London 8.17pm / Berlin 9.17pm

UK's rate of inflation has come down to 6.8% in July, from 7.9% in June. Little good news. But entire UK, no debate, poorer.

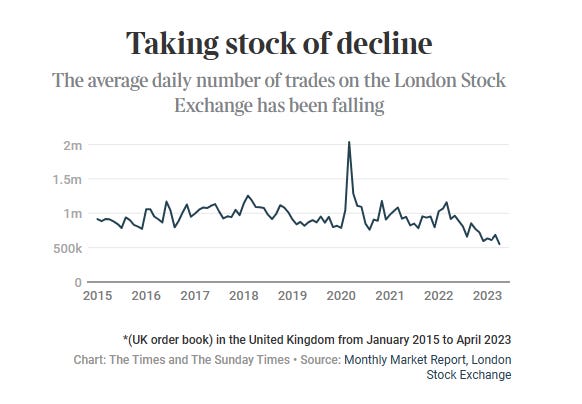

Quiet always descends on the City of London in August, as bankers and brokers head for the Med. But the hush this year is more ominous than restful. London, for so long a robust, swaggering centre of global finance, finds itself in a defensive crouch. Mergers and acquisitions departments are all but dead. When they happen at all, stock market floats are more often than not heading to New York. It appears London is falling, and the consequences for the rest of us could be momentous. One day maybe “less strategic” than Madrid and Turin, not only Paris and Berlin, Munich, or Frankfurt.

Take Flutter Entertainment, the British gambling giant. The seeds of its plan to emigrate were sown last November, when the company behind Betfair and PaddyPower held an open day for investors in New York. A hip-hop soundtrack greeted shareholders before Flutter’s management team, led by the chief executive, Peter Jackson, talked up the strengths of its fantasy sports betting brand.

“It was like a coming out party,” Jackson says. “We must have had two or three hundred people there, and the same number again watching the live stream.”

The US stock market’s greater liquidity makes it more attractive to companies such as Flutter, which could move its primary listing to New York

BRENDAN MCDERMID/REUTERS

Three months later, Flutter — whose shares are listed on the London Stock Exchange — said it wanted to add a secondary listing in New York, giving Americans a way to trade them locally. And in time, it could move its primary listing to the US, meaning it would drop out of the FTSE 100. In other words, this £23.9 billion company is thinking about abandoning Britain altogether.

Jackson insists London has been “very supportive” of Flutter but says the US stock market’s greater depth and scale — in financial jargon, its “liquidity” — make it irresistible. “Liquidity is very important,” he says, “and liquidity attracts liquidity. It’s a hard thing to fight against.”

Flutter is among a wave of companies making the transatlantic flit, including the chip designer Arm Holdings and CRH, a huge Irish building materials maker. Every week seems to bring more potential defections: last week, Plus500, another gambling operator, and YouGov, the polling outfit, said they were considering listing in the US. What started as a trickle is becoming a surge.

Taking stock of decline

These are just the most eye-catching symptoms of a malaise enveloping the City and Canary Wharf. A sagging stock market, Brexit, a work-from-home culture and a cyclical downturn in deal activity have sucked the vim out of a financial centre whose heyday spawned satires such as Harry Enfield’s Loadsamoney character.

“London feels like Vienna in 1916,” says David Cumming, head of UK equities at the investment house Newton. “The fund management industry is really on the back foot. No one is making any money.”

”No one is making any money,” David Cumming of Newton said of London

ZOLTANGABOR/GETTY IMAGES

The City may not be facing the same fate as the Austro-Hungarian empire quite yet. And why, one might wonder, should the rest of us shed tears for the bonus-rich denizens of the Square Mile? Because, in truth the City’s problems affect all of us.

The financial services industry as a whole — including in cities such as Edinburgh and Leeds — generates about £75.5 billion of taxes a year, more than 10 per cent of the government’s total take. If we want better public services, we need that revenue to pay for them. And if we want to level up Britain, well, the big investment banks in London tend to be the first port of call for investors wanting to put money into other parts of the UK.

A host of other industries, from law to accountancy to public affairs to restaurants and bars and travel agents feed off the deals that are done in the Square Mile. Fewer deals mean less business all round.

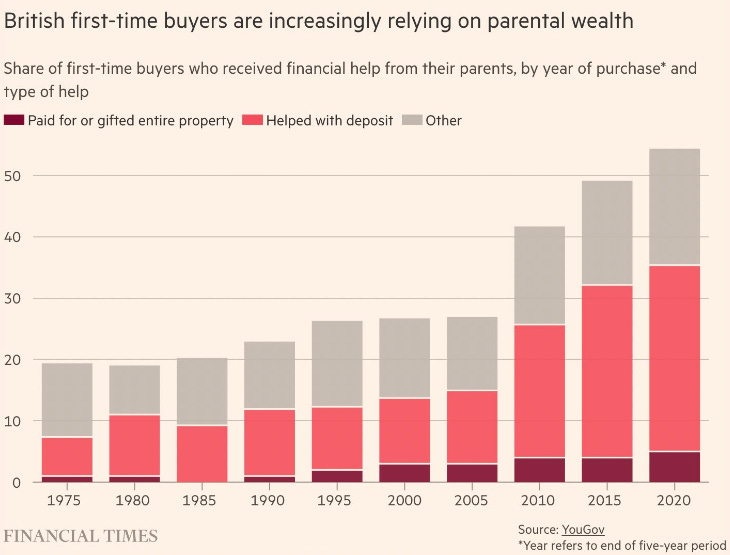

Then there are pensions. Most of the woes afflicting the City are closely related to the slow-burning pensions crisis — the main problems being the mass closure of generous defined benefits schemes, whose colossal liabilities have proved difficult for many companies to bear, and the insufficient nature of the defined contribution schemes that have largely replaced them.

“This is so fundamental for everybody in the country,” says Robert Swannell, former chairman of Marks & Spencer. “This is not some arcane City issue — this is about the nation’s wealth, and particularly pension wealth. Without profound changes, there are going to be millions of people who in 20 or 30 years’ time will find they’re horribly equipped for their retirement.”

How did we get here? There are several distinct strands to the story of the City’s decline.

The “Big Bang” deregulation masterminded by the chancellor, Nigel Lawson, in 1986 led a golden era for London

IN PICTURES LTD/CORBIS/GETTY IMAGES

Since the development of the eurodollar market in the 1950s, the City has thrived on globalisation. Margaret Thatcher’s abolition of currency exchange controls in 1979, and the “Big Bang” deregulation masterminded by her chancellor, Nigel Lawson, in 1986, ushered in a golden era. It was summed up by the word “Wimbledonisation” — the idea that foreigners were welcome to win big on a perfect financial lawn, while Britain enjoyed the lucrative role of host.

Brexit has rather changed the game. The referendum result in 2016 did not trigger the massive jobs exodus to Europe that some had predicted. But the Christmas Eve deal signed by Boris Johnson in 2020 left financial services out in the cold, with companies losing their ability to serve EU markets under so-called equivalence rules.

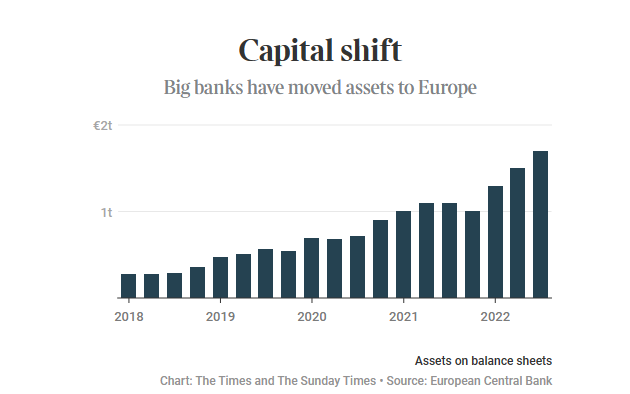

While banks have not moved significant numbers of jobs, they have created more on the continent. JP Morgan and Goldman Sachs have roughly doubled their employee counts in the EU. Marc d’Andlau, one of Goldman’s co-heads in France, told Bloomberg in April that Paris had become its EU trading hub. “Back in the day, if you didn’t sit in New York, London or Hong Kong you could feel remote,” he said. “That’s not the case any more.”

More importantly, banks have shifted enormous amounts of capital to Europe at the central bank’s request — some €1.7 trillion (£1.5 billion). The European Commission has also made clear that it wants a bigger share of activities such as derivatives trading, currently dominated by London, to take place on the other side of the Channel.

Capital shift

“London has lost its status as the entryway to Europe,” says Craig Coben, former head of equity capital markets at Bank of America Merrill Lynch. “You’ve just shot yourself in the foot very quickly — not just from a regulatory standpoint, but also reputationally. Once you start losing momentum and critical mass, a virtuous circle turns into a vicious cycle. I’m not saying we’re there yet for London, but it needs to arrest the decline.”

The government is consulting on radical proposals to crunch together pension funds into a handful of superfunds to drive money back into UK assets such as equities

MIKE KEMP/IN PICTURES/GETTY IMAGES

The mood has not been helped by the hollowing out of offices, as workers dubbed “Twats” by some colleagues come in for three days a week — typically Tuesdays, Wednesdays and Thursdays. Lower demand for space means that Canary Wharf’s vacancy rate stands at about 17 per cent and rising.

Analysts such as Simon French, chief economist at Panmure Gordon, have pointed out that UK shares swung to a discount after the 2016 Brexit vote — currently more than 40 per cent versus shares elsewhere.

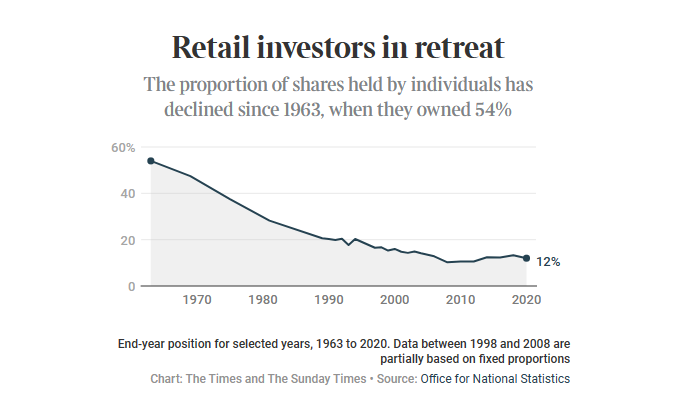

But the wilting state of the stock market is a separate strand. The flight of companies to the US has its roots in Gordon Brown’s first budget. In 1997, the then Labour chancellor took away the 20 per cent tax credit pension funds received on dividends. Pension funds dumped equities and bought government bonds — a trend that was accelerated by accounting changes in 2000.

Defined benefits schemes, which pay members a retirement income based on their salary, had more than 50 per cent of their assets invested in the UK stock market more than two decades ago, according to a report by the Tony Blair Institute for Global Change in May. That number has slumped to 4 per cent today. The impact has been massive — significantly reducing the amount of money swilling around the system.

Retail investors in retreat

What can be done? A number of ideas are circulating. The Department for Work and Pensions is consulting on radical proposals to crunch together pension funds into a handful of superfunds that could plough money back into UK assets such as stock-market equities.

The City’s sickness has caught the attention of Rishi Sunak, the chancellor, Jeremy Hunt, and the City minister, Andrew Griffith. They have commissioned myriad reviews and in December Hunt unveiled a package known as the Edinburgh reforms of financial services. Among other things, these will relax post-financial crisis rules requiring banks to ring-fence customer deposits from riskier trading activities.

Meanwhile, the London Stock Exchange is quick to point out that simply moving to the US is no panacea for British companies. The 22 émigrés to have listed there in the past 10 years have seen their shares fall by 38.1 per cent on average, according to its analysis, including disasters such as the Babylon Health virtual GP app and the second-hand car marketplace Cazoo.

That will not stop more bosses looking to America, because the Statue of Liberty dangles more than just the prospect of a bigger investor base. There is a less stringent application of ESG — environmental, social and governance-based considerations — in the US. And there happens to be a tolerance for far bigger executive salaries and bonuses.

The Schroders chief executive, Peter Harrison, a member of the government’s capital markets industry taskforce, suggests that cultural factors — objections in the UK to risk-taking and eye-catching pay — may be the biggest obstacles to a revival of the City.

“We are a socialist country with a capitalist system, and we are struggling to reconcile the two,” he says. “People have now accepted there is a problem. I’ve never been to Alcoholics Anonymous, but the first thing is to admit you’ve got a problem. But cultural change is a generational change, and that’s really hard.”

=========END————

Thank you, as always, for reading. If you have anything like a spark file, or master thought list (spark file sounds so much cooler), let me know how you use it in the comments below.

If you enjoyed this post, please share it.

______________

If a friend sent this to you, you could subscribe here 👇. All content is free, and paid subscriptions are voluntary.

——————————————————————————————————

-prada- Adi Mulia Pradana is a Helper. Former adviser (President Indonesia) Jokowi for mapping 2-times election. I used to get paid to catch all these blunders—now I do it for free. Trying to work out what's going on, what happens next. Arch enemies of the tobacco industry, (still) survive after getting doxed.

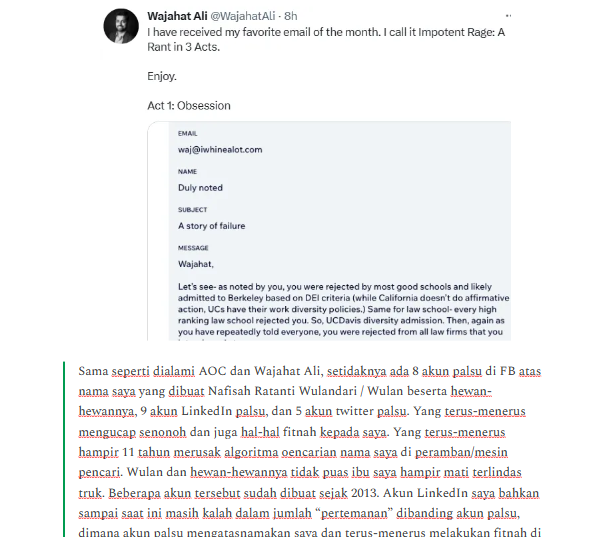

Now figure out, or, prevent catastrophic situations in the Indonesian administration from outside the government. After his mom was nearly killed by a syndicate, now I do it (catch all these blunders, especially blunders by an asshole syndicates) for free. Writer actually facing 12 years attack-simultaneously (physically terror, cyberattack terror) by his (ex) friend in IR UGM / HI UGM (all of them actually indebted to me, at least get a very cheap book). 2 times, my mom nearly got assassinated by my friend with “komplotan” / weird syndicate. Once assassin, forever is assassin, that I was facing in years. I push myself to be (keep) dovish, pacifist, and you can read my pacifist tone in every note I write. A framing that myself propagated for years.

(Very rare compliment and initiative pledge, and hopefully more readers more pledges to me. Thank you. Yes, even a lot of people associated me PRAVDA, not part of MIUCCIA PRADA. I’m literally asshole on debate, since in college). My note-live blog about Russia - Ukraine already click-read 4 millions.

=======

Thanks for reading Prada’s Newsletter. I was lured, inspired by someone writer, his post in LinkedIn months ago, “Currently after a routine daily writing newsletter in the last 10 years, my subscriber reaches 100,000. Maybe one of my subscribers is your boss.” After I get followed / subscribed by (literally) prominent AI and prominent Chief Product and Technology of mammoth global media (both: Sir, thank you so much), I try crafting more / better writing.

To get the ones who really appreciate your writing, and now prominent people appreciate my writing, priceless feeling. Prada ungated/no paywall every notes-but thank you for anyone open initiative pledge to me.

(Promoting to more engage in Substack) Seamless to listen to your favorite podcasts on Substack. You can buy a better headset to listen to a podcast here (GST DE352306207).

Listeners on Apple Podcasts, Spotify, Overcast, or Pocket Casts simultaneously. podcasting can transform more of a conversation. Invite listeners to weigh in on episodes directly with you and with each other through discussion threads. At Substack, the process is to build with writers. Podcasts are an amazing feature of the Substack. I wish it had a feature to read the words we have written down without us having to do the speaking. Thanks for reading Prada’s Newsletter.

Wants comfy jogging pants / jogginghose amid scorching summer or (one day) harsh winter like black jogginghose or khaki/beige jogginghose like this? click

Headset and Mic can buy in here, but not including this cat, laptop, and couch / sofa.

Now figure out, or, prevent catastrophic situations in the Indonesian administration from outside the government. After his mom was nearly killed by a syndicate, now I do it (catch all these blunders, especially blunders by an asshole syndicates) for free. Writer actually facing 12 years attack-simultaneously (physically terror, cyberattack terror) by his (ex) friend in IR UGM / HI UGM (all of them actually indebted to me, at least get a very cheap book). 2 times, my mom nearly got assassinated by my friend with “komplotan” / weird syndicate. Once assassin, forever is assassin, that I was facing in years. I push myself to be (keep) dovish, pacifist, and you can read my pacifist tone in every note I write. A framing that myself propagated for years.

+++++