Indonesia and the case with nickel and coal - a big share of the value-added really doesn't stay here, such that we have to resort to things like DHE (Devisa hasil export; Foreign Exchange Proceeds of Export). Foreign exchange in the form of DHE SDA must be deposited in the Indonesian financial system, based on Article 3 (1) of GR 1/2019.

Garibaldi Thohir, president director of coal miner PT Adaro Energy Indonesia, has questioned the economic viability of projects to convert coal into dimethyl ether (DME) in Indonesia, one of the government’s many proposed downstream coal projects. Garibaldi raised the doubts when asked about the substitute for natural gas at a media briefing on Thursday but said the firm would continue exploring possibilities and opportunities in the downstream coal industry.

"I don't understand how the math would [make DME projects feasible]. For example, if coal prices rose significantly, the calculation would not make sense," Garibaldi explained.

(Promoting to more engage in Substack) Seamless to listen to your favorite podcasts on Substack. You can buy a better headset to listen to a podcast here (GST DE352306207). Listeners on Apple Podcasts, Spotify, Overcast, or Pocket Casts simultaneously. podcasting can transform more of a conversation. Invite listeners to weigh in on episodes directly with you and with each other through discussion threads. At Substack, the process is to build with writers. Podcasts are an amazing feature of the Substack. I wish it had a feature to read the words we have written down without us having to do the speaking.

Still cheap or affordable because it has not taken into account the externalities of pollution and emissions. It feels cheap now, it's expensive in 20 years. After all, at this point Indonesia even oversupplies coal-fired power plants. Benefit for Indonesia moving into a higher value-added export industry that can help us transition away from coal.

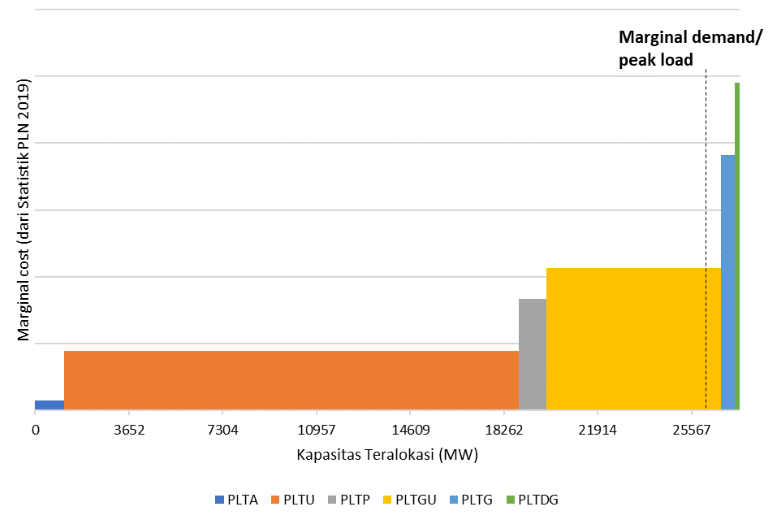

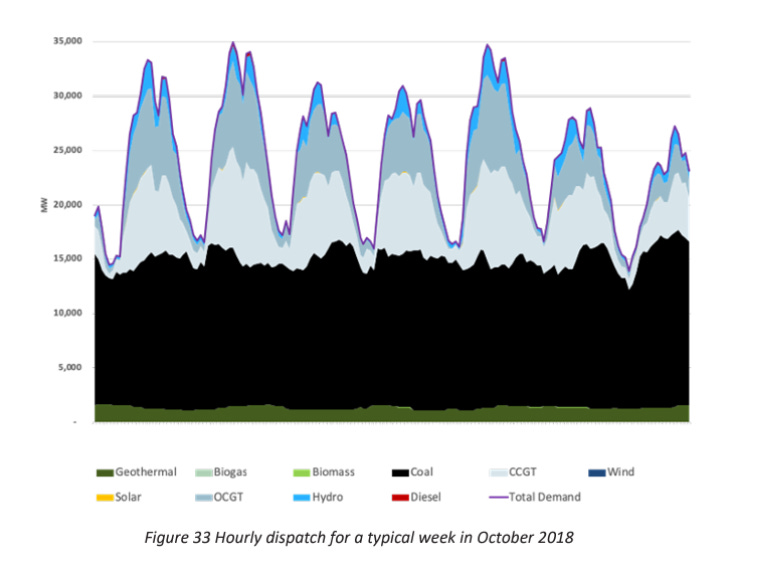

The point isn’t that coal is by characteristic base load therefore it cannot respond to load, my point is: coal is the base load generator precisely because its generation cost is cheap such that it lies at the left of the merit order. When demand fluctuates throughout the day.

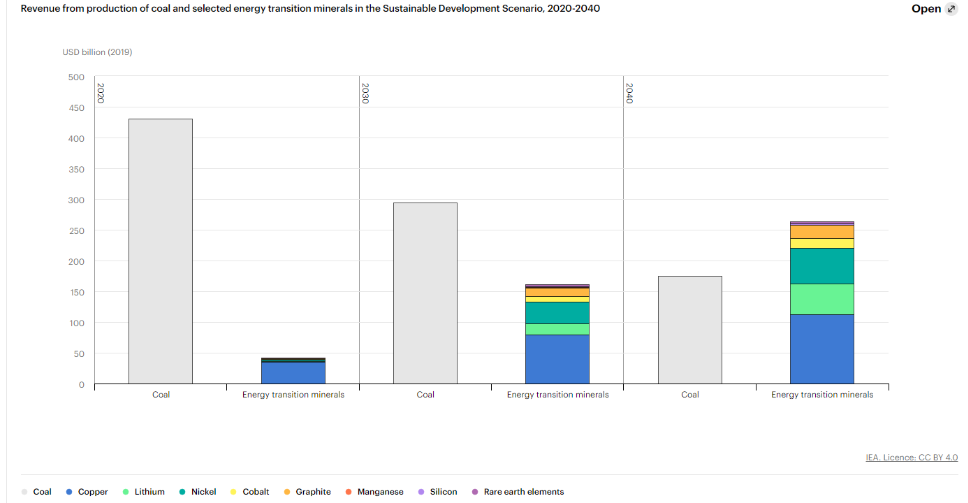

Compared to (concerned by) Pak Garibaldi, are any Indonesians concerned about the nickel (and general resource) boom (in the wake of Electric Vehicle demand) leading to Dutch Disease in the country? Indonesia experienced a commodity boom in coal and palm oil during 2000s, in particular, which may have increased inequality, according to research by Arief Anshory Yusuf, Andy Sumner, and Irlan Adiyatma Rum.

The formal manufacturing sector has historically been a haven for people in rural areas looking for better-paying jobs. When such opportunities are limited, there is an excess of unskilled labour in rural areas. Thus the rise in inequality reported since 2009 actually has a longer history.

We argue that Indonesia experienced divergence and convergence at the same time: the magnitude of the rise in inequality was significant (divergence), but the rise was greatest in provinces or districts with low initial levels of inequality (convergence). We consider the literature on drivers of changes in inequality and identify a set of hypotheses, with an empirical basis, which we introduce as potential Indonesian-specific drivers of rising inequality for future exploration.

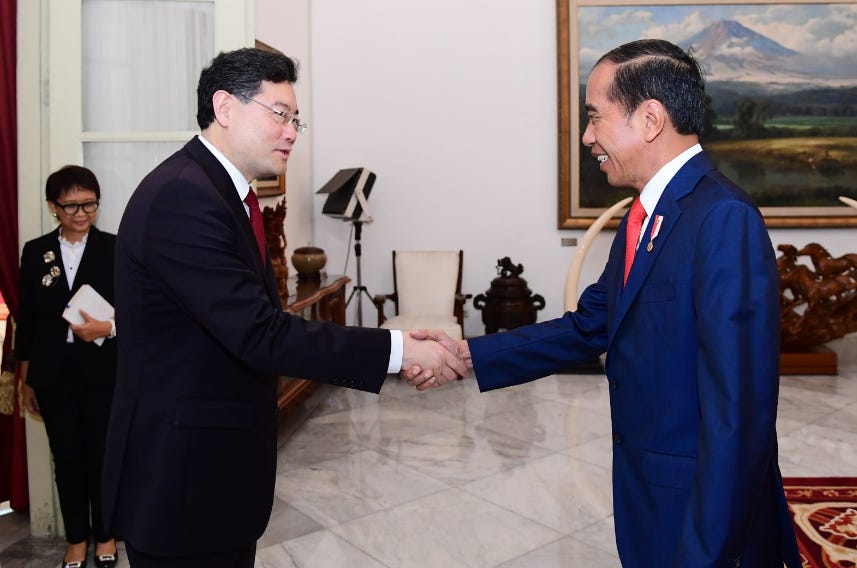

Definitely, it's always been a concern especially for coal and palm oil. For nickel, President Jokowi and the Indonesia government had preemptive strategy to counter this by banning the export of nickel ore and forcing foreign manufacturers to relocate their production here. So essentially downstreaming the sector to counteract the Dutch Disease. Without an export ban likely the situation would've been the same as coal, although an export ban generates its own distortions and trade-offs. It also remains to be seen whether this strategy alone is enough to promote more downstream investment e.g battery and stainless steel.

Because an export ban is essentially an implicit subsidy on input for downstream producers - domestic price of nickel ore in Indonesia is ~50% cheaper than intl prices. This has a big role for more upstream/intermediate sectors that use a lot of nickel, but less so for more downstream sectors that use a lot less nickel.

Like all European countries (they) still struggle to replace Russia’s supply of energy, oil, gas, Indonesia's government doesn't have a transition plan to replace coal-fired plants (as base load generators) into nuclear, geothermal, hydroelectric & those primary energy sources.

Remember the sources need to be energy-dense ones. Amid the gigantic budget of IKN (new capital city), does the Indonesian government have enough budget to finance the plan?

The Indonesian government doesn't have unlimited funds, if it were to invest, then, just like the private sector, it has to choose sectors (just a larger pool of sectors). Indonesian businesses investing in coal - that's where the money is in the short-term with the existing comparative advantage Indonesia has. But of course they didn't care about the externalities in terms of national development.

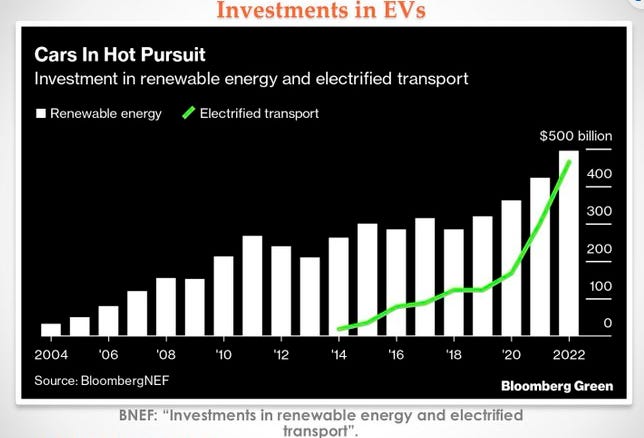

The Indonesia Government's foresight here is in recognizing that there are other sectors that's more significant for national development - and help the underdeveloped private sector to become competitive in those other sectors - nudging them through incentives etc. Level of demand for electricity for EV (currently, in Indonesia) not too high, but maybe in the next 2-3 years, or if (at least) 50,000 EV-car daily / regularly used on the street, demand for electricity in Indonesia will be rocketed.

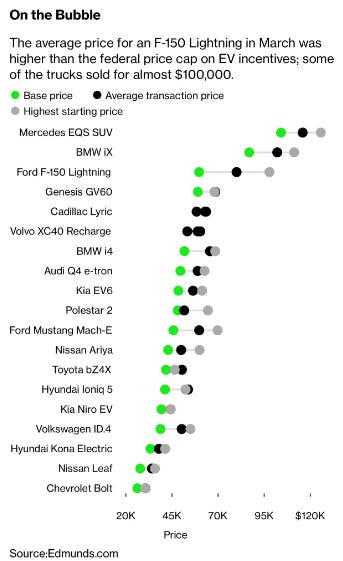

Many modeling exercises EVs already emit lower emissions even with 100% coal mix - this also depends on when the EV is charged and such. Norway is known for having a large share of electric cars on its roads, currently over 21%. Norway's electricity grid is running on 98% renewable and sustainable sources.

While Indonesia's electricity grids are running on 50% coal, 29% gas, and 6% oil. Even today with that grid EV will still reduce emission, more so in the future when EVs are likely cleaner and our grid becomes increasingly decarbonized. 'Leasing' electric vehicles suddenly became so important for US-EU trade relations and the future of clean energy supply chains. Also, why the big challenge the Inflation Reduction Act created for Europe is far from over.

Basically the leasing part of IRA creates a loophole for automakers to get benefit without having to comply to the North America assembly & critical mineral rules. Countries like Indonesia with its nickel ban & deep Chinese value chain should have less of a worry now. A Tax loophole makes EV Leasing a No-Brainer in the US An exemption in the Inflation Reduction Act is worth $7,500 to drivers who lease.

EV powertrain is more efficient at converting chemical energy to kinetic energy. Another reason might be that EVs (and hybrids) tend to be higher-value cars, and so the EV/hybrid fleet might be constructed to higher fire-safety levels. Regardless, the data suggest strongly that EVs in the fleet are not burning more often than ICE cars. Even when accounting well-to-wheel emission EV is still better than ICE vehicles, a study in Nature finds that EV is better than most ICE models if the grid emission factor is <1100 gCO2e/kWh.