NYC 1.04am

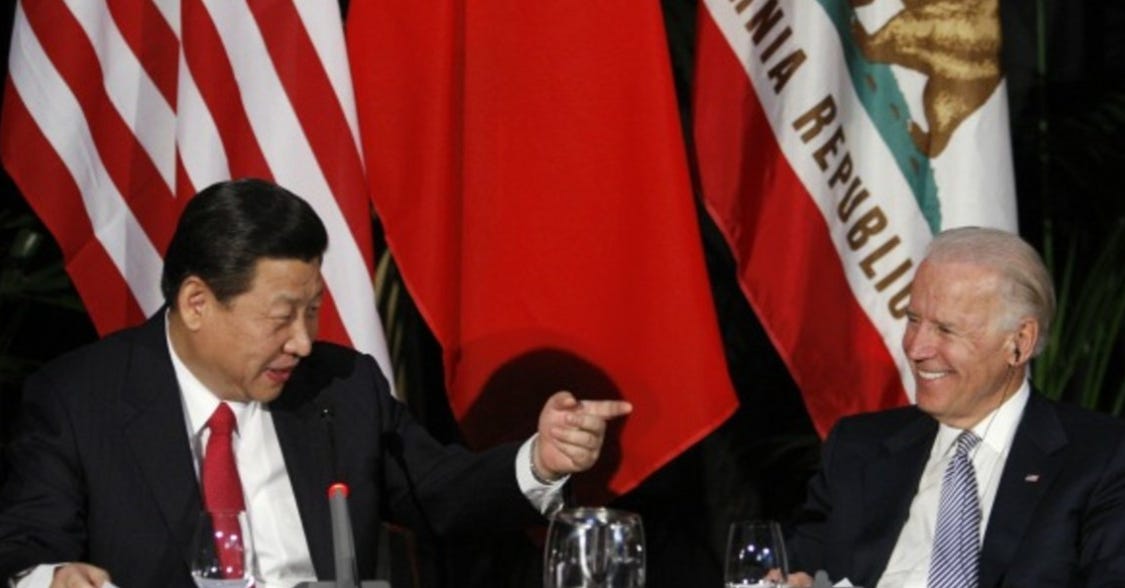

Just as China’s economy was showing signs of life, the troubles of the world’s most-indebted property developer have come roaring back, showing that a drawn-out downturn in the country’s enormous property market is far from over. How is Beijing navigating the country's economic slowdown? How will China's struggles impact the global economy? Wonder if China will eventually be forced to create a "troubled property developer relief program" -- a comprehensive recapitalization of the property developers akin to the US TARP. The push to restore contacts is being driven by a shared desire for stability in the relationship. Washington has pressed to steady matters with Beijing partly to show allies and others that it can manage a working relationship with China.

China and US are discussing a trip to DC by Xi’s top economic-policy aide, Vice Premier He Lifeng, who would be the most senior official to travel to US since Biden took office. Odds of Xi/Biden meet are rising. Following Secretary Yellen’s recent Beijing visit, Treasury announces two new working groups with China. Important opportunities to discuss and work through some bilateral and global economic challenges. Early outcomes equally important. As U.S. to be APEC host year [next November, in San Francisco] draws to a close & IPEF negotiations wind down, now’s the time to start the convo on next steps. Deepening US engagement w Asia is not just an economic imperative. It’s a strategic one. We cannot risk ceding regional trade leadership to China.

But earth not only China and U.S.

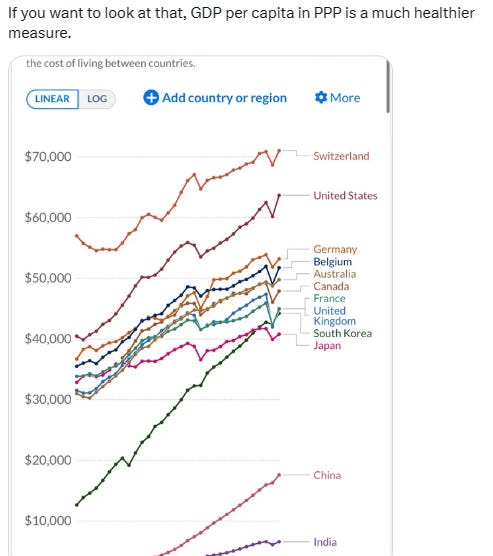

A collective sigh of relief is going up in some of the wealthiest economies. They have proved to be remarkably resilient in the face of the steepest rise in interest rates in decades. In the U.S., inflation has been whittled down, so far without much harm to growth or employment. Growth in some developing economies, including Indonesia, India and a few others in East Asia, has also been strong.

Don’t break out the champagne yet. The near-term risk of global recession may have receded, but the world economy remains fragile . Even in the economies showing resilience, the recent upbeat mood could vanish as the slow-acting effects of high interest rates sink in. A toxic trio remains firmly in place, threatening the global economy: elevated debt levels, tighter financial conditions, and weaker growth prospects. For many developing economies, these are often the ingredients of a financial crisis.

Total global debt today is stuck at historic highs, roughly two-and-a-half times the world’s total economic output. At the end of 2022, the debt-to-gross domestic product ratio for developing economies other than China was 126%, up about 30 percentage points since 2010. As interest rates have surged, government budgets have been squeezed. Many developing economies now spend more on debt-service payments than they do on health and education.

This financial squeeze shows no sign of abating. Global interest rates may be approaching their peak, but they aren’t likely to decline much in the near term. In many advanced economies, headline inflation has cooled, but core inflation—which excludes food and energy—has remained stubbornly high. That suggests major central banks will remain inclined to keep up the fight against inflation by maintaining high interest rates, as Federal Reserve Chair Jerome Powell acknowledged at the meeting of central bankers in Jackson Hole last week. Global financial markets are finally beginning to adjust to the reality of “higher-for-longer” interest rates.

Many developing countries have seen a steep increase in financing costs. For one-fifth of these economies, sovereign spreads—the difference in yields on bonds issued by these economies relative to U.S. bonds—now exceed ten percentage points, indicating a prohibitively high cost of borrowing. Not surprisingly, sovereign debt defaults by developing countries have surged. In the last four years alone, there have been 15 such defaults, compared with 19 in the previous two decades.

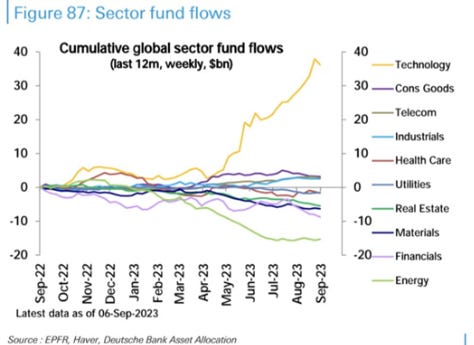

Amid these strains, global growth is slowing, and the doldrums could persist for a while. Global growth is expected to average just 2.3% this year and next—nearly a full percentage point below the prepandemic average. The latest consensus forecasts (see figure) suggest that growth in more than 85% of countries will be slower this year than last year. This broad-based slowdown should not be a surprise. Among the three major engines of the global economy, only the U.S. is delivering robust growth today. In the euro area, growth has been stalling. China’s economy is sputtering, with troubling implications for the rest of the world. Excluding China, growth in developing economies is set to slow substantially—from 4.1% last year to 2.9% this year.

The implications are bleak. By the end of next year, people in nearly 30% of developing economies will remain poorer than they were before the Covid-19 pandemic. The usual propellants of growth—trade and investment—are dwindling. Global trade growth is forecast to slow sharply this year—to less than 2% from 6% in 2022. Investment growth in developing economies this year and next is expected to average a tepid 4.2%, well below the 7.1% average in the first two decades of this century.

Persistently weak growth will make it harder for governments to tackle the array of challenges that beset their citizens. Extreme weather events have already become more frequent, with greater attendant economic damage, even in the wealthiest countries. Food insecurity is on the rise, and climate change is making it worse. At the end of 2022, 2.4 billion people—nearly a third of humanity—lacked year-round access to enough safe and nutritious food.

Bolstering growth under these conditions won’t be easy. But it can be done, provided that national and global policy makers resist the lure of shortcuts and stay focused on policy interventions that improve medium- to long-term growth. Since fiscal resources have been largely depleted and inflation is still elevated, now is not the time to think about large-scale economic stimulus packages.

Structural policies can help reduce overall uncertainty while building confidence. A central pillar of these policies must be to boost investment to meet development and climate goals. This can be done by improving public-spending efficiency, reallocating resources toward priority infrastructure projects, improving governance frameworks and business climates, and streamlining the regulatory environment. Global cooperation will be essential to accelerate the clean-energy transition, mitigate climate change, and provide debt relief for the rising number of countries facing debt distress.

The recent resilience of a few economies is welcome, but it won’t defuse the threats confronting the global economy. Policy makers need to stay focused on the hard work that lies ahead. They must complete the unfinished task of taming inflation. They must push forward with the comprehensive policy reforms that will be needed to achieve sustainable long-term growth and prosperity.

=========END————

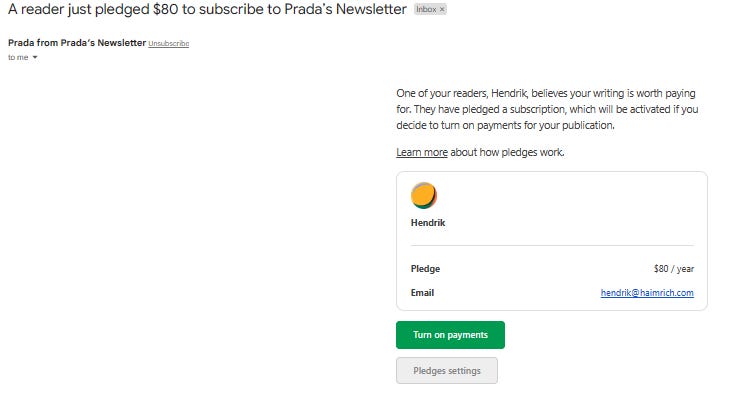

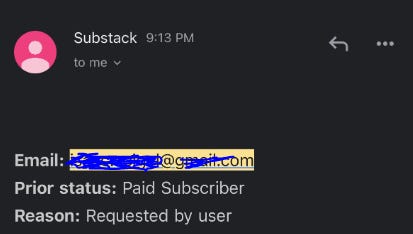

Thank you, as always, for reading. If you have anything like a spark file, or master thought list (spark file sounds so much cooler), let me know how you use it in the comments below. Thank you so much for letting me vent! If you enjoyed this article, you can give pledge to me (click PLEDGE button) or simply share this article with a friend. It helps me more than you realise.

If you enjoyed this post, please share it.

______________

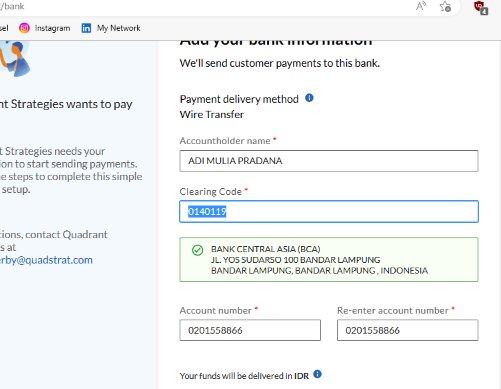

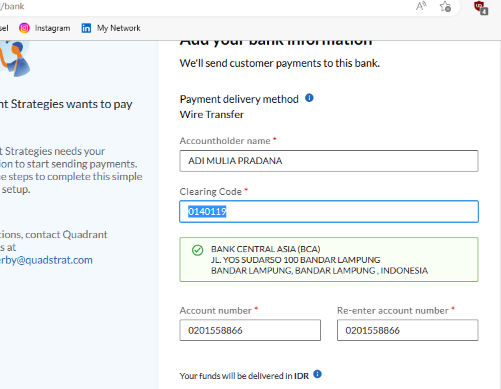

Professor Hendrik, Professor Eric, and another person, Prof David A. Andelman, former Bureau Chief NYTimes recommended my substack, also some Chief Technology of Financial Times (FT) recommended my substack, not only subscribe. I'd be happy to get more & more PLEDGE and recommendations for better crafted writing (via Bank Central Asia (with my full-name ADI MULIA PRADANA, clearing code 0140119, account number 0201558866 or via STRIPE. For me, prefer Bank Central Asia).

If a friend sent this to you, you could subscribe here 👇. All content is free, and paid subscriptions are voluntary.

——————————————————————————————————

-prada- Adi Mulia Pradana is a Helper. Former adviser (President Indonesia) Jokowi for mapping 2-times election. I used to get paid to catch all these blunders—now I do it for free. Trying to work out what's going on, what happens next. Now figure out and or prevent catastrophic of everything.

(Very rare compliment and initiative pledge, and hopefully more readers more pledges to me. Thank you. My note-live blog about Russia - Ukraine already click-read 6 millions, not counting another note especially Live Update Substack (mostly Live Update Election or massive incident)

=======

Thanks for reading Prada’s Newsletter. I was lured, inspired by someone writer, his post in LinkedIn months ago, “Currently after a routine daily writing newsletter in the last 10 years, my subscriber reaches 100,000. Maybe one of my subscribers is your boss.” After I get followed / subscribed by (literally) prominent AI and prominent Chief Product and Technology of mammoth global media (both: Sir, thank you so much), I try crafting more / better writing.

To get the ones who really appreciate your writing, and now prominent people appreciate my writing, priceless feeling. Prada ungated/no paywall every notes-but thank you for anyone open initiative pledge to me.

(Promoting to more engage in Substack) Seamless to listen to your favorite podcasts on Substack. You can buy a better headset to listen to a podcast here (GST DE352306207).

Listeners on Apple Podcasts, Spotify, Overcast, or Pocket Casts simultaneously. podcasting can transform more of a conversation. Invite listeners to weigh in on episodes directly with you and with each other through discussion threads. At Substack, the process is to build with writers. Podcasts are an amazing feature of the Substack. I wish it had a feature to read the words we have written down without us having to do the speaking. Thanks for reading Prada’s Newsletter.

Wants comfy jogging pants / jogginghose amid scorching summer or (one day) harsh winter like black jogginghose or khaki/beige jogginghose like this? click

Headset and Mic can buy in here, but not including this cat, laptop, and couch / sofa

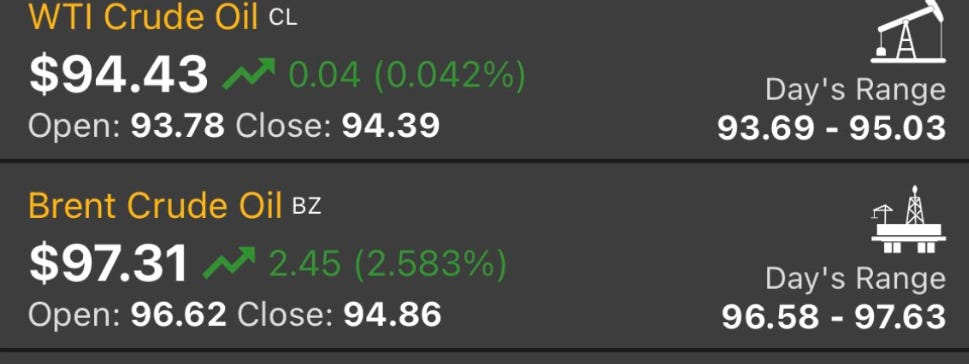

![Today October 1st Gasoline IDR 14k [USD1] is too small a hike. The fact MOPS Singapore August [USD79] too low if compare new oil price [USD93-100]](https://substackcdn.com/image/fetch/w_1300,h_650,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fcfdd246b-ab8f-4be0-b41a-6c968185c5bd_657x534.png)