3.33pm Zug / 2.33pm London

Market conditions wrought havoc on the Euro high-yield market in February as Russian aggression ground the primary market to a halt. Not a huge change for the European high yield market, which has been in quiet mode for the last 6 months, still too careful to mitigate the impact of the Ukraine - Russia war. Russian billionaires (Oligarchs) who have long sheltered their fortunes abroad -- chiefly in EU and euro member Cyprus, also in Switzerland -- are rushing to move their assets -- and they have few options on where to go.

Hedge funds, family offices and litigation finance firms have been approached by lawyers seeking funding to file legal claims against sanctioned Russians. The initiative has the potential to release as much as US$1 trillion of Russian money. Lawyers are seeking dollars from money managers to finance lawsuits targeting billions of dollars held by sanctioned Russian individuals and companies. Investors could get a cut if the claims are successful.

For example the impact of Ukraine - Russia, a US$22 billion investment firm is discovering just how complicated it can be to distance itself from sanctioned Russian money. One hedge fund team at BlackRock saw Putin’s invasion of Ukraine as a chance to buy more of the country’s stocks. That decision has backfired. A Russian private equity fund that survived the arrest and incarceration of its founder can't escape the war.

Pamplona Capital Management tapped investment bank Jefferies Financial Group for help cutting ties with its Russian oligarch backers. The firm also held preliminary talks with US PE giant Apollo Global Management Inc. over a deal. Seaport Group has traded several billion of Russian government bonds in recent weeks, becoming one of the main venues for clients to buy and sell securities that many of Wall Street’s biggest firms will no longer handle.

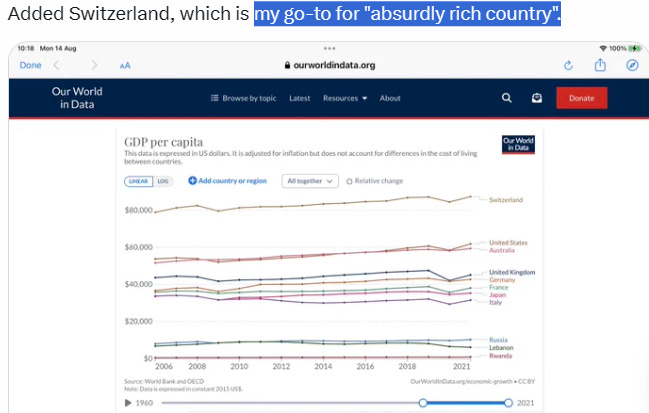

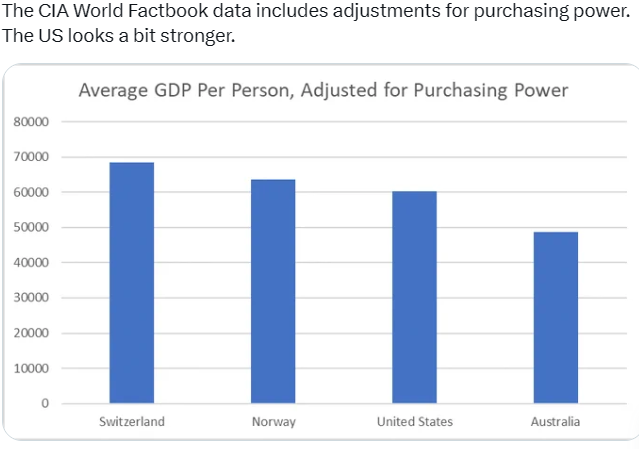

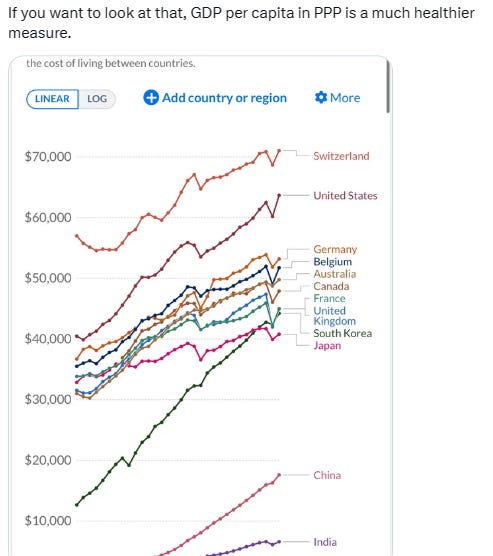

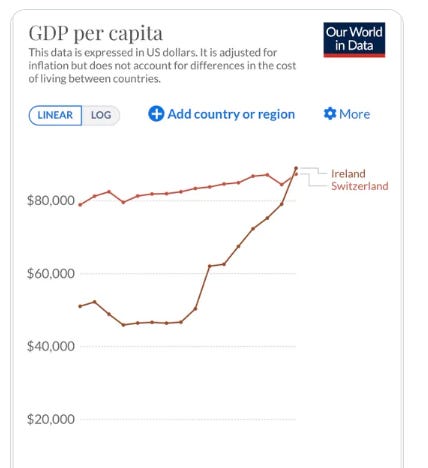

Ownership shuffles and tradition of secrecy thwart efforts by Alpine financial haven (Switzerland) to punish Oligarchs allies of Vladimir Putin. It’s hard to miss signs of Russian oligarchs in the quaint town of Zug, Switzerland. Finding their assets is another matter. After Switzerland said in February 2022 it was joining European Union sanctions against Russian oligarchs, Zug seemed like an obvious place to hunt for targets.

The streets (of Zug city) are clustered with the offices of companies founded by Russia’s wealthiest men, along with the headquarters for landmark natural-gas pipelines Nord Stream 1 and 2 and the energy-trading department of Gazprom PJSC (Public Joint Stock Company).

Another Russia’s PJSC, investment bank Houlihan Lokey is advising a group of US bondholders of Russian oil giant Lukoil PJSC on a buyback after they were excluded from a tender offer. Russian tycoons stuffed fortunes in Swiss accounts, partied on yachts in Monaco and bought mansions around London. Even the Police London Metropolitan said ”London-Grad”, to mention a massive fund from Moscow in London. But some of their empire's vital mechanics often went through a nondescript office on a Dublin backstreet.

Cafico International is barely known in Dublin business circles. But it's one of the most active 'corporate service providers' that worked with Russian clients, helping them set up and manage SPV shell companies through which they sold billions of dollars of bonds. Cafico actively courted Russian clients and even ran a Russian-language home page. Its client list was a who's who of the Russian economy: Russian Railways/VTB/Norilisk Nickel/Credit Bank of Moscow. Cafico and rivals including TMF Group and Vistra helped Russian corporations borrow at least $145b over the previous decade mainly through SPVs in Ireland, Netherlands and Luxembourg.

Many of their clients are now under sanction and the bonds' values have collapsed. Russian firms tapping Irish SPVs since 2016. There was Vneshprombank, which used a Cafico entity to borrow US$225m before collapsing amid fraud allegations. Tatfondbank, one of Russia's biggest regional lenders, which also collapsed under fraud allegations. The bank used a SPV managed by TMF in Dublin to borrow millions just weeks before it collapsed.

Credit Bank of Moscow, one of Cafico's biggest Russian clients. This once-obscure lender became increasingly close to Rosneft after the oil behemoth was sanctioned post-Crimea. It was still able to borrow billions via its Dublin SPV. The awkward situation, a lot of western companies are also tapping Dublin because of low rates of tax or Dublin to be a tax haven: (especially) Big Tech like GAFAM (Google, Amazon, Facebook, Apple, Microsoft).

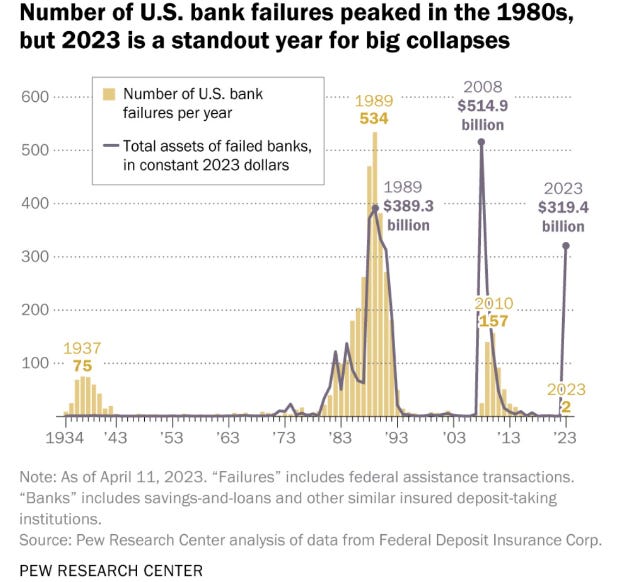

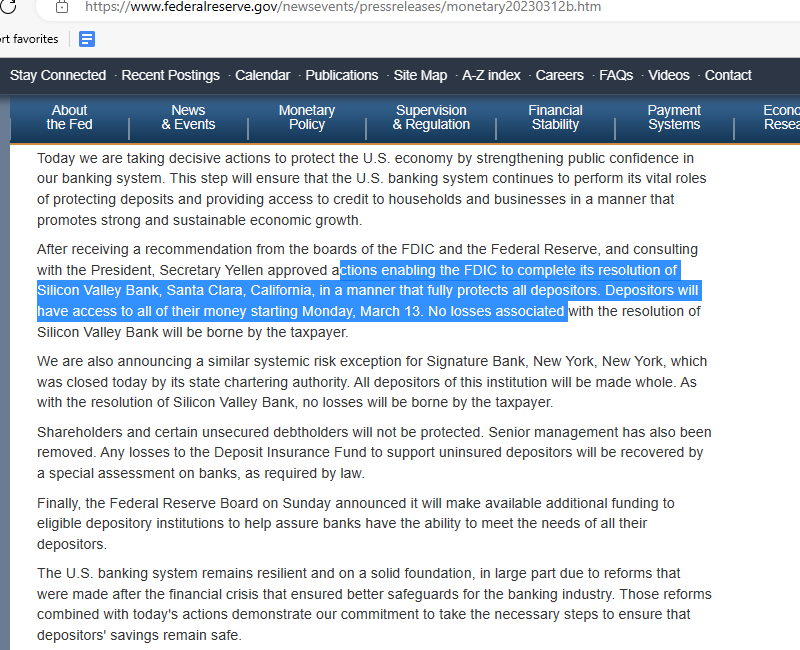

Banks are bracing for billions of dollars of potential losses on leveraged buyouts, as risky corporate debt becomes harder and harder to sell. Valuation still has much further to fall. The US high yield market has experienced the third lightest month in terms of new issue flows since the Global Financial Crisis 2008 (Lehman Brother).

Despite the crumbling situation, the leveraged loan market continued with borrowers pushing pro-sponsor flexibility in the form of voting caps. To help investors find opportunities that offer stability or upside potential, in a more challenged environment, mitigate carefully is matters. Sharply lowering its global growth forecast, the World Bank warns of several years of high inflation and tepid growth reminiscent of the stagflation of the 1970s.

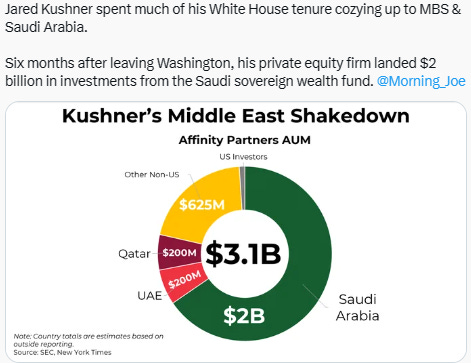

The past fifteen years, notable investigations and exposés, such as the Magnitsky Investigation, Laundromats, Offshoreleaks, Panama Papers, and Pandora Papers, have shed light on the staggering scale of global money laundering with trillions of dollars, predominantly originating from kleptocracies like Russia and other former USSR countries. These illicit funds are cleverly disguised and anonymized through laundering mechanisms, infiltrating the Western financial systems via a vast network of banks, lawyers, real estate agents, and have been utilized to purchase influence, garner political support, and secure positions within local establishments.

Recently there have been efforts to combat money laundering such as the Prevezon Case in the US, notable for its lawyer’s meeting with Donald John Trump Jr., and Danske Bank’s guilty plea for laundering $160 billion through US banks. The most notorious money laundering banks in Cyprus, Latvia, Estonia and Lithuania have been closed and major banks, including Santander, Wachovia, Standard Chartered, HSBC, and Goldman Sachs, have faced penalties for their involvement in money laundering.

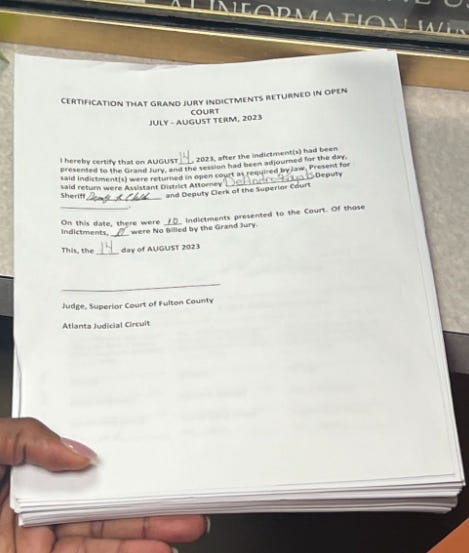

While significant progress has been made in combating money laundering in various countries, Switzerland is moving in the opposite direction. In the summer of 2021, the Swiss Attorney General’s Office (SAG) announced the closure of the Magnistky money laundering case, which was opened in response to the complaint filed by Hermitage Capitals in 2011. The SAG confirmed the accuracy of Hermitage’s analysis of the flow of illicit funds. They discovered that the criminal proceeds from a $230 million fraud were found in a Swiss account belonging to the then-husband of Olga Stepanova, a Russian tax official who had approved an illegal tax refund and the accounts of Denis Katsyv, the son of a Russian government official and owner of Prevezon Holding, who settled similar charges with the US Department of Justice in 2017 by paying $6 million.

Swiss prosecutors decided to seize CHF 4 million but chose to release the remaining frozen CHF 16 million. This raises the question of how such a decision was reached.

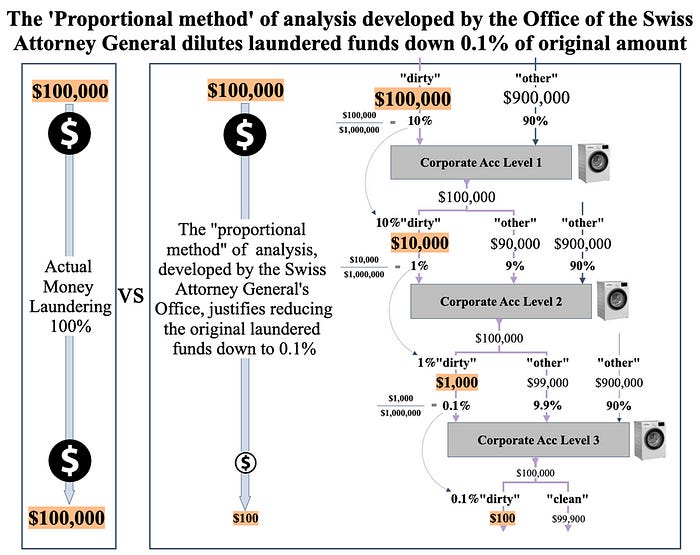

Money laundering is a sophisticated white-collar crime, involving the passage of illicit funds through multiple shell company accounts. Each additional layer of transactions serves to further obscure the origin of the criminal money. Criminals often intermingle the proceeds from one illegal activity with funds obtained through other criminal activities, making it increasingly challenging for authorities to unravel the illicit activities and hold the perpetrators accountable.

In this case, the SAG collected substantial evidence, allowing them to reconstruct the trajectory of illicit funds. However, the SAG decided to utilize the “proportional method” for analysing the amount of laundered funds at each level of the money laundering scheme which has never been used like that before.

According to the SAG’s logic, if $1 million enters the first level of the money laundering process, and $100,000 of this is clearly of criminal origin, while the remaining $900,000 is from an unidentified source, then every dollar that leaves this account should be treated in the same proportion. In essence, the SAG will only perceive the total amount in the account, as 10% ‘dirty’.

Continuing this, in the second level of the money laundering process, the criminal would then mix the $100,000 of dirty money, with $900,000 with funds from an unknown origin. Under the SAG’s logic, they would only consider $10,000 that left the first level as dirty, or 1% of the incoming $1 million to the second level, and the remaining $990k (99%) as clean.

This ratio the SAG then applies to the funds leaving the second level. When $100k leaves the second layer of money laundering, only 1% of them or $1k is considered dirty by SAG, and the remaining $99k are perfectly clean.

After the same approach applied on the third level of money laundering, the original dirty $100,000 are discounted down to $100 only, or 0.1% of original criminal funds.

It is obvious to anyone familiar with money laundering investigations that the analytical method employed by the SAG has little connection to reality. The use of multiple layers in money laundering schemes is precisely intended to obscure the origin of the funds, not to make them disappear in the process of laundering like the SAG’s method implies.

The SAG’s application of the “proportional” approach in the Magnitsky investigation led them to conclude that only 25% of the frozen funds should be confiscated.

Moreover, the Swiss Federal Criminal Court fully endorses the SAG’s “proportional” approach. The court justifies this stating that the proportionality solution ensures a balanced outcome that does not favour either party. The court also approved the SAG’s calculations based on this method, establishing it as a legal precedent.

The proportional method introduced by the SAG has undoubtedly damaged Switzerland’s reputation. However, the more concerning consequence is that it has effectively opened Pandora’s box. Now, any money launderer wishing to launder hundreds of millions or even billions through the Swiss financial system who gets caught by authorities, can simply request the application of this proportional method as a legal precedent. By paying a small fee determined by the SAG using this method, they would be able to retain 99% of the laundered funds, essentially legitimizing and benefiting from their illicit activities. This situation seriously compromises the integrity of the Swiss financial system and its ability to combat money laundering effectively.

It is crucial for other countries to be fully aware of the deficiency that has been incorporated into the Swiss legal framework. It presents an opportunity for money laundering on a mass scale. Therefore, the Financial Action Task Force (FATF) should consider putting Switzerland on a “blacklist” of High-Risk Jurisdictions subject to a Call for Action and Transparency International’s Corruption Perception Index.

The rating agencies: S&P, Moody’s, and Fitch need also to make immediate steps to reflect this major failure of Swiss AML framework, while evaluating Swiss financial institutions. In addition to that Government’s around the world should reconsider their relationship with Switzerland, as the country no longer meets the approved standards for combating money laundering.

=========END————

Thank you, as always, for reading. If you have anything like a spark file, or master thought list (spark file sounds so much cooler), let me know how you use it in the comments below.

If you enjoyed this post, please share it.

______________

If a friend sent this to you, you could subscribe here 👇. All content is free, and paid subscriptions are voluntary.

——————————————————————————————————

-prada- Adi Mulia Pradana is a Helper. Former adviser (President Indonesia) Jokowi for mapping 2-times election. I used to get paid to catch all these blunders—now I do it for free. Trying to work out what's going on, what happens next. Arch enemies of the tobacco industry, (still) survive after getting doxed.

Now figure out, or, prevent catastrophic situations in the Indonesian administration from outside the government. After his mom was nearly killed by a syndicate, now I do it (catch all these blunders, especially blunders by an asshole syndicates) for free. Writer actually facing 12 years attack-simultaneously (physically terror, cyberattack terror) by his (ex) friend in IR UGM / HI UGM (all of them actually indebted to me, at least get a very cheap book). 2 times, my mom nearly got assassinated by my friend with “komplotan” / weird syndicate. Once assassin, forever is assassin, that I was facing in years. I push myself to be (keep) dovish, pacifist, and you can read my pacifist tone in every note I write. A framing that myself propagated for years.

(Very rare compliment and initiative pledge, and hopefully more readers more pledges to me. Thank you. Yes, even a lot of people associated me PRAVDA, not part of MIUCCIA PRADA. I’m literally asshole on debate, since in college). My note-live blog about Russia - Ukraine already click-read 4 millions.

=======

Thanks for reading Prada’s Newsletter. I was lured, inspired by someone writer, his post in LinkedIn months ago, “Currently after a routine daily writing newsletter in the last 10 years, my subscriber reaches 100,000. Maybe one of my subscribers is your boss.” After I get followed / subscribed by (literally) prominent AI and prominent Chief Product and Technology of mammoth global media (both: Sir, thank you so much), I try crafting more / better writing.

To get the ones who really appreciate your writing, and now prominent people appreciate my writing, priceless feeling. Prada ungated/no paywall every notes-but thank you for anyone open initiative pledge to me.

(Promoting to more engage in Substack) Seamless to listen to your favorite podcasts on Substack. You can buy a better headset to listen to a podcast here (GST DE352306207).

Listeners on Apple Podcasts, Spotify, Overcast, or Pocket Casts simultaneously. podcasting can transform more of a conversation. Invite listeners to weigh in on episodes directly with you and with each other through discussion threads. At Substack, the process is to build with writers. Podcasts are an amazing feature of the Substack. I wish it had a feature to read the words we have written down without us having to do the speaking. Thanks for reading Prada’s Newsletter.

Wants comfy jogging pants / jogginghose amid scorching summer or (one day) harsh winter like black jogginghose or khaki/beige jogginghose like this? click

Headset and Mic can buy in here, but not including this cat, laptop, and couch / sofa.