Love Dollar Not Helping (too), Neither Love Yuan (hint: the real problem is domestic monetary)

Quito 10.29am / Washington DC and Buenos Aires 12.29pm / Beijing 11.29pm

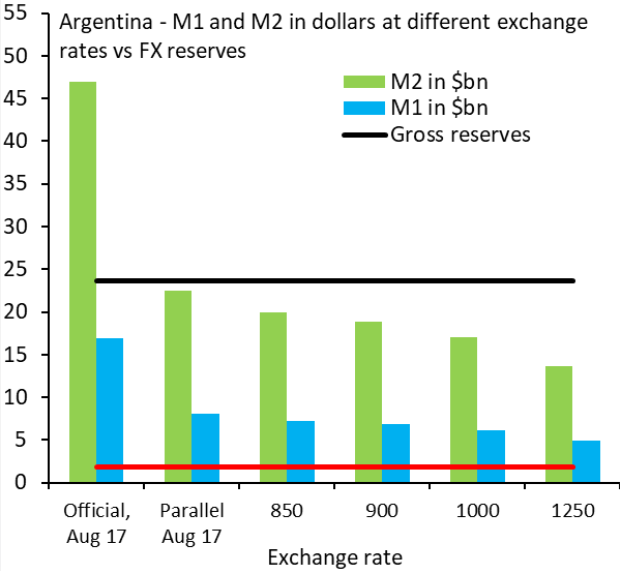

Argentina has repeatedly pegged the Peso to USD, a policy that - over and over - ends in massive devaluation and hardship. Dollarization is just the most extreme form of such a peg, so - unfortunately - the current debate is just more of the same. Right now Argentina doesn't have usable Forex Reserves to dollarize. Not even at more than a 1000 pesos per US$.

Problem is that rational people know that if the government was to try with a loan from who knows where, the conversion would be at a horrible exchange rate. Risk of panicExcept for short periods, Argentina has experienced 75 years of macroeconomic instability. To defeat inflation, it has tried almost every possible monetary and exchange rate policy. And yet, inflation is running at more than 50 per cent. To understand the impact of forex intervention on global financial markets, it is important to think about swings in demand for forex reserve assets relative to the supply of those reserve assets.

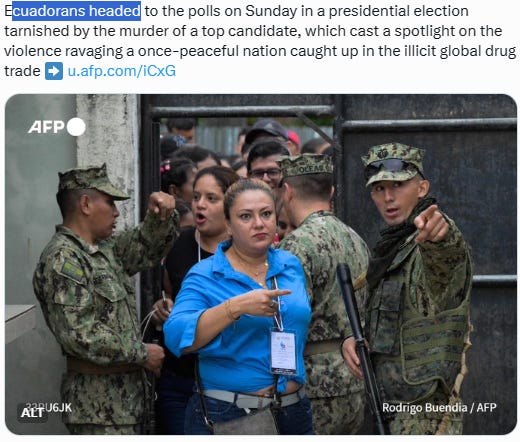

There is a recurrent debate over whether Argentina should again adopt the US dollar as a means of achieving price stability and laying the groundwork for economic growth. To make the case for dollarisation, Ecuador is often cited as a model. But what can Argentina learn from Ecuador’s 20 years of dollarisation?

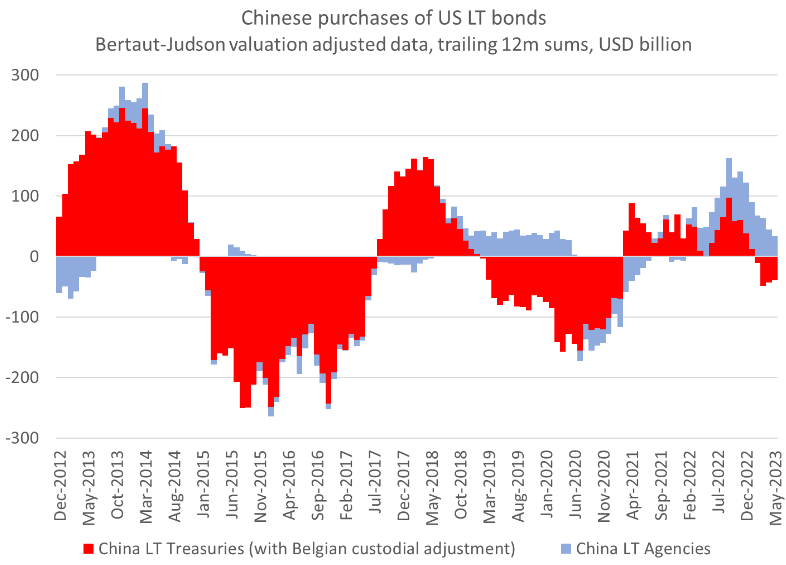

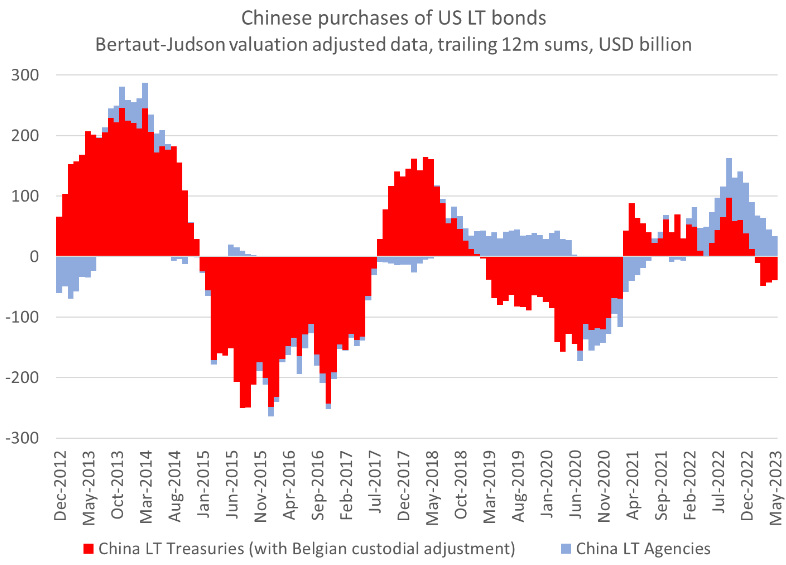

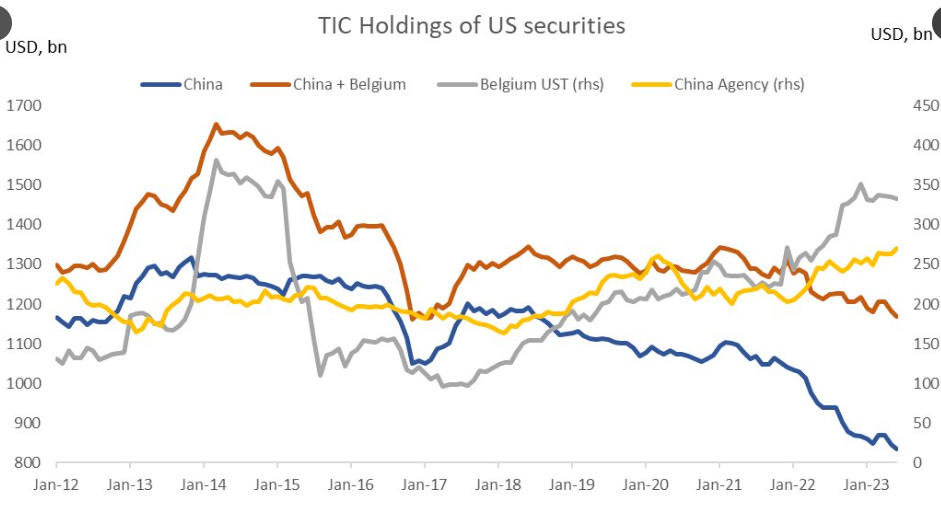

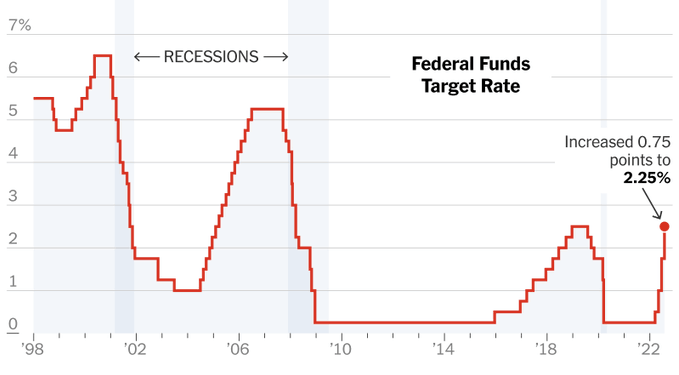

With China defending the yuan (so far through the state banks) and the yen approaching levels where Japan might intervene, the impact of foreign central bank reserves on the Treasury market is getting new attention. One, is that central banks often buy longer dated maturities than they tend to sell, for fairly obvious reasons (the most obvious source of liquidity = maturing securities) so the flow impact of purchases and sales might not be symmetric.

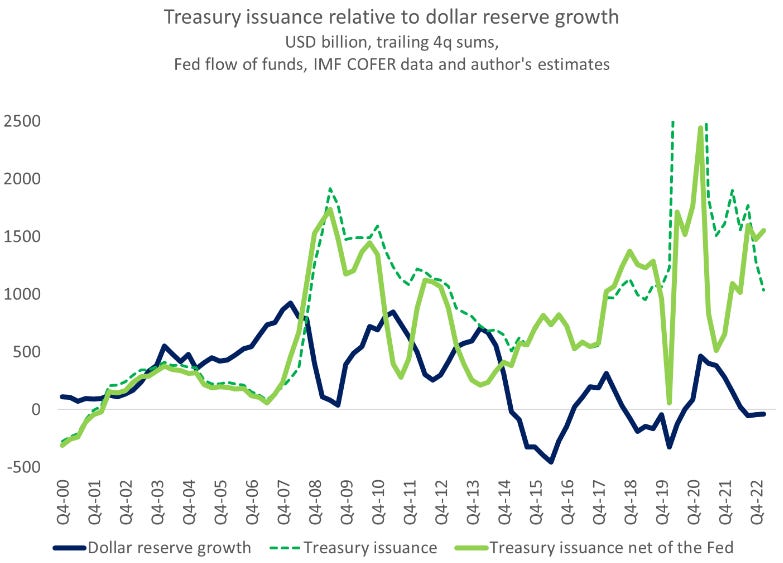

More importantly, the foreign central bank bid for Treasuries hasn't been constant over time: think of 3 historic timelines:

2003 to 2008 (dollar reserve growth exceeds UST issuance)

2009 to 2014 (big increase in dollar reserves and UST supply)

2015 on - now (no net increase in dollar reserves)

The impact of the central bank flow (or measures of holdings normalized v the stock of Treasuries) thus won't be constant. From 2003 to 2008, foreign central banks were forced out of their natural home (2s to 5s) and into everything -- Agencies, Agency MBS, dollar deposits. It distorted global flows; there was a shortage of safe reserve assets vs demand. After the GFC (Global Financial Crisis) reserve growth remained high (too high I think; the US wasn't allowed to recover through exports) but it was matched by large Treasury issuance. Setting the period of the GFC aside, dollar reserve growth mapped to Treasury issuance from 2004 to 2014. After the GFC central banks weren't obviously forced outside their preferred habitat. This of course is also the period of US QE, and if you apply estimates of the impact of QE to foreign central bank buying.

For most of the past 10 years, Treasury issuance has been absorbed by either the Fed or private markets (in part because key actors no longer put their state assets in reserves) not by foreign central banks. Central banks don't hold many long-dated Treasuries. Their portfolios are concentrated at the short end.

Now central bank reserve managers could still have an impact -- during the low for long era (2014 on until now) they were lengthening maturities to get a bit more yield (per the survey data) so bidding for longer dated bonds. Right now, we are in a world of reduced purchases (dollar reserve growth may be positive this year simply because of all the coupon payments!) more than net sales, which makes me (like JP Morgan) a bit cautious about narratives linking recent Treasury moves to intervention. 5 Months ago, in US$35 trillion debt ceiling saga, JPMorgan Chase & Co. has a weekly war room to prepare for a US debt default standoff, CEO Jamie Dimon said.

The planning effort will soon mean multiple meetings a day.

JPMorgan has taken in 9% of overall ETF flows this year, while BlackRock's 15% share of flows is its lowest since 1999. J.P. Morgan unusually close to BlackRock this year.

Central banks that in the past bought longer dated notes to generate a bit of yield and that have very large portfolios (cough, China) also have a strong incentive not to sell their long-duration Treasuries -- they often carry the bonds at book and don't want to realize losses. Chinese state banks that are carrying out the PBOC's command to stabilize the yuan also likely have a substantial liquidity buffer of their own -- they wouldn't immediately need to dip into their $300 billion or so bond portfolio. Awkward, estimate US$300 billion too, scale of the debt EVERGRANDE. As we know, EVERGRANDE filed for Chapter 15 bankruptcy protection in New York. Evergrande Group - Evergrande Real Estate Group Limited, a behemoth property developer, filed for bankruptcy protection on Thursday more than two years after it defaulted on its debt, files for bankruptcy protection in U.S. court.

Chapter 15 of the US bankruptcy code shields non-U.S. companies that are undergoing restructurings from creditors that hope to sue them or tie up assets in the U.S.

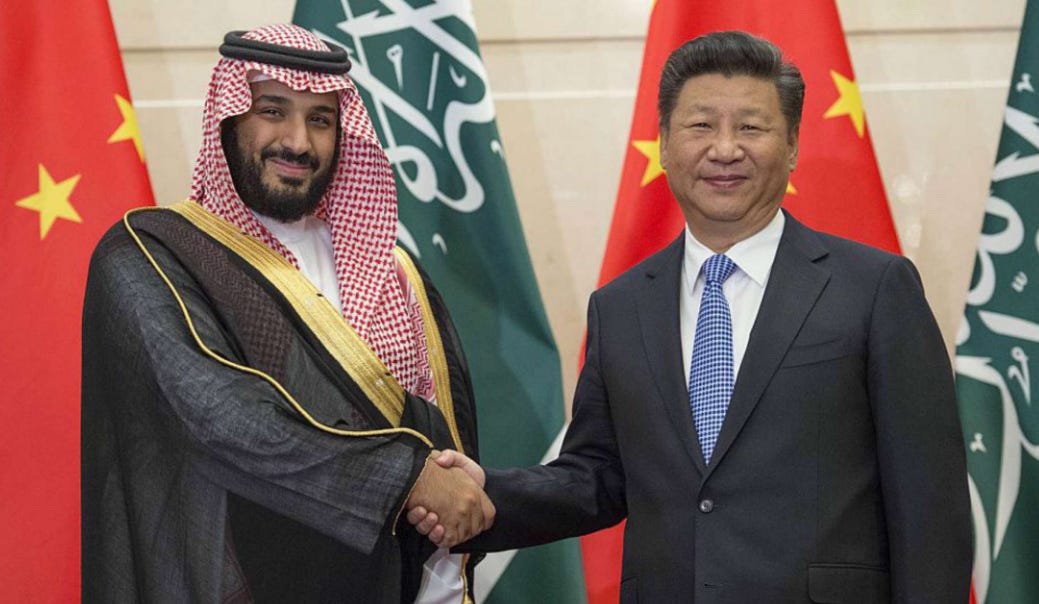

China’s central bank cut its one-year loan prime rate (Aug 21, 2023), while leaving its five-year rate unchanged. These decisions are weaker than expectations for more muscular policy intervention following a raft of data that pointed to faltering growth momentum in the world’s second-largest economy.

The People’s Bank of China trimmed its one-year loan prime rate — the peg for most household and corporate loans in China — by 10 basis points from 3.55% to 3.45%, just shy of the 15 basis points that a majority of economists expected in a Reuters poll. This was the second time China has cut this rate in three months.

The PBOC left its five-year loan prime rate — the peg for most mortgages — unchanged at 4.2%, while economists expected a 15 basis point cut due to default risks from festering liquidity woes in the country’s property sector. Country Garden is on the verge of default, while Evergrande filed last week for bankruptcy protection in a Manhattan court.

“The underwhelming LPR announcement strengthens our view that the PBOC is unlikely to embrace the much larger rates cuts that would be required to revive credit demand,” Julian Evans-Pritchard, Capital Economics’ head of China, wrote in a note.

China historically has cared about the yield on its reserve portfolio (more so than Japan's MoF) -- and it clearly liked the extra yield provided by Agencies last year. ($80b in purchases in 2022). Given rising geopolitical tensions and now concerns about Chinese FX intervention many remain very focused on foreign holdings of US securities (example: TIC data).

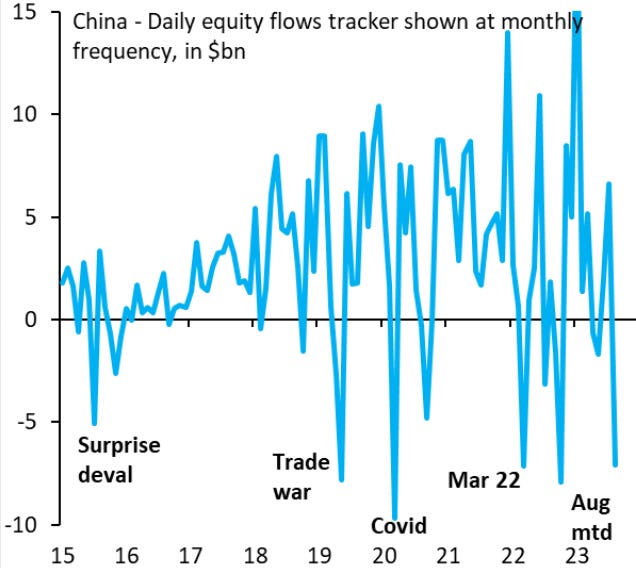

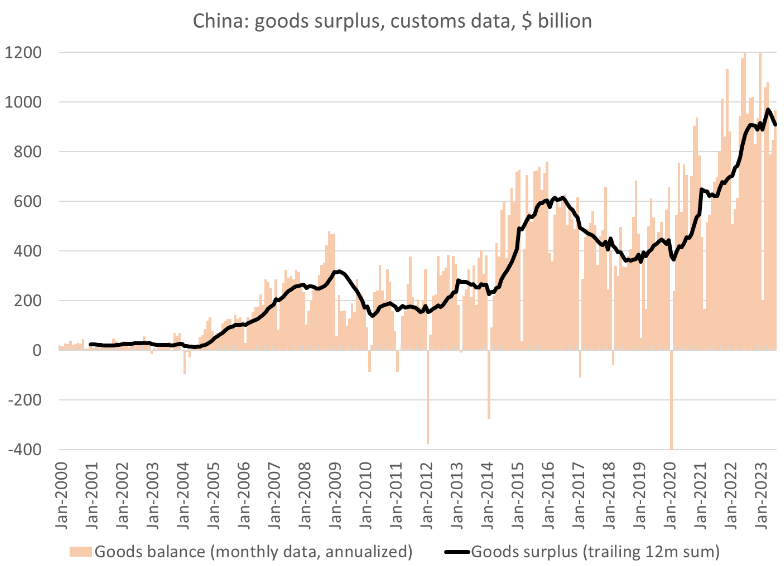

China’s trade surplus, while still massive, has begun to erode as exports weaken." Outflows from Chinese equities month to date are as large as at the onset of the trade war or the March 2022 covid outbreak in Shanghai. Meaningful shock in the real economy, financial system, and foreign confidence in the country.

The surplus (on a trailing 12m basis) did dip in July (v June), but it remains above its 2022 level. The July monthly surplus (annualized) last year was insane -- US$1.2 trillion. But the $900b monthly surplus in July doesn't really suggest much erosion.

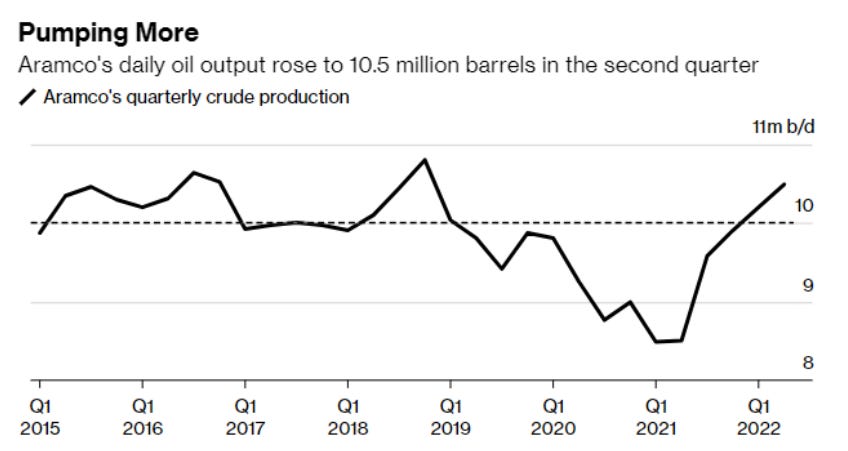

China is the world's biggest oil importer by a mile, so a lot depends on the price of oil between now over the next 6 months. The non-oil surplus should trend up a bit, simply because the base in Q4 last year was weak (the q2 base last year should have pulled the surplus down more. China’s central bank pledged to avoid excessive movements in the yuan as the currency slides toward its weakest level since 2007.

The People’s Bank of China (PBOC) also said it will “step up macroeconomic policy adjustment” while largely reaffirming its policy stance, according to its quarterly monetary policy report published Thursday (Aug 17th, 2023).

The central bank said it will prevent “over-adjustment” in the yuan, which it said has yet to deviate from its fundamentals. The PBOC has experience and ample policy tools to safeguard a stable foreign exchange market.

Dollarisation does defeat inflation. Ecuador dollarised its economy in January 2000 and price stability was achieved by 2004. From then on, inflation has been on average 3.1 per cent a year, lower than the 28 per cent average between 1970 and 1999, and similar to Chile’s (3.3 per cent), Colombia’s (4.4 per cent) and Peru’s (2.9 per cent) in the same period.

A second lesson is that dollarisation does not necessarily imply fiscal discipline — an important consideration for Argentina, where chronic inflation has been associated with persistent fiscal deficits. In Ecuador, non-financial public sector spending rose from about 26 per cent of GDP in the second half of the 1990s to 43 per cent by 2014.

To finance this expansion, the government used the windfall gains stemming from high oil prices, received Chinese financing and defaulted on private external debt. The central bank also issued paper and transferred it to the government to pay its bills; this action was only possible because the 2008 Constitution eliminated the central bank independence enacted in 1998, which banned central bank financing of the government.

As a result, Ecuador’s country risk has remained high and well above that of its neighbours. To restore fiscal soundness, Ecuador has restrained aggregate demand, sending per capita growth into negative territory during the past five years, a trend expected to continue for at least three more years according to the IMF. So, dollarisation does not automatically boost economic growth — a third lesson to be learned.

Despite the favourable international environment that prevailed for most of the past 20 years — oil prices soared above historical levels, the dollar remained depreciated, international interest rates were low and the country received abundant remittances from abroad like never before — real GDP in Ecuador grew, on average, 3.3 per cent a year between 2000 and 2019, less than the 4.7 per cent recorded in the previous 30 years.

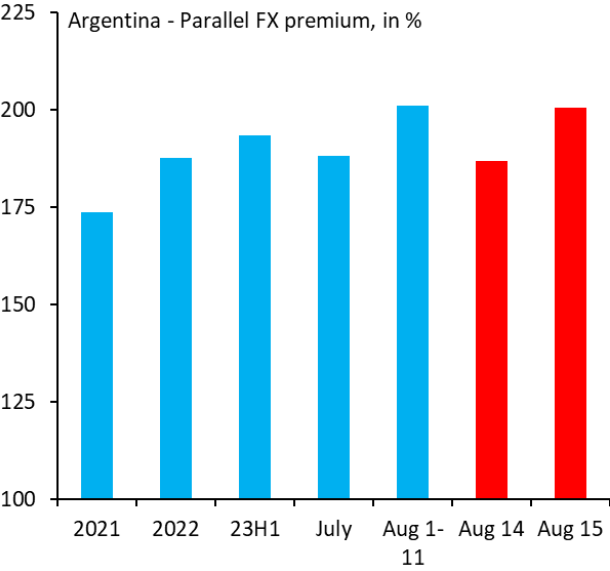

Moreover, per capita income in 2019, measured in constant values, was lower than in 2012, and has lagged behind over the past 20 years with respect to its neighbouring countries. Dollarisation also makes the economy more vulnerable to shocks and prone to volatility, a fourth lesson that Argentina must ponder. In countries that issue their own currency, the exchange rate depreciates following a shock, inducing a change in relative prices that favours domestic production and exports. For the time being Argentina's government hasn't lost control. The parallel foreign exchange premium since the primaries and devaluation hasn't moved much. Still sky high but not spiralling out of control.

But in a dollarised economy, because there is no longer an exchange rate to work as a buffer, economic activity takes the full impact of external shocks. This vulnerability is exacerbated if the country is a commodity exporter.

For Ecuador, appreciation of the dollar occurs in tandem with a decrease in the price of oil. The economy, therefore, experiences a double whammy: public finances suffer from falling oil prices, while exports are hit by a loss of competitiveness caused by the strengthening of the dollar. And, because the dollar depreciates with a rise in the price of oil, booms are magnified, and economic cycles are amplified.

During 2000-2019, the standard deviation of real GDP growth was 2.66 in Ecuador, higher than in Chile, Colombia and Peru, where it was 2.1, 1.79 and 2.44, respectively. A lesson is that dollarised economies become less competitive, unless the labour market is flexible. For Chile sample case, Chile's big current account deficits are water under the bridge. The trade surplus through July is large. Overheating is also over. Markets are right in assuming the policy rate can fall to 5% in one year.

In Ecuador, wages do not adjust downwards and labour mobility is limited. Therefore, firms cannot adjust their production costs when needed. In countries that issue their own currency, the exchange rate does the trick: wages in dollars decline as a result of the depreciation that follows a negative shock, provided the central bank keeps inflation in check. Moreover, in Ecuador, populist policies have raised real minimum wages more than 50 per cent since 2007.

Relative to neighbouring countries, minimum wages in dollars went from being the lowest in 2000 to the highest at the end of 2019. Twenty years of data from Ecuador suggest that dollarisation is a quick fix but does not address the underlying problems that hold countries back. Maintaining sound economic policies and introducing growth-oriented structural reforms are just as important, even if a country is dollarised. Moreover, the rule of law and having solid political and economic institutions are crucial for boosting investment.

Otherwise, countries become dysfunctional and generate economic imbalances that adjust either through inflation (when they issue their own currency) or through low economic growth and high unemployment (if they are dollarised). The result, inevitably, is lack of economic and social progress, irrespective of which currency is used.

=========END————

Thank you, as always, for reading. If you have anything like a spark file, or master thought list (spark file sounds so much cooler), let me know how you use it in the comments below.

If you enjoyed this post, please share it.

______________

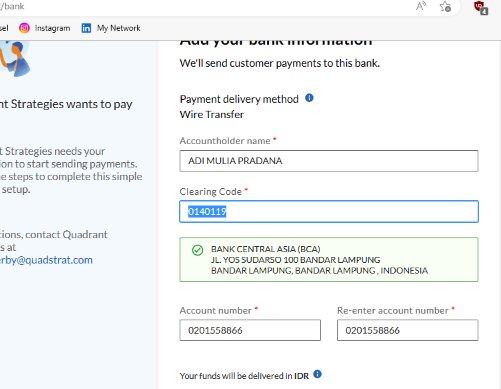

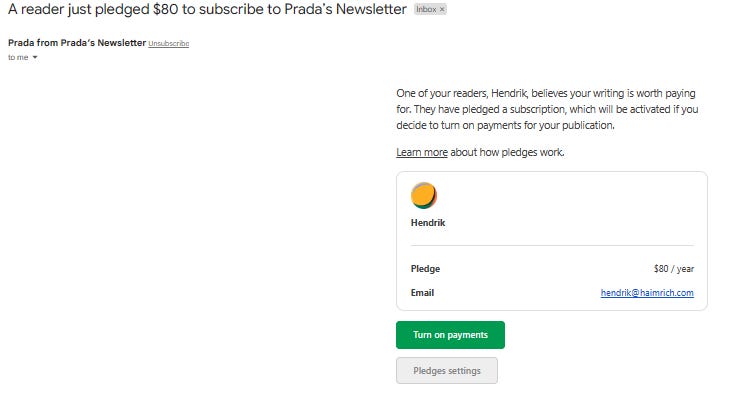

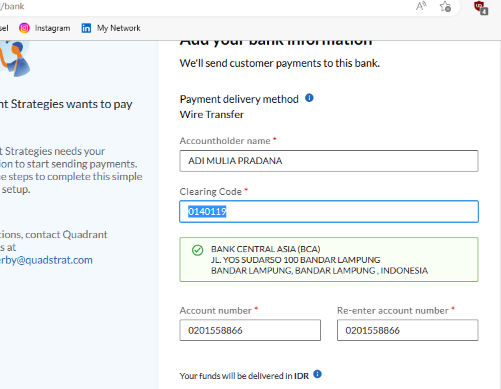

Professor Hendrik, Professor Eric, and another person, Prof David A. Andelman, former Bureau Chief NYTimes recommended my substack, also some Chief Technology of Financial Times (FT) recommended my substack, not only subscribe. I'd be happy to get more & more PLEDGE and recommendations for better crafted writing (via Bank Central Asia (with my full-name ADI MULIA PRADANA, clearing code 0140119, account number 0201558866 or via STRIPE. For me, prefer Bank Central Asia).

If a friend sent this to you, you could subscribe here 👇. All content is free, and paid subscriptions are voluntary.

—————

——————————————————————————————————

-prada- Adi Mulia Pradana is a Helper. Former adviser (President Indonesia) Jokowi for mapping 2-times election. I used to get paid to catch all these blunders—now I do it for free. Trying to work out what's going on, what happens next. Now figure out and or prevent catastrophic of everything.

(Very rare compliment and initiative pledge, and hopefully more readers more pledges to me. Thank you. My note-live blog about Russia - Ukraine already click-read 6 millions, not counting another note especially Live Update Substack (mostly Live Update Election or massive incident)

=======

Thanks for reading Prada’s Newsletter. I was lured, inspired by someone writer, his post in LinkedIn months ago, “Currently after a routine daily writing newsletter in the last 10 years, my subscriber reaches 100,000. Maybe one of my subscribers is your boss.” After I get followed / subscribed by (literally) prominent AI and prominent Chief Product and Technology of mammoth global media (both: Sir, thank you so much), I try crafting more / better writing.

To get the ones who really appreciate your writing, and now prominent people appreciate my writing, priceless feeling. Prada ungated/no paywall every notes-but thank you for anyone open initiative pledge to me.

(Promoting to more engage in Substack) Seamless to listen to your favorite podcasts on Substack. You can buy a better headset to listen to a podcast here (GST DE352306207).

Listeners on Apple Podcasts, Spotify, Overcast, or Pocket Casts simultaneously. podcasting can transform more of a conversation. Invite listeners to weigh in on episodes directly with you and with each other through discussion threads. At Substack, the process is to build with writers. Podcasts are an amazing feature of the Substack. I wish it had a feature to read the words we have written down without us having to do the speaking. Thanks for reading Prada’s Newsletter.

Wants comfy jogging pants / jogginghose amid scorching summer or (one day) harsh winter like black jogginghose or khaki/beige jogginghose like this? click

Headset and Mic can buy in here, but not including this cat, laptop, and couch / sofa.