[BREAKING] Paramount - WB [Potential Merger], Because Writer Strike and then Israel War is 'Bad News for Entertainment Industry'

Coming to an end as these services mature and media companies cleave to what makes money. The streaming wars are over because subscriber growth has come to a halt.

Los Angeles 2.22pm

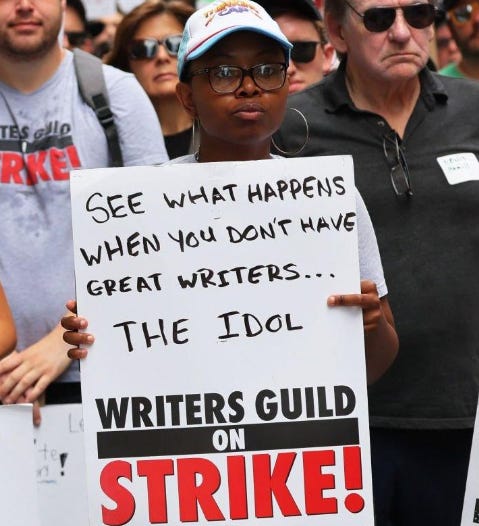

The study — which measured the economic impact of the twin walkouts on the local film and TV industry — recorded a 17% decrease in employment since the Writers Guild of America went on strike in May. Just before the work stoppage began, about 142,652 workers were employed in Hollywood, per the Bureau of Labor Statistics. As of October, that number had dropped to 117,853.

Actors and writers experienced the sharpest decline in employment during the strikes, while camera operators, editors, sound and lighting technicians and other crew members also experienced a reduction in job opportunities, the report says.

The writers’ and actors’ strikes — which ended in September and November, respectively — undoubtedly took a major toll, hampering development and stalling production on big studio releases for about six months. In the third quarter of 2023, production on TV dramas, comedies and pilots was down nearly 100% compared with the previous year, while feature film shoots plummeted by about 55%, the study says.

Due to the production shortage, the report estimates that entertainment industry workers based in the L.A. area collectively lost more than $1.4 billion in wages between April and September, which amounts to roughly .5% of the industry’s annual economic activity.

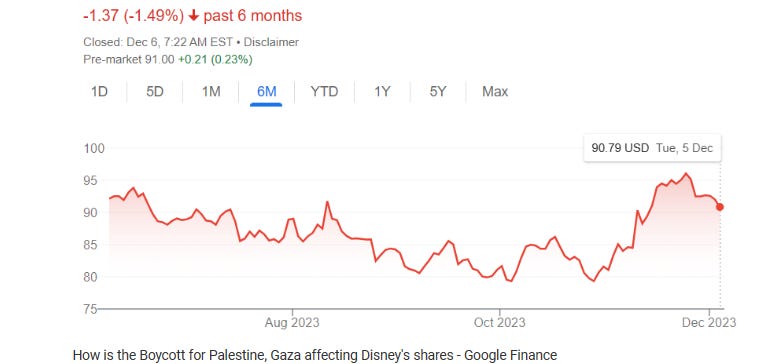

Disney stocks rose 9.46 percent in the said duration following the October 7 surprise Gaza attack especially after Bob Iger pledge to send US$2 million for Netanyahu administration, all throughout the Israeli onslaught on Gaza, though it has dipped 5.49 percent since November 24. In the six months ending December 5, Disney’s stocks lost 1.49 percent. But year to date, the company's stocks have gained 2.05 percent, as of December 5, at $90.79 apiece.

Another loss for Disney in the middle or directly effect boycott after Gaza / Palestine - Israel war. Superhero film The Marvels made just $47m (£38m) in its first weekend, in the US, making it the Marvel Cinematic Universe's lowest opening ever.

Plestia Bosbos Alaqad

Plestia Bosbos Alaqad - Thomson Reuters Institute / Reuters Institute for Study of Journalism, Matthew Leake

One of Thomson Reuters / Reuters journo, Issam Abdallah, Lebanese, killed by Israel airstrike. Killed in Israel - Lebanon border, not in Gaza.

In contrast, Avengers: Endgame made box office history in 2019 by taking a record-breaking $1.2bn (£980m) in global ticket sales in its opening run.

The Marvels, starring Brie Larson, Iman Vellani and Teyonah Parris, follows 2019's Captain Marvel film.

It was down 67% on the first film, analyst David A Gross said.

"This opening is an unprecedented Marvel box office collapse," he said, adding that second superhero instalments usually outperform the originals and The Marvels has some way to go to recoup its $220m (£179m) production cost.

In November 2019, Disney debuted Disney+, kicking off the so-called streaming wars and prompting companies across the media world to spend billions of dollars to launch services to take on Netflix.

Netflix was seen as the existential threat to the legacy media industry, so following its lead on subscriber growth was the strategy — the only one practically everyone on Wall Street and in media board rooms cared about. Pandemic lockdowns exacerbated the urgency. Writer strike, again, exacerbated the urgency. Now tension in the middle east, unclear when will end.

Now, that war to win over subscribers at any cost is over.

Disney (DIS) is hiking prices after losing a ton of money on its various streaming services. Netflix recently jacked up prices and is cracking down on password sharing. Warner Bros. Discovery, CNN’s parent company, is scrapping films and series left and right and reversing its controversial everything-under-one-streaming-roof strategy. All three services are expanding their ad-supported offerings.

Streaming itself isn’t going anywhere — it’s the present and future of Hollywood — but the spend now, ask questions later days look to be coming to an end as these services mature and media companies cleave to what makes money.

“The streaming wars are over because subscriber growth has come to a halt,” Michael Nathanson, a media analyst at MoffettNathanson, told CNN Business. “You’re fighting a war in a land that has no more resources in it.”

David Zaslav, CEO of Warner Bros. Discovery, has canceled multiple big budget projects for HBO Max, while also reiterating that he’s not trying to win the streaming “spending war.” Zaslav’s strategy is the opposite of the approach taken by his predecessor Jason Kilar, whose focus was to put as much content as possible on HBO Max, no matter the consequences.

And again from Zaslav, rumor about merger with Paramount. Since last year, Warner Bros. Discovery is also going down the consolidation path. The company announced [2022] that the long-awaited merger of its services, HBO Max and Discovery+, debut in the US.

And again from Zaslav. Zaslav met with Paramount Global CEO Robert Marc ‘Bob’ Bakish on Tuesday in New York City to discuss a possible merger, Axios has learned from multiple sources. The combination would create a news and entertainment behemoth that would likely trigger further industry consolidation.

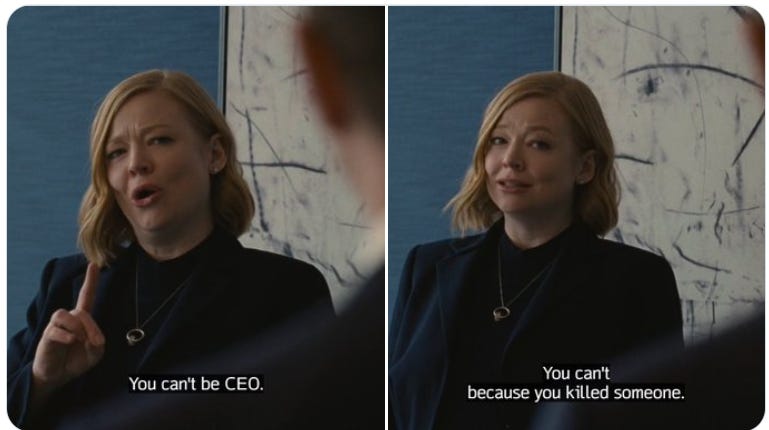

Zaslav also has spoken to Shari Ellin Redstone, who owns Paramount's parent company, about a deal. WBD's market value was around $29 billion as of Wednesday, while Paramount's was just over $10 billion, so any merger would not be of equals.

The meeting between Zaslav and Bakish, which sources say lasted several hours, took place at Paramount's headquarters in Times Square.

The duo discussed ways their companies could compliment one another. For example, each company's main streaming service — Paramount+ and Max — could merge to better rival Netflix and Disney+. It's unclear whether WBD would buy Paramount Global or its parent company, National Amusements Inc. (NAI), but a source familiar with the situation says that both options are on the table. WBD is said to have hired bankers to explore the deal.

The deal could drive substantial synergies.

WBD could use its international distribution footprint to boost Paramount's franchises, while Paramount's children's programing assets could be essential to WBD's long-term streaming ambitions. CBS News could be combined with CNN to create a global news powerhouse. CBS' crime dramas, such as "NCIS" and "Criminal Minds," could be combined with Investigation Discovery and TruTV. CBS Sports' footprint could be combined with WBD's. For example, CBS and WBD's Turner Sports currently share TV rights for March Madness.

Paramount is under enormous pressure to find a strategic partner or buyer, as it's staring down a mountain of debt.

If the first phase of the streaming revolution was the “Streaming Wars” the next phase could be dubbed the “Rumble of the Bundles.” Big media companies will do what they’ve always done: “operate in multiple different media categories. For years, Hollywood has been primarily focused on streaming video, but they’re now shifting elsewhere. More gaming, sometimes blockchain/NFT, experiential exhibits, etc.

The firm's stock jumped 12% earlier this month following a report from Puck that Skydance Media and RedBird Capital Partners were eyeing a potential deal to buy a majority stake in NAI. Mission: Impossible – Dead Reckoning Part One badly lost this year. The Paramount and Skydance sequel opened to just $25.9 million from Friday to Sunday, a steep tumble from Mission: Impossible Fallout‘s $76 million opening back in 2018.

Contrary the flop of MISSION:IMPOSSIBLE franchise under Paramount and Skydance, “Barbie” has answered the billion-dollar question with a resounding “yes.” Barely three weeks into its run, writer-director Greta Gerwig’s blockbuster has raked in an astounding $1.03 billion at the global box office, according to official Warner Bros. estimates.

Back to potential merger. NAI reached a deal with creditors to restructure some of its debt earlier this year, and previously slimmed down by selling gigantic publisher Simon & Schuster. It's also is talks to unload BET [Black Entertainment Television Network[.

One source familiar with the discussions says the strategy being considered mirrors Zaslav's blueprint for prior mergers.

When merging with Scripps in 2018 and then WarnerMedia in 2022, Zaslav kept his core strategic team in place while retaining new creative talent leaders from the companies he acquired.

Executives are confident that the deal would receive regulatory approval, despite D.C.'s active antitrust climate. Notably, Warner Bros. Discovery doesn't own a broadcast network, which would clear an easier path than would a combination with a company like NBC owner Comcast.

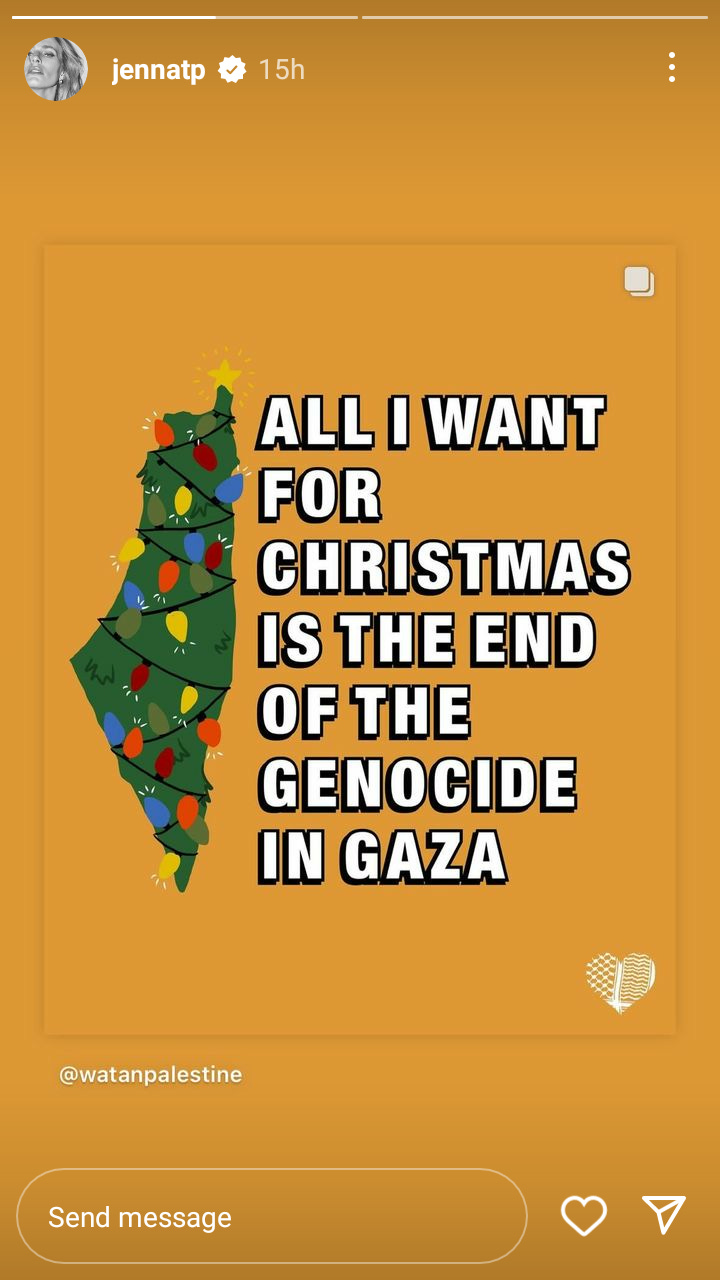

Actress, Supermodel Belgium citizen Jenna T. Peij. She uses her platform since October related feed like this [ceasefire] alongside her stories of modelling.

A tax provision used to merge WarnerMedia and Discovery expires next year, which would legally allow WBD to explore another deal. Zaslav told investors last month that the company's cost-cutting measures and debt reduction now put it in a position "to allocate more capital toward growth opportunities."

Talks between WBD and Paramount are still early, and may not ultimately result in a deal. But, given the acceleration of cord cutting the growing encroachment of Big Tech on media, neither company can remain on the sidelines for long.

With streaming transforming into something new, consumers are in for a shock to the system.

Streaming trained millions of viewers around the world to expect a lot of ad-free content for an inexpensive price. But that expectation was unsustainable, according to Nathanson.

“Wall Street just paid people for subscribers, and because it paid people for subscribers, companies did not care about the economics,” he said. “They were willing to do whatever they could to chase subscribers.”

In other words, the grow-at-any-cost strategy could never last, and now we’re at a point where companies and Wall Street are looking at balances sheets and focusing on profitability and revenue as much as scale.

And the truth is that even though the streaming wars are ending — and consumers are paying the price — there’s really no place else for any of them to go.

Streaming is here to stay. It’s the focus of Hollywood and how millions watch TV shows and films. That’s not changing even if the dynamics and strategies of the businesses behind them are.

“Video remains the most popular leisure activity in the world,” Ball said. “Streaming may change, but consumers will adapt. They love video too much.”

======== ========

I know a lot of high-ranking media, such as New York Times, Guardian, Anadolu, BILD, Spiegel, Financial Times, Strait Times, Washington Post etc subscribed my substack. Plestia ‘Bosbos’ Alaqad ready to be your Stringer or Keynote Speaker or Source about [everything related] Gaza, as Global Opinionator the Washington Post Rana Ayyub Rana Ayyub doing around 69 hours ago or 10 hours ago interview with Egyptian activist Zein Rahma, please contact Plestiaa2011@gmail.com or collab@plestiaalaqad.com

![More [Mission] Impossible: Tom Cruise Surprisingly Pro Palestine v entire Hollywood [ Pro Israel]](https://substackcdn.com/image/fetch/w_1300,h_650,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2b5dd0b9-24db-47dc-ad72-0119e40ebbea_476x401.png)

![[RENEW] 'Babel', 163 Languages of Refaat](https://substackcdn.com/image/fetch/w_1300,h_650,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fc25bd266-d4e2-4169-a5e4-e901227a8b0c_725x560.png)