ByteDance's TikTok Enjoy Burning Trillion Money in Indonesia, But Delays Full Opening of U.S. Shop

My neighbor, as Senior GM from Construction Company in Indonesia, explained to me that TikTok (in Indonesia) is trying to replace Tokopedia or SHOPEE or Lazada. Maybe since March 2023. Every TikTok user in Indonesia now can buy something and TikTok gives a discount of 40-50% (but sellers still get 100% payment). TikTok in Indonesia (ByteDance in Indonesia) in the 'burning money' stage like SHOPEE or Tokopedia or Lazada 8-9 years ago.

More gigantic market, more aggressive. TikTok set a similar tactic in Indonesia but for a “gigantic” market: America. At least, today, postponed.

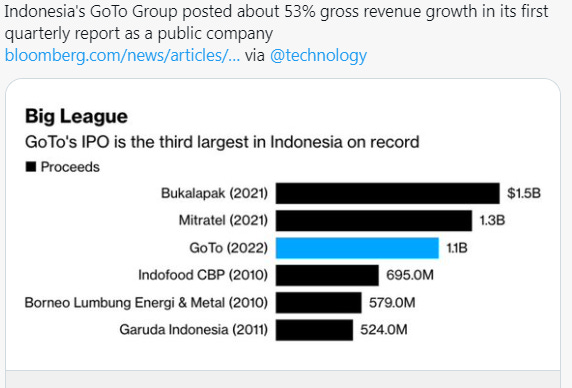

For comparison, this is minimum estimation: because now Gojek-Tokopedia (not ONLY GOJEK, or ONLY TOKOPEDIA, already merger), “burning money” stage by Gojek-Tokopedia in last (at least) 7 years around 155-160 Trillion Rupiah (around US$10.2 billion - US$10.4 billion).

TikTok Shop first launched in Indonesia and the U.K. in 2021 and expanded to several more Southeast Asia countries. Especially in Indonesia, “TikTok Shop” since March 2023 is more aggressive and tries to direct competition with existing online shop like Tokopedia, SHOPEE, and Lazada. “More burning money” stage from March 2023 for aggressive discounts by ByteDance in Indonesia area to lure anyone to use TikTok and leave from Tokopedia, Shopee, Lazada.

The business has grown rapidly in Asia, where shoppers are more willing to buy on short video or live-streaming platforms, but encountered weaker sentiment in the U.K., people familiar with the matter said.

TikTok’s Chinese parent has delayed the rollout of its shopping platform in the U.S. as concerns over the video-sharing app’s future deter merchants from joining, dragging on the company’s plans to earn more money from its prize global asset.

ByteDance has postponed opening the shop to all sellers, originally intended for early spring, to June at the earliest, people familiar with the matter said. Its actual launch date might get pushed back further because of merchants’ concerns about a possible ban of the app and tepid adoption of live-streaming e-commerce in the U.S., the people said.

After a preliminary test launch among a small pool of selected merchants late last year, TikTok struggled to attract more sellers to open storefronts, pushing back its second phase of expanding the test pool until late March, they said.

The delay in opening shops to all sellers is a setback in Beijing-based ByteDance’s most lucrative market outside China. Its U.S. business faces headwinds that include rising geopolitical tensions and intensifying e-commerce competition led by rivals such as Shein and PDD Holdings’ Temu (PinDuoDuo).

Chinese cut-price fast-fashion giant (but) headquarter in Singapore, SHEIN, defended its business model, saying demand-based production accounted for its low prices and not forced or cheap labour. Founded in China in 2008, SHEIN has swiftly claimed a top place in the global fast-fashion marketplace, offering young social-media-savvy customers low-priced collections that turn over at a steady clip.The Singapore-based firm’s strategy chief Peter Pernot-Day said that SHEIN is “an on-demand manufacturer... the global pioneer of this technology” during a visit to Paris to attend the opening of a Shein pop-up store. Very rare situation, a company with headquarters in Singapore facing / under scrutiny by the US Congress.

May 3rd, 2023, a bipartisan group of US lawmakers urge scrutiny of SHEIN (希音; Xīyīn) over forced labour reports. The letter was organised by Virginia Democrat Jennifer Wexton and Tennessee Republican John Rose and signed by 24 House members. A SHEIN (希音; Xīyīn) spokesman said the company has no suppliers in the Xinjiang Region and that it has “zero tolerance” for forced labour.

In a comment sent after publication of this article, TikTok said that the launch hasn’t been delayed and that the company continues to expand its testing in the U.S. by inviting more merchants to join as interest continues to grow.

The company’s push into online shopping is part of a drive to earn more money from its stable of Chinese and global apps that, while hugely popular, have yet to lift the company into profit.

ByteDance is targeting new revenue streams and has restructured a number of business lines to improve efficiency since Beijing tightened oversight on China’s internet sector. ByteDance recorded operating losses of more than $7 billion in 2021, The Wall Street Journal has reported.

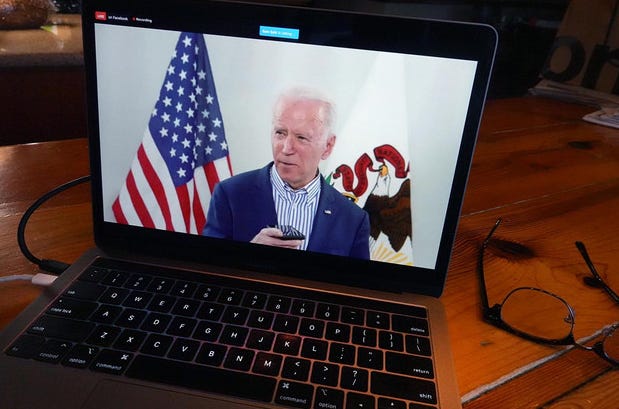

The Biden administration has said that TikTok needs to sell its U.S. operations or face a ban.

In EU, since February 23rd, 2023, the EU executive’s IT service has asked all Commission employees to uninstall TikTok from their corporate devices, as well as the personal devices using corporate apps, citing data protection concerns.

The request to uninstall the Chinese-owned social media app was communicated via email to EU officials (23 February).

“To protect the Commission’s data and increase its cybersecurity, the EC [European Commission] Corporate Management Board has decided to suspend the TikTok application on corporate devices and personal devices enrolled in the Commission mobile device services,” said the email.

Staffers were asked to do so as soon as possible and no later than 15 March. For those who do not comply by the set deadline, the corporate apps like the Commission email and Skype for Business will no longer be available.

The efficiency effort, which executives describe as losing fat and growing muscle, has led to its cutting around 20,000 workers since late 2021, people familiar with the matter said. ByteDance said it currently has over 150,000 employees globally and is hiring.

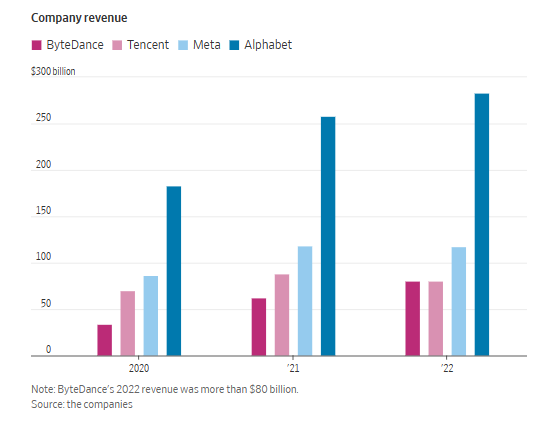

The private tech company expects revenue growth this year in the high double digits, according to investors recently briefed by the company. Its revenue, mostly from digital advertising, grew over 30% to more than $80 billion last year, the investors said. That slowed from 80% in 2021.

ByteDance still relies on China for more than 80% of its revenue, they said, but growth at its flagship apps—news aggregator Jinri Toutiao and TikTok’s Chinese version, Douyin—has stalled in the crowded and competitive marketplace. ByteDance is investing in food delivery and location-based services that bring users to shops, restaurants and hotels.

Outside its home country, ByteDance’s main attraction is TikTok, and investors say they are concerned that doubts over the app’s fate in the U.S. are causing a ripple effect, expanding risks to its other popular apps, as well as businesses such as advertising, e-commerce and cloud-computing services.

The Biden administration has said that TikTok needs to sell its U.S. operations or face a ban, citing concerns that China could access Americans’ user data. TikTok has been negotiating with U.S. officials over ways to build technical safeguards to ringfence the app’s U.S. operations.

“If TikTok hypothetically was to be banned in the U.S., customers in countries that are U.S. allies in particular may have substantial concerns over using any business product from ByteDance,” said Gary Wang, a former Boston Consulting Group consultant specializing in tech strategy and U.S.-China tech dynamics.

ByteDance executives, concerned that users could leave TikTok for alternatives such as Instagram Reels and YouTube Shorts, have pushed another app in the U.S. Lemon8, combining elements of Instagram and Pinterest, had largely focused on Japan and Southeast Asia since its debut in 2020. It has more than five million users.

Lemon8 didn’t tap the U.S. market until February, but it and ByteDance’s video-editing tool CapCut have been among the most downloaded apps in recent weeks, according to market-intelligence provider Sensor Tower.

ByteDance has only a handful of employees operating Lemon8 in the U.S., people familiar with the project said. It is hiring and transferring staff from other teams and offices, the people said.

Once dubbed an “app factory,” ByteDance has been switching away from costly experiments with rapid-fire new releases to focusing on cashing in on products that are already popular, people familiar with the strategy said.

During a March online meeting to celebrate the company’s 11th anniversary, Chief Executive Liang Rubo said ByteDance should focus on two core businesses: information platforms such as TikTok and Douyin, as well as e-commerce, according to people in attendance.

ByteDance executives, concerned that users could leave TikTok for alternatives, have introduced an app called Lemon8. Mr. Liang said ByteDance’s leadership in information platforms has become less pronounced in the past two years, with fierce competition at home and overseas, according to the people.

TikTok Shop first launched in Indonesia and the U.K. in 2021 and expanded to several more Southeast Asia countries. Especially in Indonesia, “TikTok Shop” since March 2023 is more aggresive and tries to direct competition with existing online shop like Tokopedia, SHOPEE, and Lazada. “More burning money” stage from March 2023 for aggressive discounts by ByteDance in Indonesia area to lure anyone to use TikTok and leave from Tokopedia, Shopee, Lazada. The business has grown rapidly in Asia, where shoppers are more willing to buy on short video or live-streaming platforms, but encountered weaker sentiment in the U.K., people familiar with the matter said.

Even in its best-performing market, Indonesia, the e-commerce venture has been booking losses, as it shares more revenue with sellers and offers bigger incentives, the people said.

ByteDance hasn’t been able to replicate the success of Douyin, TikTok’s Chinese sibling, in e-commerce. Last year, Douyin’s gross merchandise value, a metric commonly referred to as transaction volume by e-commerce operators, grew 76% to $204 billion, according to the people.

In January, ByteDance moved Kevin Chen, former president of its Chinese news-aggregator app, Jinri Toutiao, to Singapore to lead the product team for TikTok e-commerce. TikTok’s e-commerce team is led by ByteDance’s e-commerce head, Bob Kang, who reports to ByteDance’s China chairman and head of commercialization, the people said.

ByteDance said Mr. Kang also reports in a dotted line to TikTok CEO Shou Zi Chew for his TikTok e-commerce duties. It said the e-commerce team follows the same access controls as the rest of TikTok.

Mr. Kang pledged at the March meeting to improve the quality of the service and merchandise, people who attended said.

ByteDance tried to give fresh impetus to its U.S. e-commerce venture in March by allowing more sellers to apply for storefronts in TikTok Shop in a second phase of its rollout schedule, but merchants have been hard to attract, people familiar with the plan said. The Information, a technology-industry publication, has previously reported a slow take-up rate from merchants.

ByteDance is downsizing a China-based team that helps merchants there sell on TikTok Shop, moving some of the employees to different local teams, the people said. The effort is meant to shore up local service and attract more quality local sellers, they said.

TikTok Shop allows China-based sellers to open storefronts to sell to users in the U.K. and Southeast Asia. In the U.S., it hasn’t opened to sellers outside the country.