DC 10.54am

The US doesn't face a second Renminbi China shock -- But absent policy action Europe (Eurozone) almost certainly does.

Predictions about the greenback’s demise fail to appreciate the forces behind its continued supremacy. Positive feedback across official and private functions, the network effects associated with incumbency, and financial opportunism discourage collective action against the status quo.

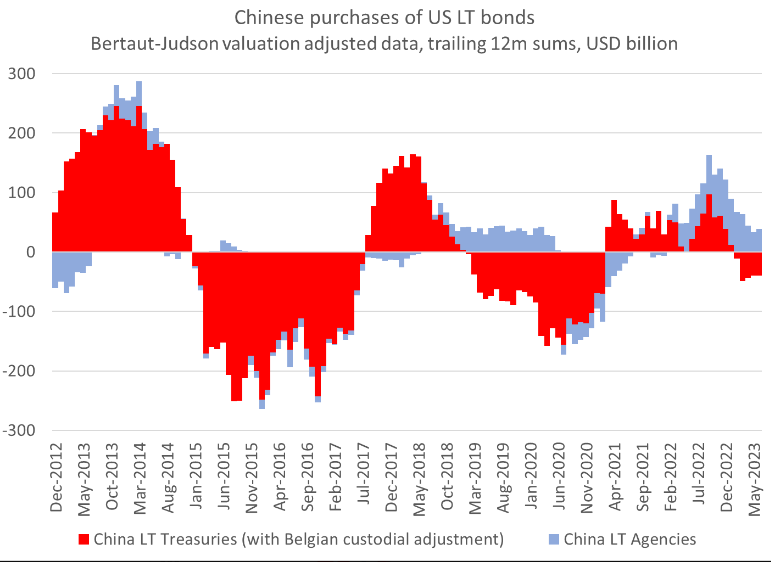

Market trades on rate differences not imbalances right now. With the current rates constellation (and both Japan lifers / postbank and China shifting into agencies and corporate bonds for the yield pickup), the US net interest rate should go from 2.4% to over 4% over the next few years.

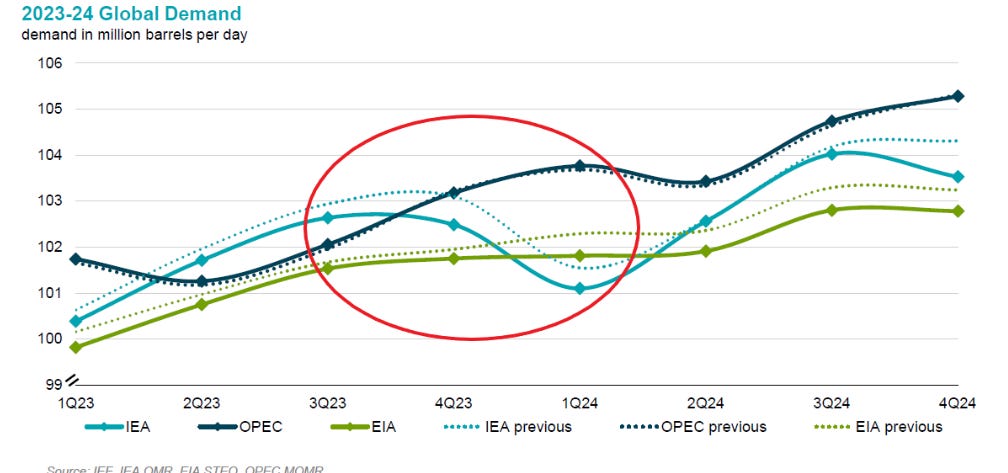

In Japan, underscoring just how weak the yen is right now, data from the Bank for International Settlements showed it at a 53-year low when measured against a broad basket of its peers and adjusted for inflation. The US would understand if MoF wanted to intervene (yen 150, oil US$100 = bad for Japan). Currently WTI and Brent in range US$89-93 per barrel. Latest meeting Bank of Japan 31 hours ago indicating a serious, bigger problem than months ago.

US net external debt position (NIIP minus the net equity position) is about negative 50% of US GDP. Over the next 3-4 years, net interest payments to the RoW will go up by a pp of US GDP. Dynamics around the US external deficit at current interest rates and dollar levels are actually pretty negative. For complex reasons, those dynamics have played out slowly (US external interest earning assets have a shorter duration than US ext. liabilities).

Many experts believe that the US dollar’s global hegemony, which has endured for nearly 80 years, is finally coming to an end. This outcome is not impossible: economic crises, increased domestic polarization, and strong geopolitical headwinds could indeed culminate in the currency’s meltdown. But it is not likely.

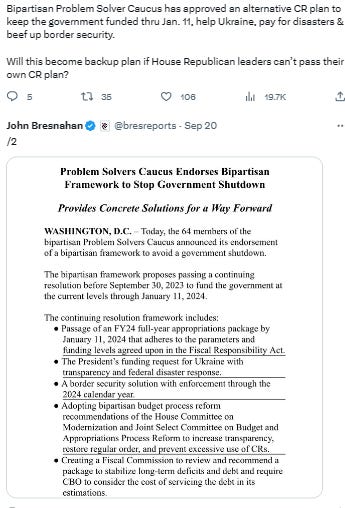

*FY: Fiscal Year

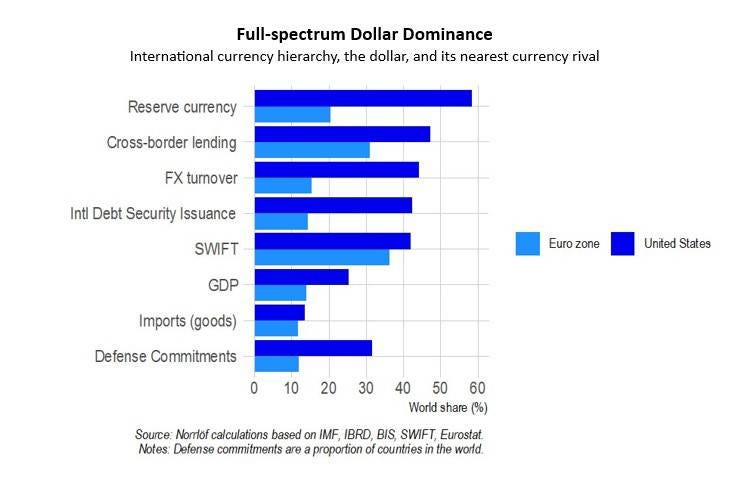

Debates about the future of the international monetary system often fail to appreciate the greenback’s full-spectrum dominance, which requires understanding its role in public and private markets, as well as the various incentives to hold dollars. So long as self-reinforcing synergies and forms of opportunism continue to prevail, narrowing the yawning chasm between the dollar and other currencies will remain difficult.

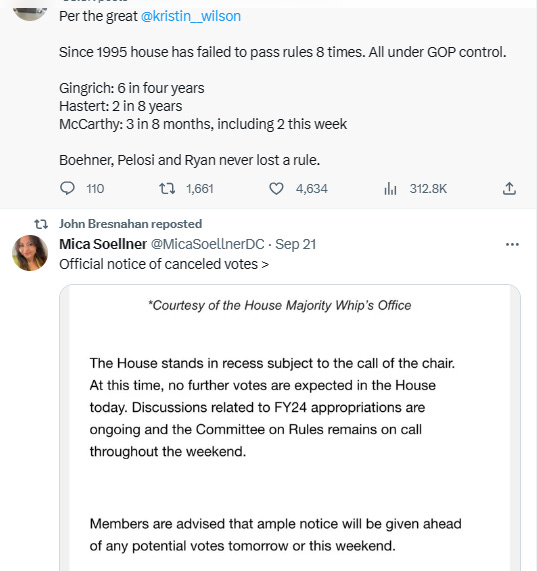

To be sure, there are threats to dollar supremacy. The greenback’s primacy and pervasiveness in the global financial system has become a major bone of contention in the great-power struggle between the United States, China, and Russia. These geopolitical challenges are happening against a backdrop of high interest rates and America’s polarized politics, which prompted the drawn-out negotiations over the US debt ceiling earlier this year; taken together, they risk undermining the perceived safety of dollar assets. But for the greenback to be unseated, multiple actors must support a substantial currency shift.

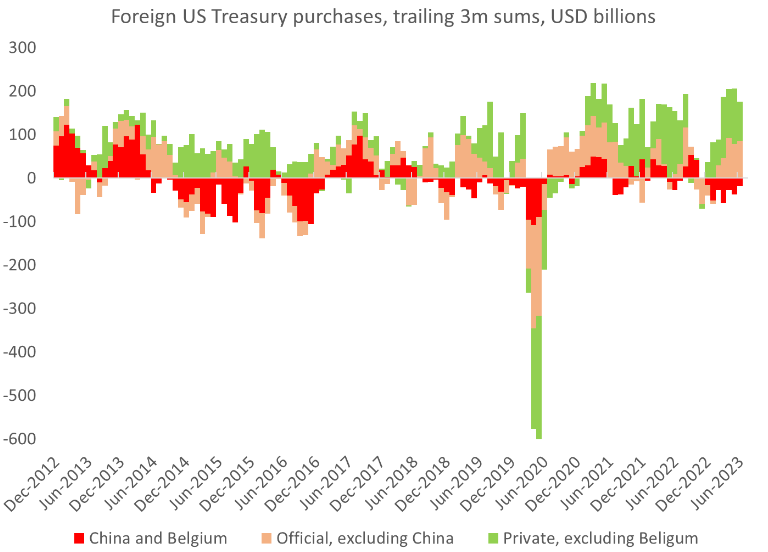

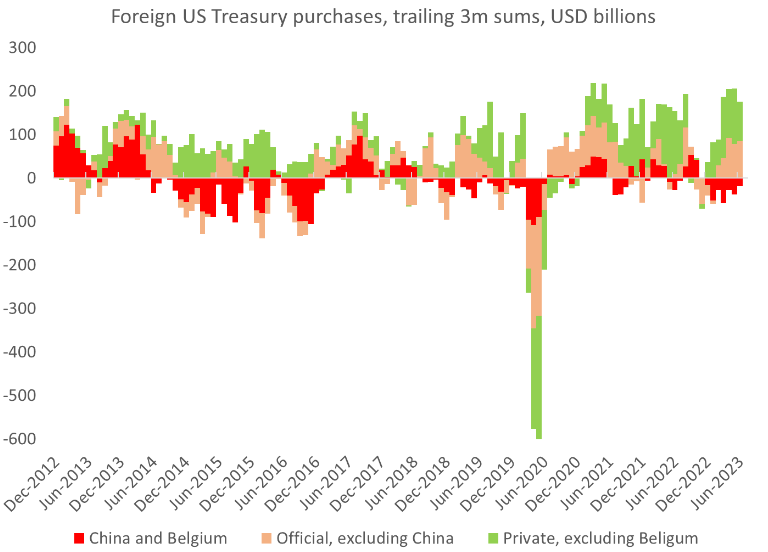

To conclude on a boring, factual note -- if you add Belgium's reported LT Treasuries to China's LT Treasuries and use the Fed's valuation adjusted series and include Agencies, China has not been a net seller of US bonds over the last 12 months of data.

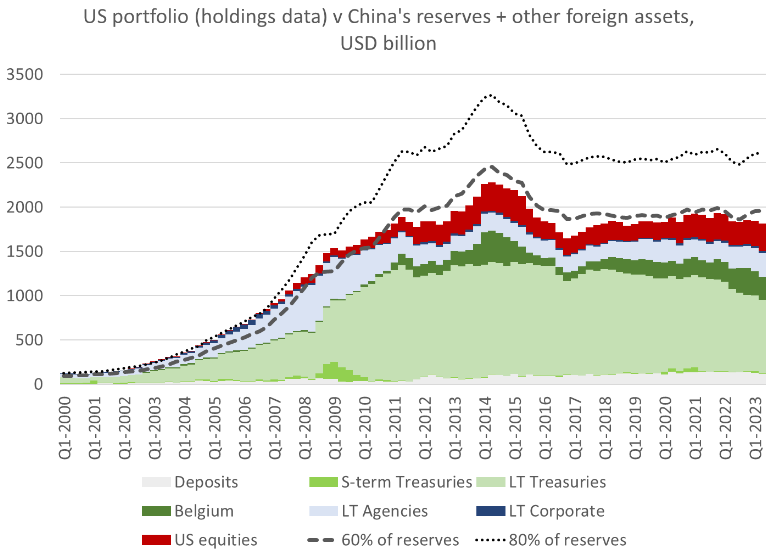

There are three big pools of foreign assets held by Chinese residents. First, the formal reserves of SAFE (and you can add in the Private Equity heavy assets of CIC). Two, the foreign portfolios of the policy banks and the big state commercial banks. Three, the offshore accounts of China's exporters. When China stops targeting 60% for the dollar share of its formal reserves, we will know (it hasn't).

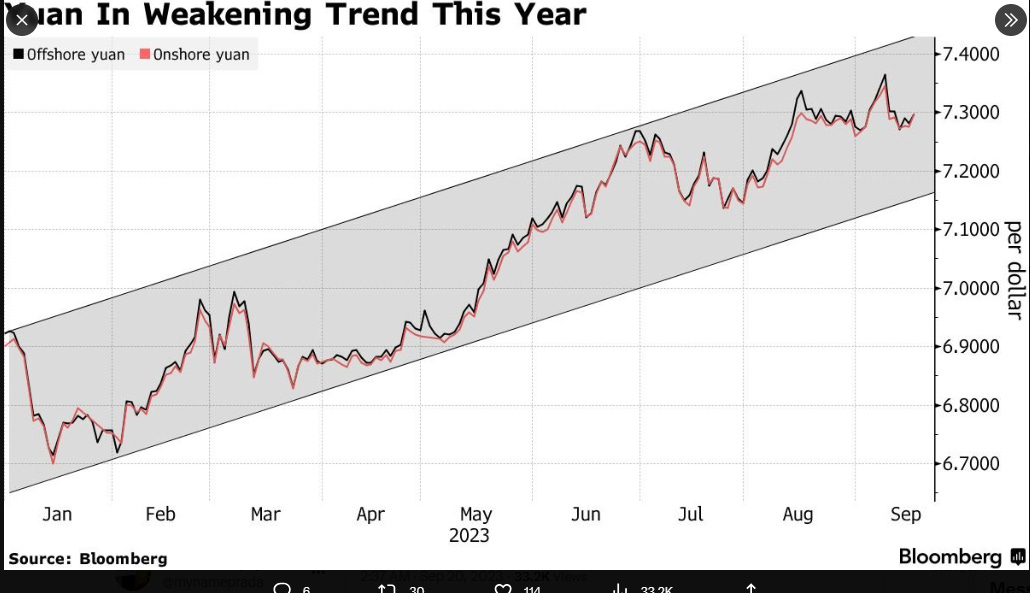

The Chinese Yuan has been under pressure to depreciate much of this year, though intensified verbal intervention and state back support have stabilized the yuan at around 7.3 (Spot) since mid-August 2023. The Chinese state banks net foreign asset position did fall $10 billion in August (the PBOC's balance sheet was basically flat -- so numbers consistent with modest net sales to support the Yuan. There is just a huge difference between trying to defend a currency when you have a US$900b - US$1 trillion trade surplus and trying to defend a currency when you don't have a massive surplus (of course, controls also help) it isn't even clear to me that the PBOC needs help from the Fed.

Moreover, the US – and potentially other countries – have a vested interest in preserving the dollar’s status as the world’s only truly global currency. Americans benefit from the ease and convenience of transacting in dollars, seigniorage, monetary flexibility, and being the world’s safe haven in times of crisis. For the US government, it serves as a non-military instrument of coercion with which to police the world, as well as a source of prestige.

Measuring dollar dominance requires a closer look at the many functions – from medium of exchange to unit of account and store of value – the greenback serves outside the US. Governments and monetary authorities use the dollar to intervene in foreign-exchange markets, to hold official reserves, and as a pegging currency. Private actors, meanwhile, rely on it as a vehicle currency, for invoicing and settlement of trade, and for investment purposes. The interplay between these different actors and roles has propelled the currency to its hegemonic position, as shown in the figure below.

The dollar outperforms its main rival – the euro – by the largest margin in the role of reserve currency, which foreign governments and monetary authorities use as an exchange-rate peg or for interventions. Government decisions thus matter for the dollar’s continued primacy. Official entities could coordinate foreign-exchange interventions to prop up or hold down the dollar. But that would require collective action, as would the successful implementation of alternative payment systems and liquidity arrangements, such as China’s Cross-Border Interbank Payment System (CIPS), a renminbi-based rival to the US Clearing House Interbank Payments System (CHIPS), or the proposed joint reserve currency issued by the BRICS group of major emerging economies. The question is whether such coordination is possible.

In the post-Cold War era, governments have been motivated primarily by economic factors when deciding whether to bulk up on a foreign currency. The liquidity, depth, and breadth of the dollar market has made the greenback widely accessible and cheaper to use than alternatives. Feedback loops between official institutions and private actors have also encouraged governments and monetary authorities to accumulate dollar-denominated reserves. For example, in times of crisis, private actors rely on central banks to supply them with dollar assets, sometimes via swap lines extended by the US Federal Reserve.

Private actors’ willingness to use and hold dollars is also a choice based on economic considerations: these actors are likely to settle payments – and thus store value – in the invoicing currency. But they coexist within a decentralized system in which each typically accounts for a small slice of the pie. Even the considerable dollar assets held within large financial institutions comprise deposits by separate entities without the means or incentives to act collectively. Thus, while independent decisions could chip away at the dollar’s global standing, a deliberate and coordinated private effort to subvert the current system is highly unlikely.

To bring about a dollar collapse and forge a new world order in which the greenback plays a diminished role would require all users to break these network effects and suffer the consequences. Governments would need to sever economic and political ties to the US. To fulfill the BRICS’ pledge to create an alternative reserve currency and payment system, for example, many of its members would have to stop relying on US liquidity and consumer demand.

Such initiatives depend on the participation of major economic actors or a preponderance of minor ones. It is unlikely that the major economies would come on board, because, with the exception of China, they all enjoy access to dollar-swap lines. Moreover, if governments abandon the dollar before another currency becomes dominant, they risk losing a liquidity lifeline in times of crisis. Many small actors would likewise be loath to jump ship, given that opportunism largely precludes collective action.

Apart from any direct economic costs, governments that conspire to thwart the dollar system risk losing America’s security guarantee. Even countries that do not benefit directly from US defense commitments will probably be reluctant to land on the wrong side of such a formidable military power.

Positive feedback across the greenback’s official and private functions, the network effects associated with its incumbency advantage, and opportunism discourage collective action against the status quo. For governments, unplugging from the dollar system also means disconnecting from all that the US has to offer, including liquidity provision, consumer demand, dollar-swap lines, and a security umbrella. Currency dominance is sticky. Absent major economic upheaval or a geopolitical realignment, the dollar’s global hegemony will continue to create the conditions for its own persistence.

====END=====

Thank you, as always, for reading. If you have anything like a spark file, or master thought list (spark file sounds so much cooler), let me know how you use it in the comments below.

If you enjoyed this post, please share it.

______________

If a friend sent this to you, you could subscribe here 👇. All content is free, and paid subscriptions are voluntary.

——————————————————————————————————

-prada- Adi Mulia Pradana is a Helper. Former adviser (President Indonesia) Jokowi for mapping 2-times election. I used to get paid to catch all these blunders—now I do it for free. Trying to work out what's going on, what happens next. Arch enemies of the tobacco industry, (still) survive after getting doxed. Now figure out, or, prevent catastrophic situations in the Indonesian administration from outside the government. After his mom was nearly killed by a syndicate, now I do it (catch all these blunders, especially blunders by an asshole syndicates) for free. Writer actually facing 12 years attack-simultaneously (physically terror, cyberattack terror) by his (ex) friend in IR UGM / HI UGM (all of them actually indebted to me, at least get a very cheap book). 2 times, my mom nearly got assassinated by my friend with “komplotan” / weird syndicate. Once assassin, forever is assassin, that I was facing in years. I push myself to be (keep) dovish, pacifist, and you can read my pacifist tone in every note I write. A framing that myself propagated for years.

(Very rare compliment and initiative pledge. Thank you. Yes, even a lot of people associated me PRAVDA, not part of MIUCCIA PRADA. I’m literally asshole on debate, since in college). Especially after heated between Putin and Prigozhin. My note-live blog about Russia - Ukraine already click-read 4 millions.

=======

Thanks for reading Prada’s Newsletter. I was lured, inspired by someone writer, his post in LinkedIn months ago, “Currently after a routine daily writing newsletter in the last 10 years, my subscriber reaches 100,000. Maybe one of my subscribers is your boss.” After I get followed / subscribed by (literally) prominent AI and prominent Chief Product and Technology of mammoth global media (both: Sir, thank you so much), I try crafting more / better writing.

To get the ones who really appreciate your writing, and now prominent people appreciate my writing, priceless feeling. Prada ungated/no paywall every notes-but thank you for anyone open initiative pledge to me.

(Promoting to more engage in Substack) Seamless to listen to your favorite podcasts on Substack. You can buy a better headset to listen to a podcast here (GST DE352306207).

Listeners on Apple Podcasts, Spotify, Overcast, or Pocket Casts simultaneously. podcasting can transform more of a conversation. Invite listeners to weigh in on episodes directly with you and with each other through discussion threads. At Substack, the process is to build with writers. Podcasts are an amazing feature of the Substack. I wish it had a feature to read the words we have written down without us having to do the speaking. Thanks for reading Prada’s Newsletter.

Wants comfy jogging pants / jogginghose amid scorching summer or (one day) harsh winter like black jogginghose or khaki/beige jogginghose like this? click

Headset and Mic can buy in here, but not including this cat, laptop, and couch / sofa.