Hvorfor å trykke penger ikke er en enkel løsning for å betale gjeld (Insist to keep (more) printing money even not solving the inflation problem, America?)

Bilingual Norsk / ˈnɔʂːk (Norwegian) / English

I går fikk jeg spørsmålet fra leser Kris:

”Hvorfor må USA låne penger for å betale gjeld/renter når man kan tenke at de bare kan trykke/øke pengemengden for å betale?”

I dagens nyhetsbrev ønsker jeg derfor å adressere spørsmålet: “Hvorfor kan ikke land bare trykke mer penger for å betale ned gjeld og renter?”

Denne tanken er det nok mange flere som sitter med nå enn noen gang tidligere i lys av økende interesse for Bitcoin. La oss se nærmere på denne problemstillingen å se på hvorfor det ikke er så enkelt som det kan virke.

For det første er inflasjonsbekymring en viktig faktor. Når et land trykker for mye penger uten en tilsvarende økning i økonomiske verdier eller produksjon (produktivitet), kan det føre til høy inflasjon ved at flere penger jager færre varer. Inflasjonen skaper som kjent ofte økonomisk ustabilitet, reduserer kjøpekraften til valutaen og resulterer i høyere priser på varer og tjenester. Derfor er det et viktig hensyn å unngå overdreven økning i pengemengden.

I tillegg spiller tillit og troverdighet en vesentlig rolle. Ved å låne penger fra innenlandske og utenlandske investorer opprettholder et land tilliten og troverdigheten til sin økonomi. Det sender et signal om ansvarlighet og forpliktelse til å tilbakebetale gjelden. Trykking av penger kan derfor undergrave tilliten til valutaen og landets økonomiske stabilitet, som kan ha negative konsekvenser på lang sikt.

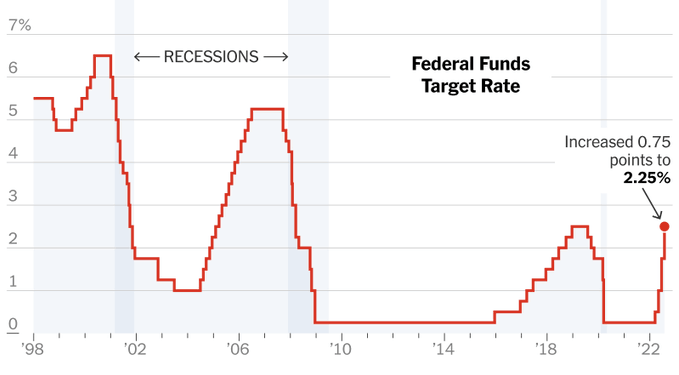

En annen viktig faktor som må tas med i vurderingen er rentesatser. Hvis et land opplever høy inflasjon, kan det føre til høyere rentesatser for å dempe inflasjonen eller tiltrekke investorer som vil ha høyere avkastning. Disse høye rentesatsene kan være svært kostbare for et lands økonomi, og de kan hemme den økonomiske veksten og mulighetene for å investere fremover.

I sum viser dette at å trykke mer penger for å betale ned gjeld ikke er en enkel eller uproblematisk løsning. Det er viktige økonomiske hensyn, inflasjonsrisiko og tillit til valutaen som må tas i betraktning. Det er derfor viktig å ha en balansert og helhetlig tilnærming og ikke bare trykke ad infinitum, selv om dere som leser dette nyhetsbrevet vet at det i praksis er det vi holder på med, men sakte og over mange tiår.

(Promoting to more engage in Substack) Seamless to listen to your favorite podcasts on Substack. You can buy a better headset to listen to a podcast here (GST DE352306207). Listeners on Apple Podcasts, Spotify, Overcast, or Pocket Casts simultaneously. podcasting can transform more of a conversation. Invite listeners to weigh in on episodes directly with you and with each other through discussion threads. At Substack, the process is to build with writers. Podcasts are an amazing feature of the Substack. I wish it had a feature to read the words we have written down without us having to do the speaking.

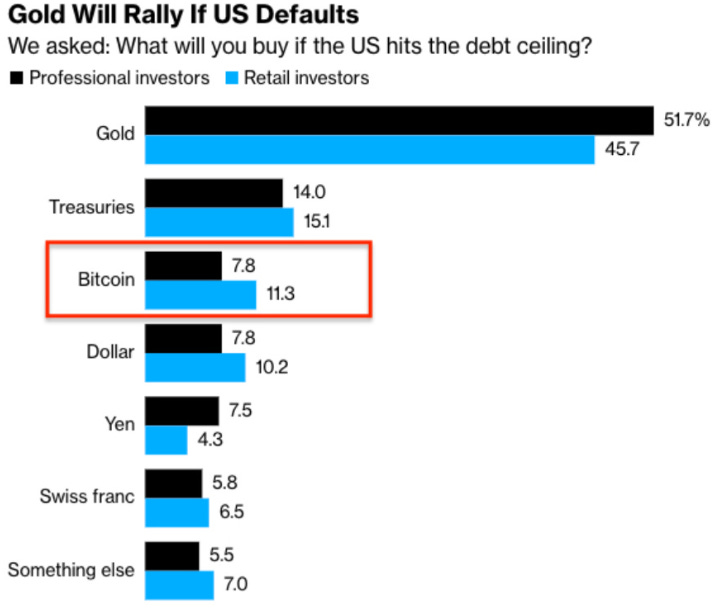

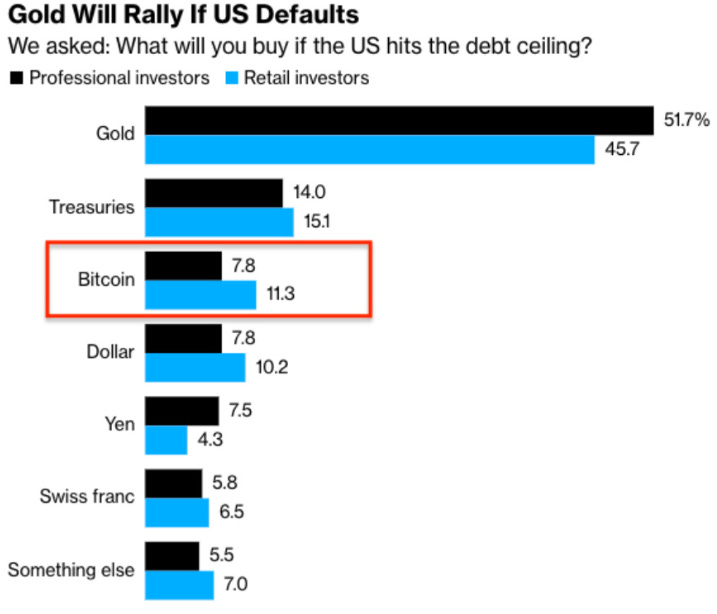

Hvis USA ikke klarer å øke gjeldstaket og ender opp i konkurs, vil det utløse en rask kamp for å beskytte verdier da tilliten til landet vil svekkes betydelig. Etterspørselen etter sølv, gull og Bitcoin vil trolig øke. Tilliten til både myndighetene og bankvesenet vil nå nye lavmål, noe som vil stimulere til økt adopsjon av alternative verdier.

Samtidig kan en massiv overgang til bitcoin bli betraktet som en større trussel mot dollaren enn tidligere. Derfor er det mulig at det blir fremmet forslag om forbud og strengere regulering. Indikatorer viser imidlertid at bitcoin vil "overta" dollaren som foretrukket eiendel hvis USA misligholder gjelden sin.

========

US retail sales increased in April, suggesting consumer spending is holding up in the face of economic headwinds including inflation and high borrowing cost. Long-term inflation expectations reach a 12-year high. Insist to keep (more) printing money even not solving the inflation problem, America?

PIMCO Economist Tiffany Wilding says inflation will probably continue to decelerate to 3% by the end of the year. US neighbor, Canada, April’s higher-than-expected inflation figures suggest further rate hikes by the Bank of Canada might not be out of the question, experts said on Tuesday (May 16th).

U.S. “staunchest” allies in Asia, Japan, the 3rd biggest economy in the world, the Japanese government will allow seven of the nation's major power companies to raise household electricity prices from June, a move likely to add to inflation–amid (fortunately) highest ever rating for Prime Minister Kishida Fumio. Biden will visit Japan (Hiroshima, for 49th G7 Summit — for special guest this year G7, again, is Jokowi Indonesia, like 48th G7 Summit last year in Schloss Elmau, Krün, Bavarian Alps Germany) & Australia this week, alongside the QUAD meeting in Australia (QUAD military alliance: Japan, India, Australia, and the U.S.). Global money supply growth and bank lending. Bank loans lagging monetary tightening in the U.S. and Japan.

Prime Minister Rishi Sunak’s administration is looking into the farming supply chain with double-digit inflation continuing to push up food prices in the UK. The ECB will hold interest rates at their peak for longer than previously thought as underlying inflation pressures persist.

The economist's mission is sometimes unpleasant, and contradicting popular truths which are economic fallacies; sometimes you have to go against the grain. Whether you are Keynesian, communist central planner or a believer in free markets all economists seem to believe in the healing powers of economic growth. Problem is our global economy is totally dependent on the planet. Greedies are making things worse. Economic growth is the only way we all get better off without taking it from someone else and governments are destroying this option.

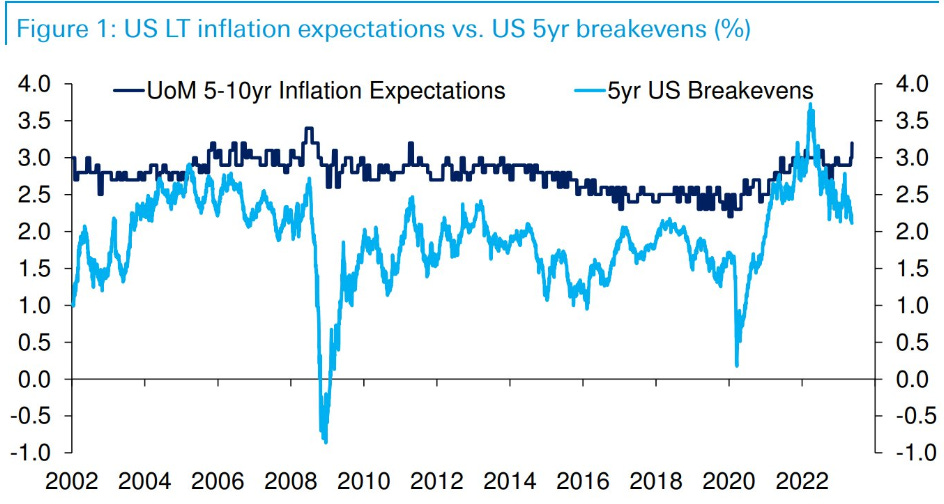

According to the University of Michigan, inflation expectations index for five to 30 years reached a 12-year high of 3.2 percent. At the same time, the consumer sentiment index declined to 63.5, compared to a pre-pandemic high of 300. The deterioration in the situation of consumers is evident.

The official narrative is that inflation is under control. However, many tend to forget that reducing inflation from 9.0 percent to 5.0 percent is relatively easy. The challenge is to bring it further down to the Federal Reserve’s target of 2 percent.

Inflation is a hidden tax. A governments always try to hide the loss of purchasing power or blame anything but itself, but the only reason that causes most prices to rise at once is printing money well above the actual demand for it.

According to the Bureau of Labor Statistics, in April, the U.S. Consumer Price Index increased 0.4 percent, seasonally adjusted, and rose 4.9 percent over the last 12 months, and core inflation increased 0.4 percent, up 5.5 percent over the year. This means that the U.S dollar has lost a purchasing power of 14 percent since 2019 and 35 percent since 2008.

The government’s failure to contain inflation is evident. Government spending has not been reduced at all, and that means a higher consumption of newly created units of currency. Rate hikes and a money-supply slump are only weakening the private sector while government continues to spend way above the levels of 2019. That is why the narrative is switching to try to make citizens accept an annual inflation of 3 percent instead of 2 percent. The message is that it is virtually the same, but it is not. Rather, it means a faster rate of impoverishment.

Many politicians try to convince us that now we must choose between inflation and growth, but that is a false dilemma. Inflation is generalized impoverishment, and, of course, it does not imply that there is growth. In fact, the evidence in most developed economies is a phenomenon closer to stagflation.

Intermezzo about Gold commodities: M & A (Merger & Acquisition) process between Newcrest Mining Limited and Newmont Corporation was finished, already listed Corcomm information about this M&A in Newmont’s web minutes ago (not yet in Newcrest web). Newcrest board backs $19.5 billion Newmont takeover. The combined entity will be the largest gold producer. Largest M&A for Newmont, stunning exit for Newcrest shareholders.

Gold on fire (plus this one carries a copper kicker). Gold sentiment is as extreme as dedollarization hysteria right now. Here are searches for "how to buy gold" on Google, back to 2004. Second tweet shows how peak searches coincided with peak gold prices in 2011. This year, fears that the US dollar will collapse are nonsense, and doomsayers are often hawking gold, investment chief says. May 8th, 2023, India’s Gold reserves hit an all-time high. Gold Reserves of Reserve Bank of India (RBI) Reserve Bank of India rises to record 794.64 Tonnes. We'll see more of these deals this year, I reckon, not only Gold mining companies but other minerals, thanks to rocketed EV (Electric Vehicle) global demand.