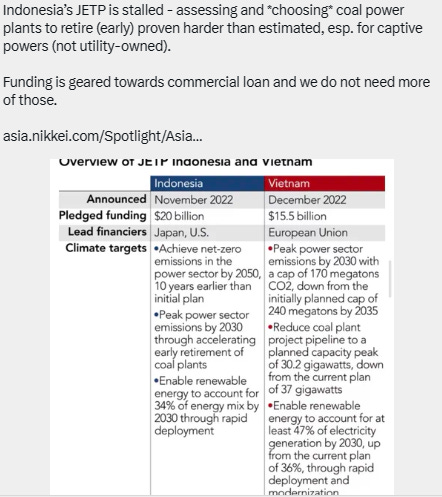

After commemorating the 22 year of 9/11, oil opens the week with a slump on mounting speculation that global demand is weakening. Oil pushed higher for a fourth day as a weaker dollar helped to offset global demand concerns, with investors awaiting a key US inflation report. Moscow has offered to sell oil to China (1,42 billion population), India (1,4 billion population), Indonesia (277 million population), Pakistan (220 m), Turkiye (81 m) at a price that is 30 percent lower than the international market rate. Global coal-fired power generation fell by 1.2% during the first half of 2022 from a year earlier as a sharp economic slowdown in China and a surge in global coal prices after Russia’s invasion of Ukraine crimped demand.

The cap creates even lower prices for them. But they'll be skeptical about signing on to a cumbersome enforcement system. They'll also resent another case of Western energy sanctions. Seems unlikely they'll sign on - but not impossible. Chinese President Xi Jinping will attend the 22nd meeting of the Council of Heads of State of the Shanghai Cooperation Organization (SCO) in Samarkand, and pay state visits to Kazakhstan and Uzbekistan from Wednesday to Friday. Of course, Xi will meet Putin too.

Despite a lot of lectures, analysts say replacing Europe with Asia is as easy as flipping a light switch, in reality, not as simple when you’re talking about (delivery process of) oil and natural gas. For example how complicated (in reality) the delivery process of oil and gas, remnants of Super Typhoon Hinnamnor halted Russia's Pacific crude shipments for part of last week, but flows recovered quickly once the storm had passed.

Asia is stocking up on dirty fuel oil for winter power generation earlier than usual as a gas shortage sees environmental concerns take a back seat to making sure the lights remain on. Finding momentum, Canadian crude oil will soon be shipped to Asia. “The maximum tanker capacity at the Port of Vancouver is 120,000 tonnes [ie Aframax]. With the completion of the TMX pipeline, the number of tankers visiting the Port of Vancouver is expected to increase 10x, from 30-50/year to ~400.”. Oil tanker owners are snapping up vessels that can haul cargoes in icy seas, a development that could help Moscow overcome the threat of a shipping bottleneck this winter.

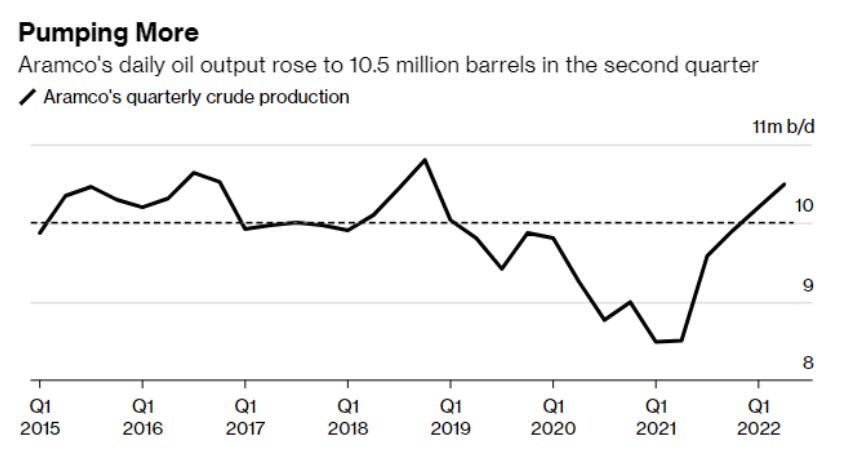

Rings hollow when Biden jet off to Riyadh to fist-bump with some of the worst autocrats on the planet, just for lowered oil price & plea to increase oil product, but failed. Imports of Russian fuel oil, high crude burn drive Saudi Q3 oil demand. Riyadh to consume additional 380 kilo barrel pd of oil in Q3. Saudi imports of Russian fuel oil rose 55% in July-Aug 2022.

Even, the U.S, Deputy Secretary of the Treasury Wally Adeyemo admits “There is one part of the Russian economy doing even better than when the war began: their oil industry.” The U.S. military is developing plans to open a facility in Saudi Arabia to test integrated air and missile defenses and new technology to combat drones, but Saudi Arabia insists on stable production of oil, not immediately increasing production. In domestic, U.S. gasoline prices have fallen now for 89 consecutive days, the longest streak of declines since 2015. One in 10 US gas stations now sell at $2.97/gal or less.

Like the U.S. after its highest ever gasoline price 3 months ago then 89 consecutive days fell, EU natural gas prices keep falling, even as the worst-case scenario of Russia halting Nordstream 1 flows moves closer to being the reality. Month-to-date September pan-European natural gas demand is about 16% below the 5-year average. Saving about 138mcm/d. The EU needs the saving to be about 300mcm/d in peak winter to achieve the EU’s 15% goal. This raises a question of whether all the bad news has been priced in, or is this just a manifestation of faith in policy makers to respond.

Another U.S. ally that suffered a painful energy embargo in the 70s, Japan’s biggest oil refiner is drawing up plans to consolidate production as domestic demand slumps because of a shrinking population and efforts to cut emissions. Putin's energy squeeze on Europe will eventually have a similar outcome to the Gulf oil embargoes — loss of market share. But in another scenario, Putin’s energy squeeze in the wake Ukraine - Russia war and western sanctions will not kill Russia, but will create a new Russia, which is giving up its illusions about the West and gradually embedding deeper into the East, finding a new self by enjoying the dividends of the rise of the East.

Amidst the energy crisis, subsidies to consumers and help for utilities will cost UK & Europe hundreds of billions of dollars—surely not something anticipated when the sanctions on Russia began. The powerhouse economy of Europe, Germany (83 million population) is facing a shortage of AdBlue, a key ingredient for modern diesel cars and trucks, as soaring energy prices send shock waves through the economy. More complicated, Germany and also Italy, Bulgaria and Romania all have refineries owned or partially owned by Russian companies. This may end with Europe delinked from Russia energy but getting there will be painful. No clue whether the price cap on Russian oil will work.

The EU takes a different approach to the U.K. with respect to energy policy, directly trying to bring down energy demand and tap energy-company profits to help consumers manage high utility bills. But it amazes me that European policymakers were apparently clueless that trying to drive Russian oil off the market would likely spike crude prices in the winter. Supply and demand logic, and harsh winter this year after months ago extreme hot in entirely Europe.

Since war began (February 24th), Putin has shredded Russia’s reputation as a so-called reliable energy provider in a matter of months. And there’s not enough market share in Asia to recoup what the Russians are going to lose in Europe (at least oil and natural gas). Russia can't shut volumes in b/c of lack of storage and risk of damaging infrastructure. Maybe. But Putin might calculate that a cutoff will create panic and a price shock that will weaken Western resolve. Discounted oil finds customers. Quite possibly the price cap will create multiple prices: the global crude price, the capped price for Russian oil, and a shadow market price that would settle somewhere between the two. The Russian oil price cap is not doomed to fail, but probably won't work as Treasury Yellen hopes. It could create a multi-tiered price system that will cut but not decimate Russia's oil revenue.

This price spread will create enormous arbitrage opportunities for traders. This is one reason China, India, ASEAN may wait and see; the alternative is they can still get deeply discounted oil, without the hassle. The service ban is not such a big stick. The market will find a way. In a country where gasoline price is the source of immense paranoia that promotes ridiculous energy independence nonsense, is it any wonder politicians do anything they can to bring down the price of energy. So, the factor is not only because of the Ukraine - Russia war alone. Not really sure under what circumstances we have to wait for it to be used. Market has changed completely since SPR was conceived. Just seems people are mad prices have not gone to $150+ like before the start of Lehman Brother crisis 2008.