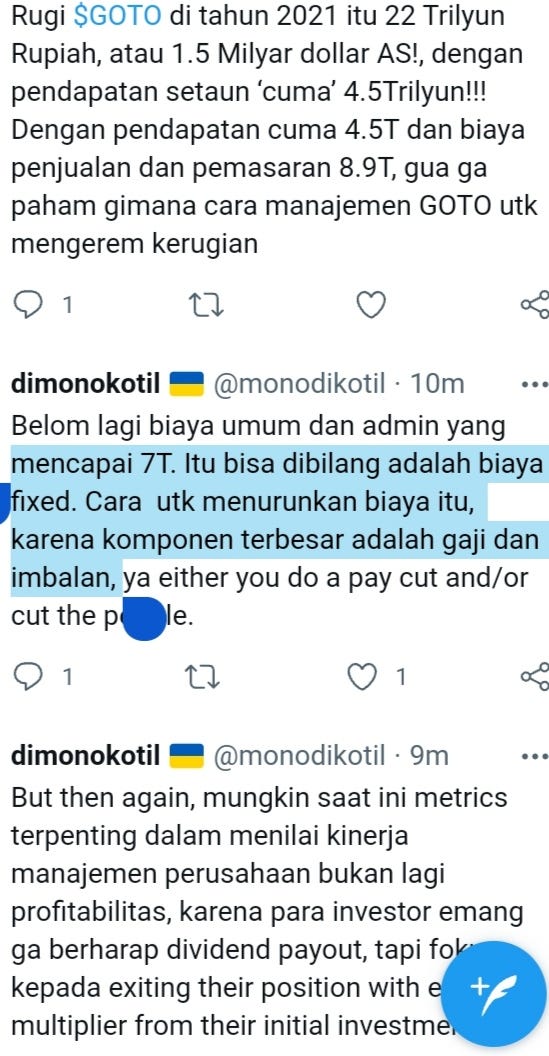

No safe place wherever your work-----I highlights until (in my) 3 (three) note-substack(s). Check (my note) about GOTO, note substack about Klarna, and note about Flexing-lifestyle. Finding product market fit is a whole lot harder than advising someone else to do it.

One fundamental error hiring managers make is being so focused on candidates’ skills they forget the importance of building trust early in the process. Flexing lifestyle (in Indonesia startup worker) has a result of error mechanism in hiring, then now a lot "the Flexing" suffering rout crisis of Tech Startup globally (not only in Indonesia). (Especially in Indonesia, maybe) every Tech startup person are stressed that they don't know how to price deals anymore as if there was ever a science to it. The 'cut burn' is more about all the wasteful expenses - office spaces, mindless perks, offsites, non performing employees, too many layers etc. Imagine in Indonesia startup tech: (even) in 1 company has a stark contrast: unpaid intern look like slavery, but in another side is overpaid remuneration.

(Again) Amid chaos, rout on Tech Startup Worldwide, not only Indonesia, maybe Indonesia netihen didn't hear a fact: very complicated conglomerate ownership amid every single startup company in Indonesia.

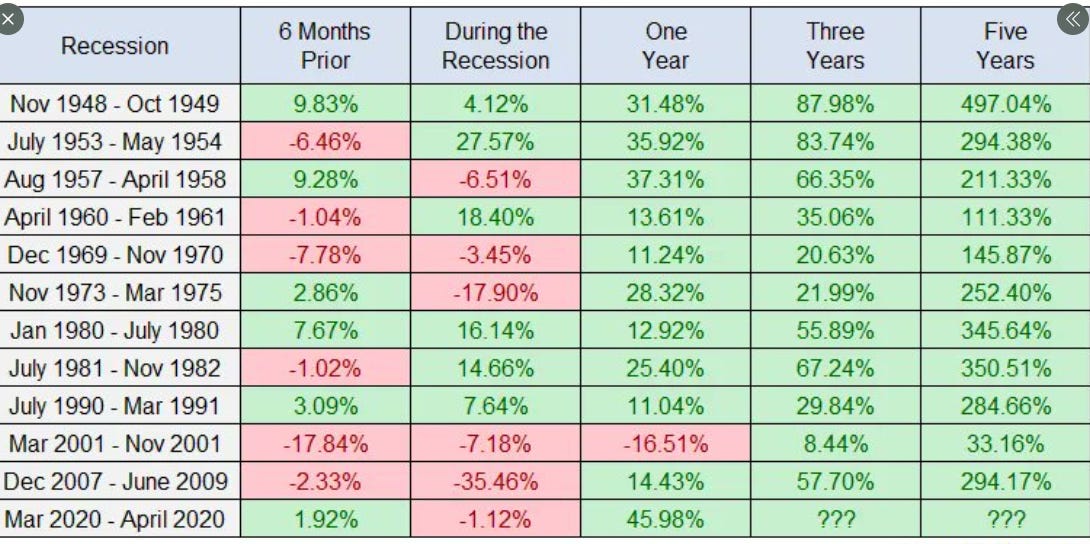

Some companies-startup have great velocity and business model for customer acquisition. When it comes to crisis management and firefighting, the traditional way to managing startup (surprisingly) still relevant, and to anticipate fluctuation of valuation, sometime too high, sometime too fall (business). Or abruptly layoff.

For example: did you know Bukalapak is the one of loop-complicated amid (1) EMTEK conglomerate, (2) Chairul Tanjung-CT Group, (3) SALIM group, and (4) even Hary Tanoe. And several graduated from (dominance) Australian college ---- same country of College (which) several daughter and son of "4 conglomerates" has graduates --- now in Bukalapak since original founder of Bukalapak (Zacky) leave the helmet.

With very strong presence/very strong market already secured by (1) SALIM group in Philippines (*because retail of Indomaret and another co-operation with local companies), Bukalapak set SmartSari in Philippines, and in Australia set up a Tech Center (*once again: now a lot Australia graduates in Bukalapak). Great founders are always selling: to investors, to customers, to current (and prospective future) team. repetition does not spoil the prayer.

Maybe SALIM (for example) wins because success to selling and not only in Indonesia. Continue raise more and bigger funds with shorter deployment cycles until valuations become more favorable - the odd funding strategy in a nutshell. No privilege WFH for/on SALIM industry: selling face to face, industry manufactured face to face (too).

This is like,..... Oases maybe, amid chaos in everywhere (include ecommerce startup). JD (China), Klarna (Sweden), Gorillaz (Germany) , Bolt, PayPal (U.S.), Brambang, and latest hit Shopee, etc.

(Another flexing, stuck-up, arrogant amid crisis)

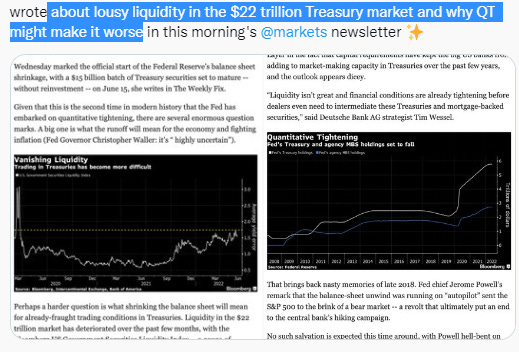

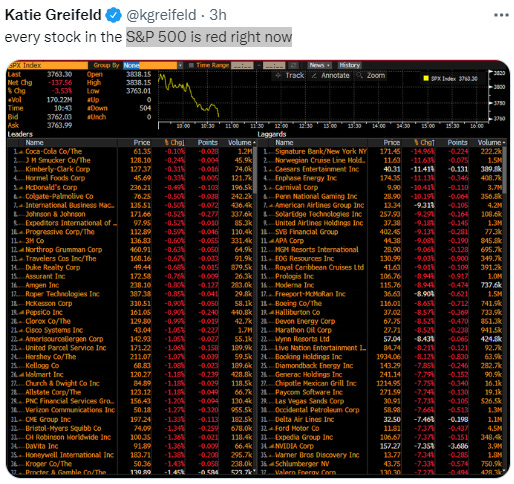

I get that investors want startups to cut burn and "survive" because of how risky the world is. But startups are risks dressed up as businesses. They live if they grow. They die if they are static. Runway isn't the end goal. Don't sacrifice ambition just to get more of it. VCs are stressed that they don't know how to price deals anymore as if there was ever a science to it. Even Sequoia remind in annual report that "very concerned situation in a tech companies crisis, globally".

I've been guilty of being voluntarily naive that everyone I work with is an expert at what they do and driven to agile-grow the business as best as they know how. I'd rather operate on the innocent until proven guilty side of the pendulum. I get burned at times. But I win mostly. I was told since April 2020 (just 1 month after covid/coronavirus hit Indonesia) about deep crisis for Indonesia startup---at least. Because I love someone, care someone. I don't care about anyone but her.

Btw... Focus.

Companies are ranked based on a blend of most recent valuation, company size, employee growth over the last 2 years, years in operation, and current revenue scale. They are founded after 2008 (*just before Lehmann Brother- Global financial crisis) raised funding in the last 2 years, and employee base growing 30%+ YoY.

A great founders are always fundraising. It’s just that sometimes they call it “fundraising” and sometimes they call it “building relationships.”. Isn't that simple to "survive" a few years without funding if your company has limited runway. Markets sure are wobbly this month. We're not investing anymore. In China named "UNINVESTIBLE".

Fundraising processes right now: it has slowed down. Lots of reasons for that. I'd bet that a big one is that that VC partner time and meetings are focused on triage and evaluating new opportunities (like Bukalapak case). Good at business" and "good at investing" are entirely uncorrelated.

A lots of companies (Indonesia & worldwide) were building and burning as if money was free. When that changes, those companies have to cut, in another side, the VCs need to decide were to deploy bridges.

Investors want startups to cut burn and "survive" because of how risky the world is. But startups are risks dressed up as businesses. They live if they grow. They die if they are static. Runway isn't the end goal.

I don't know or specialize in/about other industries but looking at marketplaces as an example, if you have capital you could easily leverage growth. Which is why vouchers/discounts became a key growth tactic for every marketplace, performance of (perfect) packaging & deliver process, also became the key factor of sustainability or failure.

Startup has to be "value driven" to scale success. "Valuation driven" is just myth. Illusion- we will be $billion by 2025 or longer, especially when start-up goes IPO. (Valuation driven model) Practical - this is our revenue & we will add at least 25% in next fiscal year. (Value driven model).

Most marketplaces lose 50-60% of their demand once they stop vouchers/incentives/discounts. It's a vicious cycle of to get growth you need to burn (on -EBITDA bases), to cut burn you need to slow growth, I guess now is the era of figuring out how to have both, especially in Pandemic Covid age.

Investors, VCs have simply evolved enough to understand how startups can leverage growth. Given that investors are one of the key steakholders then founders ought to listen to their investors more and think more conservatively.

Current shitshow of startups with slim paths to profitability and unnecessary high valuations. We need to bring back profitability on the table---like in one example: how 4 conglomerates help Bukalapak with completely complicated cooperation.

The new generation of founders should think "growth + profitability". If its hard to figure it out then you should accept the challenge and do what you're meant to do as a founder, figuring shit out. Once profit integrates with startup culture and founder mindset then the nature of starting and running startups, building products and finding solutions, raising funds and setting valuations will all change towards more sustainability and stronger foundations. If you think otherwise then we'll just be in our cycle of short term bubbles, "UNINVESTIBLE", now hammered very painful on Tech startups. You might hope the rout, the carnage in tech stocks is over, you’d probably be wrong.

All this note just typed in LCD, not in keyboard.