Biden - Bibi v MbS and Oil Price to be US$120 or Higher: Fate of Electric Vehicle, Election, and National Budget

(UPDATE September 22, 2023)

Saudi Crown Prince MbS (Mohammed bin Salman Government Entity in Saudi Arabia Saudi Vision 2030 ) - Fox Corporation Fox News Media interview

•Opens prospect of nuclear race vs Iran amid peace deal with Iran since April this year (mediate by China)

• If Iran get a nuke weapon, Saudi must have to get one too.

• Normalization talks with Israel ongoing

• Wants big US defense commitments (NATO Style defense protection for Saudi)

• Positive on Biden, Ukraine

• Hedging on China

• Addressed 9/11 families

• Apologetic on the murder Khashoggi

Riyadh - Tel Aviv 4.56pm / DC 9.56am

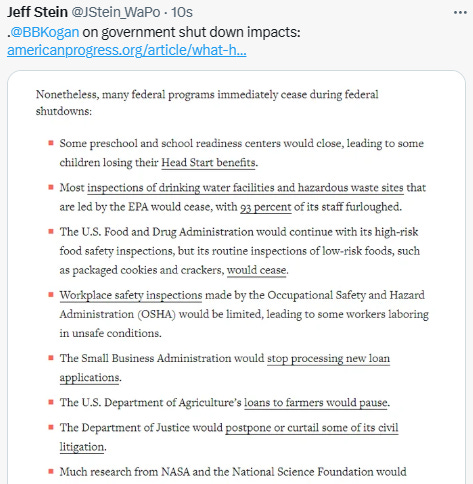

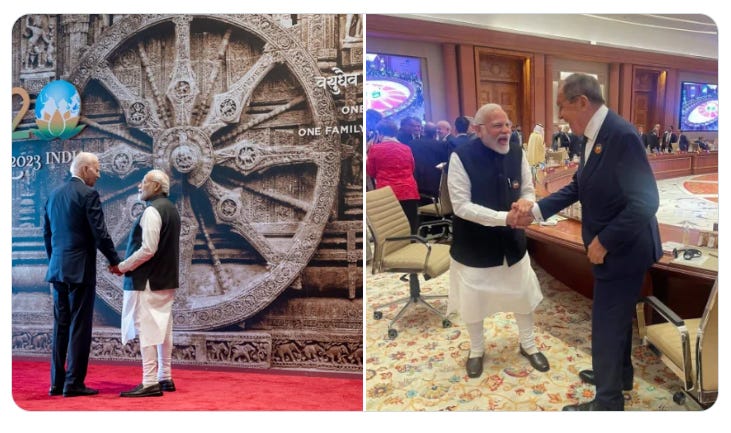

(If) next November or even earlier, in October, oil prices go to US$120 - USS122, because of breaking news in Riyadh a minute ago. Saudi Arabia has reportedly informed the Biden administration of its decision to halt all talks of normalizing ties with Israel on Sunday, just after 2 weeks ago Biden and Crown Prince MbS (Mohammed bin Salman) handshake about gigantic corridor infrastructure between India, Middle East, and Europe in the middle of G20 Summit. Saudi Arabia reportedly withdrew from normalization talks due to Benjamin Netanyahu's "extremist" government.

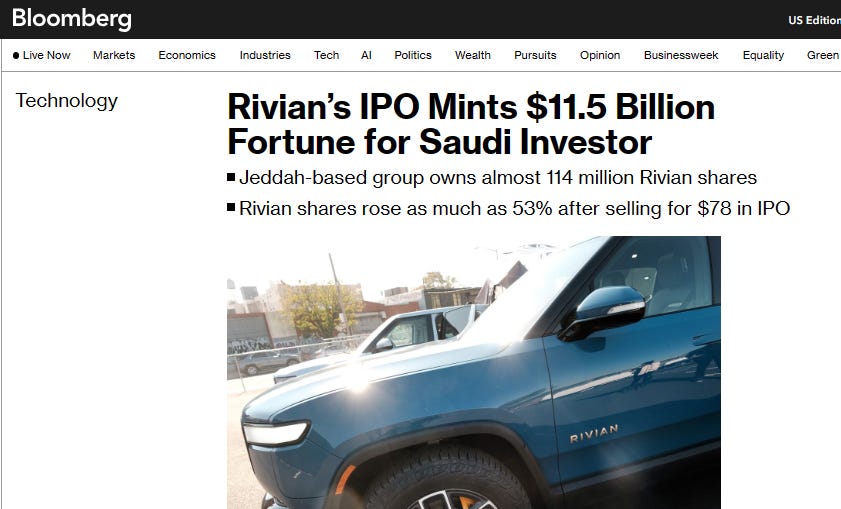

15 Years ago, when oil prices went US$150 - US$155 alongside the Subprime Mortgage crisis, there was no option about EV cars. Today, around 3% of cars on the road are EV. The more oil prices uncontrollable, the more chance of EVs being sold. Despite the US busy erecting barriers to foreign-made EVs, & Chinese batteries in particular, BYD has grown to be the largest manufacturer of battery-electric buses in North America. China's economy is sluggish but autos are a big pocket of strength. "(Bloomberg) -- China delivered 2.24 million cars wholesale in August, the most for a month this year and a record high for what is usually a slow period. For more complicated, Mohammed bin Salman, indirect owner of Saudi ARAMCO, the 4th biggest company in universe today, is also shareholder of EV automaker RIVIAN, one of TESLA’s Elon Musk rival.

But if next Winter oil prices go to US$120 or higher, a lot of countries “Net Oil Importer”, including Indonesia, must revise their national budget and or revise oil prices to the public, threatening to push gasoline prices even higher and heat up inflation across globally. For example, President of Indonesia Joko Widodo and his administration indicating that if oil price goes to US$105 or higher, his administration must increase oil prices, because another budget already used for building a new capital city (IKN NUSANTARA) and gigantic budget of election 2024. Indonesia’s elections are the world’s largest held in a single day. It’s 208 million registered voters dwarf the 168 million who were registered in the United States for its 2020 presidential election.

Also (revise of price in) all oil-private companies in the world. (But) US state of California sued five of the world's largest oil firms, Exxon Mobil, Shell, British Petroleum, ConocoPhillips and Chevron, alleging they caused billions of dollars in damages and misled the public by minimizing the risks from fossil fuels. Don’t forget CEO BP Bernard Looney resign days ago.

High oil prices have already created an unusual situation where gasoline is getting more expensive even after the summer driving season has ended. Despite demand easing, gas prices are just pennies away from their highest level of the year.

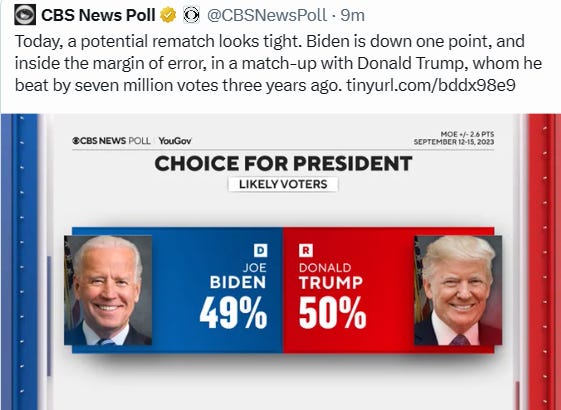

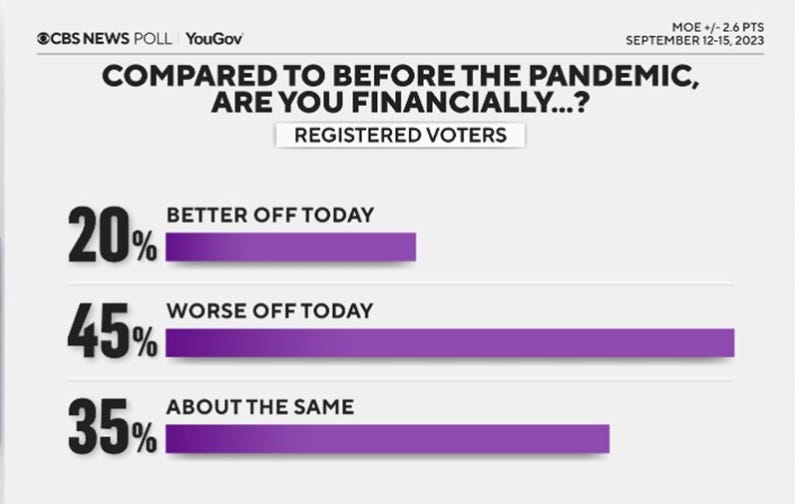

Oil Price will be sensitive issue especially in Indonesia and U.S., both will be held an election next year. President Biden is down one point, and inside the margin of error, in a match-up with Donald Trump, whom he beat by seven million votes three years ago.

Crown Prince of Saudi Arabia Mohammed bin Salman Al Saud (2nd Left) is being informed by a company official as he is flanked by CEO of Apple, Tim Cook (R) during his visit to Apple Office in Cupertino, California, United States

Oil prices have climbed back above $90 a barrel in recent days to their highest levels in 10 months. The rise has sparked fears of resurgent inflation that could damage a global economy that has proven surprisingly resilient. Why are oil prices rising?

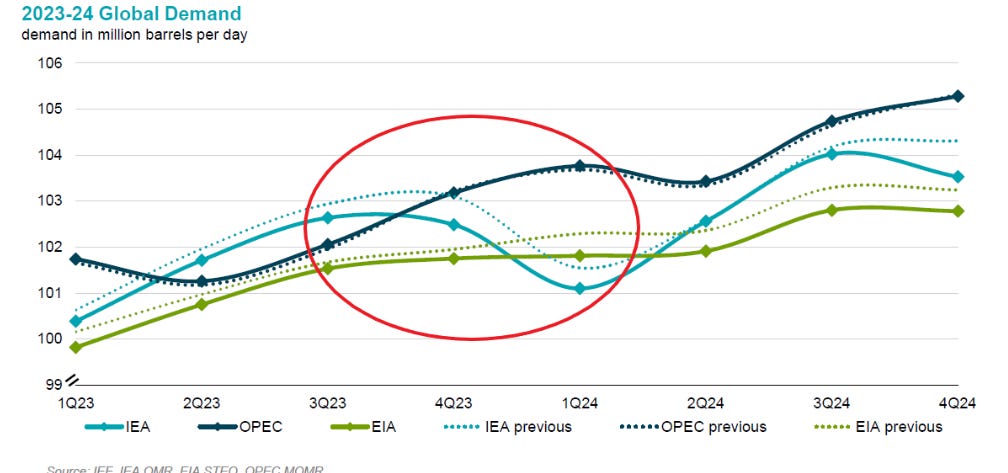

Better than expected economic conditions in big energy-consuming economies such as the US have helped to drive new records for global oil demand in 2023, with the world expected to consume an unprecedented 101.8mn barrels a day this year. A push by Saudi Arabia and Russia to restrict supply has also removed barrels from the market, depleting oil stocks.

Riyadh and Moscow last week extended production and export cuts for the remainder of 2023. “It’s a tale of oil demand numbers really holding up and very effective supply management by Saudi Arabia and OPEC, which has caused a big swing in market sentiment since June,” said Raad Alkadiri, an analyst at Eurasia Group in Washington.

The International Energy Agency and OPEC recently published updated forecasts that the cuts would produce a deficit in oil markets this year if they are maintained. “The Saudi-Russian alliance is proving a formidable challenge for oil markets,” the IEA said this week. How high can prices go?

International benchmark Brent crude settled at $93.70 a barrel on Thursday, up more than 25 per cent since June. West Texas Intermediate, the US marker, settled at $90.16. Both have hit their highest levels of 2023. Many analysts forecast oil could breach $100 in the weeks ahead because of strong demand, tight supplies and a lack of tools available to the US administration to put a lid on prices. “Global oil demand is at record highs,” said Al Salazar, an analyst at Enverus Intelligence Research. “We’ve never used this much and OPEC is cutting production in the face of it. The third component is crude and product stocks are relatively low.” Salazar added: “The simple maths means $100 Brent.”

When oil prices last surged in the aftermath of Russia’s full-scale invasion of Ukraine in 2022, USPpresident Joe Biden intervened by releasing emergency stocks from the US Strategic Petroleum Reserve. In a speech in Maryland this week, the president vowed he would “get those gas prices down again”.

But after draining almost 300mn barrels from the reserve, analysts say Washington has less ability to affect prices. “The Biden administration has used a lot of its chips early and they don’t have a lot of options left now to try to tamp down prices,” said Amrita Sen, director of research and co-founder of Energy Aspects, a consultancy. What does this mean for the economy? Oil’s climb is stoking a rise in inflation again, threatening to blow off course a campaign by the Federal Reserve to bring prices under control just as it appeared to be bearing fruit.

Higher petrol prices were primarily responsible for a 3.7 per cent year-on-year uptick in US consumer prices in August, versus a 3.2 per cent rise in July, according to data released this week by the Bureau of Labor Statistics. US prices at the pump — one of the most visible signs of inflation — have jumped more than a quarter since the beginning of the year to $3.86 a gallon on Thursday, according to AAA, a motorist group. The price of diesel, critical to freight, agriculture and other industries, has also been on the march, increasing nearly a fifth in the past three months to $4.53 a gallon. What does this mean for oil producers? Higher prices will push up profits at oil producers but are unlikely to encourage an increase in domestic production sufficient to level off the rise, say analysts.

Once known for frenzied spending on drilling, America’s shale oil industry has adopted a much more cautious approach to growth under pressure from Wall Street. It now favours returning cash to shareholders in the form of dividends and share buybacks over pumping ever greater volumes of oil. “There is a lack of desire by shale to invest in the upstream,” said Benjamin Hoff, global head of commodities at Société Générale.

Growth has decelerated, Hoff noted, with many of the privately held producers that were willing to fire up drilling rigs being snapped up by more cautious public operators. Reiterating that message last month, Rick Muncrief, chief executive of Devon Energy, one of the biggest shale drillers, told investors: “We are deeply committed to a disciplined pursuit of per-share value creation over production volume growth.”

=========END————

Thank you, as always, for reading. If you have anything like a spark file, or master thought list (spark file sounds so much cooler), let me know how you use it in the comments below.

If you enjoyed this post, please share it.

______________

If a friend sent this to you, you could subscribe here 👇. All content is free, and paid subscriptions are voluntary.

——————————————————————————————————

-prada- Adi Mulia Pradana is a Helper. Former adviser (President Indonesia) Jokowi for mapping 2-times election. I used to get paid to catch all these blunders—now I do it for free. Trying to work out what's going on, what happens next. Arch enemies of the tobacco industry, (still) survive after getting doxed. Now figure out, or, prevent catastrophic situations in the Indonesian administration from outside the government. After his mom was nearly killed by a syndicate, now I do it (catch all these blunders, especially blunders by an asshole syndicates) for free. Writer actually facing 12 years attack-simultaneously (physically terror, cyberattack terror) by his (ex) friend in IR UGM / HI UGM (all of them actually indebted to me, at least get a very cheap book). 2 times, my mom nearly got assassinated by my friend with “komplotan” / weird syndicate. Once assassin, forever is assassin, that I was facing in years. I push myself to be (keep) dovish, pacifist, and you can read my pacifist tone in every note I write. A framing that myself propagated for years.

(Very rare compliment and initiative pledge. Thank you. Yes, even a lot of people associated me PRAVDA, not part of MIUCCIA PRADA. I’m literally asshole on debate, since in college). Especially after heated between Putin and Prigozhin. My note-live blog about Russia - Ukraine already click-read 4 millions.

=======

Thanks for reading Prada’s Newsletter. I was lured, inspired by someone writer, his post in LinkedIn months ago, “Currently after a routine daily writing newsletter in the last 10 years, my subscriber reaches 100,000. Maybe one of my subscribers is your boss.” After I get followed / subscribed by (literally) prominent AI and prominent Chief Product and Technology of mammoth global media (both: Sir, thank you so much), I try crafting more / better writing.

To get the ones who really appreciate your writing, and now prominent people appreciate my writing, priceless feeling. Prada ungated/no paywall every notes-but thank you for anyone open initiative pledge to me.

(Promoting to more engage in Substack) Seamless to listen to your favorite podcasts on Substack. You can buy a better headset to listen to a podcast here (GST DE352306207).

Listeners on Apple Podcasts, Spotify, Overcast, or Pocket Casts simultaneously. podcasting can transform more of a conversation. Invite listeners to weigh in on episodes directly with you and with each other through discussion threads. At Substack, the process is to build with writers. Podcasts are an amazing feature of the Substack. I wish it had a feature to read the words we have written down without us having to do the speaking. Thanks for reading Prada’s Newsletter.

Wants comfy jogging pants / jogginghose amid scorching summer or (one day) harsh winter like black jogginghose or khaki/beige jogginghose like this? click

Headset and Mic can buy in here, but not including this cat, laptop, and couch / sofa.