Qatar LOVE to Buy Everything in DC, Paris, and London, Now Buy Washington Wizard and Washington Capitals

Sport club ownership is a hot topic right now, particularly in the (Football/Soccer) Premier League, thanks for Manchester City, first ever Middle East or Petrodollar owned, can win UEFA Champions League (12 days ago).

Wealthy investors have increasingly been eyeing opportunities to get involved with clubs at the top tier of English football for the past few years, leading to some high-profile — and in some cases highly controversial — takeovers.

Never was that more apparent than when, in 2021, the takeover of Newcastle United by the Saudi Arabia Public Investment Fund (PIF) was completed. Saudi feel motvated again to (more) buying everything in UK, especially in London. Especially because for a long time, at least in last 2 decades, Qatar buys “a lot of” things in London.

However, Newcastle are far from the only club with links to the sovereign wealth fund of the Arab nation, and now questions are being raised over the relationship between Chelsea and the Saudi PIF. The scrutiny over that relationship has intensified amid reports that several Chelsea Football Club (owned by Tood Boehly but also under CLEARLAKE) players could be on their way to Saudi clubs owned by the PIF in the last 4 days.

It has been reported by Sportsmail that the PIF has "billions of pounds of assets managed by CLEARLAKE", though Chelsea FC sources have insisted there was no Saudi involvement when the club was purchased by Clearlake in 2022.

Journalist Ben Jacobs tweeted that "CLEARLAKE and PIF have an excellent relationship", though that is not the same thing as the former being owned by the latter. Today (June 22, 2023), BlueCo, part ownership of Chelsea FC, signed an agreement to become new shareholders of French side Strasbourg.

Back again to Qatar. The US state department agreed to sell the building of (former) US Embassy in Grosvenor Square to Qatari Diar in 2009 to fund a new embassy in the Nine Elms regeneration project south of the Thames. Estimates put the Grosvenor Square site’s value at £500m before it was made a listed building, which would have reduced the value because of restrictions on development. Grosvenor Square has housed the US embassy since 1938.

Prince Andrew, (former Mayor of London) Boris Johnson and the prime minister of Qatar gazed through rain-spattered glass on to the streets of London far below as they celebrated the opening of Britain’s tallest building, the Shard, July 5th 2012, 22 days before opening Summer Olympic Games 2012.

For Johnson, (former) mayor of London, the unseasonably cold July day in 2012 symbolised London’s resurgence after the devastation of the global financial crisis.

Prince Andrew marked the occasion by abseiling down a section of the 310-metre tower for charity, saying afterwards that he had easily overcome the “psychobabble” about fear of heights.

But the day was perhaps most auspicious for Hamad bin Jassim bin Jaber al-Thani, known colloquially as HBJ. The great steel-and-glass edifice that now loomed over Britain’s capital had been built with nearly £2bn of Qatari investment.

The building served as a totem for a strategy that he pioneered: Qatar – a British protectorate from 1916 to 1971 – was deploying its vast oil-and-gas wealth to buy huge chunks of the nation that once ruled over it.

As an Observer audit now reveals today, the Qataris’ British property empire has ballooned since then into a sprawling portfolio likely to be worth in excess of £10bn.

Qatar and the vast al-Thani clan that rules it have played a real-life game of Monopoly, scooping up trophy assets such as hotels on Mayfair and Park Lane – not to mention properties on Pall Mall, Oxford Street, Bond Street and Vine Street. Prize purchases include ultra-high-end hotels such as the Ritz and Claridge’s, the international finance hub at Canary Wharf, not to mention luxury personal retreats, including rural idylls and London mansions.

But analysis of more than 4,000 land titles shows that Qatar and the al-Thanis’ British interests are larger and more diverse than previously thought, also taking in unglamorous industrial estates, modest seaside hotels and terraced houses in Bootle and Runcorn.

The state of Qatar alone, not counting individual royals’ personal holdings, is the 10th largest landowner in the UK, according to analysts at MSCI Real Assets. The emirate owns nearly 2.1m sq metres (23m sq feet) of property in Britain, more than 1.5 times the area of London’s Hyde Park.

Many of the properties are owned through Jersey, the British Virgin Islands or the Cayman Islands, meaning ownership is often difficult to determine via public disclosures.

It's hard to walk round London and admire the sights without admiring something paid for by Qatar.

From some of the most famous hotels and landmarks to the cranes arcing over the South Bank, Qatar has a substantial finger in a huge number of pies.

The UK is Qatar's single largest investment destination, with £35bn in place and another £5bn on its way in the next five years.

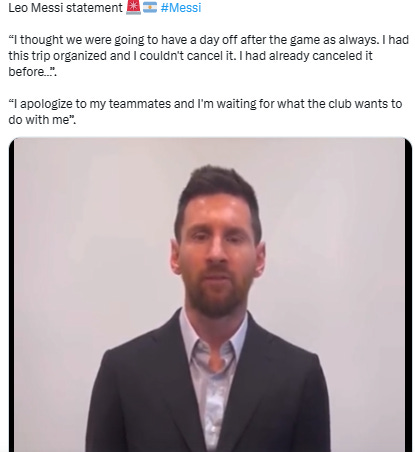

In Paris, Qatari owned the biggest club (currently) in France, Paris Saint-Germain. Tamim bin Hamad Al Thani, the Emir of Qatar, has been PSG's owner since 2011 through Qatar Sports Investments (QSI).

QSI acquired a majority stake in June 2011 and then became the club's sole owner in March 2012. This means PSG are a state-owned club, the only of its kind, and thus one of the richest teams in the world. QSI chairman Nasser Al-Khelaifi has been PSG president since the takeover. Al Thani, however, has the final word on every major decision of the club. He is both the chairman of the QIA and the founder of QSI.

Upon its arrival, QSI pledged to form a team capable of winning the UEFA Champions League. PSG have spent over €1.3bn on player transfers since the summer of 2011. These massive expenditures have translated in PSG's domination of French football but have not yet brought home the coveted UCL trophy as well as causing problems with UEFA's Financial Fair Play regulations.

PSG currently have the fifth-highest revenue in the footballing world with an annual revenue of €654m according to Deloitte, and are the world's seventh-most valuable football club, worth $4.21bn according to Forbes.

And it is now said that Qatar owns more land in London than the Queen. And this morning, Qatar buys some symbols in Washington DC. Just a few weeks after the head-snapping Saudi’s Public Investment Fund-PGA partnership, the Qatari sovereign wealth fund makes its first major US pro sports investment in our nation's capital.

The Qatar Investment Authority (QIA), a Qatari Sovereign Wealth Fund, is buying about 5% of Monumental Sports & Entertainment (MSE), a parent company of NBA' team Washington Wizards and NHL team Washington Capitals (colloquially known as the Caps). 4 Days ago, QIA is set to hire Hussam Qasim from Credit Suisse for its domestic investment team as the $450 billion sovereign wealth fund prepares for an increase in inflows.

Although rumor that Michael Jordan sells his shares in Charlotte Hornets to everyone “highest bidder”, Qatari chose to not buy Hornets. It will be the first sovereign wealth fund to invest in U.S. team sports, part of a wider embrace of institutional capital across major American leagues.

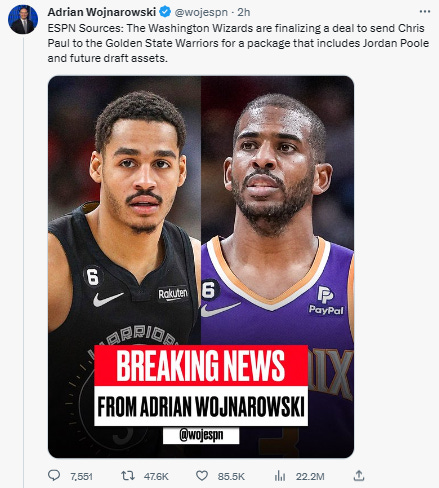

Most retweeted ever by Woj in his career. about Wizards - Warriors saga trade. 2 Hours, so far 47k retweets. Previously about James Edward Harden jr from Houston Rockets to Brooklyn Nets

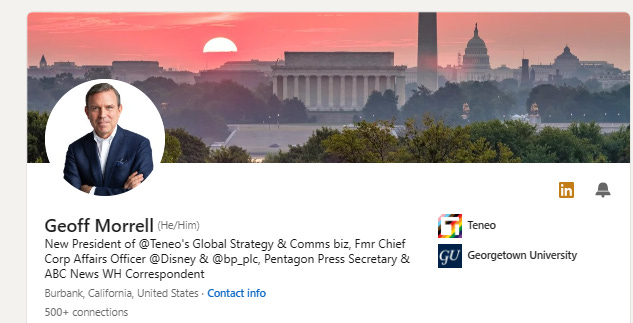

If Qatar started new trend of SWF to buy some sport club in America although already years ago happened in Europe, “the dam really broke.” Just waiting another gigantic SWF, mostly from “Petrodollar” Middle East. Like PIF Saudi, successfully make something (if in 2001) impossible: merge LIV and PGA Tour. Geoffrey “Geoff” S. Morrell, now president of Teneo, previously served a brief and contentious tenure as Disney's top communications official, has been retained by the Saudi Public Investment Fund to help with media relations for the PIF’s partnership with purpose Navigate PGA Tour-LIV Golf Merger. Saudi Arabia’s sovereign wealth fund has transformed itself from a sleepy holding company to a $1 trillion behemoth that snaps up everything from soccer clubs to electric carmakers. The shift underscores the urgency of its mission: to prepare the world’s biggest crude-exporting nation for a post-oil future. PIF to invest at least $40 billion a year in Saudi Arabia and has already created 54 new companies, branching into sectors from real estate to luxury cruises.

Its biggest holdings are still in local businesses such as Saudi National Bank, Saudi Telecom Co. and national projects like Neom, a $500-billion city-state that would run entirely on renewable power and export green energy. Since 2016, when it committed $45 billion to SoftBank Group Corp.’s technology-focused Vision Fund, PIF’s foreign interests have mushroomed. A 2018 investment in electric carmaker Lucid Motors Inc. has soared in value to almost $40 billion. It also has stakes in video game makers Activision Blizzard Inc. and Electronic Arts Inc. and the digital services and retail businesses of Indian billionaire Mukesh Ambani. In February 2022, the government transferred an $80 billion stake in Saudi state oil giant Aramco to PIF to boost its assets as the fund prepared to tap the international bond market for the first time.

Other gigantic SWF like ADIA (Abu Dhabi Investment Authority), Mubadala, etc eyeing (too) America Sport.

Welcome to (pouring) petrodollar money, Sport Business America.

==========END————

Thank you, as always, for reading. If you have anything like a spark file, or master thought list (spark file sounds so much cooler), let me know how you use it in the comments below.

If you enjoyed this post, please share it.

If a friend sent this to you, you could subscribe here 👇. All content is free, and paid subscriptions are voluntary.

————

-prada- is a Helper. Former adviser (President Indonesia) Jokowi for mapping 2-times election. I used to get paid to catch all these blunders—now I do it for free. Trying to work out what's going on, what happens next. Arch enemies of the tobacco industry, (still) survive after getting doxed.

(Very rare compliment and initiative pledge. Thank you. Yes, even a lot of people associated me PRAVDA, not part of MIUCCIA PRADA. I’m literally asshole on debate, since in college)

========

Thanks for reading Prada’s Newsletter. I was lured, inspired by someone writer, his post in LinkedIn months ago, “Currently after a routine daily writing newsletter in the last 10 years, my subscriber reaches 100,000. Maybe one of my subscribers is your boss.” After I get followed / subscribed by (literally) prominent AI and prominent Chief Product and Technology of mammoth global media (both: Sir, thank you so much), I try crafting more / better writing.

To get the ones who really appreciate your writing, and now prominent people appreciate my writing, priceless feeling. Prada ungated/no paywall every notes-but thank you for anyone open initiative pledge to me.

(Promoting to more engage in Substack) Seamless to listen to your favorite podcasts on Substack. You can buy a better headset to listen to a podcast here (GST DE352306207). Listeners on Apple Podcasts, Spotify, Overcast, or Pocket Casts simultaneously. podcasting can transform more of a conversation. Invite listeners to weigh in on episodes directly with you and with each other through discussion threads. At Substack, the process is to build with writers. Podcasts are an amazing feature of the Substack. I wish it had a feature to read the words we have written down without us having to do the speaking. Thanks for reading Prada’s Newsletter.