Electric carmaker Tesla could create 5,000 to 6,000 jobs at a new plant planned for the northern Mexican state of Nuevo Leon, said Martha Delgado, a Mexican deputy foreign minister.

There was intense competition among countries to host the Gigafactory because of its expected significant contribution to the economy. Jokowi visited Elon Musk in HQ SpaceX last May. The sprawling facility, which is expected to be one of the largest manufacturing lines, will need a considerable number of employees despite many highly automated processes. There is also a concerted effort in the region to encourage battery manufacturing since it is viewed as a strategic economic measure due to an increasing global transition towards renewable energy. In March 2022, the government of Brandenburg granted Tesla Giga Berlin-Brandenburg its final environmental approval. Currently, 10,000 people work in Giga Berlin. Tesla plans to have over 10,000 workers at each plant. In Gigafactory NYC there are 1,500 workers. Gigafactory Nevada has 7,000 workers. Gigafactory Texas is the same as Berlin, 10,000. And Gigafactory Shanghai has 15,000 workers.

President of Indonesia “Jokowi” Joko Widodo is eyeing new job 10,000 - 15,000 if Tesla choose Indonesia (mostly in KIPI - Kalimantan Industrial Park Indonesia). Indonesia really set high aims to be EV makers in Asia, not only ASEAN.

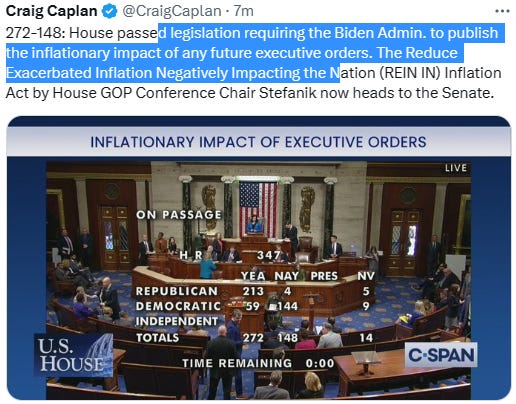

Minister Airlangga 1 hour ago said that even the Thai Government subsidizes US$5,500 for EV cars, so Jokowi administration thought “more subsidize” the same as the US$370 billion IRA’s (Inflation Reduction Act) Biden administration, which until now has limited the number of vehicles eligible for the full subsidy to 200,000 EV car per manufacturer. The IRA adds a rebate of $4,000 for used electric cars, provided they are sold by a licensed dealer. The rebate can only be applied to any particular car once.

Canada has already pointed out that the potential tax credit may violate trade deals. Now, Mexico is following suit with Canada in an effort to encourage the US government to reconsider. Mexico's Economy Minister Tatiana Clouthier called the proposed credit "discriminatory," and, according to Reuters, the country is already looking into several legal actions it may pursue going forward. Clouthier shared in a recent news conference:

It seems that Mexico does not have a specific subsidy program for electric vehicles (EVs), but it does have some incentives for public transportation operators who use electric or hybrid vehicles1. However, Mexico is also facing some challenges from the U.S. EV tax credits, which it considers discriminatory2. On the other hand, Mexico is attracting some major EV manufacturers.

The popular new Ford Mustang Mach-E electric crossover is a US EV that's eligible for the tax credit, though since it's produced in Mexico, it may only qualify for a $7,500 or $8,000 credit. If it were built in the US like the Chevy Bolt, it would get $12,500. Keep in mind, this will only prove true if the proposed credit passes with the current language.

There's a chance the credit won't pass at all. There's arguably an even better chance it will eventually pass, though only with notable changes that will work to appease those in opposition of the credit as it currently stands.

Italy’s government and German officials are leaning against a European Union plan to start phasing out combustion engine cars that's pivotal to the bloc’s green agenda. Of course, more EV wants more electricity supply, and we know prolonged war makes gargantuan people suffer, especially for Europe to cut supply (energy demand from) Russia. Since the last 48 hours, thanks to snow, Europe is facing a cold snap again., potentially boosting gas demand. Meteorologists say a sudden stratospheric warming — likely the most radical changes in temperature observed on our planet — is very possible.

Electric car owners across various areas of England will benefit from thousands of new charging points, the Department for Transport has announced. The Rishi Sunak’s administration has faced criticism for failing to boost public charging infrastructure for electric vehicles. There are just 37,055 devices available across the UK, and monthly installations need to increase by 288 per cent if ministers are to deliver on their promise of having 300,000 chargers by 2030.

A total of 2,400 new chargers will be installed in locations such as Cumbria, Norfolk, Oxfordshire and West Sussex as part of a fresh £56million in public and industry funding, it was confirmed today. Sixteen more local authority areas will receive money as part of the Local Electric Vehicle Infrastructure pilot scheme.

Europe got frozen again. Europe’s return to cheaper gas might be on the verge of squeezing out coal. The UK will be unseasonably warm Monday before temperatures dip over the course of the week. Germany has set aside more than €260 billion ($275 billion) to deal with the immediate risks of an energy crisis triggered by Russia’s war in Ukraine, but the ultimate fix will be much costlier — if the country can pull it.

About 250 gigawatts of new electricity capacity needed by 2030, as Germany faces a $1 Trillion challenge to plug a massive power gap. Germany is still worried about nuclear power. Germany is accelerating efforts to merge four high-voltage grid operators in a bid to modernize power lines for a coming influx of renewable energy. Germany will ban gas and oil heating in new or renovated buildings from next year and likely increase subsidies to support their phaseout as Europe’s largest economy steps up efforts to meet climate targets. Don’t forget Lützerath dilemma in Germany.

Contrary, France is going to town on nuclear power and trying to carve out a place for the technology in discussions that will shape European energy policies for decades to come. Its push is ruffling feathers along the way. In France, a lot of the drop has been driven by nuclear power built from the 1970s. France has 56 nuclear reactors that generate about 70% of the country's electricity. France sees “no problem” funding six new nuclear reactors proposed by President Macron. Construction of the reactors could top €50 billion. A funding framework will be introduced, said a government spokesperson. This comes after President Macron called for the European Investment Bank to fund “all low-carbon technologies available, including nuclear” France is spearheading a push in Europe to recognize nuclear power as a force to meet climate goals, meet demand about electricity amid rocketing EV sales, and cut reliance on energy from Russia.

The Japan Government is offering to subsidize part of the cost to purchase CEVs, such as Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicle (PHEVs) and Fuel Cell Electric Vehicles (FCEVs). The maximum amount of the CEV subsidies given per vehicle in 2021 is 800,000 Japanese Yen, which is about 7,200 US Dollars.

As India, the 5th biggest EV market in the world after China, U.S., Germany, and the UK, saw a slight dip in EV sales recently, some firms used this opportunity to plug stories in newspapers and falsely claim that the India government's FAME subsidy scheme is not working. But the slowdown is due to a compliance issue. The India government is going to miss its FAME-II target of supporting 1 million EV two-wheelers by FY23. But a short-term dip is good for medium-term capability building. electric two-wheeler sales are slowing down. They also say a bunch of manufacturers—17 out of the 64 listed on the government’s site as receiving subsidies for EVs—are finding it hard to meet their working capital needs because the government has stopped subsidy payments of ~Rs 1,100 crore (US$133.2 million) to them.

The lone voice in these articles is often Sohinder Gill, CEO of EV maker Hero Electric and the director general of the Society of Manufacturers of Electric Vehicles (SMEV). It’s surprising to me that the industry association of a sunrise sector like EVs does not have an independent office bearer.

But that aside, Gill says at the current rate of slowdown—distinctly visible in December and January—the government will miss its target of supporting 1 million electric two-wheelers by the end of this financial year ending March 31.

Electric Vehicles (EVs) are currently a costly way to reduce carbon emissions and unlikely to put a serious dent in oil demand in the near term.

But they remain popular with the net-zero crowd, which sees electrification as the answer to climate change. Had Democrats swept this year’s election, the EV sector would have benefited from a wave of federal subsidies. With voters opting for a divided government, any new provisions for EVs will probably be modest.

The EV industry isn’t worried. Subsidizing EVs isn’t just a poor investment of taxpayers’ dollars—it turns out subsidies are also bad for business. Tesla (TSLA -0.9%) founder Elon Musk has even been critical of government subsidies.

“Over the years, there’s been all these sort of irritating articles like Tesla survives because of government subsidies and tax credits,” Musk said in 2017. “All those things would be material if we were the only car company in existence. We are not. There are many car companies. What matters is whether we have a relative advantage in the market.”

Tesla is in an awkward position when it comes to government subsidies. Early on, the company received $465 million from the government’s Advanced Technology Vehicles Manufacturing (ATVM) Loan Program. The funds helped Tesla develop the Model S, a luxury vehicle with a price tag starting at $68,000 back in 2017.

Whatever your position on subsidies in general, it’s hard to make the case that taxpayers should foot the bill to produce luxury cars marketed to the wealthiest Americans.

You can only imagine the outcry if, say, the government subsidized the production of BMWs or Cadillacs. Or look at the uproar in Alabama in the late 1990s, when state lawmakers financed the construction of a Mercedes-Benz plant in Vernon, Alabama, population 2,000, and a median income of around $34,000 a year.

And yet, many people argue that because Tesla produces EVs, the company should get a pass. It’s true that, to some degree, government funding has helped accelerate the development of EV technology. It’s also true that the reality of subsidies can make doing business difficult, even for folks like Elon Musk.

As Musk stated in a quarterly financial results conference call, “…in fact, the incentives give us a relative disadvantage. Tesla has succeeded in spite of the incentives, not because of them.”

To understand Musk’s frustration with subsidies it’s important to understand the Zero-Emissions Vehicle (ZEV) program.

ZEV, which is active in California and nine other states, mandates auto manufacturers produce a certain number of electric cars or pay a $5,000 fine for each EV they do not produce. An auto manufacturer can avoid the penalty by purchasing ZEV credits from manufacturers like Tesla, who earn extra credits for producing more EVs than their quota.

These credits are not sold at $5,000. Instead, due to Tesla’s oversupply, they are sold by Tesla to competitors at a discount of around $1,600. On the one hand, this provides Tesla with a windfall stream of income. On the other hand, Tesla is selling something for $1,600 worth $5,000 to its competitors.

“If General Motors (GM -1.4%)or Ford or somebody else makes electric vehicles, they get to monetize their ZEV credit at 100 cents on the dollar,” explained Musk.

But because Tesla generates more credits than it needs, those extra credits are worth more to its competitors than to Tesla.

Meanwhile, a traditional automaker who may believe EVs are commercially unviable is forced to make them anyway. Under current regulations, automakers are pushed to produce more EVs than there is demand for. For example, the ZEV program requires at least 15.4 percent of an automaker’s fleet sales to be EVs or hydrogen vehicles by 2025. If consumer demand for EVs is not there by 2025, those vehicles will have to be sold at a loss.

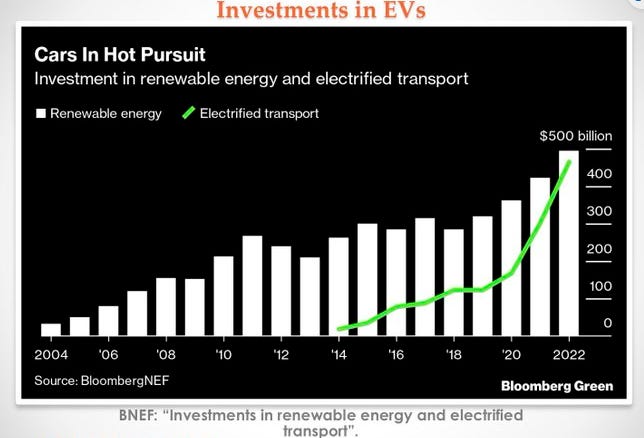

Thankfully, EVs' future and viability don't depend on subsides—there’s plenty of capital in the private markets.

This is especially true in the transportation sector, and even more so when fuel is involved. Fuel is a multi-trillion-dollar global market, meaning any company that captures even a sliver of market share stands to make billions in profit. And global consumers are eager to find an affordable, clean, reliable source of alternative energy to fuel the transportation sector.

Financially viable EV companies aren't dependent on taxpayer subsidies. There is plenty of demand for new technology that reduces carbon emissions and delivers affordable transportation. There is plenty of room for innovation. In fact, the transportation market is ripe for it.